What is a contract fee in stocks – What are contract fees in stocks? This seemingly simple question delves into a complex world of trading costs, often overlooked by novice investors. These fees, a hidden component of every stock transaction, can significantly impact your investment returns. Understanding contract fees is crucial for making informed trading decisions, as they represent a significant expense that can eat into your profits.

Contract fees are the various charges levied on stock trades, encompassing brokerage fees, exchange fees, and regulatory fees. They are determined by factors such as the brokerage firm, the trading platform, the specific stock or exchange, and the type of order placed. Contract fees can vary widely, so it is essential to understand how they are calculated and what factors influence their cost.

Understanding Contract Fees in Stocks: What Is A Contract Fee In Stocks

Contract fees are charges associated with trading stocks, essentially representing the cost of facilitating the transaction. They are incurred by both buyers and sellers and play a crucial role in the stock market’s ecosystem.

Types of Contract Fees

Contract fees encompass various charges that contribute to the overall cost of trading stocks. These fees can be categorized as follows:

- Brokerage Fees: These are commissions charged by your brokerage firm for executing trades on your behalf. They are typically calculated as a percentage of the trade value or a fixed amount per trade.

- Exchange Fees: These fees are levied by the stock exchange where the trade takes place. They are designed to cover the exchange’s operating costs and contribute to its infrastructure.

- Regulatory Fees: These fees are mandated by regulatory bodies, such as the Securities and Exchange Commission (SEC), to oversee the stock market and protect investors.

Contract Fees in Different Trading Scenarios

Contract fees can vary significantly depending on the type of trade you’re making. Let’s explore how these fees differ in various trading scenarios.

Contract Fees in Stock Trading, What is a contract fee in stocks

The contract fees you pay for buying or selling stocks are typically lower than for options or futures trading. This is because stock trades are generally simpler and involve fewer complexities. Here’s a breakdown of contract fees for different stock trades:* Market Orders: These orders are executed at the best available price at the time of order placement. The contract fee for a market order is usually a flat fee, regardless of the size of the order.

Limit Orders

These orders are executed at a specific price or better. The contract fee for a limit order can vary depending on the brokerage firm and the order size. Some brokers may charge a tiered fee structure, where the fee increases as the order size grows.

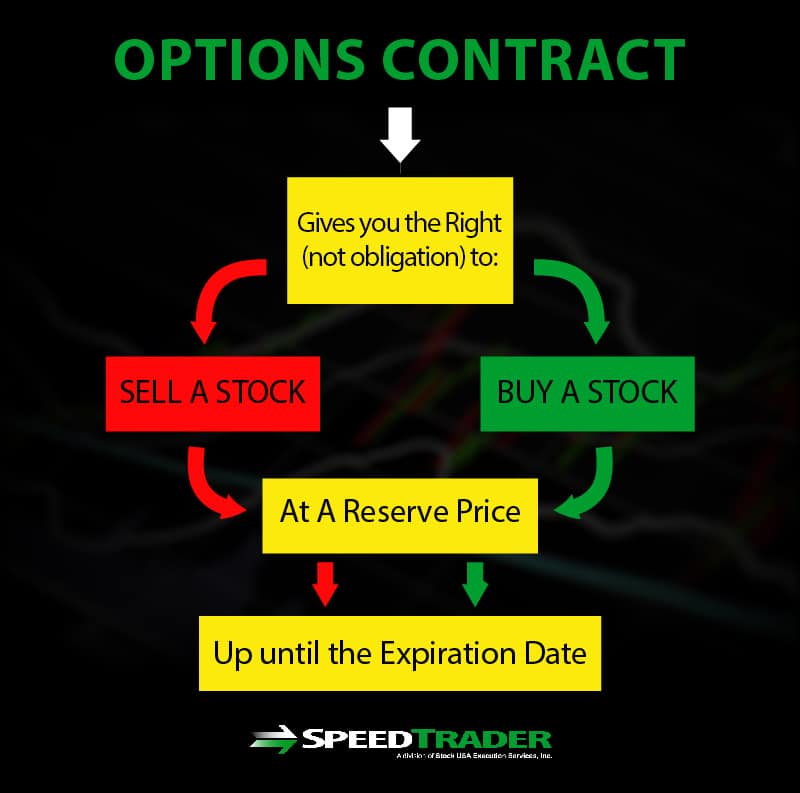

Contract Fees in Options Trading

Options trading involves the right to buy or sell an underlying asset at a specific price within a certain timeframe. The contract fees for options trading are generally higher than for stock trading due to the added complexity and risk associated with options.* Call Options: Give the holder the right to buy an underlying asset at a specific price.

