How does cost plus contract work? Understanding this seemingly simple question unlocks a world of complexities within the realm of contractual agreements. These contracts, where the buyer reimburses the seller for all incurred costs plus an agreed-upon fee, offer a unique approach to project management, particularly suited for projects with uncertain scopes or significant technological challenges. This exploration delves into the nuances of cost-plus contracts, examining their various types, risk implications, and the crucial elements involved in their successful implementation.

From defining the core principles and identifying different cost-plus models – such as cost-plus-fixed-fee, cost-plus-percentage-of-cost, and cost-plus-incentive-fee – we’ll analyze how costs are calculated and fees are determined. We’ll also investigate the crucial role of risk management, highlighting strategies to mitigate potential cost overruns and disputes. Finally, we’ll weigh the advantages and disadvantages, considering legal and ethical implications to provide a comprehensive understanding of this contract type.

Definition of Cost-Plus Contracts

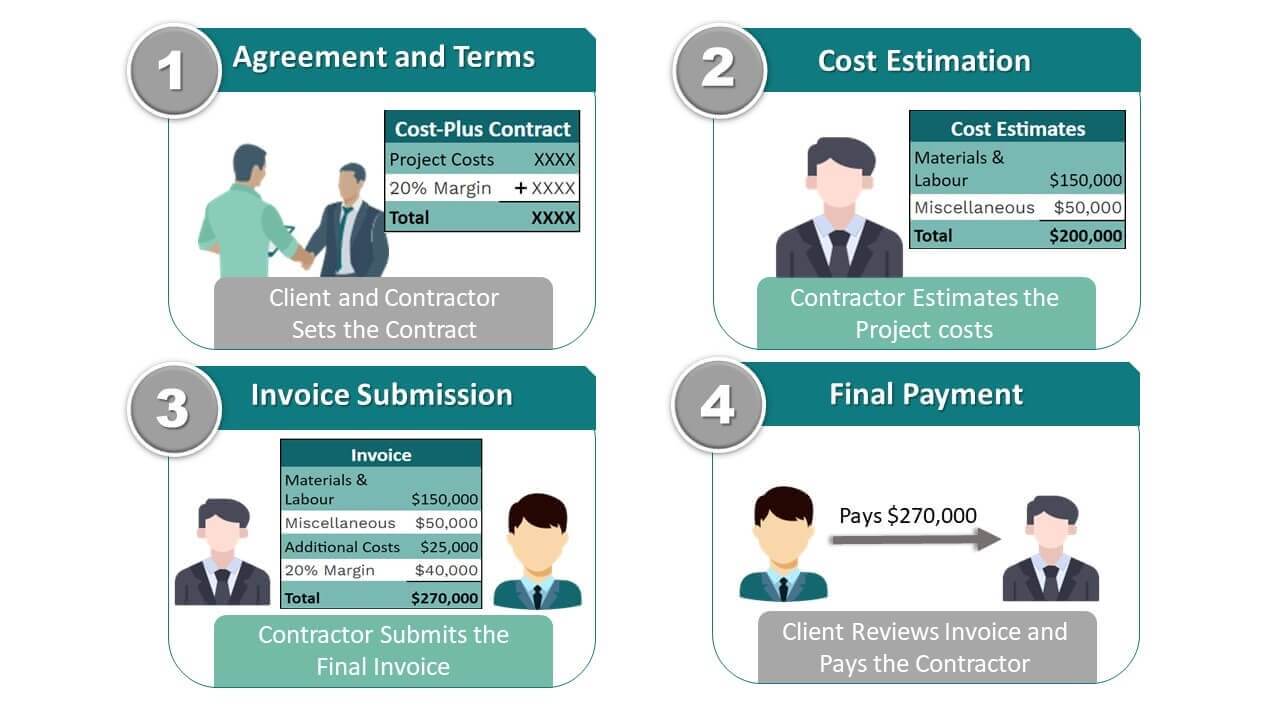

Cost-plus contracts represent a fundamental approach to project pricing where the contractor’s payment is based on the actual costs incurred during the project’s execution, plus a predetermined profit margin or fee. This approach offers flexibility, particularly in projects with uncertain scopes or requirements, but requires careful monitoring to prevent cost overruns.Cost-plus contracts are agreements where the buyer reimburses the seller for all allowable costs incurred in performing the contract, plus a predetermined fee or profit margin.

