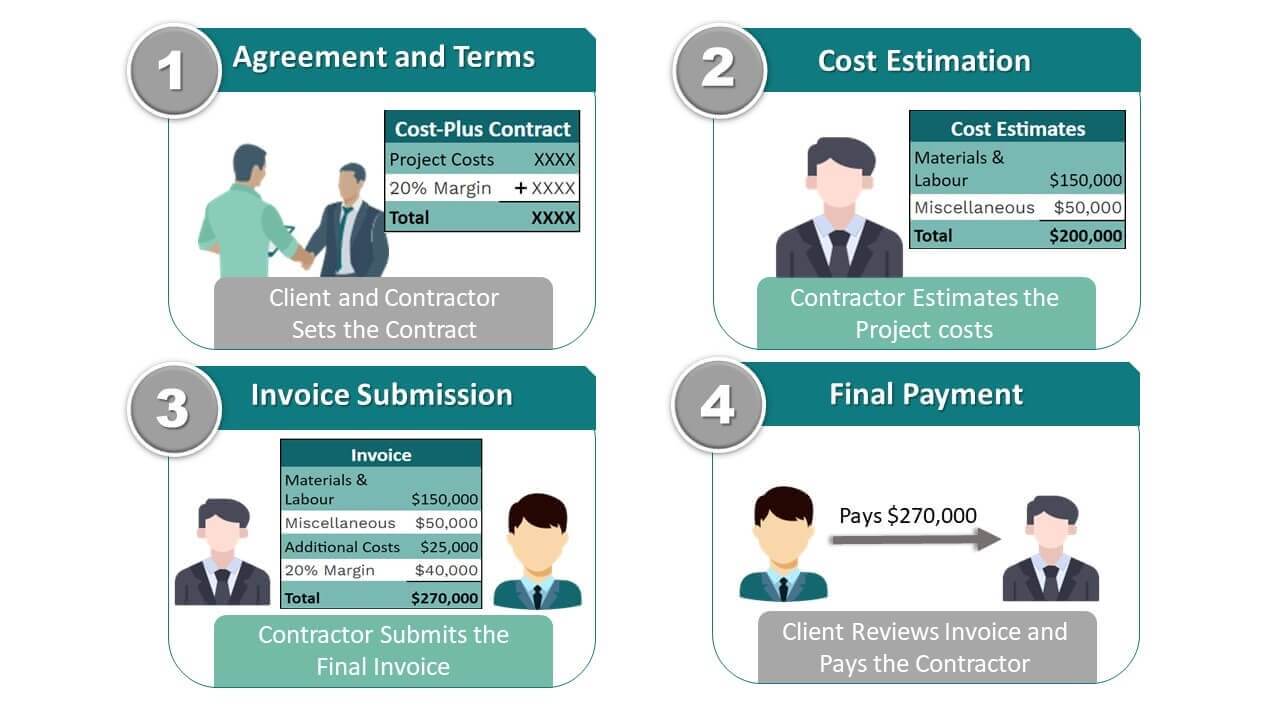

How does a cost plus contract work? Understanding this type of contract is crucial for both businesses and clients. It’s a unique arrangement where the contractor is reimbursed for all project costs, plus an additional fee. This fee can be a fixed amount, a percentage of costs, or even tied to performance incentives. This approach offers flexibility, especially for complex projects with uncertain scopes, but also carries inherent risks regarding cost control.

This guide will explore the different types of cost-plus contracts, how costs are calculated and reimbursed, the risk mitigation strategies involved, and the best practices for negotiation and management. We’ll also compare cost-plus contracts with other common contract types, providing real-world examples to illustrate their practical application.

Definition of a Cost-Plus Contract

Cost-plus contracts represent a fundamental approach to project pricing where the contractor’s payment is based on the actual costs incurred during the project’s execution, plus an agreed-upon profit margin or fee. This differs significantly from fixed-price contracts, offering flexibility but also presenting unique risk considerations for both parties.A cost-plus contract is essentially a reimbursement agreement. The client agrees to pay all allowable costs the contractor incurs, plus a predetermined percentage or fixed fee as profit.

