What is a target cost contract? It’s a contractual arrangement where the buyer and seller agree on a target cost for a project, with the final price adjusted based on actual costs incurred. This type of contract can be a win-win for both parties, fostering collaboration and incentivizing cost efficiency. But it’s not without its complexities. Understanding the key components, advantages, and potential drawbacks is crucial before embarking on a target cost contract.

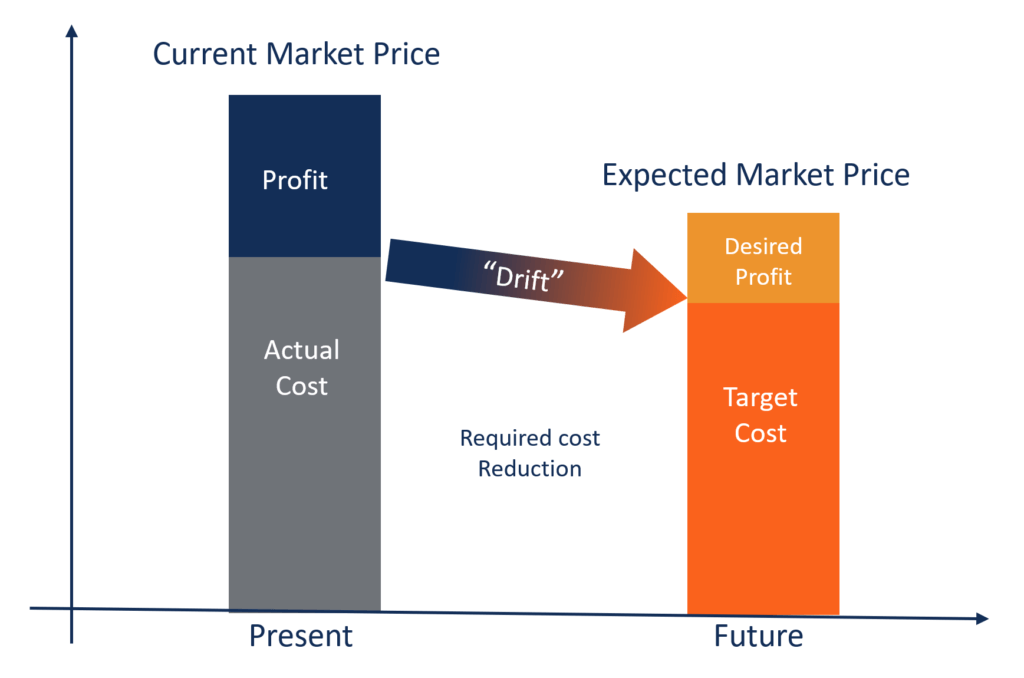

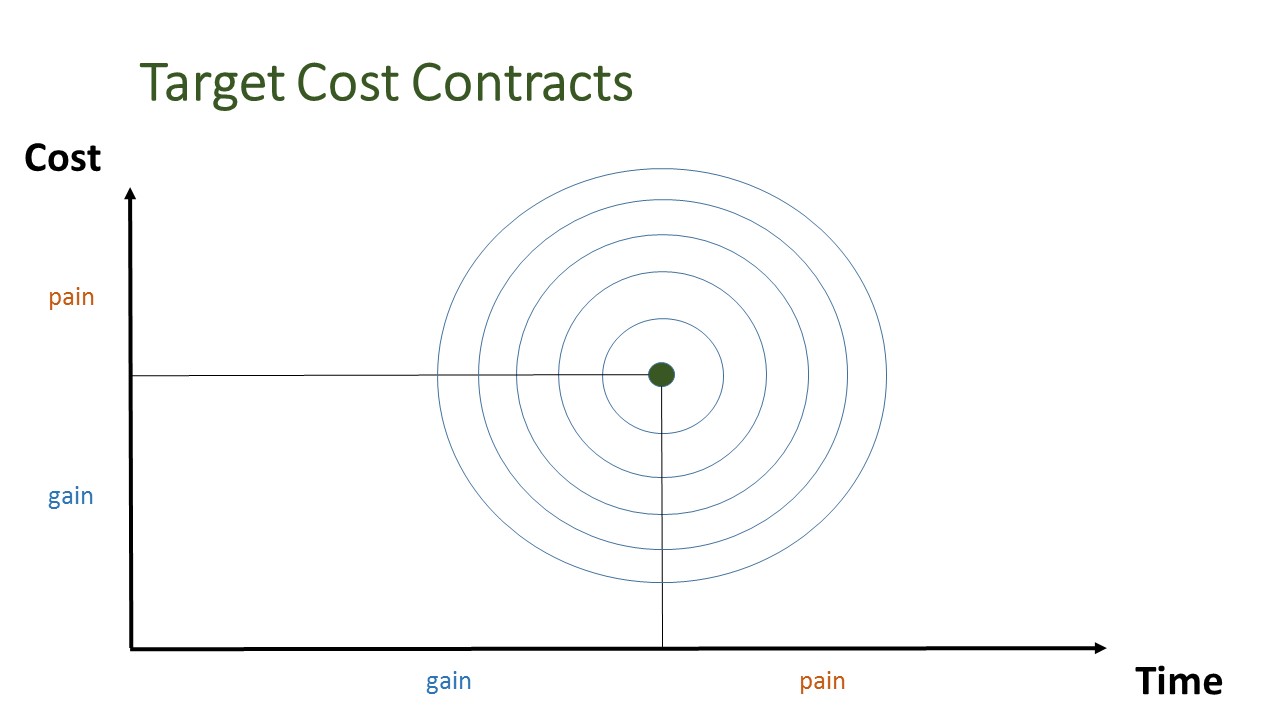

At its core, a target cost contract aims to align incentives between the buyer and seller. The buyer wants the project completed within a reasonable budget, while the seller wants to be fairly compensated for their work. A target cost contract seeks to achieve this balance by establishing a target cost for the project, a target profit for the seller, and a mechanism for sharing any cost savings or overruns.

Definition of a Target Cost Contract

A target cost contract is a type of agreement where the buyer and seller collaborate to achieve a mutually agreed-upon target cost for a project or product. This type of contract encourages cost-effectiveness and transparency, as both parties share the risk and reward associated with achieving the target cost.

Defining Target Cost Contracts

A target cost contract, also known as a “cost-plus-incentive fee” contract, is a type of contract where the buyer pays the seller for the actual costs incurred in completing a project, plus a predetermined fee or incentive. The key element is the “target cost,” which is the estimated cost of completing the project. This target cost is established during the contract negotiation process, based on the best available estimates and projections.

Real-World Example

Imagine a company needs to develop a new software application. Instead of using a fixed-price contract, they opt for a target cost contract with a software development firm. The target cost is set at $1 million, and the contract specifies that the buyer will reimburse the actual costs incurred by the developer, up to the target cost. If the developer manages to complete the project for less than $1 million, they receive a pre-agreed incentive, such as a percentage of the cost savings.

