What is a due diligence fee on a purchase contract? It’s a crucial aspect of many large transactions, often overlooked until it’s time to sign on the dotted line. This fee, paid typically by the buyer, covers the costs associated with investigating the property or business being purchased. Think of it as your upfront investment in ensuring you’re not buying a lemon.

Understanding what’s included, who pays, and how much it costs is key to a smooth and successful purchase.

This guide will break down due diligence fees, explaining different fee structures, who usually pays, and how they compare to other transaction costs. We’ll also look at the legal aspects and explore various scenarios to illustrate the practical implications of these fees. By the end, you’ll have a solid grasp of due diligence fees and how they impact your purchase.

Defining Due Diligence Fees

Okay, so like, you’re tryna buy something big – a house, a biz, whatever – and before you totally commit, you gotta do your homework, right? That’s where due diligence comes in. It’s basically making sure everything’s on the up and up before you plunk down your cash. And that homework ain’t free.Due diligence fees are, like, the upfront cost of that investigation.

Think of it as paying someone to be your super-sleuth and check everything out. It’s not a deposit on the actual purchase; it’s payment for the professional services that help you avoid a total disaster. It’s totally legit and protects

you*, the buyer.

Examples of Due Diligence Fees

Due diligence fees are super common in all sorts of big-ticket purchases. If you’re buying a company, you’re gonna need to check their financials, their legal standing, and their operations. Buying a building? You’ll want inspections to make sure there are no hidden problems like leaky roofs or asbestos. Even buying a seriously awesome car collection might involve a mechanic’s inspection to make sure everything’s running smoothly.

Basically, anytime you’re dropping some serious dough on something complex, due diligence is key, and that means fees.

Terminology for Due Diligence Fees

People use different words for these fees, it’s totally chill. You might see them called “investigation fees,” “inspection fees,” or even just “due diligence costs.” Sometimes they’re bundled into a larger “transaction fee,” but whatever they’re called, they’re all basically the same thing: payment for the professional services involved in investigating the purchase.

Components of a Due Diligence Fee

The breakdown of a due diligence fee depends on what you’re buying and how in-depth you need the investigation to be. For example, buying a small business might involve just a quick review of financial records, costing a few hundred bucks. But buying a huge corporation? We’re talking thousands, maybe even tens of thousands, depending on the size and complexity of the business.

The fee usually covers things like:

- Legal review of contracts and documents.

- Environmental assessments (to check for contamination or hazards).

- Financial audits (to verify the seller’s claims).

- Property inspections (to identify any structural issues).

- Appraisals (to determine fair market value).

Basically, it’s all the stuff needed to make sure you’re not getting totally ripped off. Think of it as an insurance policy – it costs money upfront, but it could save you a whole lot more in the long run.

Who Pays the Due Diligence Fee?

Okay, so like, you’re tryna buy a house or a biz, right? It’s not just, “OMG, I want it!” You gotta do your homework – that’s due diligence. And guess what? Someone’s gotta pay for all that investigating.Usually, the buyer foots the bill for the due diligence fee. Think of it like this: you’re the one taking the risk, so you’re the one paying to make sure you’re not buying a total lemon.

It’s your money on the line, so you’re investing in making sure the deal is legit. It’s totally your responsibility to check out the property or business thoroughly. This fee covers things like inspections, appraisals, legal reviews – the whole shebang.

Responsibility Shifts

But, sometimes, things get, like,totally* different. The seller might agree to cover the fee, especially in a buyer’s market where there’s a ton of competition. Or, maybe they’ll split it – a 50/50 deal. It all depends on how much leverage each party has. For example, if the seller is super eager to make a sale and the property has been on the market for ages, they might be more willing to chip in or even cover the whole fee.

Conversely, if the buyer is desperate to get their hands on a particularly desirable property, they might be less likely to negotiate the fee. Basically, it’s all about negotiation skills and market conditions, total negotiation power play.

Negotiating the Fee

Negotiating the due diligence fee is like haggling at a flea market – it’s all about finding that sweet spot. Both buyer and seller want to make a deal that works for them. The buyer will try to keep the fee low, while the seller might want it to be higher to offset their costs or simply to discourage frivolous offers.

Sometimes, it’s a back-and-forth dance, with each side making offers until they reach an agreement. The actual amount can be based on a percentage of the purchase price, a flat fee, or even an hourly rate for the professionals involved. It’s all up for grabs!

Refundable vs. Non-Refundable Fees

Now, here’s the kicker: is that fee refundable? If it’s non-refundable, that means you’re paying for the due diligence process regardless of whether you end up buying the property or business. This is pretty common, and sellers may prefer this because it ensures they get compensated for the time and resources spent on the process. However, if it’s refundable, then you get your money back if the deal falls through – say, if you find something seriously wrong during your investigation.

