What are allowable costs for federal contracts –

What are allowable costs for federal contracts? This question is at the heart of successful government contracting, determining what expenses can be billed to the government and how those costs are tracked. Navigating this landscape requires understanding the fundamental principles of allowable costs, the intricacies of cost accounting standards, and the distinction between direct and indirect expenses. Whether you’re a seasoned contractor or just starting out, grasping these concepts is crucial for ensuring compliance, maximizing profitability, and maintaining a strong relationship with the government.

This guide will delve into the key elements of allowable costs in federal contracts, providing a comprehensive overview of the rules, regulations, and best practices. We’ll explore the role of cost accounting standards, examine different cost allocation methods, and discuss the specific considerations for cost reimbursement and fixed-price contracts. By the end, you’ll have a solid understanding of what costs are permissible, how to properly allocate them, and the importance of accurate reporting.

*

Cost Allocation Methods: What Are Allowable Costs For Federal Contracts

Cost allocation is the process of assigning costs to specific cost objects, such as products, services, or projects. In federal contracts, it’s crucial to allocate costs fairly and accurately to ensure compliance with government regulations and to ensure the contractor receives fair compensation for their work. This process involves distributing costs across various cost objects, which can be products, services, projects, or departments.

Common Cost Allocation Methods, What are allowable costs for federal contracts

Several common methods are used to allocate costs in federal contracts. These methods are chosen based on the specific nature of the contract, the type of costs being allocated, and the requirements of the government agency.

- Direct Cost Allocation: Direct costs are easily and directly traceable to a specific cost object. For instance, the cost of materials used in a specific product or the wages of employees directly working on a particular project are direct costs. These costs are allocated directly to the relevant cost object without any further calculations.

- Indirect Cost Allocation: Indirect costs are not directly traceable to a specific cost object. Examples include administrative overhead, rent, and utilities. These costs are shared by multiple cost objects, requiring a systematic allocation method.

Activity-Based Costing (ABC)

Activity-based costing (ABC) is a method of allocating indirect costs to cost objects based on the activities that drive those costs. This approach is more precise than traditional methods that allocate costs based on volume or revenue. ABC focuses on identifying activities that consume resources and then assigns those costs to the products or services that utilize those activities.

Advantages of ABC

- Improved Cost Accuracy: ABC provides a more accurate allocation of costs by considering the specific activities involved in producing a product or service. This leads to a better understanding of the true cost of each product or service.

- Enhanced Cost Control: By understanding the cost drivers of each activity, organizations can identify areas where they can reduce costs and improve efficiency.

- Better Decision-Making: ABC provides more accurate cost information, which can lead to better decisions about pricing, product mix, and resource allocation.

Disadvantages of ABC

- Complexity: Implementing ABC can be complex and time-consuming, requiring a detailed analysis of activities and cost drivers.

- Costly Implementation: The initial implementation of ABC can be expensive, requiring data collection, analysis, and system changes.

Hypothetical Scenario

Imagine a construction company that is bidding on a federal contract to build a new school. The company uses ABC to allocate costs for the project. The company identifies several activities involved in the project, such as site preparation, foundation construction, framing, roofing, and finishing. Each activity has its own cost drivers, such as labor hours, equipment usage, and materials consumed.

The company then tracks the costs associated with each activity and allocates those costs to the project based on the activity’s usage. For example, if the site preparation activity requires 100 labor hours, the company allocates the cost of labor for site preparation to the project based on the 100 labor hours used. Similarly, the company allocates the cost of equipment used for site preparation based on the number of hours the equipment was used for that activity.

This approach ensures that the project costs are accurately allocated based on the specific activities involved.

