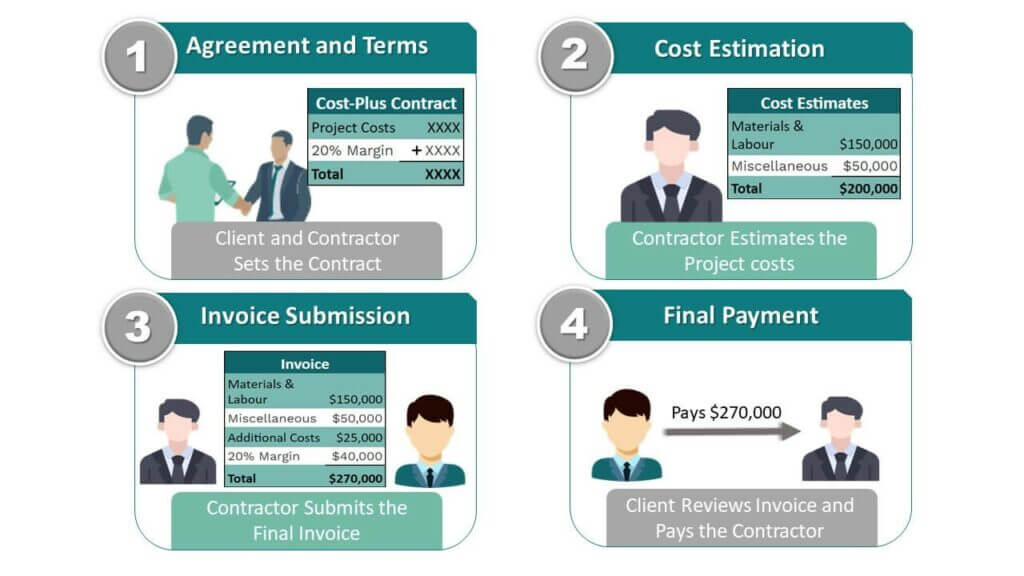

How does a cost plus contract work? Unraveling the intricacies of cost-plus contracts reveals a fascinating world of negotiated risk and collaborative project management. Unlike fixed-price contracts where the price is set upfront, cost-plus agreements offer a different approach, where the contractor is reimbursed for all allowable project costs plus an agreed-upon fee. This flexibility can be particularly attractive for complex projects with unpredictable challenges, allowing for adjustments and adaptations as the project unfolds.

But this flexibility comes with its own set of considerations, demanding careful planning, meticulous cost tracking, and robust risk mitigation strategies. Understanding these nuances is key to successfully navigating the landscape of cost-plus contracts.

This guide delves into the various types of cost-plus contracts—from fixed-fee to incentive-based models—examining their unique structures and implications. We’ll explore the critical aspects of cost allocation, tracking, and risk management, providing practical examples and insights to empower you to make informed decisions. We’ll also navigate the complexities of contract negotiation and administration, offering strategies for minimizing potential pitfalls and maximizing project success.

Prepare to demystify the world of cost-plus contracts and equip yourself with the knowledge to effectively utilize this powerful contracting tool.

Defining Cost-Plus Contracts

Yo! So, you wanna know about cost-plus contracts? Think of it like this: you’re ordering a custom-built spaceship – you don’t know exactly how much it’ll cost upfront, right? That’s where a cost-plus contract comes in. It’s all about transparency and flexibility, but with a healthy dose of potential for… well, let’s just say “unforeseen expenses.”Cost-plus contracts are fundamentally different from your standard fixed-price deals.

In a fixed-price contract, the price is set in stone (or at least, supposed to be). The contractor takes on the risk of cost overruns. But with a cost-plus contract, the buyer pays all the allowable costs incurred by the contractor, plus a predetermined profit margin or fee. It’s like saying, “Hey, I’ll pay for everything you spend, plus a little extra for your troubles.” Simple, right?

Well, kinda.