This structure is particularly suitable for projects with uncertain scopes or significant potential for unforeseen changes. Think of it like this: you hire a contractor to renovate your kitchen, but the extent of the damage isn’t fully known until the walls are opened. A cost-plus contract would cover the unexpected repairs, while still guaranteeing a fair profit for the contractor.

Fundamental Principles of Cost-Plus Contracts

The core principle is transparency and accurate cost tracking. Both parties must agree on what constitutes an “allowable cost,” which usually involves detailed record-keeping and regular reporting by the contractor. This ensures that the client is paying only for legitimate expenses related to the project. The profit margin is usually pre-negotiated and is often a percentage of the total allowable costs, or a fixed fee regardless of the total cost.

This creates a shared interest in efficient cost management; a lower cost means a smaller profit for the contractor but also a lower cost for the client.

Key Characteristics of Cost-Plus Contracts

Cost-plus contracts are characterized by their flexibility and risk-sharing. Unlike fixed-price contracts where the contractor bears the risk of cost overruns, in a cost-plus contract, this risk is shared. The client benefits from the contractor’s expertise and the assurance that all necessary work will be completed, even if unforeseen circumstances arise. However, the client also assumes some risk of potentially higher-than-anticipated costs if the project becomes more complex than initially estimated.

This shared risk necessitates clear communication, robust cost-tracking mechanisms, and a high degree of trust between the client and contractor. The lack of a fixed price also makes it crucial to establish clear parameters for allowable costs to prevent potential disputes.

Distinguishing Cost-Plus from Other Contract Types

Cost-plus contracts differ significantly from fixed-price contracts, where the price is predetermined and the contractor bears the risk of cost overruns. They also contrast with time and materials contracts, which typically involve an hourly rate for labor and the cost of materials. In a cost-plus contract, the focus is on reimbursing actual costs plus a fee, providing more predictability for the contractor regarding profit while maintaining flexibility to adapt to changing project needs.

The degree of risk sharing is a key differentiator; fixed-price contracts place the majority of the risk on the contractor, while cost-plus contracts distribute it more evenly between the client and contractor.

Types of Cost-Plus Contracts

Cost-plus contracts offer a flexible approach to project management, particularly useful when the scope of work is uncertain or subject to change. However, the different types of cost-plus contracts vary significantly in their risk allocation and fee structures. Understanding these variations is crucial for selecting the most appropriate contract type for a given project.

Cost-Plus-Fixed-Fee Contracts

This common type of cost-plus contract reimburses the contractor for all allowable costs incurred in performing the work, plus a fixed fee that is predetermined at the outset. The fixed fee is not subject to change regardless of the actual costs incurred, providing the contractor with a predictable profit margin. This structure incentivizes efficient cost management by the contractor, as any savings are directly reflected in their profit.

Cost-Plus-Percentage-of-Cost Contracts

In a cost-plus-percentage-of-cost contract, the contractor’s fee is a percentage of the total allowable costs incurred during the project. This percentage is established upfront. While seemingly simple, this type carries a significant risk for the client. The contractor’s incentive is to maximize costs, as their fee increases proportionally. This can lead to cost overruns and less efficient project management.

This contract type is generally avoided due to its inherent conflict of interest.

Cost-Plus-Incentive-Fee Contracts

Cost-plus-incentive-fee contracts aim to align the interests of both the contractor and the client. The contractor is reimbursed for allowable costs, and their fee is determined based on the achievement of predetermined targets, such as cost, schedule, or performance goals. This structure encourages efficient cost management and timely completion, as the contractor’s fee is directly linked to their performance.