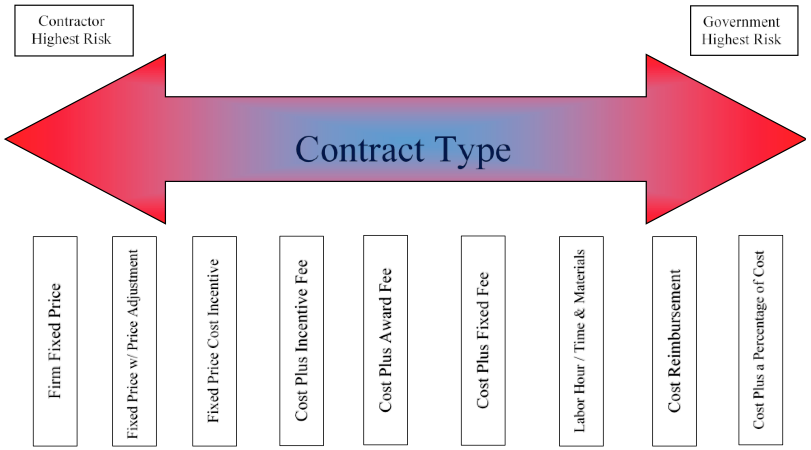

Fixed-Price Contracts

Fixed-price contracts are a type of contract where the government agrees to pay a predetermined price for the goods or services provided by the contractor. This price is fixed at the beginning of the contract and does not change regardless of the actual cost incurred by the contractor. Fixed-price contracts are often used when the scope of work is well-defined and the government can accurately estimate the cost of the project.

They provide the government with certainty about the cost of the project and incentivize the contractor to manage their costs efficiently.

Types of Fixed-Price Contracts

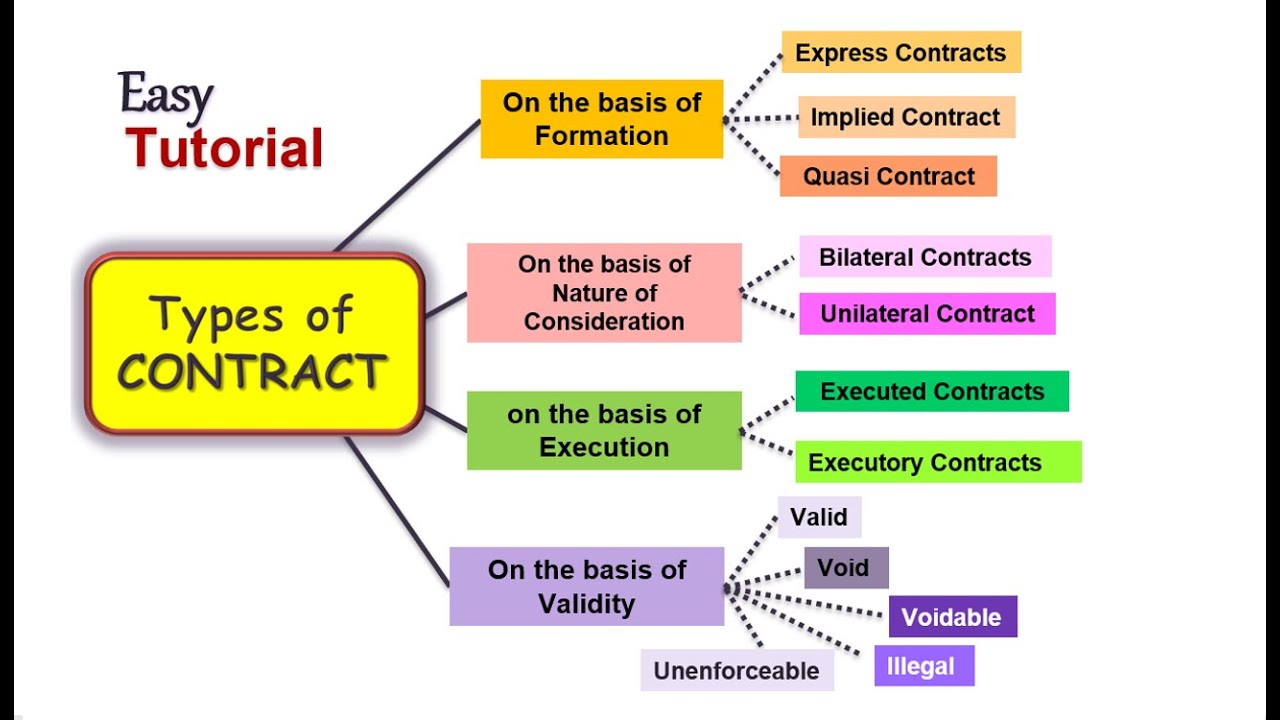

Fixed-price contracts can be further classified into different types based on the level of risk and responsibility shared by the government and the contractor. Here are some common types of fixed-price contracts:

- Firm-Fixed-Price (FFP): This is the most common type of fixed-price contract. Under an FFP contract, the price is fixed and does not change, regardless of the contractor’s actual costs. The contractor bears all the risk associated with cost overruns. The government benefits from a fixed price and the contractor is motivated to manage costs efficiently.