Conversely, if the actual cost exceeds the target cost, the developer shares a portion of the cost overrun with the buyer. This shared risk and reward incentivizes both parties to work together to achieve the target cost and complete the project efficiently.

Key Components of a Target Cost Contract

Target cost contracts, also known as cost-plus incentive fee contracts, are a type of procurement contract where the buyer and seller agree on a target cost for the project. This target cost represents the estimated cost of fulfilling the project requirements. The contract then Artikels a mechanism for sharing any savings or losses that may occur during project execution.

Target Cost, Target Profit, and Shared Savings/Loss Mechanism

These three elements form the core of a target cost contract.

- Target Cost: This is the estimated cost of completing the project. It’s determined through a detailed cost breakdown and analysis, involving both the buyer and seller. The target cost serves as a baseline for evaluating the project’s actual cost.

- Target Profit: This is the profit margin the seller expects to earn if the project is completed at the target cost. It’s negotiated beforehand and represents the seller’s compensation for its expertise and effort. The target profit is typically a fixed percentage of the target cost.

- Shared Savings/Loss Mechanism: This is a crucial aspect of the target cost contract. It Artikels how any cost savings or overruns are shared between the buyer and seller. The shared savings/loss mechanism incentivizes both parties to work collaboratively to minimize costs and maximize efficiency.

For example, a contract might specify a 50/50 sharing arrangement, where both the buyer and seller share equally in any cost savings or overruns. Alternatively, the contract could include a tiered sharing mechanism, where the buyer receives a larger share of the savings when the actual cost is significantly lower than the target cost.

