How much does an oil futures contract cost – The world of oil futures contracts, where investors navigate the volatile landscape of global energy markets, is an intriguing one. Understanding the cost of entering this realm is crucial, as it involves not only the price of the underlying commodity but also a complex web of fees and margin requirements.

An oil futures contract represents a commitment to buy or sell a specific quantity of oil at a predetermined price on a future date. These contracts are traded on organized exchanges and provide a way for market participants to manage price risk, speculate on future price movements, or hedge against potential losses. The cost of an oil futures contract is influenced by several factors, including the contract size, the underlying oil type, and the prevailing market conditions.

Understanding Oil Futures Contracts: How Much Does An Oil Futures Contract Cost

Oil futures contracts are legally binding agreements to buy or sell a specific quantity of oil at a predetermined price on a future date. These contracts are traded on organized exchanges, such as the New York Mercantile Exchange (NYMEX) and the Intercontinental Exchange (ICE).Oil futures contracts play a vital role in the energy markets, enabling participants to hedge against price fluctuations, speculate on future price movements, and manage their exposure to oil price risk.

Types of Oil Futures Contracts

Oil futures contracts are available for various types of oil, including:

- Crude Oil: Crude oil futures contracts are the most widely traded oil futures contracts. They represent the price of a specific type of crude oil, such as West Texas Intermediate (WTI) or Brent crude, at a future date.

- Gasoline: Gasoline futures contracts represent the price of gasoline at a future date. These contracts are typically used by refiners and gasoline retailers to hedge against price fluctuations.

- Heating Oil: Heating oil futures contracts represent the price of heating oil at a future date. These contracts are typically used by wholesalers and retailers to hedge against price fluctuations.

Factors Influencing Oil Futures Prices

Numerous factors can influence the price of oil futures contracts. These include:

- Global Supply and Demand: The balance between global oil supply and demand is a primary driver of oil prices. Increased demand, such as economic growth or rising global population, tends to push prices higher, while increased supply, such as new oil discoveries or increased production, tends to push prices lower.

- Geopolitical Events: Geopolitical events, such as wars, political instability, or sanctions, can significantly impact oil prices. For example, the 2003 invasion of Iraq led to a sharp increase in oil prices due to concerns about supply disruptions.

- Economic Conditions: Economic conditions, such as interest rates, inflation, and currency exchange rates, can also influence oil prices. A strong economy tends to lead to higher demand for oil, while a weak economy can lead to lower demand.

- Weather: Weather events, such as hurricanes or cold snaps, can also impact oil prices. For example, a hurricane that damages oil production facilities in the Gulf of Mexico can lead to supply disruptions and higher prices.

- Technological Advancements: Technological advancements, such as the development of new oil extraction techniques or alternative energy sources, can also influence oil prices. For example, the rise of renewable energy sources, such as solar and wind power, could potentially lead to lower demand for oil in the long term.

Cost of an Oil Futures Contract

The cost of an oil futures contract is influenced by several factors, including the contract size, trading fees, and margin requirements. Understanding these factors is crucial for determining the overall cost of trading oil futures contracts.

Contract Size and Cost

The contract size of an oil futures contract determines the quantity of oil being traded. For example, a single contract for West Texas Intermediate (WTI) crude oil represents 1,000 barrels of oil. The cost of an oil futures contract is directly proportional to the contract size. Therefore, a larger contract size will result in a higher cost, while a smaller contract size will result in a lower cost.

Trading Fees

Several fees are associated with trading oil futures contracts, including brokerage fees, exchange fees, and clearing fees.

Brokerage Fees

Brokerage fees are charged by the brokerage firm that facilitates the trade. These fees can vary depending on the brokerage firm, the type of account, and the trading volume.

Exchange Fees

Exchange fees are charged by the exchange where the futures contracts are traded. These fees are typically a fixed amount per contract.

Clearing Fees

Clearing fees are charged by the clearinghouse that guarantees the performance of the contract. These fees are also typically a fixed amount per contract.

Margin Requirements

Margin requirements are a deposit that traders must maintain in their trading account to cover potential losses. These requirements are set by the exchange and can fluctuate based on market volatility.

Initial Margin

The initial margin is the deposit required to open a futures position. This margin is typically a percentage of the contract value.

Maintenance Margin

The maintenance margin is the minimum amount of money that must be maintained in the trading account to keep the position open. If the account balance falls below the maintenance margin, a margin call will be issued, requiring the trader to deposit additional funds to bring the account balance back up to the initial margin level.

Factors Affecting Contract Cost

The cost of an oil futures contract is determined by a complex interplay of factors that influence the supply and demand dynamics of crude oil. Understanding these factors is crucial for investors and traders to make informed decisions about buying or selling oil futures contracts.

Supply and Demand

The most fundamental factor influencing oil futures prices is the balance between supply and demand. When demand exceeds supply, prices tend to rise, and vice versa.