- Fixed-Price Incentive (FPI): This type of contract includes an incentive clause that rewards the contractor for exceeding performance targets or completing the project ahead of schedule. The contractor shares a portion of the savings with the government. The government benefits from potential cost savings, and the contractor is motivated to exceed expectations.

- Fixed-Price with Economic Price Adjustment (FP-EPA): This type of contract is used when the cost of materials or labor is likely to fluctuate significantly. The contract price includes a provision for adjustments based on changes in the cost of specific inputs. The government benefits from protection against inflation, and the contractor is compensated for increased costs.

Cost Overruns and Cost Reductions

Cost overruns and cost reductions are handled differently in fixed-price contracts compared to cost-reimbursement contracts.

- Cost Overruns: In a fixed-price contract, the contractor is responsible for any cost overruns. The government is not obligated to pay any additional costs beyond the agreed-upon price. This incentivizes the contractor to carefully manage costs and complete the project within the agreed-upon budget.

- Cost Reductions: If the contractor is able to complete the project for less than the agreed-upon price, they may be able to keep the savings. However, the government may also negotiate a price reduction to reflect the lower costs. The contractor is motivated to find cost savings and the government may benefit from lower costs.

Unallowable Costs

Understanding which costs are unallowable in federal contracts is crucial for contractors to ensure compliance and avoid potential penalties. Unallowable costs are those that the government considers inappropriate for reimbursement under a contract. These costs are typically prohibited due to their lack of direct connection to the contract work, potential for abuse, or conflict with ethical principles.

Rationale for Prohibiting Certain Costs

The rationale behind prohibiting certain costs is multifaceted and aims to ensure fairness, accountability, and efficient use of taxpayer funds. For instance, entertainment expenses are generally considered unallowable because they are not directly related to the performance of the contract work and can be subject to misuse. This prohibition aims to prevent contractors from using government funds for non-essential activities.

Common Categories of Unallowable Costs

- Entertainment Expenses: Costs associated with entertainment, such as meals, drinks, and tickets to sporting events or concerts, are generally unallowable unless directly related to the performance of the contract work and approved by the contracting officer. This is due to the potential for abuse and the lack of direct connection to the contract’s purpose.

- Lobbying Costs: Costs associated with lobbying efforts, such as expenses incurred to influence legislation or government policy, are unallowable. This prohibition is based on the principle that government funds should not be used to influence government decisions.

- Political Contributions: Contributions to political campaigns or organizations are strictly prohibited under federal contracts. This restriction ensures that government funds are not used to influence political outcomes.

- Advertising Costs: Advertising expenses are generally unallowable unless they are directly related to the performance of the contract work and approved by the contracting officer. This is to prevent contractors from using government funds for promotional activities that do not benefit the contract.

- Bad Debts: Losses resulting from uncollectible debts are typically unallowable. This is because the government is not responsible for covering the contractor’s financial risks associated with bad debts.

- Penalties and Fines: Costs associated with penalties or fines incurred due to violations of laws or regulations are generally unallowable. This is because the government should not bear the burden of the contractor’s non-compliance.

- Personal Expenses: Costs related to personal expenses, such as clothing, travel for personal reasons, and entertainment, are generally unallowable. This ensures that government funds are used only for contract-related activities.

- Gifts and Gratuities: Costs associated with gifts or gratuities to government personnel are prohibited under federal contracts. This restriction aims to prevent conflicts of interest and ensure ethical conduct.

Consequences of Claiming Unallowable Costs

Claiming unallowable costs in a federal contract can lead to serious consequences for contractors. These consequences can include:

- Disallowance of Costs: The government may disallow the unallowable costs, meaning that the contractor will not be reimbursed for them.

- Contract Termination: In severe cases, the government may terminate the contract if the contractor repeatedly claims unallowable costs or engages in fraudulent activities.

- Financial Penalties: The government may impose financial penalties on the contractor for claiming unallowable costs.

- Reputational Damage: Claiming unallowable costs can damage the contractor’s reputation and make it difficult to secure future contracts.

- Criminal Prosecution: In cases of deliberate fraud or misrepresentation, the contractor may face criminal prosecution.

Auditing and Reporting

Auditing and reporting are crucial components of federal contract management, ensuring compliance with regulations and accountability for taxpayer dollars. Cost audits verify the accuracy and allowability of expenses claimed by contractors, while cost reporting provides a detailed record of project expenditures.