Cost-Plus Contract Definition and Differentiation

A cost-plus contract is a type of agreement where the buyer reimburses the seller for all allowable costs incurred in performing the contract, plus a predetermined fee or profit margin. This differs from a fixed-price contract, where the price is fixed regardless of the actual costs incurred. In a fixed-price contract, the contractor bears the risk of cost overruns, while in a cost-plus contract, that risk is largely transferred to the buyer.

Think of it as the difference between buying a pre-packaged meal versus ordering a custom-made one from a fancy restaurant – you know the price upfront with the pre-packaged meal, but the custom meal is a bit of a gamble.

Industries Using Cost-Plus Contracts

Cost-plus contracts are frequently used in situations where the scope of work is uncertain, or where the project is highly complex and requires specialized expertise. This is common in government contracting, especially for defense projects, where the exact requirements may evolve throughout the project lifecycle. Research and development, construction of unique buildings, and complex engineering projects also frequently utilize this contract type.

Imagine building a one-of-a-kind theme park ride – you can’t exactly nail down the price before you even start designing the thing!

Comparison of Cost-Plus and Fixed-Price Contracts

Here’s a table breaking down the key differences. Think of it as a handy cheat sheet for your next contract negotiation:

| Feature | Cost-Plus Contract | Fixed-Price Contract |

|---|---|---|

| Price Determination | Costs + Fee/Profit Margin | Fixed Price Agreed Upon Upfront |

| Risk Allocation | Mostly on Buyer | Mostly on Contractor |

| Payment Structure | Reimbursement of Costs + Fee | Lump Sum Payment or Milestones |

| Suitability | Uncertain Scope, Complex Projects | Clearly Defined Scope, Standard Projects |

Types of Cost-Plus Contracts

Yo, what’s up, peeps? So you’ve got the basics of cost-plus contracts down, right? Now let’s dive into the nitty-gritty – the differenttypes* of these bad boys. It’s like choosing your weapon in a business battle; each one has its strengths and weaknesses. Pick the wrong one, and you’ll be singing the blues louder than a Metallica concert.There are several variations on the cost-plus theme, each with its own unique fee structure and risk profile.

Think of it as a buffet – you can choose the dish that best suits your appetite (and your budget). But be warned, some dishes are spicier than others!

Cost-Plus-Fixed-Fee (CPFF) Contracts

This is the most common type of cost-plus contract. Imagine this: you agree to pay for all the project’s allowable costs, plus a predetermined, fixed fee. The fixed fee is set upfront and doesn’t change, regardless of how much the project actually costs. It’s like buying a plane ticket – you know the price beforehand, no matter how long the flight takes or how much fuel it burns.

The contractor is incentivized to manage costs efficiently, but they’re also protected from cost overruns.The fee is usually a percentage of the estimated costs, but it can also be a fixed dollar amount. Factors influencing the fee include the complexity of the project, the contractor’s experience, and the level of risk involved. For example, a highly complex project with a high degree of uncertainty might command a higher fixed fee.Advantages: Provides cost certainty for the buyer (within reason, of course), and incentivizes the contractor to control costs.Disadvantages: The contractor might not be as motivated to innovate or find cost-saving measures if the fee is already set.

Also, detailed cost accounting is crucial.

Cost-Plus-Percentage-of-Cost (CPPC) Contracts

This one’s a bit more…risky. The contractor gets reimbursed for all allowable costs, plus a percentage of those costs as a fee. So, the more the project costs, the more the contractor earns. Sounds sweet, right? Wrong! This creates a strong incentive for cost overruns – the contractor might be tempted to add unnecessary expenses to boost their profits.

It’s like giving a kid a blank check to buy candy; they’ll probably go overboard.The percentage is negotiated upfront, and factors like project complexity and risk influence it. A simple, low-risk project might have a lower percentage than a complex, high-risk one.Advantages: Simple to administer.Disadvantages: High risk of cost overruns due to the direct incentive for the contractor to inflate costs.

This type is generally avoided because of this inherent conflict of interest.

