How much does it cost to start a contracting business? This question is often the first hurdle for aspiring entrepreneurs in the construction industry. The answer, however, is not a simple one-size-fits-all figure. The costs of launching a contracting business can vary significantly depending on a multitude of factors, including location, scope of services, and business structure. This comprehensive guide delves into the various financial considerations involved in starting a contracting business, providing a detailed breakdown of initial costs, ongoing expenses, and strategies for financial planning.

From registering your business and obtaining necessary licenses to acquiring equipment and marketing your services, every step requires careful planning and budgeting. Understanding the financial landscape is crucial for setting realistic expectations, securing funding, and ultimately achieving success in the competitive contracting market.

Initial Costs: How Much Does It Cost To Start A Contracting Business

Starting a contracting business involves various initial expenses. These costs are essential for setting up your business, obtaining necessary licenses and permits, and acquiring equipment.

Business Registration and Licensing

The initial cost of registering a business, obtaining licenses, and permits can vary depending on the state and type of contracting business.

- Business Registration: This cost can range from $50 to $500 depending on the state.

- Licenses and Permits: Obtaining necessary licenses and permits, including contractor licenses, business licenses, and permits related to specific types of work, can cost anywhere from $100 to $1,000 or more, depending on the state and type of work you’ll be doing.

- Business Bank Account: Setting up a business bank account is crucial for separating your personal and business finances. Most banks charge a monthly fee of $10 to $25 for business accounts.

Insurance Costs

Insurance is essential for protecting your business and yourself from potential liabilities. The cost of insurance will depend on factors like the type of contracting work, the size of your business, and your location.

- General Liability Insurance: This type of insurance protects your business from claims of bodily injury or property damage caused by your work. The average cost of general liability insurance for contractors can range from $500 to $1,500 per year.

- Workers’ Compensation Insurance: If you have employees, you are required to carry workers’ compensation insurance. This insurance covers medical expenses and lost wages for employees who are injured on the job. The cost of workers’ compensation insurance varies by state and industry.

- Property Insurance: Property insurance covers your business property, such as tools, equipment, and vehicles, from damage caused by fire, theft, or natural disasters. The cost of property insurance depends on the value of your property and the level of coverage you choose.

Equipment and Tools

Acquiring the necessary equipment and tools is a significant expense for contractors. The specific tools you need will depend on the type of contracting work you’ll be doing.

- Hand Tools: Basic hand tools like hammers, screwdrivers, pliers, and wrenches are essential for any contractor. The cost of these tools can range from $100 to $500 depending on the quality and quantity.

- Power Tools: Power tools like drills, saws, and sanders are also essential for many types of contracting work. The cost of power tools can vary significantly depending on the brand, power, and features. A basic set of power tools can cost from $500 to $2,000.

- Safety Equipment: Safety equipment is crucial for protecting yourself and your employees from injuries. This equipment includes items like hard hats, safety glasses, gloves, and respirators. The cost of safety equipment can range from $100 to $500.

- Vehicle: A reliable vehicle is essential for transporting tools and equipment to job sites. The cost of a vehicle will depend on the type and size of the vehicle you need.

Marketing and Advertising

Getting the word out about your contracting business is crucial for attracting clients. Marketing and advertising play a key role in building your brand and generating leads. You’ll need to consider different strategies and their associated costs to determine the best approach for your business.

Marketing Strategies and Costs

| Strategy | Estimated Cost | Potential ROI | Description |

|---|---|---|---|

| Website | $500 – $5,000+ | High | A professional website provides credibility and a platform to showcase your services, testimonials, and contact information. |

| Social Media Marketing | $0 – $1,000+ | Moderate to High | Utilizing platforms like Facebook, Instagram, and LinkedIn can help you connect with potential clients, build your brand, and share updates. |

| Online Advertising | $100 – $1,000+ per month | Moderate to High | Platforms like Google Ads and social media advertising allow you to target specific demographics and interests, driving traffic to your website or landing pages. |

| Local Advertising | $50 – $500+ per month | Moderate | Traditional methods like print advertising in local newspapers or magazines, community events, and partnerships with local businesses can reach a targeted audience. |

Website Costs

Building a website is an investment that can pay off in the long run. You’ll need to consider the following costs:* Domain Name Registration: This is the address of your website, like “yourbusiness.com”. You can register a domain name for around $10-$15 per year.

