How much does a futures contract cost – Yo, ever wondered how much it costs to get in on the futures game? Futures contracts, they’re like a ticket to ride the wave of a specific asset’s price in the future. But, just like anything else, there’s a price tag attached.

Think of it like this: Futures contracts are agreements to buy or sell something at a set price on a specific date in the future. This means you can lock in a price for a commodity like oil or a financial instrument like a stock index. But, to get in on the action, you gotta pay up.

Understanding Futures Contracts

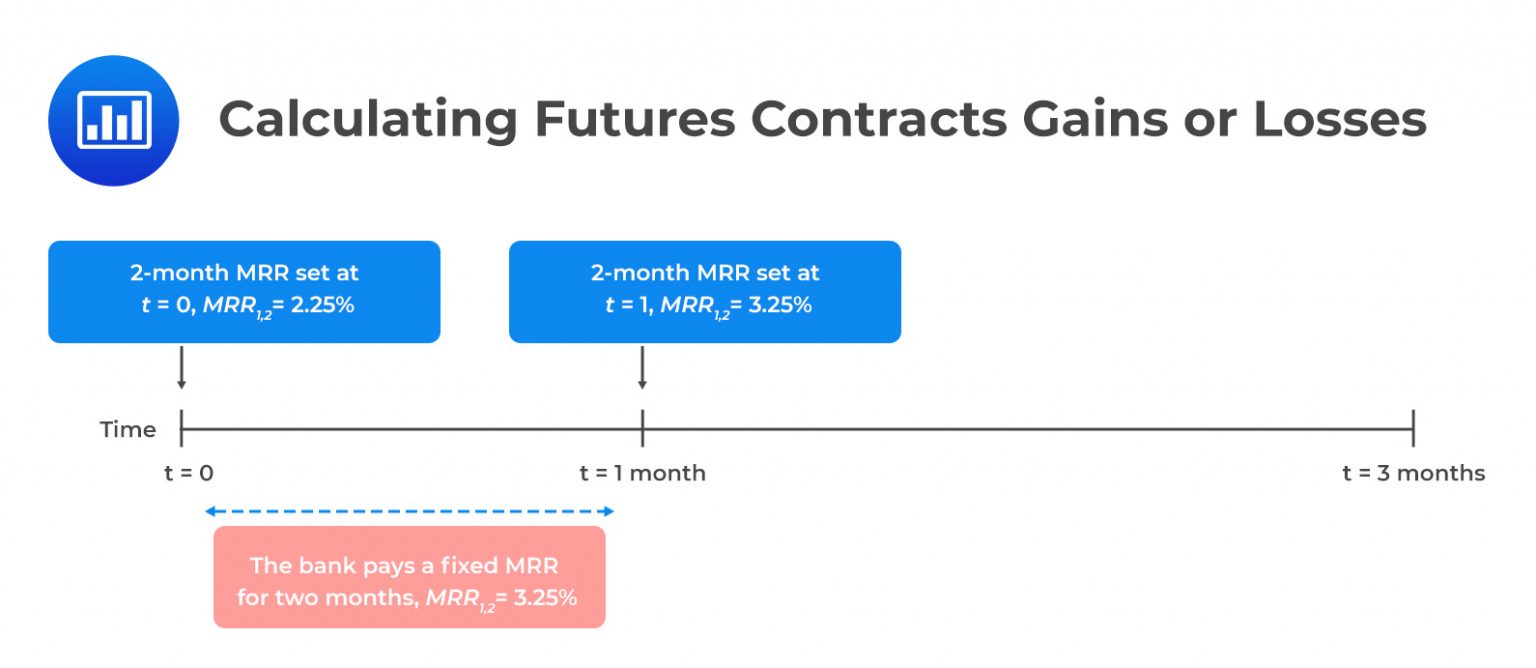

A futures contract is a legally binding agreement to buy or sell an underlying asset at a predetermined price on a future date. These contracts are standardized and traded on organized exchanges, offering a structured way to manage price risk associated with various assets.

Futures Contracts vs. Spot Contracts

Futures contracts differ from spot contracts in several crucial aspects. Spot contracts involve the immediate purchase and delivery of an asset at the prevailing market price. In contrast, futures contracts involve a future date for delivery and a fixed price agreed upon at the time of entering the contract. This feature allows participants to lock in prices for future transactions, mitigating price volatility and offering potential profit opportunities.

Types of Futures Contracts

Futures contracts are available for a wide range of assets, encompassing commodities, financial instruments, and even indices.

Commodity Futures

Commodity futures are contracts for the future delivery of commodities like agricultural products (wheat, corn, soybeans), energy (crude oil, natural gas), and precious metals (gold, silver).

Financial Futures

Financial futures are contracts for the future delivery of financial instruments, such as interest rate futures (Treasury bonds, Eurodollar futures), currency futures (USD/JPY, EUR/USD), and stock index futures (S&P 500, Nasdaq 100).