The incentive fee is usually calculated based on a formula or shared savings arrangement. For example, a target cost might be set, and any savings below that target are shared between the client and the contractor according to a predetermined ratio.

| Contract Type | Fee Structure | Risk Allocation | Suitability |

|---|---|---|---|

| Cost-Plus-Fixed-Fee | Fixed fee plus allowable costs | Contractor bears some cost risk; client bears less risk regarding the fee | Suitable for projects with well-defined scope but potential for cost fluctuations. |

| Cost-Plus-Percentage-of-Cost | Percentage of allowable costs | High risk for the client; low risk for the contractor | Generally unsuitable due to potential for cost inflation. |

| Cost-Plus-Incentive-Fee | Incentive fee based on performance targets plus allowable costs | Risk shared between client and contractor | Suitable for complex projects where cost and schedule efficiency are crucial. |

Cost Calculation and Reimbursement

Cost-plus contracts necessitate a clear and transparent process for calculating allowable costs and subsequent reimbursement to the contractor. Accurate cost tracking and documentation are crucial for ensuring fair compensation and preventing disputes. This section details the process of calculating allowable costs, common cost categories, excluded costs, and a step-by-step procedure for verification.

Allowable Cost Categories, How does a cost plus contract work

Allowable costs under a cost-plus contract generally fall into several key categories. Understanding these categories is essential for both the contractor and the client to ensure accurate cost accounting and avoid disagreements. The specific categories and their allowable inclusions can vary based on the contract’s terms and the nature of the project.

- Direct Materials: These are the raw materials directly used in the production of the goods or services. Examples include lumber for a construction project, specific components for manufacturing, or specialized chemicals for a research project. Detailed records, including purchase orders and invoices, are necessary to substantiate these costs.

- Direct Labor: This includes the wages, salaries, and benefits of employees directly involved in the project. This requires accurate time tracking and payroll records to demonstrate the direct labor hours expended on the specific project. Overtime premiums, if allowable per the contract, should be clearly documented.

- Overhead Costs: These are indirect costs associated with running the business and supporting the project. Examples include rent, utilities, administrative salaries, and depreciation of equipment. Overhead costs are often allocated to the project based on a predetermined method, such as a percentage of direct labor costs or a predetermined overhead rate agreed upon in the contract. Proper accounting procedures are essential for allocating overhead costs fairly and accurately.

Excluded Costs and Justification Requirements

Certain costs are typically excluded from reimbursement under cost-plus contracts unless specifically justified and approved beforehand. These exclusions aim to prevent unnecessary expenses and ensure cost efficiency.

- Unreasonable Costs: Expenses deemed excessive or not necessary for the project’s successful completion are usually disallowed. For example, lavish entertainment expenses or excessive travel costs would typically require strong justification.

- Unallowable Costs: These are costs specifically prohibited by the contract or government regulations. Examples include fines and penalties, interest payments, and bad debts.

- Costs Incurred Before Contract Award: Expenses incurred before the contract was formally awarded are generally not reimbursable unless explicitly agreed upon in advance.

Justification for including otherwise excluded costs often requires detailed documentation, including quotes, proposals, and explanations demonstrating the necessity and reasonableness of the expense in relation to the project.

Cost Documentation and Verification Procedure

A systematic approach to documenting and verifying costs is critical for successful cost-plus contract management. This ensures transparency, facilitates accurate reimbursement, and minimizes potential disputes.

- Detailed Cost Tracking: Maintain meticulous records of all costs incurred, including invoices, receipts, time sheets, and purchase orders. These records should clearly link costs to specific project tasks or deliverables.

- Cost Coding: Implement a system for coding costs to allow for easy categorization and tracking. This facilitates accurate allocation of costs to different project elements and helps in identifying potential cost overruns.

- Regular Cost Reporting: Submit regular cost reports to the client, outlining the incurred costs and providing supporting documentation. The frequency of these reports should be specified in the contract.

- Client Review and Approval: Allow the client to review and approve the cost reports before reimbursement. This ensures transparency and agreement on the allowable costs.