This fee can be a fixed percentage of the total allowable costs or a fixed dollar amount. The simplicity of this structure makes it attractive in situations where the exact scope of work is difficult to define upfront.

Cost-Plus Contract Principles

The core principle underlying cost-plus contracts is transparency and accountability. The contractor meticulously documents all costs, which are then reviewed and audited by the buyer to ensure they align with the agreed-upon allowable cost categories. The fee structure, whether percentage-based or fixed, provides the contractor with an incentive to complete the project efficiently, while also protecting them from unforeseen expenses.

The contract clearly defines allowable and unallowable costs, preventing disputes later. Effective cost control mechanisms are crucial to prevent excessive costs.

Real-World Example of a Cost-Plus Contract

Imagine a construction company hired to renovate a historic building. The extent of necessary repairs might not be fully known until the work begins. A cost-plus contract would be suitable here. The contractor would be reimbursed for all legitimate expenses (materials, labor, permits, etc.), plus a predetermined percentage (e.g., 15%) of these costs as profit. This allows flexibility to address unexpected issues (like discovering structural damage) without jeopardizing the project.

Key Characteristics of Cost-Plus Contracts

Cost-plus contracts differ significantly from other contract types, primarily in their pricing mechanism. Unlike fixed-price contracts where the total cost is predetermined, cost-plus contracts involve reimbursement for actual costs plus a fee. This contrasts with time-and-materials contracts, which also reimburse costs but lack a predetermined profit margin, potentially leading to less control over the overall project expenditure. The defining characteristic is the reimbursement of actual costs incurred, making it ideal for projects with unpredictable scopes or requirements.

Effective cost control measures are essential, and a clear definition of allowable costs is crucial to prevent disputes.

Types of Cost-Plus Contracts

Cost-plus contracts offer a flexible approach to project management, particularly useful when the scope of work is uncertain or subject to change. Understanding the different types of cost-plus contracts is crucial for selecting the best option that aligns with project needs and risk tolerance. This section will explore three common variations, highlighting their key differences in risk allocation and potential cost implications.Cost-plus contracts, while offering flexibility, require careful management to prevent cost overruns.

The specific type chosen significantly impacts the financial responsibility shared between the client and the contractor. A clear understanding of each type’s characteristics is essential for successful project execution.

Cost-Plus-Fixed-Fee (CPFF) Contracts

In a CPFF contract, the contractor is reimbursed for all allowable costs incurred during the project, plus a fixed fee agreed upon beforehand. The fixed fee represents the contractor’s profit and is not affected by cost overruns or underruns. This structure provides the contractor with a predictable profit margin, while the client retains control over costs by carefully monitoring allowable expenses.

This arrangement mitigates the contractor’s risk related to cost overruns but still requires the client to actively manage the project’s budget.

Cost-Plus-Percentage-of-Cost (CPPC) Contracts

CPPC contracts reimburse the contractor for all allowable costs plus a percentage of those costs as profit. The percentage is predetermined and agreed upon at the outset of the project. This approach directly links the contractor’s profit to the project’s overall cost. While seemingly straightforward, this structure incentivizes the contractor to potentially inflate costs to increase their profit margin.

This presents a higher risk for the client regarding cost control and requires strong oversight mechanisms to ensure responsible cost management. Consequently, this type of contract is less frequently used than others due to the inherent risk. For example, if the agreed percentage is 15% and the total allowable cost reaches $1 million, the contractor’s profit would be $150,000.

Cost-Plus-Incentive-Fee (CPIF) Contracts

CPIF contracts reimburse the contractor for all allowable costs and include an incentive fee based on the achievement of predetermined performance targets. The incentive fee is shared between the client and contractor based on how well the project meets established goals, such as completing the project on time or under budget. This structure aligns the interests of both parties, encouraging collaboration and efficiency.