Cost-Plus-Incentive-Fee (CPIF) Contracts

This is where things get interesting. The contractor gets reimbursed for allowable costs, plus a fee that’s based on how well they perform against pre-agreed targets. Think of it as a performance bonus. Meet the targets (cost, schedule, performance), get the full bonus. Miss the targets?

Your bonus gets smaller, or you might even get nothing. It’s like a video game – the better you play, the bigger the reward.The fee is calculated based on a shared savings or loss arrangement. The target cost and fee are established upfront, and any cost savings or overruns are shared between the buyer and the contractor according to a predetermined formula.

For example, a 50/50 sharing arrangement means that if the project comes in under budget, both parties share the savings equally.Advantages: Strong incentive for cost control and performance, encourages collaboration between buyer and contractor.Disadvantages: Requires careful planning and negotiation of targets and sharing arrangements. More complex to administer than CPFF.

Here’s a quick rundown of when each type might be most suitable:

- CPFF: Suitable for projects with a high degree of uncertainty, where a fixed fee provides cost certainty for the buyer, but the contractor needs some protection from unforeseen circumstances.

- CPPC: Rarely used due to its inherent risk of cost overruns. Generally avoided unless there are exceptional circumstances.

- CPIF: Best for projects where strong performance incentives are needed and collaboration between buyer and contractor is crucial. Suitable for complex projects where cost and performance targets can be clearly defined.

Cost Allocation and Tracking

Okay, so you’ve got your cost-plus contract all signed and sealed. High five! But the party doesn’t stop there, my friend. Now comes the slightly less glamorous, but equally crucial part: tracking every single rupiah (or dollar, pound, whatever your currency is) spent. Think of it as being an accountant for your own awesome project. It’s all about making sure you’re getting paid for what you actually did, and not getting ripped off.

Let’s dive into the nitty-gritty.

Allocating costs in a cost-plus contract is like meticulously building a Lego castle – each brick (cost) has its place, and you need to keep track of them all. The key here is distinguishing between allowable and unallowable costs. Allowable costs are basically expenses that the client agrees to cover. Unallowable costs? Yeah, those are the ones that’ll make your client raise an eyebrow – and probably refuse to pay.

Think of it like this: allowable costs are your essential ingredients for project success; unallowable costs are the extra sprinkles that taste good but might bankrupt the whole cake.

Allowable and Unallowable Costs

Allowable costs are directly related to the project’s successful completion. This includes things like materials, labor, and reasonable overhead. Unallowable costs, on the other hand, are generally considered extravagant, unnecessary, or unrelated to the project itself. Think lavish company retreats in Bali (unless it’s directly related to client meetings, of course!).

Here’s a breakdown:

| Allowable Costs | Unallowable Costs |

|---|---|

| Direct Materials: The raw materials directly used in the project (e.g., wood for a house, software licenses for a program). | Excessive Entertainment Expenses: Lavish dinners and parties not directly related to project needs. |

| Direct Labor: Wages and salaries of employees directly working on the project. | Fines and Penalties: Costs incurred due to violations of laws or regulations. |

| Overhead Costs: Indirect costs like rent, utilities, and administrative salaries (usually a percentage of direct costs). | Political Contributions: Donations to political parties or campaigns. |

| Travel Expenses: Reasonable travel expenses for project-related meetings or site visits. | Interest Expenses: Interest paid on loans for project financing (unless specifically agreed upon). |

Cost Tracking Methods

Keeping tabs on your costs is crucial. You don’t want to end up in a situation where you’re losing money because you haven’t been tracking your expenses properly. This is where diligent documentation comes in handy. Think of it as your project’s financial diary – detailed, accurate, and organized. No cheating!

Common methods include using accounting software, spreadsheets, or even good old-fashioned notebooks (though I recommend the software route for easier tracking and reporting). Regardless of the method, make sure you’re documenting every expense, including receipts and invoices. This will make your life (and your client’s) a lot easier when it comes to reconciliation.

