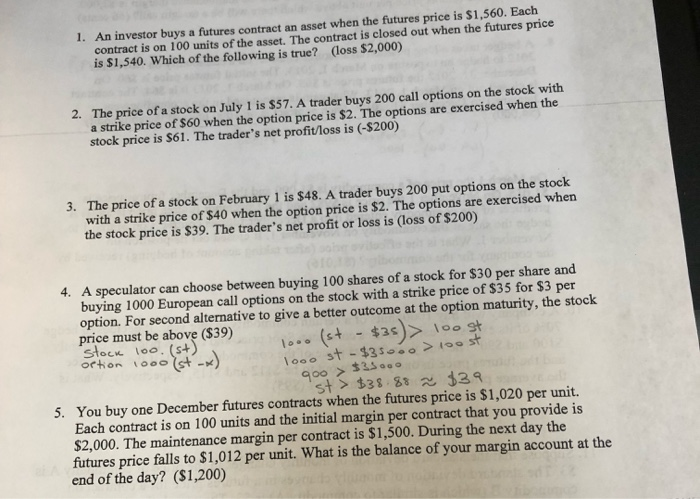

How much does a gold futures contract cost? This question often arises for investors seeking to delve into the world of precious metal trading. Gold futures contracts, a popular financial instrument, offer a unique avenue to speculate on the price of gold, but understanding their associated costs is crucial for informed decision-making. These contracts represent an agreement to buy or sell a specific amount of gold at a predetermined price on a future date, offering both opportunities and risks.

Understanding the factors influencing the cost of these contracts, such as brokerage fees, exchange fees, and margin requirements, is paramount for traders to navigate the market effectively and manage their risk exposure.

Gold futures contracts, like other financial instruments, are subject to various factors that determine their cost. These factors include global economic conditions, interest rates, inflation, geopolitical events, and supply and demand dynamics. The price of gold futures contracts is influenced by the market’s perception of the underlying asset’s value, driven by these external forces. Central bank policies, such as interest rate adjustments, can also significantly impact the price of gold futures contracts, as they influence the attractiveness of alternative investments.

Understanding Gold Futures Contracts

Gold futures contracts are financial instruments that allow investors to buy or sell a specific amount of gold at a predetermined price on a future date. These contracts are traded on organized exchanges, providing a standardized and transparent way to participate in the gold market. Gold futures contracts play a crucial role in the financial markets, offering various benefits to both investors and businesses.

Contract Specifications

Gold futures contracts have specific terms and conditions that define the contract’s obligations and characteristics. These specifications ensure that all parties involved understand the contract’s details and obligations.

Underlying Asset

The underlying asset of a gold futures contract is physical gold, typically measured in troy ounces. Each contract represents a specific amount of gold, which is standardized across the exchange.

Contract Size

The contract size defines the amount of gold represented by each contract. The standard contract size for gold futures traded on the COMEX (Commodity Exchange Division of the New York Mercantile Exchange) is 100 troy ounces. This means that each contract represents 100 ounces of gold.

Trading Unit

The trading unit refers to the minimum number of contracts that can be traded. In most cases, the trading unit for gold futures is one contract. This means that investors can buy or sell a minimum of 100 ounces of gold with each transaction.

Delivery Date

The delivery date specifies the date on which the physical gold must be delivered to the buyer or received by the seller. Gold futures contracts have various delivery dates, ranging from a few months to several years.

Differences Between Spot Gold and Gold Futures, How much does a gold futures contract cost

Spot gold refers to the immediate purchase or sale of physical gold at the current market price. Gold futures contracts, on the other hand, are agreements to buy or sell gold at a predetermined price on a future date.

Spot gold is a physical commodity that is bought and sold immediately at the current market price. Gold futures contracts are financial instruments that allow investors to buy or sell gold at a predetermined price on a future date.

- Timing of Delivery: Spot gold is delivered immediately, while gold futures contracts involve delivery on a future date. This difference allows investors to lock in a price for gold at a later date, providing protection against price fluctuations.

- Price Determination: Spot gold prices are determined by the current market forces, while gold futures prices are based on expectations about future gold prices. These expectations are influenced by various factors, such as economic conditions, geopolitical events, and supply and demand dynamics.