Web Hosting

This is the space on a server where your website files are stored. Web hosting plans vary in price, ranging from $5 to $100+ per month depending on features and storage space.

Website Design

You can choose to design your website yourself using website builders or hire a professional web designer. Website design costs can range from a few hundred dollars to thousands of dollars, depending on complexity and features.

Social Media Marketing Costs

Social media marketing can be a cost-effective way to reach a large audience. While some platforms are free to use, you may need to invest in paid advertising to boost your reach and engagement. * Organic Social Media: Creating engaging content and interacting with your followers is free. However, building a strong following and generating leads takes time and effort.

Paid Social Media Advertising

You can run targeted ads on platforms like Facebook, Instagram, and LinkedIn to reach specific demographics and interests. Costs for paid social media advertising vary based on factors like target audience, campaign duration, and ad format.

Online Advertising Costs

Online advertising platforms like Google Ads and social media advertising allow you to target specific s and demographics, driving traffic to your website or landing pages.* Google Ads: Google Ads is a pay-per-click (PPC) advertising platform where you bid on s relevant to your business. Costs for Google Ads vary based on factors like competition, bidding strategy, and ad quality.

Social Media Advertising

Similar to Google Ads, social media advertising platforms allow you to target specific demographics and interests. Costs for social media advertising vary based on factors like target audience, campaign duration, and ad format.

Local Advertising Costs

Local advertising campaigns can help you reach a targeted audience in your geographic area.* Print Advertising: This includes advertising in local newspapers, magazines, and community publications. Costs vary depending on publication size, ad placement, and duration.

Community Events

Sponsoring or participating in local events can help you build brand awareness and connect with potential clients. Costs vary depending on the event type and level of sponsorship.

Partnerships

Collaborating with local businesses can help you reach a wider audience. Costs may involve sharing marketing expenses or providing reciprocal services.

Administrative and Operational Costs

Administrative and operational costs are the ongoing expenses you’ll incur to keep your contracting business running smoothly. These costs are crucial for maintaining your business infrastructure and ensuring efficient operations.

Office Space and Utilities

These costs include rent or mortgage payments for office space, utilities like electricity, water, and internet, and other administrative expenses such as phone lines and office supplies. The cost of office space can vary significantly depending on your location and the size of your office. For instance, renting a small office in a suburban area might cost around $1,000 per month, while a larger office in a bustling city center could cost upwards of $5,000 per month.

Utilities, on the other hand, are typically based on usage and can fluctuate depending on the season. For example, your electricity bill might be higher during the summer months due to increased air conditioning usage.

Hiring Employees or Independent Contractors

You might need to hire employees or independent contractors to handle specific tasks or projects, depending on the size and scope of your contracting business. The cost of hiring employees includes wages, benefits, and payroll taxes. Benefits can include health insurance, retirement plans, and paid time off. Payroll taxes include Social Security, Medicare, and unemployment taxes. The cost of hiring independent contractors is generally lower than hiring employees because you are not responsible for providing benefits or paying payroll taxes.

However, you still need to pay them for their services, and you may need to pay taxes on their earnings.