Sample Cost Tracking System

Let’s say you’re building a website. Here’s a simplified cost tracking system:

| Date | Description | Category | Amount |

|---|---|---|---|

| 2024-03-01 | Domain Name Registration | Direct Costs | $15 |

| 2024-03-05 | Web Hosting | Direct Costs | $20 |

| 2024-03-10 | Designer Salary (Week 1) | Direct Labor | $1000 |

| 2024-03-15 | Office Rent | Overhead | $500 |

Risk Management in Cost-Plus Contracts

Yo! So you’ve figured out how cost-plus contracts work, eh? That’s great, but let’s be real – these things aren’t exactly risk-free. Think of it like ordering a custom-built spaceship: you’re paying for the materials and the builder’s time, but the final price? A bit of a mystery until it’s finished. This uncertainty brings a whole bunch of potential problems for both the buyer (the one ordering the spaceship) and the seller (the one building it).

Let’s dive into the minefield of risk and how to navigate it without blowing ourselves up.

Cost-plus contracts, while offering flexibility, inherently carry significant risks for both parties involved. For the buyer, the biggest worry is cost overruns. The seller, on the other hand, might find themselves stuck with unexpected expenses or even a loss if the project goes south. It’s a delicate balancing act, like juggling chainsaws while riding a unicycle. But fear not, my friend, there are ways to mitigate these risks.

Buyer’s Risks and Mitigation Strategies

The buyer’s main concern is runaway costs. Imagine ordering a simple website and ending up with a bill that could buy a small island. To prevent this, buyers need strong oversight. This includes detailed specifications, regular progress reports, independent cost audits, and a clear definition of what constitutes “allowable costs.” Think of it like having a hawk-eyed accountant constantly watching the builder’s every move.

Without this, the buyer is essentially writing a blank check. Strong contract language limiting the seller’s fee percentage or setting a maximum total cost is crucial. This acts as a safety net, preventing the cost from spiralling out of control. For example, a clause could state that “the total cost shall not exceed $X, regardless of actual costs incurred.”

Seller’s Risks and Mitigation Strategies

For the seller, the risk is different. They could face unexpected costs, delays, or even a loss if the project scope changes frequently or if the buyer is difficult to work with. To mitigate this, sellers need clear and comprehensive contracts that Artikel the scope of work, payment terms, and procedures for change orders. Think of it as having a detailed roadmap for the spaceship build, with clear sign-offs at each stage.

Accurate cost estimation at the beginning is vital, and building in contingency reserves for unforeseen issues is smart. Additionally, securing progress payments protects the seller from the risk of non-payment.

Contractual Clauses for Risk Management

Several clauses can significantly improve risk management. For instance, a “cost control clause” could mandate regular cost reporting and require the seller to justify any significant cost overruns. A “change order clause” should define the process for approving any modifications to the original scope, including cost and timeline adjustments. A “dispute resolution clause” is essential to establish a clear process for resolving any disagreements between the buyer and the seller.

Finally, a “termination clause” should Artikel the conditions under which the contract can be terminated and the consequences for each party. These clauses are like safety belts and airbags for your cost-plus contract – they won’t prevent accidents entirely, but they’ll significantly lessen the impact.

Best Practices for Managing Risk in Cost-Plus Contracts

Remember, prevention is better than cure. A well-defined contract is the cornerstone of successful risk management. Here are some key best practices:

- Thorough due diligence on the seller: Don’t just pick the cheapest option; choose a reputable and experienced contractor.

- Detailed project scope definition: Avoid ambiguity; clearly Artikel every aspect of the project.

- Regular monitoring and reporting: Keep a close eye on progress and costs.

- Independent cost audits: Get an objective assessment of the seller’s cost claims.

- Effective communication: Maintain open and transparent communication between buyer and seller.

- Contingency planning: Prepare for potential delays and cost overruns.