Contract Price Adjustment Clause

This clause is essential for ensuring fairness and transparency in target cost contracts. It Artikels the process for adjusting the final contract price based on the actual project costs.

- Purpose: The price adjustment clause is designed to account for any deviations from the target cost, whether due to unforeseen circumstances, changes in scope, or variations in material prices.

- Mechanism: The clause typically defines a formula for calculating the final contract price based on the actual cost incurred, the target cost, and the agreed-upon sharing arrangement. For example, the formula might include a predetermined percentage for sharing savings or losses, or it might be based on a sliding scale that adjusts the sharing percentage depending on the magnitude of the cost variance.

It’s crucial for both the buyer and seller to understand the price adjustment clause thoroughly. This ensures that the final contract price reflects the actual project costs and that both parties are fairly compensated.

Advantages of Using a Target Cost Contract

Target cost contracts offer a compelling approach to project management, providing a framework that benefits both the buyer and the seller. This type of contract incentivizes collaboration, fosters cost efficiency, and promotes a shared understanding of project goals and risks.

Benefits for Buyer and Seller

Target cost contracts present a win-win scenario for both the buyer and the seller, offering a range of advantages.

- For the Buyer:

- Cost Control: Target cost contracts provide a clear and defined target cost, allowing buyers to better predict and manage project expenses. This predictability enhances budgeting and financial planning.

- Incentivized Efficiency: By sharing the cost savings with the seller, buyers encourage efficient resource allocation and cost optimization. This results in a more cost-effective project outcome.

- Enhanced Collaboration: The shared risk and reward structure fosters a collaborative environment between the buyer and seller, promoting open communication and a shared commitment to project success.

- For the Seller:

- Increased Profit Potential: Sellers can potentially earn higher profits by exceeding expectations and achieving cost savings beyond the target cost. This incentivizes innovation and efficient execution.

- Reduced Risk: By sharing the risk with the buyer, sellers have a safety net against potential cost overruns, mitigating financial uncertainties associated with traditional fixed-price contracts.

- Enhanced Reputation: Successfully delivering projects under a target cost contract demonstrates a commitment to cost efficiency and project excellence, enhancing the seller’s reputation and attracting future clients.

Incentivizing Cost Efficiency and Collaboration

The core principle of target cost contracts is to align the interests of both parties, creating a shared incentive to achieve cost efficiency and project success.

- Cost Savings Sharing: The contract typically includes a mechanism for sharing cost savings between the buyer and seller, often through a predetermined percentage split. This encourages the seller to identify and implement cost-saving measures, as they directly benefit from the resulting savings.

- Collaborative Problem Solving: Target cost contracts promote open communication and collaboration throughout the project lifecycle. Both parties work together to identify potential cost overruns, find innovative solutions, and mitigate risks. This shared approach fosters a spirit of partnership and problem-solving.

Examples of Advantageous Situations

Target cost contracts are particularly advantageous in situations where:

- Complex Projects: For projects with high levels of uncertainty and complexity, target cost contracts provide a flexible framework that can adapt to changing requirements and unforeseen challenges.

- Long-Term Partnerships: When buyers and sellers are engaged in long-term collaborations, target cost contracts can foster a trust-based relationship, encouraging both parties to prioritize mutual success.

- Innovation and Research: Target cost contracts are well-suited for projects involving research and development, where cost efficiency and innovative solutions are paramount. The shared risk and reward structure incentivizes creative problem-solving and exploration of new technologies.

Disadvantages of Using a Target Cost Contract: What Is A Target Cost Contract

While target cost contracts offer advantages like fostering collaboration and incentivizing cost efficiency, they also present certain drawbacks that businesses should carefully consider. These disadvantages stem from the inherent complexity of the contract structure and the potential for disputes.

Challenges in Determining a Fair and Accurate Target Cost, What is a target cost contract

Establishing a fair and accurate target cost is crucial for the success of a target cost contract. However, this process can be challenging due to various factors:

- Uncertainty in Scope and Requirements: The initial scope and requirements of a project may evolve over time, making it difficult to accurately estimate the target cost upfront. Unforeseen changes, technological advancements, or evolving customer needs can lead to cost variations that were not anticipated at the outset.

