How much do futures contracts cost? This is a question that many potential investors ask, as futures contracts can offer significant leverage and potential for profit, but also carry a degree of risk. The cost of trading futures contracts is multifaceted, encompassing various fees and margin requirements that can impact overall profitability.

Understanding the cost structure of futures contracts is crucial for making informed trading decisions. This guide delves into the key factors that influence the cost of futures contracts, including initial margin, trading costs, and maintenance margin. We will also explore how profit and loss are calculated and how futures contracts are settled at expiration.

Maintenance Margin

The maintenance margin is a crucial element in futures trading, acting as a safety net to protect brokers from losses incurred by traders who experience adverse price movements in their futures positions. It serves as a minimum amount of equity that must be maintained in a trading account to ensure sufficient funds are available to cover potential losses.

Calculation and Breach

The maintenance margin is typically calculated as a percentage of the total contract value. This percentage varies depending on the specific futures contract and the broker’s risk appetite. For instance, a futures contract with a value of $100,000 and a maintenance margin requirement of 5% would necessitate a minimum balance of $5,000 in the trading account.

The maintenance margin is usually a fixed percentage of the contract’s value, but it can fluctuate based on factors such as market volatility and the underlying asset’s price.

When the account equity falls below the maintenance margin, the trader receives a margin call. This signifies that additional funds are required to bring the account back to the required margin level. Failure to meet the margin call can lead to the liquidation of the trader’s position, resulting in potential losses.

Fluctuation of Maintenance Margin Requirements

Maintenance margin requirements can fluctuate based on market conditions and the specific futures contract. Here are some factors that can influence these requirements:

- Market Volatility: Higher volatility in the underlying asset’s price typically leads to increased maintenance margin requirements. This is because greater price fluctuations pose a higher risk of losses for the broker.

- Contract Maturity: As the contract’s expiration date approaches, the maintenance margin requirement may increase. This is due to the heightened risk associated with contracts nearing maturity.

- Broker’s Risk Appetite: Different brokers have varying risk tolerance levels. Some brokers may have higher maintenance margin requirements than others, reflecting their preference for a more conservative approach.

For example, during periods of heightened market volatility, such as during economic uncertainty or geopolitical events, the maintenance margin requirements for futures contracts may increase significantly. Conversely, during periods of low volatility, these requirements may be reduced.

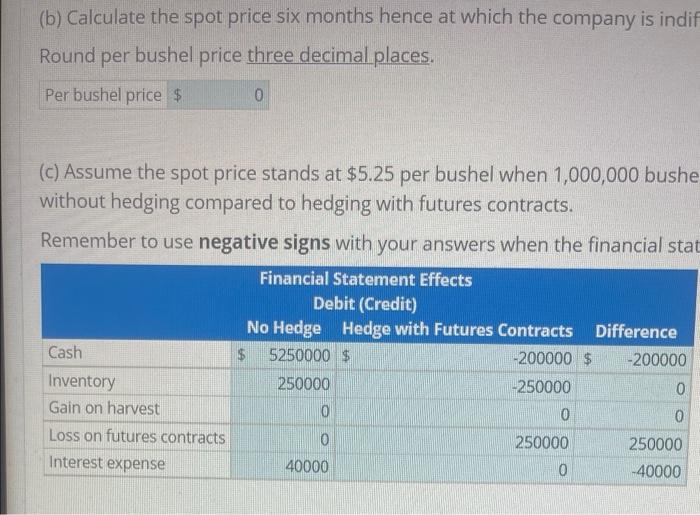

Profit and Loss Calculations

Futures contracts are leveraged instruments, meaning that you can control a large amount of underlying asset with a relatively small initial investment. This leverage magnifies your potential profits but also increases your potential losses. Understanding how profit and loss are calculated in futures trading is crucial for managing risk and making informed trading decisions.

Profit and Loss Calculation

The profit or loss on a futures contract is determined by the difference between the entry price and the exit price, multiplied by the contract size.

Profit/Loss = (Exit Price – Entry Price) x Contract Size

For example, if you buy a futures contract for $100 and later sell it for $110, your profit would be $10 per contract. If you sell a futures contract for $100 and later buy it back for $90, your profit would be $10 per contract.

Factors Influencing Profit and Loss, How much do futures contracts cost

Several factors can influence the profit or loss on a futures contract. These include:

- Price Movements: The most significant factor affecting profit and loss is the price movement of the underlying asset. If the price moves in your favor, you will make a profit. If the price moves against you, you will incur a loss.

- Margin Requirements: Futures contracts require an initial margin deposit, which acts as a good faith deposit and helps to mitigate the risk of default. While the margin does not represent the entire value of the contract, it is subject to daily fluctuations based on price movements. If the price moves against your position, your margin account may be subject to a margin call, requiring you to deposit additional funds to maintain the required margin level.

- Trading Costs: Trading costs include brokerage fees, exchange fees, and other expenses associated with trading futures contracts. These costs can impact your overall profit or loss.

Profit and Loss Scenarios

The following table illustrates potential profit and loss scenarios for a futures contract:

| Scenario | Entry Price | Exit Price | Profit/Loss per Contract |

|---|---|---|---|

| Scenario 1: Profit | $100 | $110 | $10 |

| Scenario 2: Loss | $100 | $90 | -$10 |

Note: These are simplified examples, and actual profit and loss scenarios may vary depending on the specific futures contract, market conditions, and trading strategy.

Futures Contract Settlement

Futures contracts expire on a specific date, and at expiration, the contract must be settled. Settlement is the process of fulfilling the obligations Artikeld in the contract, which involves either the delivery of the underlying asset or the exchange of cash.There are two primary methods for settling futures contracts:

Cash Settlement

Cash settlement is the most common method of settling futures contracts. In this method, the difference between the contract’s final price and the price at which the contract was entered into is calculated. This difference, known as the settlement price, is then paid or received in cash by the parties to the contract.

The settlement price is determined by the exchange based on the final trading price of the contract on the last trading day.

For example, if an investor bought a futures contract for $100 and the contract expires at $110, the investor would receive a $10 profit. Conversely, if the contract expired at $90, the investor would incur a $10 loss.

Physical Delivery

Physical delivery involves the actual delivery of the underlying asset to the buyer and payment by the buyer to the seller. This method is less common than cash settlement, as it is often more costly and complex.

Physical delivery is usually preferred for commodities such as agricultural products, energy, and metals, where the actual product is traded.

For example, if an investor bought a futures contract for 100 barrels of oil, they would be obligated to receive 100 barrels of oil at the expiration date. Similarly, if an investor sold a futures contract for 100 barrels of oil, they would be obligated to deliver 100 barrels of oil at the expiration date.

In conclusion, the cost of futures contracts is influenced by a variety of factors, including initial margin, trading costs, and maintenance margin. By understanding these costs, traders can make informed decisions about whether futures trading aligns with their risk tolerance and investment goals.

FAQ Compilation: How Much Do Futures Contracts Cost

What are the minimum trading requirements for futures contracts?

Minimum trading requirements for futures contracts vary based on the specific contract and brokerage. Some brokers may have minimum deposit requirements, while others may have minimum order sizes. It’s essential to check with your broker for their specific requirements.

Can I use leverage in futures trading?

Yes, futures trading allows for leverage, meaning you can control a larger position with a smaller initial investment. However, leverage can amplify both gains and losses, so it’s crucial to manage risk carefully.

Are there any tax implications for futures trading?

Yes, profits from futures trading are typically taxed as short-term capital gains, while losses can be deducted from other capital gains or income. It’s essential to consult with a tax professional to understand the specific tax implications of futures trading in your jurisdiction.