What is cost of money in government contracts – What’s the Cost of Money in Government Contracts? This is a question that’s gonna make your head spin, man! You see, when the government’s dishing out cash for a project, they’re not just throwing money around willy-nilly. They’re factoring in things like interest rates and inflation, which can make the price tag a whole lot bigger than you might think.

Imagine you’re bidding on a contract to build a new school. You’ve gotta consider how much it’s gonna cost you to borrow the money to buy materials and pay your workers. That’s where the “cost of money” comes in. The higher the interest rates, the more you’re gonna have to pay back, which means you gotta charge the government more.

It’s a whole chain reaction, you know?

Understanding the Concept

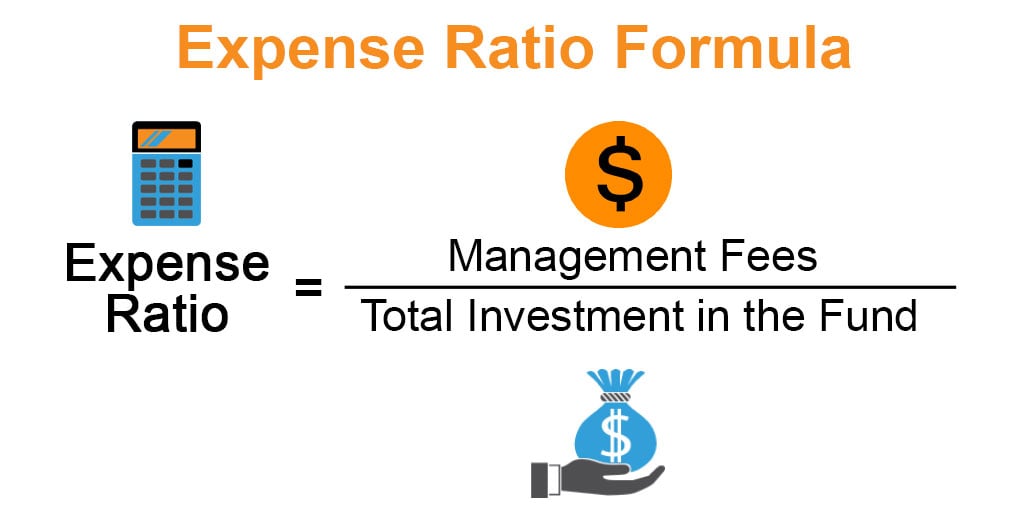

The cost of money, in the context of government contracts, refers to the expense incurred by the contractor for financing the project. This cost is essentially the interest paid on borrowed funds or the opportunity cost of using the contractor’s own funds for the project. Understanding the cost of money is crucial in government contracting because it directly influences the overall bid price and the contractor’s profitability.

A thorough analysis of the cost of money helps contractors make informed decisions regarding financing options and pricing strategies.

Examples of Cost of Money in Government Contracts

The cost of money is often reflected in government contracts through various mechanisms. Here are some examples:

- Interest on Loans: If a contractor needs to borrow funds to finance a project, the interest paid on these loans is a direct cost of money. This interest expense is factored into the overall project cost and reflected in the bid price.

- Opportunity Cost of Funds: If a contractor uses its own funds for a project, there is an opportunity cost associated with that decision. This opportunity cost represents the potential return the contractor could have earned by investing those funds elsewhere. For example, if the contractor could have earned a 5% return by investing its funds in the stock market, that 5% represents the opportunity cost of using those funds for the government contract.

- Discount Rates: Government agencies may use discount rates to calculate the present value of future costs and benefits associated with a project. This discount rate reflects the time value of money and incorporates the cost of money into the project evaluation process.

Significance of Understanding the Cost of Money

Understanding the cost of money is vital for several reasons in government contracting:

- Accurate Bid Pricing: Failing to account for the cost of money can lead to underbidding, potentially resulting in financial losses for the contractor. Conversely, overestimating the cost of money can make the bid uncompetitive.

- Profitability Analysis: By factoring in the cost of money, contractors can accurately assess the profitability of a government contract. This helps them make informed decisions about whether to pursue a particular contract or not.

- Negotiation Strategies: Understanding the cost of money allows contractors to effectively negotiate contract terms, such as payment schedules and financing options, that minimize their financing costs and maximize their profitability.

- Risk Management: The cost of money can be influenced by factors such as interest rate fluctuations and changes in market conditions. By understanding these risks, contractors can develop strategies to mitigate their impact on project costs and profitability.

Factors Influencing Cost of Money

The cost of money in government contracts is influenced by a complex interplay of economic and financial factors. Understanding these factors is crucial for both government agencies and contractors to effectively manage contract costs and ensure fair and competitive bidding processes.

Interest Rates

Interest rates play a significant role in determining the cost of money in government contracts. When interest rates rise, the cost of borrowing money increases, leading to higher financing costs for contractors. Conversely, when interest rates fall, borrowing becomes less expensive, reducing the cost of money for contractors.

