What is contract fee – What is a contract fee? It’s the heart of any agreement, the agreed-upon sum or rate that defines the financial exchange between parties. Imagine you’re hiring a contractor to build a deck – the contract fee is the price you pay for their expertise and labor. Contract fees can take many forms, from simple lump sums to complex milestone payments, each reflecting the unique nature of the work involved.

Understanding contract fees is essential for both those seeking services and those providing them. It ensures clarity, fairness, and a solid foundation for successful collaboration. Let’s explore the factors that influence these fees, the different payment structures, and the legal considerations involved.

Definition of Contract Fee

A contract fee is a predetermined amount of money paid to a party for fulfilling a specific task or service Artikeld in a contract. It’s a common practice in various industries, ensuring clarity and fairness for both the client and the service provider.

Types of Contract Fees

Contract fees can take various forms depending on the nature of the work and the agreement between the parties. Here are some common types:

- Consulting Fees: Paid to individuals or firms for providing expert advice, guidance, and strategic insights on a particular project or business area.

- Service Fees: Charged for performing specific services, such as web development, marketing, legal assistance, or accounting services.

- Project Fees: A lump sum paid for completing a specific project with a defined scope and deliverables, regardless of the actual time or effort required.

- Hourly Fees: Calculated based on the number of hours spent working on a project, often used for tasks that require flexibility and may involve unexpected challenges.

- Retainer Fees: Paid upfront to secure the availability of a professional for a specific period, guaranteeing their services for a pre-defined timeframe.

The Purpose of Contract Fees

Contract fees serve a crucial purpose for both parties involved:

- For the Client: Contract fees provide transparency and predictability regarding the cost of services, allowing for better budgeting and financial planning. It also establishes clear expectations and accountability for the service provider.

- For the Service Provider: Contract fees ensure fair compensation for their expertise, time, and effort invested in fulfilling the agreed-upon tasks. It also provides a sense of security and financial stability, allowing them to allocate resources and plan for future projects.

Factors Influencing Contract Fees

The contract fee, the financial compensation for the services rendered under a contract, is determined by several factors that are crucial to understand when negotiating or evaluating a contract. These factors are dynamic and can vary depending on the specific circumstances, industry, and market conditions.

Scope of Work and Complexity

The scope and complexity of the work Artikeld in the contract are key determinants of the contract fee. More extensive and complex projects requiring specialized skills, advanced technologies, or significant resources will naturally command higher fees. For instance, a contract for a simple website design will have a lower fee than a contract for developing a sophisticated e-commerce platform with integrated payment gateways and complex backend systems.

Experience and Expertise

The experience and expertise of the contractor are directly proportional to the contract fee. Contractors with extensive experience, proven track records, and specialized skills in a particular field are typically compensated at higher rates than those with less experience. This is because their expertise brings value and reduces the risk associated with the project. A seasoned architect with decades of experience designing high-rise buildings will command a higher fee than a recent graduate with limited experience.

Market Conditions and Industry Standards, What is contract fee

Market conditions and industry standards significantly influence contract fees. The prevailing market rates for similar services, the demand for specific skills, and the overall economic climate can all impact the fee. In a highly competitive market with an abundance of contractors, fees may be lower due to increased competition. Conversely, in a niche market with limited skilled professionals, fees may be higher due to the scarcity of talent.

Time and Resources

The time required to complete the project and the resources needed to execute it are essential factors in determining the contract fee. Contracts that require extensive time commitments, specialized equipment, or significant personnel will naturally have higher fees. A contract for a multi-year construction project will have a higher fee than a contract for a short-term software development project.

Location and Geographical Factors

The location of the project and any geographical factors can influence the contract fee. Projects in high-cost areas, such as major metropolitan cities, may have higher fees due to higher living costs and operating expenses. Additionally, projects requiring travel, logistics, or specialized equipment may have additional costs factored into the fee.

Contract Duration and Payment Terms

The duration of the contract and the payment terms can also impact the contract fee. Longer-term contracts may have lower hourly rates but may result in higher overall fees due to the extended duration. The payment terms, such as upfront payments, milestones, or payment schedules, can also affect the contract fee.

Contingency Fees and Risk

Contingency fees are often included in contracts to account for unforeseen circumstances or risks. These fees are typically a percentage of the base fee and are designed to protect the contractor from unexpected costs or delays. The level of risk associated with the project will influence the size of the contingency fee.

Other Factors

Several other factors can influence contract fees, including the urgency of the project, the client’s budget, and the reputation of the contractor. Projects with tight deadlines may have higher fees due to the need for expedited services. Client budgets can also play a role in determining the fee, as contractors may adjust their rates to meet the client’s financial constraints.