Futures contracts are a powerful tool for managing price risk and generating potential returns. They offer flexibility in terms of contract size, delivery date, and underlying asset, catering to diverse investment needs.

Cost Components of a Futures Contract: How Much Does A Futures Contract Cost

Futures contracts, while seemingly complex, are built upon a foundation of relatively simple cost components. Understanding these components is crucial for traders to make informed decisions and manage their risk effectively. The primary cost components associated with trading futures contracts include margin requirements, commissions, and fees.

Margin Requirements, How much does a futures contract cost

Margin requirements are a critical aspect of futures trading. They represent the amount of money a trader needs to deposit with their broker to secure a futures contract. This deposit serves as collateral, ensuring that the trader can cover potential losses. Margin requirements are typically a small percentage of the total contract value. For example, a trader might need to deposit $1,000 to control a $100,000 futures contract.

Margin requirements are not the same as the total cost of the contract.

Margin requirements are designed to manage risk. If the market moves against the trader’s position, the margin account will be drawn upon to cover potential losses. Conversely, if the market moves in the trader’s favor, the margin account will increase.

Commissions and Fees

Brokers charge commissions and fees for facilitating futures trades. These charges vary depending on the broker, the type of contract, and the trading volume.

- Commissions are fees charged for executing a trade. They are typically calculated as a fixed amount per contract or a percentage of the contract value.

- Fees can include various charges, such as account maintenance fees, inactivity fees, and data fees. These fees are often recurring and can add up over time.

It’s important to compare the fees and commissions charged by different brokers before choosing one. Transparent pricing structures and competitive fees are crucial for minimizing trading costs.

Margin Requirements and Initial Investment

Margin requirements in futures trading are a crucial aspect that serves as a financial safeguard for both the trader and the clearinghouse. These requirements represent a deposit that the trader must maintain in their trading account to ensure they can fulfill their obligations under the futures contract.

Initial Margin

Initial margin is the initial deposit that a trader must make to open a futures position. It is calculated as a percentage of the contract’s notional value, which is the total value of the underlying asset being traded. The initial margin requirement acts as a security deposit, covering potential losses incurred during price fluctuations until the next trading day.

Initial Margin = Percentage of Notional Value

For instance, if the initial margin requirement for a particular futures contract is 5% and the notional value of the contract is $100,000, then the initial margin required would be $5,000.

Maintenance Margin

Maintenance margin is the minimum amount of equity that a trader must maintain in their trading account at all times. If the account equity falls below the maintenance margin level, the trader will receive a margin call, requiring them to deposit additional funds to bring their account balance back to the initial margin level. The maintenance margin is typically set at a lower percentage than the initial margin, usually around 75% to 80% of the initial margin.

Comparison of Margin Requirements

Margin requirements vary across different futures contracts, primarily influenced by factors such as:

- Volatility of the Underlying Asset: Contracts based on highly volatile assets like crude oil or gold typically have higher margin requirements to mitigate potential losses.

- Contract Size: Larger contracts, involving a greater notional value, generally demand higher margin requirements.

- Liquidity of the Market: Futures contracts traded in more liquid markets, with higher trading volumes, often have lower margin requirements due to reduced price fluctuations.

- Brokerage Firm Policies: Individual brokerage firms may impose their own margin requirements, which can vary based on their risk tolerance and trading platform policies.

Trading Costs and Fees

Futures trading involves various costs beyond the initial margin requirement. Understanding these costs is crucial for determining the overall profitability of your trades.

Brokerage Commissions

Brokerage commissions are fees charged by your broker for facilitating your trades. They are typically calculated as a percentage of the contract value or a fixed fee per trade.

- Percentage-based commissions: This type of commission is calculated as a percentage of the contract value. For example, a commission of 0.1% on a contract worth $100,000 would be $100.

- Fixed fees: This type of commission is a flat fee charged per trade, regardless of the contract value. For example, a fixed fee of $10 per trade would be charged for every trade, regardless of the contract value.

Brokerage commissions can vary depending on the broker, the type of account, and the trading volume. It is important to compare commission rates from different brokers before choosing one.

Clearing and Settlement Fees

Clearing and settlement fees are charged by the clearinghouse for processing and settling trades. These fees ensure that all trades are executed and settled in a timely and efficient manner.

- Clearing fees: These fees are charged by the clearinghouse for guaranteeing the performance of each party to a futures contract. Clearing fees typically range from a few dollars to a few hundred dollars per contract, depending on the contract size and the clearinghouse.

- Settlement fees: These fees are charged by the clearinghouse for settling the trades. Settlement fees typically range from a few dollars to a few hundred dollars per contract, depending on the contract size and the clearinghouse.

Clearing and settlement fees are typically included in the overall cost of trading futures contracts.

Other Fees

Other fees associated with futures trading include:

- Data fees: Some brokers charge fees for access to real-time market data. This data is essential for making informed trading decisions.