- Impact on Contract Financing: Higher interest rates increase the cost of financing for contractors, as they need to pay more to lenders for the use of funds. This can impact the overall cost of the project and may lead to higher bids from contractors. Conversely, lower interest rates reduce financing costs, potentially resulting in lower bids.

- Impact on Discount Rate: The discount rate, used to calculate the present value of future cash flows, is often influenced by interest rates. A higher discount rate reduces the present value of future cash flows, making projects less attractive and potentially leading to lower bids. Conversely, a lower discount rate increases the present value of future cash flows, making projects more attractive and potentially leading to higher bids.

Inflation

Inflation is a key factor that influences the cost of money in government contracts. When inflation is high, the purchasing power of money decreases, leading to higher costs for contractors to acquire materials, labor, and other resources.

- Impact on Material and Labor Costs: Inflation can lead to increases in the cost of materials, labor, and other resources required for project completion. Contractors need to factor in these inflationary pressures when calculating their bids, potentially leading to higher contract prices.

- Impact on Contract Value: In contracts with long durations, inflation can significantly impact the real value of the contract. To mitigate this risk, contracts often include provisions for inflation adjustments, ensuring that the contractor is compensated for rising costs over time.

Cost of Money in Contract Pricing: What Is Cost Of Money In Government Contracts

The cost of money is a critical component of contract pricing, particularly for long-term contracts. It reflects the time value of money, acknowledging that money available today is worth more than the same amount in the future due to potential earnings. This section will delve into how the cost of money is incorporated into contract pricing and the significance of discount rates.

Incorporation of Cost of Money in Contract Pricing

The cost of money is incorporated into contract pricing through the use of discount rates. These rates reflect the opportunity cost of using funds for a project rather than investing them elsewhere. The discount rate is applied to future cash flows to determine their present value, which is the amount that would need to be invested today to achieve those future cash flows.

This present value is then used as the basis for the contract price.

Discount Rates in Contract Pricing

Discount rates are crucial for evaluating the financial viability of a project and ensuring fair compensation for the contractor. They are determined by considering various factors, including:

- Risk-free rate: This is the return an investor can expect from a risk-free investment, such as a U.S. Treasury bond. It serves as a baseline for the discount rate.

- Risk premium: This accounts for the specific risks associated with the project, such as market volatility, technological uncertainty, or regulatory changes. The higher the risk, the higher the risk premium and the discount rate.

- Inflation: This reflects the erosion of purchasing power over time. Higher inflation rates typically result in higher discount rates to compensate for the reduced value of future cash flows.

- Market conditions: The overall economic climate, including interest rates and investor sentiment, can influence the discount rate. In periods of low interest rates and high investor confidence, discount rates may be lower.

Impact of Different Cost of Money Assumptions, What is cost of money in government contracts

The cost of money assumption can significantly impact contract pricing. For example, a higher discount rate will result in a lower present value of future cash flows, leading to a lower contract price. Conversely, a lower discount rate will result in a higher present value and a higher contract price.

The cost of money is a significant factor in contract pricing, and it is essential to use a discount rate that accurately reflects the risks and opportunities associated with the project.

Cost of Money in Contract Performance

The cost of money plays a crucial role in contract performance, impacting both the financial health of the contracting parties and the successful completion of the project. Understanding how the cost of money affects contract performance is essential for businesses to effectively manage their financial resources and ensure project success.

Impact of Cost of Money on Contract Performance

The cost of money can significantly influence the financial viability and overall success of a contract. Here are some key ways in which it affects contract performance:

- Increased Project Costs: Higher interest rates increase the cost of borrowing for both the contractor and the client, leading to higher project costs. This can make it difficult to maintain profitability, especially for long-term projects.

- Cash Flow Management: The cost of money directly affects cash flow management. If a contractor has to pay a high interest rate on borrowed funds, it may struggle to meet its financial obligations, potentially delaying project completion.

- Profitability: The cost of money impacts a contractor’s profitability. High interest rates on loans can eat into profit margins, making it challenging to achieve desired returns on investment.

- Contract Renegotiation: In cases of significant changes in interest rates, contractors and clients may need to renegotiate contract terms to adjust for the increased cost of money.

Importance of Managing the Cost of Money

Managing the cost of money is crucial for both contractors and clients during contract execution. Effective management helps ensure:

- Financial Stability: By minimizing the cost of money, businesses can maintain financial stability, ensuring they have the resources to complete the project and meet their financial obligations.

- Project Success: Managing the cost of money allows for better cash flow management, reducing the risk of project delays and ensuring timely completion.

- Profitability: Minimizing the cost of money can help preserve profit margins, enabling businesses to achieve their financial goals.

Minimizing the Cost of Money in Contract Performance

Businesses can implement various strategies to minimize the cost of money during contract performance. These include:

- Negotiate Favorable Payment Terms: Contractors should negotiate payment terms that allow them to receive payments promptly, reducing the need for borrowing and minimizing interest costs.