Contract Negotiation and Administration: How Does A Cost Plus Contract Work

So, you’ve decided to brave the wild world of cost-plus contracts. Congratulations, you’ve signed up for a rollercoaster ride of paperwork, potential profit (or loss!), and enough jargon to make your head spin faster than a top. But fear not, my fellow adventurers! Navigating this terrain successfully requires a keen eye for detail, a healthy dose of negotiation prowess, and a contract that’s clearer than a politician’s promise (just kidding… mostly).

Let’s tackle the nitty-gritty of making this beast work for you.Negotiating a cost-plus contract is less about haggling over a price tag and more about defining the boundaries of the project. It’s about ensuring that both parties are on the same page regarding expectations, responsibilities, and, crucially, the potential for cost overruns. This isn’t some casual backyard barbecue; it’s a legally binding agreement that can make or break your project.

Fee Structures

The fee structure is the heart of the cost-plus contract. It determines how much you, the contractor, will earn beyond the reimbursable costs. Common structures include a fixed fee (a predetermined amount regardless of actual costs), a percentage of costs (a percentage of the total allowable costs incurred), or a combination of both. Negotiating this requires a thorough understanding of your projected costs, your desired profit margin, and the client’s budget.

For example, a fixed fee offers predictability for the client, while a percentage-of-costs fee can incentivize cost control (or, conversely, cost inflation, if not carefully managed). The key is to find a structure that balances both parties’ interests.

Cost Limitations

Uncontrolled costs are the bane of cost-plus contracts. Therefore, establishing clear cost limitations is paramount. This involves defining allowable costs, identifying cost categories, and setting ceilings for specific budget items. For instance, you might agree on a maximum budget for materials, labor, and travel. This prevents runaway costs and provides the client with some much-needed peace of mind (and prevents them from calling you at 3 AM with existential dread).

Consider including mechanisms for cost control, such as regular budget reviews and approvals for significant cost changes. Think of it as building a financial safety net, because let’s face it, unexpected things

always* happen.

Dispute Resolution Mechanisms

Disagreements are inevitable, even with the most meticulously crafted contract. Therefore, defining a clear and efficient dispute resolution mechanism is crucial. This could involve mediation, arbitration, or litigation. Mediation is often preferred for its less formal and less expensive nature. Arbitration provides a more structured process, while litigation is a last resort.

Whatever method is chosen, ensure it’s clearly Artikeld in the contract to avoid future confusion and delays. Think of it as a pre-emptive strike against future project meltdowns.

Contract Language, How does a cost plus contract work

Ambiguity is the enemy of a successful cost-plus contract. Clear and concise language is paramount to avoid misunderstandings and potential disputes. Each term and condition should be defined explicitly, leaving no room for interpretation. Using plain language, avoiding jargon, and employing specific examples helps ensure clarity. Think of it as writing a contract for your grandma – she should understand every word without needing a legal dictionary.

Common Negotiation Pitfalls

Failing to thoroughly analyze your costs before entering negotiations is a recipe for disaster. Underestimating the time and resources required can lead to financial losses. Another common pitfall is neglecting to include clear mechanisms for change orders and cost adjustments. These should be explicitly defined, including a process for approval and documentation. Finally, overlooking the importance of risk allocation can leave you vulnerable to unexpected expenses.

Remember, you are essentially partnering with your client, so a shared understanding of risks and their mitigation is crucial. This isn’t a game of chicken; it’s a collaborative effort.

Cost Reporting and Performance Monitoring

Effective administration of a cost-plus contract involves meticulous cost tracking and regular reporting. This includes maintaining accurate records of all expenses, submitting regular progress reports, and providing timely updates to the client. Performance monitoring is equally important, ensuring that the project is on track to meet its objectives and within budget. Regular meetings, progress reviews, and performance indicators can help identify and address potential issues early on.

Think of it as driving with a GPS – regular check-ins ensure you’re not heading in the wrong direction.

Illustrative Example

Okay, so picture this: We’re building a ridiculously awesome, state-of-the-art mobile app for a fictional company called “IndomieGo,” a food delivery service specializing in, you guessed it, Indomie. This isn’t your average ramen app; we’re talking augmented reality noodle-choosing, personalized spice level recommendations, and drone delivery integration (because why not?). This is a project that screams “Cost-Plus Contract!”This IndomieGo app development will be handled under a cost-plus-fixed-fee contract.