The potential for higher profits incentivizes the contractor to manage costs effectively and achieve performance targets. However, defining clear and measurable performance targets is critical to the success of a CPIF contract. For instance, a target might be completing a project within a specific timeframe and budget; exceeding the target could result in a larger incentive fee for the contractor.

| Type | Description | Risk | Cost Implications |

|---|---|---|---|

| Cost-Plus-Fixed-Fee (CPFF) | Contractor reimbursed for all allowable costs plus a fixed fee. | Lower risk for contractor; moderate risk for client (cost overruns possible). | Predictable profit for contractor; potential for cost overruns if not managed properly. |

| Cost-Plus-Percentage-of-Cost (CPPC) | Contractor reimbursed for all allowable costs plus a percentage of those costs as profit. | High risk for client (potential for cost inflation). | Unpredictable cost for client; potential for significant cost overruns. |

| Cost-Plus-Incentive-Fee (CPIF) | Contractor reimbursed for all allowable costs plus an incentive fee based on performance targets. | Shared risk between client and contractor; potential for cost savings. | Cost dependent on performance; potential for cost savings and increased efficiency. |

Cost Elements Included in Cost-Plus Contracts

Cost-plus contracts, while offering flexibility, necessitate a clear understanding of allowable cost elements to prevent disputes and ensure fair compensation. This section details the types of costs typically included, differentiating between direct and indirect costs, and emphasizing the critical role of precise cost definitions.

Allowable costs in a cost-plus contract are those explicitly agreed upon by both the contracting parties as reimbursable. These costs are categorized into direct and indirect costs, each with its own specific characteristics and documentation requirements. Careful consideration of these categories during contract negotiation is crucial for successful project execution.

Direct Costs

Direct costs are those directly attributable to the specific project. These are relatively easy to track and allocate, contributing directly to the creation of the deliverable. Accurate tracking of direct costs is fundamental to the cost-plus contract’s transparent nature.

Examples of direct costs include materials, labor directly involved in the project’s production, and equipment specifically purchased or rented for the project. For instance, in a construction project, the cost of cement, bricks, and the wages of construction workers are direct costs. Similarly, in software development, the salaries of the programmers working directly on the software are direct costs.

Indirect Costs

Indirect costs, also known as overhead costs, are not directly tied to a specific project but are necessary for the overall operation of the business undertaking the project. These costs are often allocated to projects based on a predetermined formula, such as a percentage of direct costs or a specific allocation rate. Careful allocation is essential to prevent cost overruns and ensure fair cost allocation across multiple projects.

Examples of indirect costs include rent for office space, administrative salaries, utilities, and insurance. In a construction project, this could include the general contractor’s office overhead, while in a software development project, it could include the cost of maintaining the company’s servers and network infrastructure. The precise allocation method for these costs should be clearly defined within the contract.

Defining Allowable Costs to Prevent Disputes

Clearly defining allowable costs upfront is paramount to avoid future disputes. Ambiguity can lead to disagreements about what expenses are reimbursable, potentially delaying project completion and damaging the contractor-client relationship. A well-defined cost breakdown, specifying which costs are included and excluded, with detailed explanations, is essential.

For example, the contract should explicitly state whether travel expenses are allowable, specifying the class of travel permitted. Similarly, it should clarify whether entertainment expenses are reimbursable and, if so, under what circumstances. This level of detail minimizes the potential for misunderstandings and disputes later in the project lifecycle.

Cost Element Review Checklist

A comprehensive checklist helps ensure all cost elements are accounted for and appropriately documented. This checklist facilitates a thorough review of the cost elements, minimizing the risk of disputes and ensuring transparency.

The checklist should include items such as verification of direct costs against invoices and timesheets, review of indirect cost allocation methods, confirmation of the inclusion or exclusion of specific cost categories (e.g., travel, entertainment, taxes), and a final review for any discrepancies or missing documentation. Using a standardized checklist ensures consistency and minimizes the chances of overlooking crucial cost elements.

Calculating Costs and Fees in Cost-Plus Contracts

Accurately calculating costs and fees is crucial in cost-plus contracts to ensure fair compensation for the contractor while protecting the client from excessive expenses. The method of calculation varies depending on the specific type of cost-plus contract used. Understanding these calculations is vital for both parties involved.