This is usually a point of negotiation. If the buyer is high-risk, the seller might insist on a non-refundable fee to protect themselves from wasted time and resources. Conversely, a low-risk buyer might negotiate for a fully or partially refundable fee.

Amount and Structure of Due Diligence Fees

Okay, so you’re tryna figure out how much this whole due diligence thing is gonna cost, right? It’s not always a set price – think of it more like a custom-made pizza, the toppings (and the price) depend on what you order.Due diligence fees aren’t one-size-fits-all; they’re super flexible. They can be a flat fee, a percentage of the purchase price, or even a combo of both.

It totally depends on the complexity of the deal and the type of transaction. Think of it like this: buying a used bike from your friend is way different than buying a whole mega-mansion, right?

Due Diligence Fee Calculation Methods

Basically, there are three main ways these fees get calculated:

- Fixed Fee: This is like a set price for a specific service. Imagine you’re paying a certain amount for a lawyer to review contracts, regardless of how long it takes. It’s straightforward and predictable, but might not always cover every eventuality.

- Percentage of Purchase Price: This is more common in larger deals. The fee is a percentage of the total amount you’re paying for the property or business. For example, 0.5% to 2% of the purchase price isn’t uncommon. This means the bigger the deal, the bigger the fee.

- Hybrid Approach: Some deals use a mix of both – a fixed fee for certain tasks plus a percentage of the purchase price. This lets you budget for certain things upfront while accounting for the size of the transaction.

Examples of Fee Ranges

Let’s get real. The cost can vary wildly. For buying a small business, you might see fees between $2,000 and $10,000, depending on size and complexity. A major real estate acquisition could easily run into the hundreds of thousands, maybe even millions, of dollars. It’s all relative, dude.

Comparison of Fee Structures

| Fee Structure | Advantages | Disadvantages | Typical Use Cases |

|---|---|---|---|

| Fixed Fee | Predictable cost, easy budgeting | May not cover all necessary tasks, potentially underpriced for complex deals | Small business acquisitions, simple real estate transactions |

| Percentage of Purchase Price | Scales with deal size, covers more comprehensive due diligence | Can be costly for large transactions, less predictable | Large real estate acquisitions, mergers and acquisitions |

| Hybrid Approach | Combines predictability with scalability | More complex to negotiate and manage | Mid-sized transactions, deals with varying complexity |

Factors Influencing Due Diligence Fee Amount, What is a due diligence fee on a purchase contract

Several things can impact the final price tag. Think of it as adding extra toppings to your pizza.

- Complexity of the Transaction: A simple deal will cost less than a complex one with multiple entities or intricate legal issues. Think buying a used car vs. merging two giant corporations.

- Scope of Due Diligence: The more extensive the investigation (environmental studies, financial audits, etc.), the higher the cost. More research = more moolah.

- Expertise Required: Specialized professionals (like environmental consultants or forensic accountants) charge more than generalists. Think of it like paying a specialist versus a general doctor.

- Time Involved: The longer the process takes, the more expensive it will be. Think overtime pay for professionals.

- Geographic Location: Costs vary by location; a due diligence review in NYC will likely cost more than one in a smaller town.