The fixed fee is set at 10% of the total allowable costs. This means the developer, let’s call them “KodeKopi,” will be reimbursed for all eligible project costs, plus that 10% as their profit margin. Sounds sweet, right? Well, it’s sweet until the costs start spiraling out of control… but we’ll get to that.

Project Scope and Fee Structure

The project scope includes design, development, testing, and deployment of the IndomieGo mobile application. This encompasses all features mentioned previously, including AR integration, personalized recommendations, and (yes, you read that right) drone delivery integration. The initial project budget estimate is $100,000. The contract clearly defines allowable costs, including labor, materials, software licenses, and third-party services. Anything outside this list requires prior written approval from IndomieGo.

The 10% fixed fee is $10,000. KodeKopi is responsible for providing detailed invoices for all incurred expenses.

Cost Allocation and Tracking

KodeKopi uses a project management software to meticulously track all costs. Each expense is categorized (labor, materials, etc.), linked to specific project tasks, and documented with supporting invoices or receipts. This ensures transparency and accountability. Weekly reports are submitted to IndomieGo, detailing progress, costs incurred, and a projected budget forecast. This allows for early identification of potential cost overruns.

A detailed breakdown of labor costs, including hourly rates for developers, designers, and testers, is provided, with a clear justification for each resource allocation.

Addressing Potential Cost Overruns

The contract includes a clause for addressing cost overruns. If KodeKopi anticipates exceeding the initial budget, they are obligated to immediately notify IndomieGo. A joint review will then be conducted to assess the reasons for the overrun, evaluate the necessity of the additional costs, and determine a course of action. This might involve renegotiating the scope of the project, adjusting the timeline, or securing additional funding.

However, any changes to the project scope or budget require mutual written agreement between IndomieGo and KodeKopi. The contract stipulates a process for dispute resolution, including mediation, if necessary. For example, if integrating drone delivery proves significantly more expensive than initially projected due to unforeseen regulatory hurdles, KodeKopi would present a detailed justification for the added costs, and both parties would negotiate a solution.

This might involve scaling back the drone delivery feature, extending the project timeline, or increasing the budget with a corresponding adjustment to the fixed fee.

In conclusion, understanding how a cost-plus contract works is crucial for both buyers and sellers navigating complex projects. While offering flexibility and adaptability, these contracts require careful planning, transparent cost tracking, and robust risk management strategies. By understanding the various types of cost-plus contracts, the nuances of cost allocation, and the importance of effective negotiation, parties can mitigate potential risks and maximize the benefits of this collaborative approach.

Ultimately, a well-structured cost-plus contract can foster a successful partnership, leading to project completion that meets both budgetary and performance expectations. The key is informed decision-making and proactive risk management.

General Inquiries

What are some common reasons for choosing a cost-plus contract over a fixed-price contract?

Cost-plus contracts are often preferred when project scope is uncertain, technology is rapidly evolving, or when a high degree of collaboration and flexibility is needed. They’re also useful when the buyer lacks the expertise to fully define the project’s requirements upfront.

How can disputes be resolved under a cost-plus contract?

Dispute resolution mechanisms should be clearly defined within the contract itself. This might include arbitration, mediation, or litigation. Clearly defined dispute resolution clauses are essential for avoiding protracted legal battles.

What are some examples of unallowable costs in a cost-plus contract?

Unallowable costs typically include penalties, fines, entertainment expenses, and costs that are deemed unreasonable or not directly related to the project. The specific list of allowable and unallowable costs should be explicitly detailed within the contract.

How frequently should cost reports be submitted under a cost-plus contract?

The frequency of cost reporting is typically specified in the contract, but it’s common to see monthly or quarterly reports, depending on the project’s size and complexity. Regular reporting allows for proactive monitoring and early identification of potential cost overruns.