Finally, the reputation and track record of the contractor can also impact the fee, as clients are often willing to pay a premium for reputable and experienced professionals.

Structure of Contract Fees

The structure of contract fees refers to the way in which the fee is paid out over time. Different payment structures can be used, each with its own advantages and disadvantages. Choosing the right payment structure is crucial for both the client and the contractor, as it can impact the overall project cost, risk, and timeline.

Lump Sum Payment

A lump sum payment is a single, fixed amount paid to the contractor for the completion of the entire project. This structure is common for projects with well-defined scopes and deliverables.

Advantages of Lump Sum Payment

- Predictability: Both the client and the contractor know the exact cost of the project upfront.

- Simplicity: The payment structure is straightforward and easy to understand.

- Reduced Risk for the Client: The client has a fixed budget and knows the total cost of the project.

Disadvantages of Lump Sum Payment

- Risk for the Contractor: The contractor bears the risk of unforeseen costs or changes in scope.

- Limited Flexibility: Changes to the project scope after the contract is signed can be difficult and costly.

- Potential for Disputes: Disputes can arise if the project scope is not clearly defined or if there are changes to the scope during the project.

Example

A construction company agrees to build a house for a client for a lump sum of $500,000. The contract specifies the scope of work, materials, and completion date. The client pays the $500,000 upon completion of the project, regardless of any unforeseen costs or delays.

Hourly Rate Payment

An hourly rate payment is a structure where the contractor is paid for the time spent working on the project. This structure is common for projects with undefined scopes or projects where the time required to complete the work is uncertain.

Advantages of Hourly Rate Payment

- Flexibility: The client can adjust the scope of work or add new tasks as needed.

- Transparency: The client can track the contractor’s time and understand how the fees are calculated.

- Reduced Risk for the Contractor: The contractor is compensated for the actual time spent on the project, mitigating the risk of unforeseen costs.

Disadvantages of Hourly Rate Payment

- Lack of Predictability: The total project cost can be difficult to estimate upfront.

- Potential for Overbilling: The contractor may be incentivized to work longer hours to maximize their earnings.

- Complexity: Tracking time and billing can be time-consuming and require detailed documentation.

Example

A freelance writer is hired to write articles for a website at an hourly rate of $50. The client pays the writer for the number of hours spent writing, regardless of the number of articles produced.

Milestone Payments

Milestone payments are made to the contractor at specific stages of the project, known as milestones. This structure is common for projects with complex deliverables or projects that involve multiple phases.

Advantages of Milestone Payments

- Phased Payment: The client does not have to pay the entire project cost upfront.

- Progress Tracking: The client can track the project’s progress based on the completion of milestones.

- Reduced Risk for Both Parties: The client can evaluate the contractor’s work at each milestone and decide whether to proceed with the next phase. The contractor is compensated for the work completed, reducing the risk of non-payment.

Disadvantages of Milestone Payments

- Complexity: Defining clear milestones and payment terms can be complex.

- Potential for Disputes: Disputes can arise if there is disagreement over the completion of a milestone.

- Increased Administrative Burden: Tracking milestones and payments requires careful documentation.

Example

A software development company is hired to develop a website for a client. The project is divided into four milestones: design, development, testing, and launch. The client pays the company a set amount for each milestone upon completion.

Negotiation of Contract Fees

Negotiating contract fees is a crucial part of any business deal, ensuring that both parties reach an agreement that is mutually beneficial. The negotiation process can be complex, requiring careful consideration of various factors and effective communication strategies.

Key Steps in Negotiating Contract Fees

The negotiation of contract fees typically involves several key steps, each requiring careful planning and execution.

- Preparation: Before entering negotiations, both parties must thoroughly research the market, understand the value of the services or products being offered, and establish realistic expectations for the contract fee.

- Initial Offer: The party initiating the negotiation should present a clear and concise initial offer, outlining the proposed fee and any associated terms and conditions. The initial offer should be based on a solid understanding of the market value and the value proposition being offered.

- Counteroffers: After the initial offer is presented, the other party may counter with a different fee or propose modifications to the terms and conditions. Both parties should carefully consider the counteroffers and be prepared to justify their positions.

- Negotiation and Compromise: The negotiation process involves back-and-forth communication, with both parties seeking to reach an agreement that is acceptable to both sides. It often requires compromise and flexibility to find a mutually beneficial solution.

- Final Agreement: Once both parties agree on the contract fee and all other terms and conditions, the agreement should be documented in a clear and concise contract, ensuring that both parties understand their obligations and responsibilities.

Effective Negotiation Strategies and Tactics

Effective negotiation strategies and tactics are essential for achieving a successful outcome in contract fee negotiations.