- Audits: Periodic audits can help verify the accuracy and completeness of the cost records. These audits can be conducted internally or by an independent third party, depending on the contract’s terms.

Risk and Incentive Mechanisms

Cost-plus contracts, while offering flexibility, present inherent risks for both the buyer and the seller. Understanding these risks and implementing effective mitigation strategies is crucial for successful project execution. This section explores the inherent risks and Artikels mechanisms to manage and even leverage them for mutual benefit.

The primary risk for the buyer in a cost-plus contract lies in the potential for cost overruns. Without stringent cost controls, the seller might be incentivized to increase expenses, ultimately leading to higher-than-anticipated project costs for the buyer. Conversely, the seller faces the risk of unforeseen expenses and potential losses if the agreed-upon profit margin is insufficient to cover actual costs.

The seller also risks losing future contracts if the project is delivered late or fails to meet quality standards, regardless of cost.

Risk Mitigation Mechanisms

Effective risk mitigation involves a combination of strategies implemented by both parties. These strategies focus on transparency, accountability, and shared responsibility for project success.

Audits provide a critical mechanism for verifying the accuracy of the seller’s cost reports. Regular and independent audits, conducted by a third-party auditor, help ensure that all claimed costs are legitimate and reasonable. Performance incentives, such as bonuses for on-time and within-budget completion, motivate the seller to control costs and deliver the project efficiently. Finally, robust cost control measures, including pre-approved budgets, regular cost tracking, and value engineering initiatives, help maintain transparency and prevent uncontrolled spending.

Incentive Structures for Cost Efficiency

Incentive structures can be designed to align the interests of both the buyer and the seller, encouraging cost-effectiveness without compromising quality.

One common approach is to incorporate a shared savings clause. This clause stipulates that any cost savings achieved below a predetermined target are shared between the buyer and the seller according to a pre-agreed ratio. For example, a 50/50 split means that if the project is completed $100,000 under budget, the buyer and the seller each receive $50,000.

Another approach is to offer performance-based bonuses tied to specific cost targets or milestones. Meeting or exceeding these targets results in additional payments to the seller, incentivizing efficient resource management and cost optimization. Conversely, penalties can be included for significant cost overruns, providing a disincentive for unnecessary expenses. These incentives can be structured to reward both cost efficiency and quality, ensuring the project meets the buyer’s requirements within the agreed-upon budget.

Contract Negotiation and Management

Cost-plus contracts, while offering flexibility, necessitate meticulous negotiation and robust management to mitigate potential risks and ensure fair compensation for both parties. Effective negotiation establishes a clear understanding of project scope, cost parameters, and responsibilities, laying the groundwork for a successful partnership. Ongoing management ensures adherence to agreed-upon terms, promotes transparency, and facilitates timely dispute resolution.

Key Aspects of Cost-Plus Contract Negotiation

Negotiating a cost-plus contract requires a strategic approach focused on defining the project’s scope, establishing clear cost accounting methods, and defining acceptable profit margins. Ambiguity in any of these areas can lead to disputes and cost overruns. Both parties should enter the negotiation with well-defined objectives and a thorough understanding of the project’s complexities.

Best Practices for Ongoing Contract Management

Maintaining transparency and accountability is paramount throughout the project lifecycle. Regular progress meetings, detailed cost reporting, and independent audits can help ensure that expenses are accurately tracked and that the project stays on schedule and within budget. Effective communication channels must be established to facilitate prompt resolution of any emerging issues. A collaborative approach, focusing on mutual understanding and problem-solving, fosters a productive working relationship.

Essential Clauses for Cost-Plus Contracts

A well-drafted cost-plus contract should include specific clauses to protect the interests of both the buyer and the contractor. These clauses should clearly define allowable costs, the method of calculating the contractor’s fee, the process for change orders, dispute resolution mechanisms, and termination provisions. The inclusion of a detailed scope of work, performance metrics, and payment schedules is also crucial.