Cost-Plus-Fixed-Fee Contract Calculations

The total contract price in a cost-plus-fixed-fee (CPFF) contract is determined by adding the total allowable costs incurred by the contractor to a pre-negotiated fixed fee. This fixed fee compensates the contractor for its profit and overhead regardless of the actual costs incurred.

- Step 1: Determine Allowable Costs: This involves meticulously tracking and documenting all costs directly related to the project, adhering to the contract’s defined allowable cost categories. These typically include direct materials, labor, and other direct costs, along with indirect costs allocated according to a pre-agreed method (e.g., overhead rates based on a percentage of direct labor costs).

- Step 2: Negotiate the Fixed Fee: Before project commencement, the contractor and client negotiate a fixed fee that represents the contractor’s profit and overhead. This fee is typically a percentage of the estimated costs or a fixed dollar amount. The negotiation considers factors like project complexity, risk, and the contractor’s experience.

- Step 3: Calculate the Total Contract Price: Once the allowable costs are finalized and the fixed fee is agreed upon, the total contract price is simply the sum of these two figures. For example, if allowable costs total $100,000 and the fixed fee is $10,000, the total contract price is $110,000.

Cost-Plus-Incentive-Fee Contract Calculations

In a cost-plus-incentive-fee (CPIF) contract, the contractor’s fee is tied to the project’s performance against predetermined targets. The incentive mechanism encourages the contractor to control costs and achieve performance goals.

The calculation process involves:

- Step 1: Establish Target Cost and Fee: Initially, a target cost is established, representing the anticipated costs for completing the project. A target fee is also negotiated, representing the contractor’s compensation if the project is completed at the target cost. For example, a target cost of $150,000 and a target fee of $15,000.

- Step 2: Define Performance Goals: Specific performance metrics are established, such as project completion time, quality standards, or other relevant factors. These metrics will determine the incentive structure.

- Step 3: Determine Incentive Share Ratios: The contract specifies the share ratios between the contractor and client for cost underruns or overruns. For instance, a 70/30 share ratio means the contractor receives 70% of the savings from cost underruns, while the client receives 30%. Similarly, the contractor would bear 70% of any cost overruns.

- Step 4: Calculate the Final Fee: After project completion, the actual costs are compared to the target cost. Based on the cost variance and the share ratios, the final fee is calculated.

Example: If actual costs are $140,000 (a $10,000 underrun), the contractor’s share is $10,000

– 0.70 = $7,000. The final fee would be the target fee ($15,000) plus the contractor’s share of the underrun ($7,000), totaling $22,000.Conversely, if actual costs were $160,000 (a $10,000 overrun), the contractor’s share of the overrun would be deducted from the target fee. The final fee would be $15,000 – ($10,000

– 0.70) = $8,000.

Risk Management in Cost-Plus Contracts

Cost-plus contracts, while offering flexibility, present unique risks for both buyers and sellers. Effective risk management is crucial for a successful project outcome, requiring proactive strategies and careful contract design. This section explores these risks and Artikels mitigation techniques.

The inherent nature of cost-plus contracts, where the seller’s profit is tied to the incurred costs, creates potential for cost overruns and disputes. For buyers, the lack of a fixed price introduces uncertainty regarding the final project cost. Sellers, conversely, risk potential losses if costs exceed projections, especially if unforeseen circumstances arise.

Buyer Risks and Mitigation Strategies

Buyers face significant risks in cost-plus contracts, primarily concerning cost overruns and potential for inflated costs. To mitigate these, buyers should implement rigorous cost control measures, including regular cost reviews and independent audits. Clearly defined scopes of work, detailed specifications, and a strong change management process are essential.

Establishing a clear and transparent cost reporting system is paramount. This allows the buyer to track expenses against the budget and identify any deviations early on. Regular meetings with the seller to review progress and costs can help prevent issues from escalating.

Seller Risks and Mitigation Strategies

Sellers in cost-plus contracts are exposed to the risk of unforeseen costs and potential for reduced profitability if costs escalate beyond projections. This risk can be mitigated through detailed cost estimation, thorough risk assessment, and effective cost control practices. The contract should include provisions for addressing unforeseen circumstances and allow for adjustments to the fee structure in certain situations.