- Subjectivity in Cost Estimation: Estimating the target cost involves subjective judgments about labor, materials, and overhead expenses. Different parties may have differing perspectives on these factors, leading to disagreements about the initial target cost.

- Complexity of Project: For complex projects with multiple stakeholders and intricate workflows, accurately forecasting costs becomes even more challenging. The sheer number of variables and potential interdependencies can make it difficult to achieve a precise target cost.

Potential Disputes and Disagreements Regarding Cost Overruns or Savings

Disputes can arise when cost overruns or savings occur, as both parties need to agree on the legitimacy of the cost variations. This can be a source of tension and conflict:

- Defining Cost Overruns: Determining what constitutes a legitimate cost overrun can be contentious. Factors such as unforeseen circumstances, changes in project scope, or market fluctuations may be considered by one party but not the other.

- Sharing of Savings: Disputes can arise over the sharing of cost savings. If the contractor achieves significant cost savings, the client may expect a larger share of the savings, while the contractor may argue for a greater share based on their efforts and expertise.

- Transparency and Documentation: Lack of transparency and inadequate documentation can fuel disputes. Both parties must maintain clear records of costs incurred and savings achieved to avoid misunderstandings and disagreements.

Comparison to Other Contract Types

Target cost contracts, like any other contract type, have unique characteristics that set them apart. To fully understand their strengths and weaknesses, it’s crucial to compare them with other common contract types, namely fixed-price and cost-plus contracts. By examining the advantages and disadvantages of each contract type in various scenarios, we can gain valuable insights into their suitability for different projects.

Comparison with Fixed-Price Contracts

Fixed-price contracts, also known as lump-sum contracts, involve a predetermined price for the entire project scope. The contractor assumes the risk of cost overruns, while the buyer enjoys the certainty of a fixed price.

Advantages of Fixed-Price Contracts:

- Clear Cost Definition: The buyer knows the exact cost upfront, making budgeting and financial planning easier.

- Reduced Risk for Buyer: The buyer is protected from cost overruns, as the contractor bears the responsibility for managing costs.

- Simplified Procurement Process: The bidding process is streamlined, as contractors submit bids based on a defined scope of work.

Disadvantages of Fixed-Price Contracts:

- Limited Flexibility: Changes in scope or requirements can lead to disputes and costly renegotiations.

- Risk for Contractor: The contractor bears the risk of cost overruns, potentially leading to financial losses.

- Incentive for Cost Minimization: Contractors may be incentivized to cut corners or compromise quality to maximize profit.

Advantages of Target Cost Contracts:

- Shared Risk and Reward: Both the buyer and contractor share the risk and reward of the project’s success.

- Incentive for Cost Control: The contractor is motivated to minimize costs, as they share in the savings.

- Flexibility for Changes: The contract allows for adjustments to scope and requirements with mutual agreement.

Disadvantages of Target Cost Contracts:

- Complexity: The contract requires careful planning and negotiation to establish a fair target cost and profit sharing arrangement.

- Potential for Disputes: Disagreements over cost adjustments and profit sharing can arise, leading to disputes.

- Limited Cost Certainty: The final cost is not fixed, and the buyer may face some uncertainty.

Comparison with Cost-Plus Contracts

Cost-plus contracts, also known as cost-reimbursable contracts, allow the contractor to recover all allowable costs incurred during the project. The buyer pays a predetermined fee, typically a percentage of the costs, to cover the contractor’s profit.

Advantages of Cost-Plus Contracts:

- Maximum Flexibility: The buyer can make changes to the scope and requirements without significant cost implications.

- Reduced Risk for Contractor: The contractor is guaranteed to recover all allowable costs, minimizing financial risk.

- Suitable for Complex Projects: Ideal for projects with uncertain scope, where cost estimates are difficult to predict.

Disadvantages of Cost-Plus Contracts:

- Lack of Cost Certainty: The final cost is unknown until the project is complete, making budgeting difficult.

- Potential for Cost Overruns: The contractor may have less incentive to control costs, leading to higher expenses.

- Limited Buyer Control: The buyer has less control over the project’s costs and may face higher expenses than anticipated.