- Supply: Factors affecting oil supply include production levels, OPEC policies, geopolitical events, and technological advancements in extraction techniques. For example, disruptions in production due to political instability or natural disasters can lead to a decrease in supply, pushing prices higher.

- Demand: Factors affecting oil demand include global economic growth, consumer spending patterns, and government policies related to energy consumption. For instance, a strong global economy with increased industrial activity and transportation demand can lead to higher oil prices.

Geopolitical Events

Geopolitical events play a significant role in influencing oil futures prices.

- Political Instability: Conflicts in oil-producing regions, such as the Middle East, can disrupt production and transportation, leading to supply shortages and higher prices.

- Sanctions: Economic sanctions imposed on oil-producing countries can restrict exports and impact global supply.

- Trade Wars: Trade disputes between major economies can disrupt global oil trade flows and affect prices.

Economic Indicators

Economic indicators provide insights into the health of the global economy and its impact on oil demand.

- GDP Growth: Strong GDP growth in major economies typically translates into higher demand for oil, driving prices upward.

- Inflation: High inflation can erode the purchasing power of consumers, potentially leading to reduced demand for oil and lower prices.

- Interest Rates: Higher interest rates can make borrowing more expensive, potentially slowing economic growth and reducing demand for oil.

Trading Oil Futures Contracts

Trading oil futures contracts allows investors to speculate on the future price of crude oil or to hedge against price fluctuations. This section explores various ways to trade oil futures, associated risks, and strategies employed by traders.

Trading Methods

Oil futures contracts can be traded through several methods, each offering different advantages and drawbacks.

- Brokers: Brokers act as intermediaries between traders and exchanges, facilitating the buying and selling of contracts. They offer access to various trading platforms, research tools, and account management services.

- Exchanges: Exchanges like the New York Mercantile Exchange (NYMEX) and the Intercontinental Exchange (ICE) provide a centralized marketplace for trading futures contracts. They establish trading rules, ensure contract standardization, and facilitate price discovery.

- Online Platforms: Online trading platforms offer a convenient way to access and execute trades. These platforms often provide real-time market data, charting tools, and order management features.

Risks Associated with Trading Oil Futures Contracts

Trading oil futures contracts involves significant risks, including:

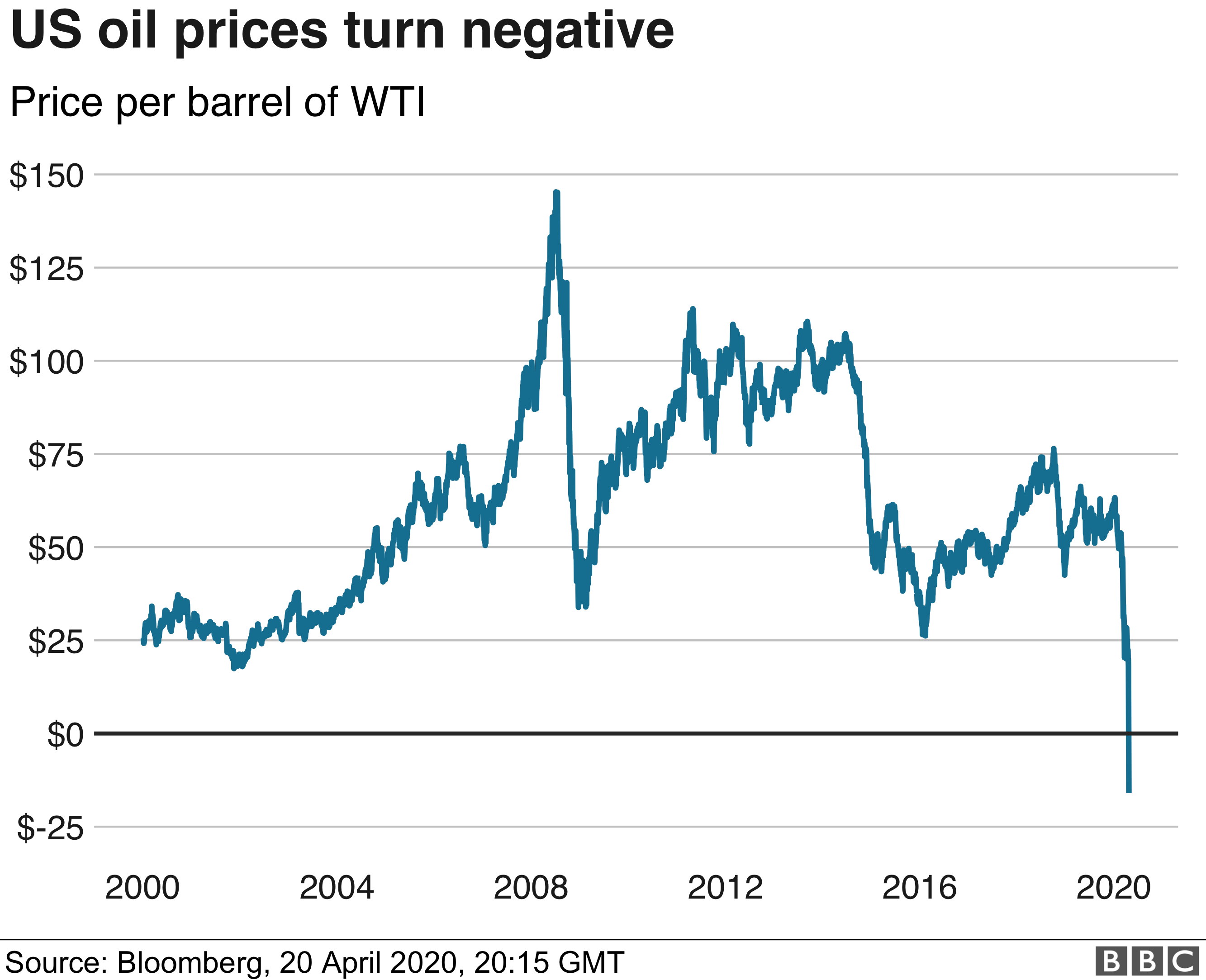

- Price Volatility: Oil prices are notoriously volatile, subject to various factors like global supply and demand, geopolitical events, and economic conditions. This volatility can lead to substantial losses if the market moves against your position.

- Margin Calls: Futures contracts require traders to deposit a margin, which is a percentage of the contract value. If the market moves against your position, you may receive a margin call, demanding additional funds to cover potential losses. Failure to meet a margin call can result in the liquidation of your position.

Strategies for Trading Oil Futures Contracts

Traders employ various strategies when trading oil futures contracts, with two common approaches:

- Hedging: Hedging involves using futures contracts to mitigate price risk. For instance, an oil producer might sell futures contracts to lock in a price for their future production, protecting them from a potential price decline.

- Speculation: Speculation involves taking a position in the futures market based on an expectation of future price movements. For example, a trader might buy oil futures contracts if they believe prices will rise, hoping to profit from the price difference.

Example Scenario

Imagine Sarah, a young investor with a moderate risk appetite, is interested in trading oil futures contracts. She believes that the price of crude oil will rise in the coming months due to increased global demand and geopolitical tensions. Let’s walk through the steps Sarah would take and the costs involved in entering and exiting this trade.

Entering the Trade, How much does an oil futures contract cost

Sarah decides to buy one contract for West Texas Intermediate (WTI) crude oil, which represents 1,000 barrels of oil. The current price of WTI is $80 per barrel.

- Initial Margin: Sarah’s broker requires an initial margin of $5,000 to open the position. This margin serves as a deposit to cover potential losses.

- Brokerage Fees: Sarah pays a brokerage fee of $25 per contract for the trade execution.

Exiting the Trade

After a few weeks, the price of WTI rises to $85 per barrel, and Sarah decides to sell her contract.

- Profit Calculation: Sarah’s profit is calculated as follows:

Profit = (Selling Price – Buying Price) x Contract Size – Brokerage Fees

Profit = ($85 – $80) x 1,000 barrels – $25

Profit = $5,000 – $25 = $4,975

- Margin Return: Sarah receives her initial margin of $5,000 back, along with the profit of $4,975.

Factors to Consider

Sarah should consider several factors before entering the trade, such as:

- Market Conditions: She should analyze global oil supply and demand, economic growth, geopolitical events, and other factors that could influence oil prices.

- Risk Tolerance: Sarah should assess her ability to withstand potential losses. Oil prices can fluctuate significantly, and she could lose her entire initial margin if the price moves against her position.

- Trading Strategy: Sarah should develop a clear trading strategy that Artikels her entry and exit points, risk management techniques, and profit targets.

Navigating the world of oil futures contracts requires a deep understanding of the costs involved, from initial margin requirements to brokerage fees and exchange charges. This knowledge empowers investors to make informed decisions, manage risk effectively, and potentially profit from the ever-changing dynamics of the global oil market. Whether you’re a seasoned trader or a newcomer to the energy markets, understanding the intricacies of oil futures contracts is key to navigating this complex and dynamic realm.

Essential Questionnaire

What are the different types of oil futures contracts?

Oil futures contracts are available for various types of crude oil, including West Texas Intermediate (WTI) and Brent crude, as well as refined products like gasoline and heating oil.

How often are oil futures contracts settled?

Most oil futures contracts expire on the last business day of the month. Traders can choose to settle their contracts physically or financially.

What is the minimum amount of money required to trade oil futures?

The minimum amount required, known as the margin, varies depending on the specific contract and the broker. It’s typically a percentage of the contract’s value.

Are there any tax implications associated with trading oil futures?

Yes, profits from oil futures trading are generally considered taxable income, while losses can be used to offset other capital gains.