- Focus on Value: Both parties should focus on the value being offered and the benefits that the agreement will bring. This involves highlighting the unique strengths and capabilities of the service or product and demonstrating its ability to meet the client’s specific needs.

- Build a Strong Relationship: Establishing a positive and collaborative relationship with the other party is crucial for successful negotiations. This involves open communication, active listening, and a willingness to understand the other party’s perspective.

- Be Prepared to Walk Away: Both parties should have a clear understanding of their walk-away point, which is the minimum acceptable fee or terms. This helps ensure that they don’t settle for an agreement that is not in their best interests.

- Utilize Negotiation Tactics: Several negotiation tactics can be employed to improve the chances of achieving a favorable outcome. These include:

- Anchoring: The first party to present a number or proposal sets the “anchor” for the negotiation, influencing subsequent offers and discussions.

- Framing: Presenting information in a way that emphasizes the benefits or advantages of a particular option can influence the other party’s perception and decision-making.

- Logrolling: This involves trading concessions on different issues to reach an agreement that is mutually beneficial. For example, one party might concede on the contract fee in exchange for more favorable payment terms.

Tips for Reaching a Mutually Beneficial Agreement

Achieving a mutually beneficial agreement on the contract fee requires careful consideration of the following tips:

- Understand the Other Party’s Needs: Take the time to understand the other party’s priorities, objectives, and concerns. This information can help you identify areas of potential compromise and develop creative solutions that address both parties’ needs.

- Be Flexible and Willing to Compromise: Successful negotiations often involve some degree of compromise from both parties. Be willing to adjust your initial position and explore alternative solutions to find common ground.

- Focus on Long-Term Value: Consider the long-term implications of the agreement and the potential for future collaborations. A mutually beneficial agreement can lead to a stronger and more sustainable relationship.

- Document the Agreement: Once both parties have reached an agreement, it is crucial to document it in a clear and concise contract that Artikels all the terms and conditions. This helps to avoid misunderstandings and disputes in the future.

Legal Considerations of Contract Fees: What Is Contract Fee

Contract fees are an integral part of any agreement, and their legal implications are crucial for ensuring a smooth and successful business relationship. Understanding the legal considerations of contract fees is essential for both parties involved to avoid disputes and protect their interests.

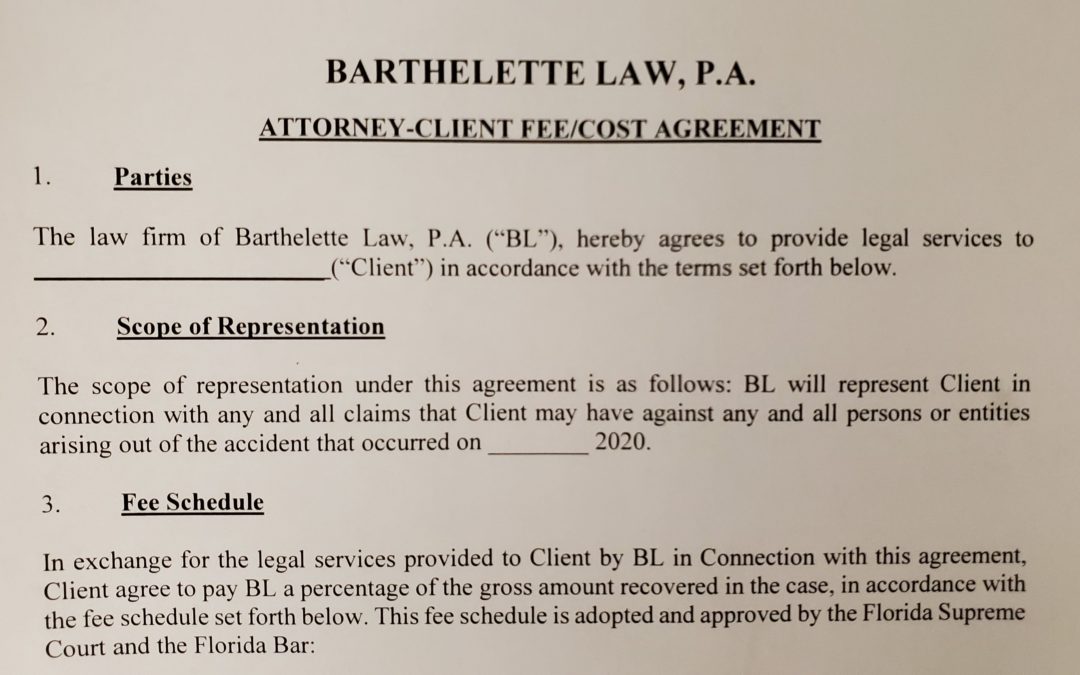

Enforceability of Contract Fees

The enforceability of contract fees depends on several factors, including the clarity of the agreement, the legality of the services rendered, and the compliance with applicable laws and regulations. A well-defined contract that clearly Artikels the scope of work, payment terms, and responsibilities of both parties is essential for establishing the enforceability of the fees.