Advantages of Target Cost Contracts:

- Cost Control Incentive: The contractor is motivated to minimize costs, as they share in the savings.

- Shared Risk and Reward: Both the buyer and contractor share the risk and reward of the project’s success.

- Flexibility for Changes: The contract allows for adjustments to scope and requirements with mutual agreement.

Disadvantages of Target Cost Contracts:

- Complexity: The contract requires careful planning and negotiation to establish a fair target cost and profit sharing arrangement.

- Potential for Disputes: Disagreements over cost adjustments and profit sharing can arise, leading to disputes.

- Limited Cost Certainty: The final cost is not fixed, and the buyer may face some uncertainty.

Key Characteristics of Contract Types

| Contract Type | Price | Risk | Flexibility | Cost Certainty |

|---|---|---|---|---|

| Fixed-Price | Predetermined | Contractor | Limited | High |

| Target Cost | Negotiated Target | Shared | Moderate | Moderate |

| Cost-Plus | Cost Reimbursable | Buyer | High | Low |

Applications of Target Cost Contracts

Target cost contracts are widely used in various industries where there is a need for collaborative cost management and shared risk. They are particularly suitable for complex projects where the final scope of work may not be fully defined at the outset.

Industries and Projects

Target cost contracts are commonly employed in industries where there is a high degree of uncertainty or complexity involved in project execution. These industries include:

- Construction: Target cost contracts are frequently used in large-scale construction projects, such as infrastructure projects, commercial buildings, and industrial facilities. The complexity and variability of construction projects make them well-suited for a target cost approach.

- Engineering: Engineering projects, particularly those involving advanced technologies or innovative solutions, often benefit from target cost contracts. This approach allows for flexibility in design and implementation while incentivizing cost optimization.

- Software Development: In software development, target cost contracts are often used for projects with evolving requirements or where the final scope of work is not fully defined at the beginning. This contract type allows for adjustments to the scope and budget as the project progresses.

- Aerospace and Defense: Target cost contracts are prevalent in the aerospace and defense industries, where complex systems and high-value projects require close collaboration and cost control.

- Research and Development: Target cost contracts are also used in research and development projects, where the outcome and final costs are uncertain. This approach allows for flexibility in the research process while incentivizing efficient resource utilization.

Suitability for Different Types of Work

The suitability of target cost contracts depends on several factors, including the complexity of the work, the level of uncertainty, and the willingness of both parties to share risk and collaborate.

- Construction: Target cost contracts are well-suited for construction projects with a high degree of uncertainty, such as those involving complex designs, challenging site conditions, or fluctuating material costs. This contract type allows for adjustments to the scope and budget as the project progresses, mitigating risks associated with unforeseen circumstances.

- Engineering: Target cost contracts are particularly beneficial for engineering projects that involve innovative solutions or advanced technologies. This contract type encourages creativity and flexibility in design and implementation while incentivizing cost optimization. It is also suitable for projects with a high degree of customization or where the final scope of work is not fully defined at the outset.

- Software Development: Target cost contracts are often used in software development projects with evolving requirements or where the final scope of work is not fully defined at the beginning. This contract type allows for adjustments to the scope and budget as the project progresses, accommodating changes in requirements and ensuring efficient resource utilization.

Real-World Examples

- The construction of the Burj Khalifa, the world’s tallest building, was a complex project that involved significant uncertainties and risks. A target cost contract was used to manage the project’s costs and mitigate potential risks. The project was completed successfully, demonstrating the effectiveness of target cost contracts in handling large-scale, complex projects.

- The development of the Boeing 787 Dreamliner, a highly innovative aircraft, was a challenging project that required significant collaboration and cost control. A target cost contract was used to manage the project’s costs and ensure that the aircraft met its performance and safety standards. The project was completed successfully, highlighting the benefits of target cost contracts in managing complex engineering projects.

- The development of the Google Search engine, a complex software project with evolving requirements, utilized a target cost contract to manage the project’s costs and ensure its successful completion. The project was completed successfully, demonstrating the effectiveness of target cost contracts in managing software development projects with evolving requirements.

Considerations for Implementing a Target Cost Contract

Implementing a target cost contract requires careful consideration and planning to ensure success for both parties. This type of contract is best suited for projects where collaboration, trust, and a shared understanding of the project’s objectives are paramount.