Due Diligence Fee vs. Other Fees

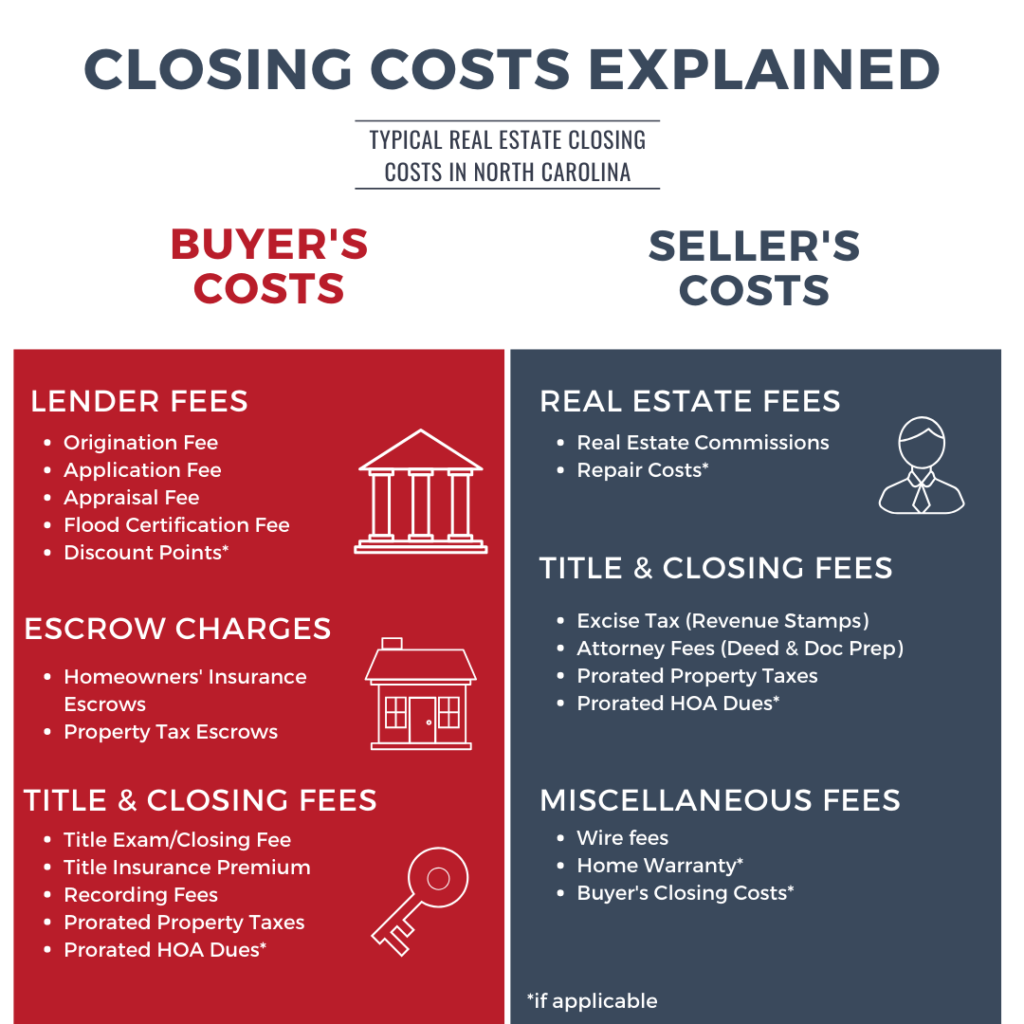

Okay, so like, you’re buying a house, right? It’s a total rollercoaster, and there are, like, a million fees involved. It’s super important to know the difference between them all, especially the due diligence fee. It’s not the same as earnest money or closing costs, even though they all happen around the same time. Think of it like this: each fee serves a totally different purpose in the whole process.

The due diligence fee is, like, your ticket to investigate the property. It lets you do your research, get inspections, and make sure everything is on the up and up before you’re totally committed. Earnest money, on the other hand, shows the seller you’re serious about buying the place. It’s kinda like a good faith deposit, showing you’re not just messing around.

And closing costs? Those are all the extra expenses that come at the very end of the deal – things like title insurance and recording fees. It’s the final push before you get the keys!

Key Differences Between Fees

These fees are all super distinct and show up in different parts of the contract. The due diligence fee is usually paid upfront, giving you time to do your investigation. Earnest money is typically paid soon after the offer is accepted and is often applied towards the down payment or returned if the deal falls through (depending on the contract).

Closing costs are usually paid at closing, the final step of the purchase. The contract will clearly state the amount of each fee, when it’s due, and what happens if the deal doesn’t go through.

| Fee Type | Purpose | Timing | Outcome if Deal Falls Through |

|---|---|---|---|

| Due Diligence Fee | To cover costs of inspecting and investigating the property | Early in the process, often with the offer | Usually non-refundable, unless specifically stated otherwise in the contract. Think of it as payment for services rendered. |

| Earnest Money | Shows good faith and seriousness of the buyer’s intent to purchase | After offer acceptance | Often refundable if the deal falls through due to reasons Artikeld in the contract, sometimes forfeited if the buyer backs out without a valid reason. |

| Closing Costs | Covers various expenses associated with finalizing the purchase | At closing | Paid regardless of whether the deal closes, unless a specific clause is in place. |

Legal and Contractual Aspects: What Is A Due Diligence Fee On A Purchase Contract

Okay, so like, due diligence fees aren’t just some random cash grab. They’re a totally legit part of a business deal, and getting the legal stuff right is, like, super important. Messing it up could totally backfire, so let’s break down the deets.The legal implications are all about making sure everything’s fair and above board. The contract needs to be crystal clear—no room for misinterpretations or shady dealings.

If the contract is vague, it can lead to major disagreements and even lawsuits. Think of it like this: a poorly written contract is like a recipe with missing ingredients—it’s a recipe for disaster! The courts will look at the contract to figure out what was agreed upon, and if it’s unclear, things can get messy, real messy.