Software Subscriptions

Various software subscriptions are essential for managing your contracting business effectively. These include accounting software, project management tools, and other software subscriptions.

| Software Category | Examples | Estimated Monthly Cost | Features |

|---|---|---|---|

| Accounting Software | Xero, QuickBooks Online, FreshBooks | $20 – $100 | Invoice creation, expense tracking, financial reporting |

| Project Management Tools | Asana, Trello, Monday.com | $0 – $100 | Task management, collaboration, project tracking |

| Other Software Subscriptions | Microsoft Office 365, Dropbox, Zoom | $5 – $50 | Email, document storage, video conferencing |

Financial Planning and Budgeting

Financial planning is crucial for any contracting business, as it helps you manage your cash flow, make informed decisions, and ensure the long-term sustainability of your operations. A well-structured budget will Artikel your projected income, expenses, and financial goals, allowing you to track your progress and make necessary adjustments along the way.

Creating a Detailed Budget

A detailed budget for your contracting business should encompass all aspects of your income and expenses. It should include:* Projected Income: This section should Artikel your anticipated revenue based on the types of projects you expect to undertake, your pricing strategy, and your estimated workload.

Direct Costs

These are the costs directly associated with each project, such as materials, labor, and equipment rentals.

Indirect Costs

These are the overhead costs that are not directly tied to specific projects, such as office rent, utilities, insurance, and marketing expenses.

Financial Goals

This section should Artikel your financial objectives, such as profit margins, debt repayment, and investment plans.

Example:If you are a residential contractor, your budget might include:

Projected Income

$500,000 per year, based on an average of 10 projects per year with an average project value of $50,000.

Direct Costs

$250,000 per year, including materials, labor, and equipment rentals.

Indirect Costs

$100,000 per year, including office rent, utilities, insurance, and marketing expenses.

Financial Goals

Achieve a profit margin of 20% and repay any business loans within 5 years.

Financial Management Resources and Tools, How much does it cost to start a contracting business

Several resources and tools can assist contractors in managing their finances and tracking their income and expenses:* Accounting Software: Programs like QuickBooks, Xero, and FreshBooks offer features for tracking income and expenses, generating invoices, managing payroll, and creating financial reports.

Budgeting Apps

Apps like Mint, YNAB (You Need a Budget), and Personal Capital can help you create and track your budget, monitor your spending, and set financial goals.

Financial Advisors

A financial advisor can provide personalized guidance on financial planning, investment strategies, and retirement planning.

Business Bank Accounts

Separating your business finances from your personal finances is essential for tax purposes and financial organization.

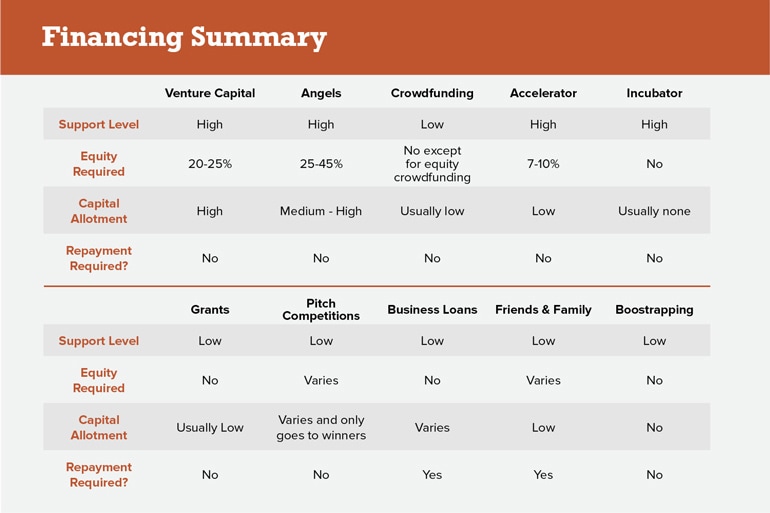

Securing Funding

Securing funding is often essential for starting and growing a contracting business. Here are some common funding options:* Bank Loans: Traditional bank loans are a common source of funding for businesses, but they typically require a strong credit history and a solid business plan.

Lines of Credit

Lines of credit provide access to a predetermined amount of funding that you can draw upon as needed, offering flexibility for short-term financing.

Crowdfunding

Platforms like Kickstarter and Indiegogo allow you to raise funds from a large number of individuals, often through pre-orders or donations.