- Trading Location: Spot gold is traded on over-the-counter markets, while gold futures contracts are traded on organized exchanges, such as the COMEX. This difference ensures transparency and standardization in the trading process.

Factors Influencing Gold Futures Contract Prices

The price of gold futures contracts is influenced by a complex interplay of economic, political, and market factors. Understanding these factors is crucial for investors seeking to navigate the gold futures market effectively.

Global Economic Conditions

Global economic conditions play a significant role in determining gold futures prices. During periods of economic uncertainty or recession, investors often turn to gold as a safe-haven asset. This increased demand for gold can drive up its price. Conversely, when the global economy is strong and investors are optimistic about growth, gold may be less attractive, potentially leading to lower prices.

Interest Rates

Interest rates are inversely correlated with gold prices. When interest rates rise, the opportunity cost of holding gold, which does not pay interest, increases. This can make gold less attractive to investors, potentially leading to lower prices. Conversely, when interest rates fall, the opportunity cost of holding gold decreases, potentially boosting demand and driving up prices.

Inflation

Gold is often seen as a hedge against inflation. As inflation rises, the purchasing power of fiat currencies declines, making gold a more attractive investment. Increased demand for gold as an inflation hedge can drive up prices.

Geopolitical Events

Geopolitical events, such as wars, political instability, or international tensions, can also impact gold prices. During periods of geopolitical uncertainty, investors often seek safe-haven assets, driving up demand for gold and pushing prices higher.

Supply and Demand Dynamics

The supply and demand for gold also play a crucial role in determining its price. Gold is a finite resource, and its supply is relatively inelastic. Increased demand for gold, driven by factors like investment, jewelry, and industrial uses, can lead to higher prices. Conversely, a decrease in demand can lead to lower prices.

Central Bank Policies

Central bank policies, such as interest rate changes or quantitative easing, can impact gold prices. When central banks pursue accommodative monetary policies, such as lowering interest rates or increasing the money supply, this can lead to increased inflation and potentially drive up gold prices. Conversely, when central banks tighten monetary policy, this can potentially put downward pressure on gold prices.

Market Sentiment

Market sentiment, or the overall mood of investors, can also influence gold prices. When investors are optimistic about the economy, they may be less inclined to invest in gold, potentially leading to lower prices. Conversely, when investor sentiment is negative, gold may be seen as a safe-haven asset, driving up demand and prices.

Trading Gold Futures Contracts

Trading gold futures contracts involves buying or selling a contract that obligates the trader to buy or sell a specific quantity of gold at a predetermined price and future date. This is a complex process that requires a deep understanding of the market dynamics and a well-defined trading strategy.

Opening and Closing Positions

To open a gold futures contract, traders must first establish an account with a futures brokerage firm. They then submit an order to buy or sell a specific number of contracts at a particular price. Once the order is executed, the trader assumes a long or short position in the gold futures market.

- A long position is held when a trader buys a gold futures contract, anticipating that the price of gold will rise in the future. If the price does rise, the trader can sell the contract at a profit.

- A short position is held when a trader sells a gold futures contract, anticipating that the price of gold will fall.

If the price does fall, the trader can buy the contract back at a lower price and make a profit.

To close a position, traders simply need to submit an order to sell (if they have a long position) or buy (if they have a short position) the same number of contracts they initially bought or sold. The profit or loss is determined by the difference between the entry price and the closing price, adjusted for any commissions and fees.

Trading Strategies

There are several different trading strategies employed in the gold futures market, each with its own set of risks and rewards.

- Hedging: Hedging involves using gold futures contracts to mitigate potential losses from price fluctuations in the underlying asset. For example, a gold miner might sell gold futures contracts to protect against a decline in gold prices, which would impact their revenue.

- Speculation: Speculation involves taking a position in the gold futures market based on the expectation that the price will move in a particular direction.

For example, a trader might buy gold futures contracts if they believe the price of gold will rise, hoping to profit from the price difference.

- Arbitrage: Arbitrage involves exploiting price discrepancies between different markets. For example, a trader might buy gold futures contracts on one exchange and simultaneously sell them on another exchange if the prices differ, aiming to profit from the price difference.