Contract Language Clarity

Dude, clarity is key! The contract needs to explicitly state who pays the fee, how much it is, and what it covers. No hidden fees or sneaky clauses allowed! Using precise language is crucial to prevent any future disputes. Think of it as writing a text to your crush—you want to be super clear and avoid any misunderstandings, right?

Ambiguity is the enemy here; clear, concise language is your best friend.

Common Contract Clauses

Contracts often include clauses specifying the amount of the fee, how it’s paid (e.g., upfront, in installments), and what happens if the buyer decides not to proceed with the purchase. Some clauses might state that the fee is non-refundable, while others might allow for a partial refund under certain circumstances. For example, a clause might say something like, “The Buyer shall pay a non-refundable due diligence fee of $X upon execution of this Agreement.” Another clause might say, “If the Buyer terminates this Agreement prior to closing, the Due Diligence Fee shall be forfeited, except in cases of material misrepresentation by the Seller.” These clauses are totally standard, and they protect both the buyer and the seller.

Sample Contract Clause

The Buyer shall pay a non-refundable due diligence fee of $10,000 to the Seller upon execution of this Agreement. This fee is intended to compensate the Seller for the costs associated with providing the Buyer with access to confidential information and materials necessary for conducting due diligence. The due diligence fee is payable within five (5) business days of the execution of this Agreement. This fee is not refundable regardless of whether the Buyer proceeds with the purchase of the Property.

Illustrative Scenarios

Okay, so like, due diligence fees can be totally different depending on the situation. Sometimes you get your money back, sometimes you don’t, and sometimes you get some of it back. Let’s break down some scenarios, totally relatable ones, you know?

Fully Refundable Due Diligence Fee

Imagine this: You’re tryna buy a rad vintage car, right? The seller agrees to a $5,000 due diligence fee. The contract explicitly states that if you, after inspecting the car (mechanically, legally, everything!), decidenot* to buy it for any reason—maybe the engine’s totally busted, or the title’s messed up—you get your whole $5,000 back. No sweat.

It’s like a “try before you buy” situation, but with a hefty deposit. This protects you, the buyer, from getting stuck with a lemon. The seller, though, is taking a risk, because they’re holding out for a buyer who might back out.

Partially Refundable Due Diligence Fee

Let’s say you’re looking at a sweet apartment building. You pay a $10,000 due diligence fee. The contract says that if you don’t buy the building, you’ll get $5,000 back. The other $5,000 is kept by the seller to cover their costs associated with letting you poke around—like, maybe they hired an accountant to go over the financials, or a lawyer to check the paperwork.

This is pretty common. It’s a compromise; you get some money back, but the seller is still compensated for their time and effort. It’s like a “we’re cool, but you’re paying for some of the hassle” scenario.

Non-Refundable Due Diligence Fee

This one’s a bit tougher. Think you’re buying a small business. You pay a $2,000 due diligence fee, but the contract clearly states it’s non-refundable, no matter what. Even if the business is a total disaster, you’re not getting your money back. This is usually because the seller wants to ensure you’re serious.

It’s like a commitment fee. For the buyer, it’s risky, but it might show the seller that you’re a serious contender. The seller is protected; they’ve got their fee regardless of the outcome. It’s basically, “This is my time and effort, and you’re paying for the privilege of looking.”

Navigating the complexities of a large purchase requires a clear understanding of all associated costs. Due diligence fees, while seemingly a small part of the overall transaction, play a significant role in protecting the buyer’s interests. By understanding the various aspects of these fees – from their calculation and payment to their legal implications – you can confidently negotiate the terms and ensure a transparent and successful purchase.

Remember to always review the contract carefully and seek professional advice when needed.

Questions and Answers

Is a due diligence fee always refundable?

No, the refundability of a due diligence fee depends entirely on the contract’s terms. Some contracts stipulate a full refund if the deal falls through, while others may be partially refundable or non-refundable.

What happens if the buyer discovers serious problems during due diligence?

If significant problems are uncovered, the buyer may be able to negotiate a price reduction, walk away from the deal (if the contract allows), or renegotiate the terms. The due diligence fee’s refundability will then depend on the specific contract clauses.

Can I negotiate the due diligence fee?

Yes, the amount of the due diligence fee is often negotiable, especially in competitive markets. A strong negotiation position depends on factors such as market conditions and the specifics of the transaction.

Who typically handles the due diligence process?

Buyers usually hire their own professionals (lawyers, accountants, etc.) to conduct due diligence. However, the seller might provide certain documents to facilitate the process.