For example, a clause specifying allowable indirect costs, such as administrative overhead, is essential to prevent disputes over cost allocation. Similarly, a clearly defined process for submitting and approving change orders prevents misunderstandings and delays. A dispute resolution clause outlining a structured process, such as mediation or arbitration, can help to avoid costly litigation. Finally, a termination clause specifying the conditions under which the contract can be terminated and the consequences of termination protects both parties from unforeseen circumstances.

These clauses, along with a detailed definition of deliverables and acceptance criteria, provide a framework for a successful and mutually beneficial project.

Real-World Applications: How Does A Cost Plus Contract Work

Cost-plus contracts, while carrying inherent risks, find practical application across diverse sectors where precise cost estimations upfront are challenging or impossible. Their flexibility makes them suitable for projects with evolving requirements or those involving significant uncertainty. The success of a cost-plus contract hinges on robust contract management and a strong, collaborative relationship between the client and contractor.Cost-plus contracts are particularly well-suited to projects with a high degree of technical complexity, demanding specialized expertise and potentially unpredictable challenges.

The adaptability of these contracts allows for adjustments as the project unfolds, mitigating potential disruptions and cost overruns that might plague fixed-price arrangements.

Industries and Project Types

Cost-plus contracts frequently appear in research and development, particularly in fields like pharmaceuticals and aerospace, where innovative solutions require iterative processes and unpredictable outcomes. Government contracts, especially those involving defense or infrastructure projects, often utilize this model due to the complex nature of the work and the need for flexibility. Construction projects, especially large-scale ones with changing specifications, also frequently employ cost-plus contracts.

Furthermore, complex IT projects, involving custom software development or large-scale system integrations, often benefit from the flexibility afforded by this contract type.

Appropriate Scenarios for Cost-Plus Contracts

A cost-plus contract is most appropriate when the scope of work is poorly defined or likely to change significantly throughout the project lifecycle. This is common in situations where technological advancements might necessitate design alterations, or when unexpected challenges arise during construction or development. Situations with a high degree of uncertainty, where accurate cost estimation at the outset is practically impossible, also favor this approach.

Finally, projects requiring specialized expertise and highly skilled labor, where finding a contractor willing to take on a fixed-price contract is difficult, are good candidates for cost-plus contracts.

Successful and Unsuccessful Applications

A successful example is the development of a new cancer treatment drug. The pharmaceutical company employed a cost-plus contract with a research firm, allowing for adjustments to the research plan as new data emerged. This flexible approach resulted in the timely development of a highly effective drug, although the final cost was higher than initially projected. Conversely, an unsuccessful application might involve a large-scale construction project where inadequate oversight and a lack of clear cost control mechanisms led to significant cost overruns and project delays, ultimately damaging the client-contractor relationship.

In this scenario, the flexibility inherent in the cost-plus contract became a liability due to insufficient monitoring and management.

Ultimately, the success of a cost-plus contract hinges on clear communication, robust cost tracking, and a strong collaborative relationship between the client and contractor. While offering flexibility and adaptability, it demands careful planning, transparent accounting, and a shared commitment to efficient cost management. By understanding the nuances of this contract type, both parties can navigate the project successfully, achieving mutually beneficial outcomes.

Detailed FAQs

What happens if unforeseen costs arise in a cost-plus contract?

Generally, unforeseen costs are reviewed and justified by the contractor. The contract should Artikel a process for handling such situations, possibly involving client approval for significant deviations from the initial budget.

Can a cost-plus contract be terminated early?

Yes, but the contract should specify the terms for early termination, including how already incurred costs will be handled and any potential penalties.

How are disputes resolved in a cost-plus contract?

The contract should Artikel a dispute resolution process, often involving mediation or arbitration, to avoid costly litigation.

Is a cost-plus contract suitable for all projects?

No. Cost-plus contracts are best suited for complex projects with uncertain scopes where flexibility is paramount. They are less suitable for projects with well-defined scopes and fixed budgets.