Key Considerations for Traders

Traders need to consider several factors before entering the gold futures market, including:

- Margin Requirements: Futures contracts require traders to deposit a certain amount of money, known as margin, to cover potential losses. The margin requirement is a percentage of the contract value and can vary depending on the broker and the contract size.

- Leverage: Futures contracts offer leverage, which allows traders to control a large amount of gold with a relatively small investment.

However, leverage also amplifies both profits and losses.

- Risk Management Techniques: Trading gold futures involves significant risk, and traders must implement effective risk management techniques to protect their capital. This includes setting stop-loss orders to limit potential losses and diversifying their portfolio.

Costs Associated with Gold Futures Contracts: How Much Does A Gold Futures Contract Cost

Trading gold futures contracts involves various costs, which can significantly impact your overall profitability. It’s essential to understand these costs before venturing into this market.

Brokerage Fees

Brokerage fees are charges levied by your broker for facilitating your trades. These fees vary depending on the broker, the trading platform used, and the volume of your trades.

- Commission Fees: These are per-trade fees charged by your broker for executing your buy or sell orders.

- Transaction Fees: These are fees charged by the exchange for processing your trades.

- Clearing Fees: These are fees charged by the clearinghouse for guaranteeing the settlement of your trades.

Margin Requirements

Margin requirements are the amount of money you need to deposit with your broker to secure a futures contract. This amount is a percentage of the total contract value and is subject to changes based on market volatility.

- Initial Margin: This is the amount you need to deposit to open a position. It acts as a good faith deposit and helps mitigate potential losses.

- Maintenance Margin: This is the minimum amount of margin you need to maintain in your account to keep your position open. If your account balance falls below the maintenance margin, you will receive a margin call, requiring you to deposit additional funds to cover potential losses.

Interest Costs

If you hold a futures contract for an extended period, you may incur interest costs on the margin you have deposited. This is because the margin you deposit is typically held in a margin account, and brokers may charge interest on these funds.

Other Costs

Besides the above, other costs associated with trading gold futures contracts include:

- Data Fees: Some brokers charge fees for accessing real-time market data and charting tools.

- Software Fees: If you use specialized trading software, you may need to pay a subscription fee.

Factors Influencing Costs

Several factors influence the overall cost of trading gold futures contracts:

- Market Volatility: When the gold market is volatile, margin requirements tend to be higher, leading to increased costs.

- Contract Size: Larger contracts have higher margin requirements and, therefore, higher costs.

- Trading Frequency: Frequent trading can result in higher brokerage fees and interest costs.

Comparison with Other Investment Options

Trading gold futures contracts is just one way to invest in gold. Other options include:

- Physical Gold: Buying physical gold, such as coins or bars, involves storage costs and potential security risks. However, it offers ownership of the underlying asset.

- Gold ETFs: Gold ETFs track the price of gold and are traded on stock exchanges. They offer diversification and liquidity but may have higher expense ratios than futures contracts.

Benefits and Risks of Trading Gold Futures Contracts

Trading gold futures contracts can be a complex and potentially lucrative endeavor, but it’s essential to understand both the potential benefits and risks before diving in. This section will delve into the advantages and disadvantages of this trading strategy, comparing it to other investment options to help you make informed decisions.

Potential Benefits of Trading Gold Futures Contracts

Gold futures contracts offer several potential benefits, particularly for investors seeking to hedge against inflation, diversify their portfolios, and speculate on price movements.

- Hedging Against Inflation: Gold is often seen as a safe-haven asset during periods of economic uncertainty and inflation. Gold futures contracts allow investors to lock in a price for gold, mitigating the risk of rising prices in the future. For example, an investor concerned about inflation could buy gold futures contracts to protect the purchasing power of their investments.

- Portfolio Diversification: Gold is a non-correlated asset, meaning its price movements are not closely tied to those of traditional investments like stocks and bonds. Adding gold futures contracts to a portfolio can help diversify risk, potentially reducing overall portfolio volatility. Imagine an investor with a stock-heavy portfolio who wants to mitigate losses during market downturns. Gold futures contracts can act as a hedge, offering potential returns even when stocks are declining.