Thorough planning and accurate cost estimation at the outset are crucial. This involves identifying potential risks, developing contingency plans, and building those contingencies into the cost estimate. Maintaining detailed records of all expenses and justifying each cost incurred is essential for protecting the seller’s financial interests.

Contract Clauses for Cost Overrun Management

Several contract clauses can help manage cost overruns. These include:

A clause defining acceptable cost variations, outlining the permissible percentage of cost increase above the initial estimate before requiring buyer approval for further expenditures. This prevents runaway costs. Another crucial clause is a cost-control mechanism that mandates regular cost reports and allows for buyer review and approval of major cost changes. Finally, a dispute resolution mechanism should be clearly defined to address any disagreements about costs.

Effective Communication and Monitoring

Effective communication and ongoing project monitoring are vital for successful cost-plus contract management. Regular meetings between the buyer and seller to review progress, discuss challenges, and address potential issues are essential. This ensures that both parties are aligned and that problems are identified and resolved promptly. Transparent reporting and open communication help foster trust and prevent disputes.

Implementing a robust monitoring system allows both parties to track progress against the project plan and identify potential deviations from the budget. This proactive approach enables timely intervention and minimizes the impact of unforeseen events. The monitoring system should include regular progress reports, cost reports, and risk assessments.

Advantages and Disadvantages of Cost-Plus Contracts

Cost-plus contracts, while offering flexibility, present a unique set of advantages and disadvantages that must be carefully weighed against the specific circumstances of a project. Understanding these aspects is crucial for making informed decisions regarding contract selection. The suitability of a cost-plus contract hinges heavily on the level of uncertainty surrounding the project scope, the expertise of the contractor, and the risk tolerance of both parties involved.

Advantages of Cost-Plus Contracts

Cost-plus contracts are particularly well-suited for projects with high uncertainty or evolving requirements. The inherent flexibility allows for adjustments as the project progresses, mitigating the risks associated with unforeseen complexities or changes in scope. This adaptability is a significant advantage when dealing with innovative or complex projects where precise cost estimation upfront is challenging or impossible.

- Flexibility and Adaptability: Cost-plus contracts provide the freedom to modify project scope and specifications as needed, accommodating unforeseen challenges or opportunities that arise during execution. This is especially valuable in research and development projects or those involving cutting-edge technologies.

- Shared Risk: The risk is shared between the buyer and the contractor. The buyer shares the risk of cost overruns, but this is often balanced by the contractor’s commitment to efficient execution and cost control. This shared risk incentivizes collaboration and problem-solving.

- Incentive for Contractor Performance: Depending on the type of cost-plus contract (e.g., cost-plus-incentive-fee), the contractor may be incentivized to control costs and achieve performance targets, leading to better overall project outcomes. This alignment of incentives promotes efficiency.

- Access to Specialized Expertise: Cost-plus contracts can be particularly attractive when engaging contractors with unique or specialized skills and experience, even if their exact cost contribution is difficult to estimate in advance.

Disadvantages of Cost-Plus Contracts

The primary disadvantage of cost-plus contracts is the potential for cost overruns. Without a fixed price, there’s a greater risk that the final cost will exceed the initial budget. This necessitates robust cost control mechanisms and thorough monitoring to mitigate this risk.

- Potential for Cost Overruns: The absence of a predetermined price creates a risk of escalating costs, especially if the project scope expands significantly or if the contractor’s cost management is inadequate. This requires vigilant oversight and potentially results in higher overall project costs.

- Lack of Price Certainty: The final cost is not known at the outset, making budgeting and financial planning more challenging. This uncertainty can create difficulties in securing financing or in managing overall project expenses.

- Increased Monitoring Requirements: Effective cost control requires more extensive monitoring and oversight compared to fixed-price contracts. This increases administrative burden and demands greater attention from both parties.

- Potential for Cost Inflation: The contractor may have less incentive to optimize costs if they are reimbursed for all allowable expenses. This potential for cost inflation necessitates rigorous auditing and cost accounting practices.