Cost Audits

Cost audits are independent assessments conducted by government auditors to verify the allowability of costs claimed by contractors. They play a critical role in ensuring that federal funds are used appropriately and that contractors are not overcharging the government.

- Scope of Audit: Cost audits cover a wide range of expenses, including direct and indirect costs, labor costs, materials, travel, and overhead. Auditors examine supporting documentation, such as invoices, receipts, and time sheets, to ensure that costs are properly allocated and documented.

- Audit Procedures: Auditors use a variety of techniques to conduct cost audits, including reviewing financial records, interviewing personnel, and performing analytical procedures. They may also request access to contractor facilities and records.

- Audit Findings: The results of a cost audit are documented in an audit report, which Artikels any discrepancies or areas of concern. The report may identify instances of unallowable costs, inadequate documentation, or noncompliance with contract terms.

Importance of Accurate Cost Reporting

Accurate and complete cost reporting is essential for effective federal contract management. It allows government agencies to track project expenditures, assess contractor performance, and ensure that taxpayer dollars are being used efficiently.

- Transparency and Accountability: Accurate cost reporting promotes transparency and accountability by providing a clear record of how federal funds are being spent. It allows government agencies and taxpayers to track project progress and identify any potential issues.

- Contract Compliance: Cost reports are used to verify compliance with contract terms and conditions. Contractors are required to submit detailed reports that demonstrate how they have incurred and allocated costs.

- Financial Management: Accurate cost reporting is essential for effective financial management. It allows government agencies to monitor contract budgets, identify potential cost overruns, and make informed decisions about project funding.

Preparing and Submitting Cost Reports

Preparing and submitting cost reports is a critical step in federal contract management. Contractors are required to adhere to specific guidelines and deadlines for reporting.

- Understanding Reporting Requirements: Contractors must carefully review the contract terms and conditions to understand the specific reporting requirements, including the frequency, format, and content of reports.

- Gathering Cost Data: Contractors must gather accurate and complete cost data from their accounting systems and other relevant sources. This data should be organized and documented in a manner that supports the reported costs.

- Preparing the Report: Contractors must prepare cost reports using the prescribed format and include all required information. This may include a summary of costs, detailed breakdowns of expenses, and supporting documentation.

- Submitting the Report: Cost reports must be submitted to the government agency in a timely manner, according to the specified deadlines. Electronic submission is often preferred, and contractors should ensure that the report is properly formatted and transmitted.

Understanding allowable costs in federal contracts is essential for both contractors and government agencies. By adhering to the principles of cost accounting standards, employing appropriate cost allocation methods, and maintaining transparent reporting, both parties can ensure fair and accurate billing practices. While navigating the complexities of allowable costs can be challenging, a clear understanding of these principles empowers contractors to maximize profitability and fosters trust in the government contracting process.

Remember, accurate and compliant cost reporting is the foundation for successful and ethical government contracting.

Quick FAQs

What is the purpose of cost accounting standards (CAS) in federal contracts?

CAS are designed to ensure consistency and fairness in how contractors allocate and report costs on federal contracts. They provide a common framework for defining allowable costs, ensuring that government agencies are paying for legitimate expenses and contractors are not taking advantage of the system.

What are some common examples of unallowable costs in federal contracts?

Unallowable costs often include expenses deemed unnecessary, extravagant, or unrelated to the contract work. These can include:

– Entertainment expenses

– Political contributions

– Fines and penalties

– Personal expenses of company executives

– Costs that violate federal labor laws.

How are cost audits conducted in federal contracts?

Cost audits are typically conducted by government auditors or independent contractors. They examine a contractor’s accounting records and supporting documentation to verify the accuracy and allowability of costs claimed. Audits may involve reviewing invoices, time sheets, purchase orders, and other relevant documents.

What are the consequences of claiming unallowable costs in a federal contract?

Claiming unallowable costs can lead to serious consequences, including:

– Contract termination

– Financial penalties

– Legal action

– Damage to reputation

What resources are available for contractors to learn more about allowable costs in federal contracts?

The Federal Acquisition Regulation (FAR) is the primary source of guidance on allowable costs. Additional resources include the Cost Accounting Standards Board (CASB) website, the Defense Contract Audit Agency (DCAA), and industry associations like the National Contract Management Association (NCMA).

-*