Put Options

Give the holder the right to sell an underlying asset at a specific price.Contract fees for options trading can be influenced by:* The type of option: Call or put options may have different contract fees.

The strike price

The price at which the underlying asset can be bought or sold.

The expiration date

The date by which the option must be exercised.

Contract Fees in Futures Trading

Futures trading involves contracts to buy or sell an asset at a specific price on a future date. The contract fees for futures trading are generally the highest among the three scenarios discussed. * Futures contracts: Represent an agreement to buy or sell a specific asset at a predetermined price on a future date.The contract fees for futures trading can vary based on:* The underlying asset: Different assets, such as commodities, currencies, or indexes, can have varying contract fees.

The contract size

The amount of the underlying asset covered by the futures contract.

The exchange

Different exchanges may charge different contract fees.

Example: Let’s say you want to buy 100 shares of a company at $50 per share. The contract fee for a market order is $5. The total cost of the trade would be (100 shares

- $50/share) + $5 = $5005. If you were to place a limit order at $48 per share and the contract fee was $10, the total cost of the trade would be (100 shares

- $48/share) + $10 = $4810.

Factors Influencing Contract Fees

Contract fees are a crucial component of the trading process, impacting the overall cost of your investments. Understanding the factors that influence these fees is essential for making informed trading decisions and optimizing your returns. Several key elements can affect the amount you pay in contract fees, from the brokerage firm you choose to the specific stock you trade.

Brokerage Firm and Trading Platform

The brokerage firm you select plays a significant role in determining the contract fees you pay. Different brokerages have varying fee structures, which can be influenced by factors like their business model, technology, and market positioning. Some brokerages may offer lower contract fees as a competitive advantage, while others may charge higher fees to offset the costs of providing additional services or advanced trading tools.

Similarly, the trading platform you use can also impact contract fees. Some platforms may charge a flat fee per contract, while others may charge a percentage of the contract value. The fees can also vary based on the specific features and functionalities offered by the platform.

Specific Stock and Exchange

The specific stock you trade and the exchange where it is listed can also influence contract fees. Certain stocks may have higher contract fees due to their volatility, liquidity, or the exchange’s fee structure. For example, options contracts on highly volatile stocks may have higher fees compared to options contracts on more stable stocks.

Trade Size and Account Type

The size of your trade can also affect contract fees. Larger trades may attract lower fees per contract due to economies of scale, while smaller trades may have higher fees. The type of account you hold with your brokerage firm can also influence contract fees. For example, institutional investors may have access to lower contract fees compared to individual investors.

This is because institutions typically trade in larger volumes, providing them with greater negotiating power.

Trading Volume

Trading volume can also impact contract fees. Brokerages may offer discounted fees to clients who trade in high volumes. This is because high-volume traders generate significant revenue for brokerages, allowing them to offer lower fees as an incentive.

Table Summarizing Factors Influencing Contract Fees

| Factor | Potential Impact on Contract Fees |

|---|---|

| Brokerage Firm | Lower fees may be offered by some brokerages as a competitive advantage, while others may charge higher fees for additional services or advanced trading tools. |

| Trading Platform | Fees can vary based on the platform’s fee structure, features, and functionalities. |

| Specific Stock and Exchange | Certain stocks or exchanges may have higher contract fees due to factors like volatility, liquidity, or the exchange’s fee structure. |

| Trade Size | Larger trades may attract lower fees per contract due to economies of scale, while smaller trades may have higher fees. |

| Account Type | Institutional investors may have access to lower contract fees compared to individual investors. |

| Trading Volume | Brokerages may offer discounted fees to clients who trade in high volumes. |

Navigating the world of contract fees requires careful consideration and strategic planning. By understanding the intricacies of these costs, investors can make informed decisions, minimize unnecessary expenses, and maximize their potential returns. Choosing the right brokerage firm, utilizing discount brokers, and exploring commission-free options can significantly impact your overall trading costs. Ultimately, mastering the nuances of contract fees is an essential step toward achieving long-term investment success.

Question & Answer Hub

Are contract fees the same for all brokers?

No, contract fees can vary significantly between brokers. Some brokers may offer lower fees for specific types of trades or for certain account types. It is essential to compare fees across different brokers before making a decision.

How can I avoid paying contract fees?

While it is impossible to completely avoid contract fees, you can minimize them by choosing a broker with lower fees, utilizing discount brokers, or trading in bulk. Some brokers also offer commission-free trading for certain types of stocks or ETFs.

What are the benefits of using a commission-free brokerage account?

Commission-free brokerage accounts can save you money on trading fees, but they may come with other fees or limitations. It is essential to carefully review the terms and conditions of any commission-free account before opening one.