Comparison of Advantages and Disadvantages

| Advantages | Disadvantages |

|---|---|

| Flexibility and adaptability to changing project needs | Potential for significant cost overruns |

| Shared risk between buyer and contractor | Lack of price certainty at the outset |

| Incentive for contractor performance (in some variations) | Increased monitoring and oversight requirements |

| Access to specialized expertise | Potential for cost inflation due to lack of price pressure |

Legal and Ethical Considerations

Cost-plus contracts, while offering flexibility, necessitate careful consideration of legal and ethical implications to ensure fairness, transparency, and compliance. Failure to do so can lead to disputes, legal action, and reputational damage for all parties involved.Legal implications primarily revolve around ensuring the contract’s compliance with applicable laws and regulations, particularly those concerning government contracts, procurement processes, and accounting standards.

Ethical concerns, on the other hand, focus on the accurate reporting of costs, maintaining transparency in the process, and avoiding conflicts of interest.

Compliance with Relevant Regulations

Cost-plus contracts, especially those involving government agencies or publicly funded projects, must adhere strictly to various regulations. These regulations often dictate allowable costs, documentation requirements, and auditing procedures. For example, the US Federal Acquisition Regulation (FAR) provides detailed guidelines for cost-plus contracts awarded by the federal government, specifying acceptable cost categories, the methods for calculating indirect costs, and the requirements for cost audits.

Non-compliance can result in contract termination, penalties, and legal repercussions. Similarly, other countries have their own procurement regulations that must be followed. Failure to understand and comply with these regulations is a significant legal risk.

Ethical Concerns in Cost Reporting

Accurate and transparent cost reporting is paramount in maintaining the ethical integrity of a cost-plus contract. Inflating costs, including unnecessary expenses or charging excessive fees, is a serious ethical breach. This can erode trust between the contracting parties and potentially lead to legal challenges. For instance, including personal expenses as business costs or failing to disclose related-party transactions are clear violations of ethical conduct.

The principle of “good faith and fair dealing” is central to maintaining ethical standards in contractual relationships.

Examples of Ethical Dilemmas, How does cost plus contract work

Consider a scenario where a contractor is responsible for managing a cost-plus project and has the option of using either a more expensive, higher-quality material or a cheaper, less durable alternative. While using the cheaper material might increase the contractor’s profit margin, it could compromise the project’s long-term quality and potentially violate the implied ethical obligation to deliver a project that meets the client’s needs.

Another example might involve a contractor failing to disclose a potential conflict of interest, such as a personal relationship with a subcontractor, which could influence their selection and pricing decisions. Such situations underscore the importance of establishing clear ethical guidelines and implementing robust oversight mechanisms.

In conclusion, navigating the intricacies of cost-plus contracts requires a thorough understanding of their various components and potential pitfalls. While offering flexibility and potentially mitigating some risks for the seller, they demand rigorous cost control and transparent communication from both parties. By carefully defining allowable costs, establishing clear fee structures, and implementing robust risk mitigation strategies, organizations can leverage the benefits of cost-plus contracts while minimizing potential downsides.

Careful planning and a clear understanding of the contract’s terms are paramount to successful project execution and a mutually beneficial outcome.

Questions and Answers: How Does Cost Plus Contract Work

What are some common reasons for disputes in cost-plus contracts?

Disputes often arise from ambiguities in defining allowable costs, disagreements over the accuracy of cost reporting, and lack of clear communication regarding changes to the project scope.

How can a buyer protect themselves from potential cost overruns in a cost-plus contract?

Buyers can mitigate risk through thorough cost estimation at the outset, regular cost reporting and audits, independent cost verification, and the inclusion of clauses limiting cost escalation or setting a maximum total contract price.

Are cost-plus contracts suitable for all types of projects?

No, cost-plus contracts are best suited for projects with uncertain scopes, high levels of technological uncertainty, or those requiring significant flexibility during execution. They are less suitable for projects with well-defined scopes and predictable costs where fixed-price contracts are generally preferred.

What is the difference between a cost-plus-fixed-fee and a cost-plus-incentive-fee contract?

In a cost-plus-fixed-fee contract, the seller receives a fixed fee regardless of the final cost. In a cost-plus-incentive-fee contract, the seller’s fee is adjusted based on their performance against pre-defined targets, incentivizing cost efficiency and project success.