- Software fees: Some brokers charge fees for access to trading platforms and software. These platforms can provide advanced charting and analysis tools, as well as order execution capabilities.

- Withdrawal fees: Some brokers charge fees for withdrawing funds from your account.

It is important to understand all the fees associated with futures trading before you start trading. These fees can significantly impact your overall profitability.

Factors Influencing Futures Contract Costs

The cost of trading futures contracts is influenced by several factors, including the characteristics of the underlying asset, market conditions, and trading activity. Understanding these factors is crucial for traders to make informed decisions and manage their trading costs effectively.

Underlying Asset Price Volatility

The price volatility of the underlying asset significantly impacts trading costs. High volatility translates to wider price fluctuations, increasing the risk of losses and potentially leading to larger margin requirements. For instance, a highly volatile asset like crude oil may require a larger margin deposit compared to a less volatile asset like gold.

Contract Maturity and Trading Volume

The maturity date of a futures contract and the trading volume also influence costs. As the contract approaches its expiration date, its price becomes more sensitive to market movements, leading to higher volatility and potentially higher trading costs. Conversely, contracts with longer maturities generally have lower trading costs. Similarly, contracts with higher trading volumes tend to have lower trading costs due to increased liquidity and competition among market participants.

Regulatory Fees and Exchange Fees

Trading futures contracts involves regulatory fees and exchange fees, which contribute to the overall cost. These fees are typically charged by regulatory bodies and exchanges to cover administrative expenses and ensure market integrity. Regulatory fees may vary depending on the contract type and trading volume, while exchange fees may differ based on the specific exchange and the contract traded.

Regulatory fees and exchange fees are generally a fixed cost component of futures trading.

Cost Management Strategies

Minimizing trading costs in the futures market is crucial for maximizing profits. This involves employing strategies to reduce transaction fees, optimize margin requirements, and leverage risk management techniques.

Strategies for Minimizing Trading Costs

The following strategies can significantly reduce trading costs in futures markets:

- Choosing the Right Broker: Brokers offer different commission structures, margin requirements, and trading platforms. Compare offerings from various brokers to identify the most cost-effective option. Consider brokers with low commissions, competitive margin rates, and advanced trading tools.

- Negotiating Commissions: For high-volume traders, negotiating lower commission rates with brokers is possible. Discuss volume discounts and explore alternative commission structures, such as tiered commissions or fixed-fee options.

- Minimizing Slippage: Slippage refers to the difference between the expected execution price and the actual price at which an order is filled. To minimize slippage, use limit orders, avoid trading during volatile market periods, and choose brokers with fast order execution speeds.

- Utilizing Trading Platforms: Advanced trading platforms can offer features that optimize trading costs. Look for platforms with order types that minimize slippage, real-time market data, and order management tools that facilitate efficient trading.

The Role of Risk Management Techniques

Risk management plays a crucial role in cost control by mitigating potential losses and maximizing profits. Effective risk management techniques can help traders manage their exposure to market fluctuations and minimize unnecessary trading costs.

- Stop-Loss Orders: Stop-loss orders automatically exit a position when a predefined price level is reached, limiting potential losses. They help protect against adverse market movements and reduce the risk of significant losses.

- Position Sizing: Proper position sizing involves determining the appropriate amount of capital to allocate to each trade. This ensures that losses are manageable and that trading costs are proportionate to the risk taken.

- Diversification: Diversifying across different futures contracts or asset classes reduces overall portfolio risk. By spreading investments, traders can mitigate losses in any single market and manage trading costs more effectively.

Tools and Resources for Cost Analysis and Optimization

Several tools and resources can aid in analyzing and optimizing trading costs:

- Trading Journals: Maintaining a trading journal helps track trading performance, analyze costs, and identify areas for improvement. Documenting trades, commissions, and other expenses provides valuable insights for cost optimization.

- Spreadsheets and Software: Spreadsheets and specialized trading software can automate cost analysis, track performance metrics, and generate reports on trading expenses. These tools streamline the process of identifying and reducing trading costs.

- Brokerage Statements: Reviewing brokerage statements regularly helps identify any hidden fees or unexpected charges. Compare statements from different brokers to ensure that trading costs are competitive.

So, yeah, there are costs involved in trading futures contracts, but the key is to understand them and manage them wisely. The good news is, there are ways to keep those costs in check, from minimizing commissions to using risk management strategies.

Question Bank

What’s the biggest cost associated with futures contracts?

Margin requirements are usually the biggest cost. It’s like a down payment to secure your position in the market.

Are there any other fees I need to worry about?

Yeah, there are brokerage commissions, clearing fees, and even exchange fees. It’s important to factor in all those costs when you’re planning your trades.

Can I avoid paying margin?

Nope, margin requirements are a standard part of futures trading. Think of it as a way to ensure you can cover any potential losses.

:max_bytes(150000):strip_icc()/how-to-remove-food-coloring-stains-2146883_V4-69541ce7cab842d9a101fda9e36e0475.png?w=700)