- Speculating on Price Movements: Gold futures contracts allow investors to speculate on the price movements of gold. Investors who believe gold prices will rise can buy contracts, hoping to profit from the price difference when they sell the contracts later. For instance, an investor anticipating a surge in gold prices due to geopolitical events might purchase gold futures contracts to capitalize on the potential price appreciation.

Risks Associated with Trading Gold Futures Contracts

While gold futures contracts offer potential benefits, they also come with inherent risks that investors must carefully consider. These risks include price volatility, margin calls, and counterparty risk.

- Price Volatility: Gold prices can fluctuate significantly, making gold futures contracts a risky investment. Even small price changes can result in substantial gains or losses for investors. For example, a sudden drop in gold prices could lead to significant losses for investors holding long positions in gold futures contracts.

- Margin Calls: To trade gold futures contracts, investors must deposit a certain amount of money, known as margin, as collateral. If the price of gold moves against the investor’s position, they may receive a margin call, requiring them to deposit additional funds to cover potential losses. Failure to meet a margin call can result in the liquidation of the investor’s position.

Imagine an investor who has bought gold futures contracts but faces a decline in gold prices. The brokerage firm may issue a margin call, demanding additional funds to cover the potential losses.

- Counterparty Risk: Counterparty risk refers to the risk that the other party in a futures contract may not be able to fulfill their obligations. This risk is particularly relevant for investors trading with less-established brokers or clearinghouses. In a worst-case scenario, if the counterparty defaults, investors could lose their entire investment.

Comparison with Other Investment Options

Comparing gold futures contracts with other investment options, such as investing in physical gold, gold ETFs, or gold mining stocks, helps investors understand the unique characteristics and risks associated with each approach.

- Physical Gold: Investing in physical gold involves buying and storing gold bars or coins. This approach offers direct ownership of the asset but can be costly due to storage and security concerns.

- Gold ETFs: Gold exchange-traded funds (ETFs) track the price of gold and offer investors exposure to the gold market without the need to buy and store physical gold. However, ETFs may have associated fees and may not offer the same potential for leverage as futures contracts.

- Gold Mining Stocks: Investing in gold mining stocks provides exposure to the gold market through the performance of gold mining companies. However, these investments are subject to the risks associated with individual companies, including operational, financial, and regulatory challenges.

In conclusion, understanding the costs associated with gold futures contracts is essential for investors seeking to participate in this market. While these contracts offer potential benefits such as hedging against inflation, diversifying portfolios, and speculating on price movements, they also come with inherent risks like price volatility, margin calls, and counterparty risk. Traders must carefully consider their investment objectives, risk tolerance, and financial resources before venturing into the world of gold futures contracts.

By understanding the complexities of this market, investors can make informed decisions and manage their risk exposure effectively.

Common Queries

What are the main types of costs associated with gold futures contracts?

The main costs associated with gold futures contracts include brokerage fees, exchange fees, and margin requirements. Brokerage fees are charged by the brokerage firm for facilitating the trade, while exchange fees are levied by the exchange where the contract is traded. Margin requirements represent the initial deposit required to open a position, which serves as collateral to cover potential losses.

How do margin requirements affect the cost of trading gold futures contracts?

Margin requirements can significantly influence the cost of trading gold futures contracts. A higher margin requirement means a larger initial deposit is needed, which can tie up capital and limit trading opportunities. The margin requirement is typically a percentage of the contract value and can vary depending on market volatility and the trader’s account size.

What are the advantages of trading gold futures contracts?

Trading gold futures contracts offers several advantages, including hedging against inflation, diversifying a portfolio, and speculating on price movements. Futures contracts allow investors to lock in a price for future delivery, providing protection against price fluctuations. They also offer leverage, allowing traders to control a larger position with a smaller initial investment.

What are the risks associated with trading gold futures contracts?

Trading gold futures contracts carries several risks, including price volatility, margin calls, and counterparty risk. Price volatility can lead to significant losses, while margin calls require traders to deposit additional funds to maintain their positions. Counterparty risk arises from the possibility that the other party to the contract may default on their obligations.