- Optimize Working Capital: Effective working capital management can help businesses minimize the need for external financing. This can involve optimizing inventory levels, improving accounts receivable collection, and managing accounts payable effectively.

- Secure Competitive Financing: Contractors should shop around for competitive financing options to secure loans at favorable interest rates. This can involve exploring different lenders and loan products.

- Utilize Contractual Provisions: Contracts can include provisions that address the cost of money, such as escalation clauses that allow for adjustments in contract prices based on changes in interest rates.

Cost of Money in Contract Disputes

The cost of money, often referred to as interest, can be a significant factor in contract disputes. When one party believes the other has breached the contract, the aggrieved party may seek compensation for the financial losses incurred due to the breach, including the cost of money. This can be a complex issue, as the legal implications of cost of money claims are often debated.

Legal Implications of Cost of Money Claims

Cost of money claims in contract disputes are subject to legal scrutiny. Courts and arbitration panels carefully evaluate the legitimacy of such claims, considering various factors, including:

- The terms of the contract: The contract itself should clearly define the payment terms, including interest rates or penalties for late payments. If the contract explicitly states that interest will be charged for delayed payments, it strengthens the claim for cost of money.

- The nature of the breach: The type of breach and its impact on the aggrieved party’s finances are crucial. For example, a delay in payment might warrant a cost of money claim, but a breach related to defective goods might not.

- The prevailing market interest rates: Courts generally consider the prevailing market interest rates when assessing the reasonableness of the cost of money claim. The interest rate claimed should be justifiable and not exceed the prevailing market rates.

- The principle of mitigation: The aggrieved party is expected to take reasonable steps to mitigate their losses. Failure to do so might weaken their claim for cost of money.

Case Studies

Several case studies demonstrate the impact of cost of money in contract disputes:

- In the case of XYZ Corporation vs. ABC Construction, a construction company failed to meet the agreed-upon completion date. The delay caused significant financial losses for XYZ Corporation, including increased financing costs. XYZ Corporation successfully argued for the cost of money as part of their damages, demonstrating the financial burden they faced due to the delay.

- In Smith & Sons vs. Jones Enterprises, a supplier failed to deliver the agreed-upon quantity of materials on time. The delay disrupted the construction project, leading to increased financing costs for Smith & Sons. The court ruled in favor of Smith & Sons, acknowledging the cost of money as a legitimate expense incurred due to the supplier’s breach.

Best Practices for Managing Cost of Money

Managing the cost of money in government contracts effectively is crucial for maximizing profitability and ensuring financial stability. This involves a proactive approach to minimize financing costs, optimize cash flow, and maintain compliance with contract terms.

Strategies for Minimizing Cost of Money in Contract Performance

Minimizing the cost of money during contract performance requires a strategic approach to manage working capital, optimize financing options, and ensure timely payments.

- Negotiate favorable payment terms: Seek extended payment terms or milestone-based payments to maximize cash flow and reduce financing needs.

- Optimize working capital: Implement efficient inventory management, streamline accounts receivable processes, and minimize accounts payable to reduce the need for external financing.

- Explore alternative financing options: Investigate government-backed loans, lines of credit, or factoring services to secure cost-effective financing solutions.

- Monitor interest rates and market conditions: Stay informed about prevailing interest rates and market trends to capitalize on opportunities for refinancing or securing favorable loan terms.

Assessing the Cost of Money in Government Contracts

A comprehensive assessment of the cost of money in government contracts is essential to identify potential areas for improvement and optimize financial performance.

- Review contract terms: Carefully analyze payment terms, interest rates, and any applicable financing provisions to understand the cost of money associated with the contract.

- Evaluate internal financing costs: Assess the cost of using internal funds for contract performance, including opportunity costs and potential risks.

- Assess external financing costs: Analyze the costs of external financing, including interest rates, fees, and other associated expenses.

- Compare financing options: Evaluate different financing options, such as government-backed loans, commercial loans, and factoring services, to identify the most cost-effective solution.

So, when it comes to government contracts, understanding the “cost of money” is key. It’s not just about the initial price tag, but also about how those costs can change over time. You gotta be smart and plan ahead, or you could end up losing your shirt. It’s a tough game, but with the right knowledge, you can play it like a pro.

Clarifying Questions

How do I calculate the cost of money in a government contract?

There’s no one-size-fits-all answer, man. It depends on the specific contract and the factors involved. You’ll need to consult with a financial expert to get a proper calculation.

What are some strategies for minimizing the cost of money in a contract?

You can try to negotiate a lower interest rate, secure financing with a longer repayment term, or even find ways to reduce your overall expenses. It’s all about being smart and resourceful!

What are the legal implications of cost of money claims in a contract dispute?

That’s a question for a lawyer, buddy! It’s a complex issue with a lot of legal jargon. It’s best to seek professional advice if you’re facing a dispute.