Grants

Government agencies and private organizations offer grants to businesses in specific industries, often targeting projects that align with their mission.

Legal and Regulatory Considerations

Starting a contracting business involves navigating a complex legal landscape. Understanding and complying with relevant regulations is crucial for smooth operations and avoiding legal issues. This section explores the legal requirements, business structures, and ethical considerations associated with running a contracting business.

Licensing and Permits

Before launching your contracting business, you must obtain the necessary licenses and permits. These requirements vary by state and locality. The specific licenses needed will depend on the type of contracting work you plan to perform. For example, electrical, plumbing, or HVAC contractors often require specialized licenses. You can typically obtain information about licensing requirements from your state’s licensing board or your local government.

Insurance

Insurance is essential for any contracting business, as it protects you from financial losses due to accidents, injuries, or property damage. Common types of insurance for contractors include:

- General liability insurance: Protects you from claims arising from bodily injury or property damage to third parties.

- Workers’ compensation insurance: Covers medical expenses and lost wages for employees injured on the job.

- Professional liability insurance: Protects you from claims arising from errors or omissions in your work.

Business Structure

Choosing the right business structure is a crucial decision that impacts your legal liability, tax obligations, and administrative burden. Common business structures for contracting businesses include:

- Sole proprietorship: The simplest structure, where the business is owned and operated by one person. The owner is personally liable for all business debts and obligations.

- Partnership: Two or more individuals agree to share in the profits and losses of a business. Partners typically have joint liability for business debts.

- Limited Liability Company (LLC): Offers liability protection to its owners (members), who are not personally responsible for business debts. LLCs provide a balance between the simplicity of a sole proprietorship and the liability protection of a corporation.

Contracts and Payment Terms

Contracts are the foundation of any contracting business. They Artikel the scope of work, payment terms, and other important details of a project. Here are some key considerations for contracts:

- Clear and concise language: Contracts should be easy to understand and free from ambiguity. Avoid using technical jargon that may be unfamiliar to clients.

- Detailed scope of work: Define the specific tasks to be performed, materials to be used, and any other relevant details.

- Payment terms: Clearly state the payment schedule, method of payment, and any applicable penalties for late payments.

- Dispute resolution: Include a clause outlining how disputes will be resolved, such as through mediation or arbitration.

Ethical Considerations

Maintaining ethical business practices is crucial for building trust and a positive reputation. Key ethical considerations for contractors include:

- Honesty and transparency: Be truthful about your qualifications, pricing, and project timelines.

- Fair and competitive pricing: Avoid charging excessive fees or engaging in unfair pricing practices.

- Professionalism and courtesy: Treat clients and subcontractors with respect and maintain a professional demeanor.

- Compliance with laws and regulations: Adhere to all applicable building codes, safety regulations, and environmental standards.

Starting a contracting business is a significant undertaking, demanding a blend of entrepreneurial spirit, financial savvy, and a deep understanding of the industry. While the initial costs may seem daunting, with careful planning, strategic budgeting, and a commitment to delivering high-quality services, it is possible to establish a successful and profitable contracting business. By navigating the complexities of licensing, insurance, marketing, and financial management, entrepreneurs can lay a strong foundation for their ventures and carve a niche in the construction landscape.

Clarifying Questions

What are the common legal structures for a contracting business?

Common legal structures for contracting businesses include sole proprietorships, partnerships, and limited liability companies (LLCs). The choice depends on factors like liability protection, tax implications, and administrative complexity.

What are the essential insurance policies for contractors?

Essential insurance policies for contractors typically include general liability insurance, workers’ compensation insurance, and property insurance. These policies provide protection against potential risks associated with the business operations.

How can I find affordable marketing solutions for my contracting business?

Affordable marketing solutions for contractors include leveraging social media platforms, utilizing online directories, and building relationships with local businesses and community organizations. These strategies can help reach potential clients without breaking the bank.