Key Factors to Consider

Before entering into a target cost contract, both parties should carefully evaluate several key factors. These factors help determine if this contract type is suitable for the project and set the stage for a successful implementation.

- Project Complexity: Target cost contracts are generally more suitable for complex projects with a high degree of uncertainty. These projects benefit from the flexibility and collaboration that this contract type offers.

- Relationship Between Parties: A strong and trusting relationship between the parties is essential. Open communication, shared goals, and a willingness to collaborate are key to success.

- Risk Allocation: Both parties should understand and agree on the allocation of risks associated with the project. This includes defining which party bears the responsibility for cost overruns or underruns.

- Cost Estimating Capabilities: Accurate cost estimation is crucial for both parties. The parties should have the necessary expertise and resources to develop realistic cost estimates and track project progress.

- Performance Measurement: Clear and measurable performance indicators should be established to track progress and assess performance against agreed-upon objectives. This helps ensure that both parties are aligned on expectations and progress.

- Contract Management Expertise: Effective contract management is essential for successful implementation. This involves careful planning, communication, and monitoring throughout the project lifecycle.

Importance of Clear Communication, Trust, and Collaboration

Open and honest communication is the cornerstone of a successful target cost contract. Both parties must be willing to share information, discuss challenges, and work together to find solutions. Trust is essential, as it enables both parties to rely on each other’s expertise and commitment to achieving the project’s objectives. Collaboration is crucial for successful implementation. This involves actively working together to define project scope, develop cost estimates, and manage risks.

Regular meetings, open communication channels, and a willingness to compromise are essential for fostering a collaborative environment.

Steps for Effective Implementation

Implementing a target cost contract requires a structured approach to ensure a smooth and successful project. Following these steps can help maximize the benefits of this contract type.

- Define Project Scope: Clearly define the project’s scope, objectives, and deliverables. This provides a shared understanding of what is expected and helps avoid misunderstandings.

- Develop Cost Estimates: Work collaboratively to develop realistic and accurate cost estimates. This involves considering all potential costs, including direct costs, indirect costs, and contingency allowances.

- Establish Performance Metrics: Agree on measurable performance indicators to track progress and assess performance against objectives. This ensures both parties are aligned on expectations and progress.

- Allocate Risks: Define the allocation of risks associated with the project. This includes identifying potential risks, assessing their likelihood and impact, and assigning responsibility for managing them.

- Establish Communication Channels: Define clear communication channels and protocols for regular updates, issue resolution, and decision-making. This ensures timely and effective communication throughout the project lifecycle.

- Monitor Project Progress: Regularly monitor project progress against the agreed-upon plan and performance metrics. This helps identify potential issues early and allows for corrective action.

- Conduct Performance Reviews: Regularly review project performance and adjust the plan as needed. This ensures that the project remains on track and that both parties are satisfied with the progress.

- Settle Final Costs: Upon project completion, carefully review and settle final costs. This involves verifying all expenses and ensuring that they align with the agreed-upon target cost.

In essence, a target cost contract offers a collaborative approach to project management. It’s a powerful tool for achieving cost-effective results when trust and open communication are present. However, it’s crucial to carefully consider the potential challenges and ensure a robust framework for managing costs and resolving any disputes that may arise. As with any contract, transparency and a clear understanding of the terms are paramount for a successful and mutually beneficial outcome.

User Queries

How is the final price determined in a target cost contract?

The final price is calculated by adding the actual costs incurred to the agreed-upon target profit. Any cost savings or overruns are shared between the buyer and seller according to the contract’s terms.

What happens if the actual costs exceed the target cost?

If the actual costs exceed the target cost, the seller typically bears a portion of the overrun, while the buyer may also contribute depending on the contract’s terms. This incentivizes both parties to minimize costs and control project expenses.

What are some common industries where target cost contracts are used?

Target cost contracts are frequently used in industries such as construction, engineering, aerospace, and defense, where projects are complex and require a high degree of collaboration between the buyer and seller.

What are some key considerations when implementing a target cost contract?

Key considerations include clearly defining the scope of work, establishing a robust cost tracking system, and fostering open communication and collaboration between the buyer and seller. It’s also crucial to have a well-defined dispute resolution mechanism in place.