- Valid Contract: A contract must be valid to be legally enforceable. This means it must have all the essential elements of a contract, including offer, acceptance, consideration, and mutual assent. If a contract is invalid, the fees may not be enforceable.

- Legality of Services: The services provided must be legal and not violate any applicable laws or regulations. If the services are illegal, the contract fees may not be enforceable.

- Compliance with Laws and Regulations: The contract must comply with all applicable laws and regulations, including those related to consumer protection, employment, and taxation. Non-compliance can lead to legal challenges and potential unenforceability of the contract fees.

Importance of Defining Scope of Work and Payment Terms

Clearly defining the scope of work and payment terms is crucial for ensuring the enforceability of contract fees and avoiding disputes.

- Scope of Work: The scope of work should be clearly defined in the contract, outlining the specific tasks, deliverables, and responsibilities of both parties. This helps prevent disputes regarding the services provided and the fees owed.

- Payment Terms: The contract should clearly specify the payment terms, including the amount of the fees, payment schedule, payment methods, and any applicable penalties for late payments. This provides clarity and avoids confusion regarding financial obligations.

Legal Issues Related to Contract Fees

Various legal issues can arise related to contract fees, such as:

- Breach of Contract: If one party fails to fulfill its obligations under the contract, the other party may have grounds to sue for breach of contract and seek damages, including the unpaid contract fees.

- Unjust Enrichment: If one party receives a benefit without providing any consideration, the other party may be able to claim unjust enrichment and seek restitution of the fees.

- Fraud or Misrepresentation: If one party misrepresents the scope of work or the payment terms, the other party may have grounds to void the contract and recover the fees.

Examples of Contract Fees in Different Industries

Contract fees vary significantly across different industries, reflecting the unique characteristics and complexities of each sector. This section provides a comprehensive overview of contract fees in various industries, including technology, healthcare, and finance, illustrating how industry-specific factors influence the determination of contract fees.

Contract Fees in the Technology Industry

The technology industry is characterized by rapid innovation, evolving business models, and a high demand for specialized skills. These factors influence contract fees, which can vary depending on the specific project or service.

Examples of Contract Fees in Technology

- Software Development: Contract fees for software development projects typically range from $50 to $250 per hour, depending on the complexity of the project, the experience of the developers, and the location of the development team. For example, a complex mobile app development project might involve a contract fee of $150,000 to $500,000, while a simple website development project could cost between $5,000 and $20,000.

- Cloud Consulting: Cloud consulting services involve providing expert advice and guidance on cloud computing strategies, implementation, and management. Contract fees for cloud consulting typically range from $200 to $500 per hour, depending on the experience and expertise of the consultant. For example, a cloud migration project for a large enterprise might involve a contract fee of $100,000 to $500,000.

- Data Analytics: Data analytics services involve collecting, analyzing, and interpreting data to provide insights and support decision-making. Contract fees for data analytics services typically range from $150 to $400 per hour, depending on the complexity of the analysis and the expertise of the data scientist. For example, a data analytics project for a marketing campaign might involve a contract fee of $20,000 to $100,000.

Contract Fees in the Healthcare Industry

The healthcare industry is characterized by complex regulations, high stakes, and a focus on patient care. These factors influence contract fees, which can vary depending on the type of healthcare service, the level of expertise required, and the geographic location.

Examples of Contract Fees in Healthcare

- Medical Billing: Medical billing services involve processing and submitting claims to insurance companies for reimbursement. Contract fees for medical billing services typically range from 5% to 10% of the revenue collected. For example, a medical billing company might charge a fee of $5,000 to $10,000 per month for a practice that generates $100,000 in revenue.

- Home Healthcare: Home healthcare services involve providing medical care to patients in their homes. Contract fees for home healthcare services typically range from $25 to $75 per hour, depending on the type of care provided and the level of expertise required. For example, a home healthcare agency might charge a fee of $50 per hour for a skilled nursing visit.

- Telemedicine: Telemedicine services involve providing medical care remotely using technology. Contract fees for telemedicine services typically range from $50 to $150 per consultation, depending on the type of service provided and the expertise of the provider. For example, a telemedicine platform might charge a fee of $75 for a virtual consultation with a physician.

Contract Fees in the Finance Industry

The finance industry is characterized by high levels of risk, complex transactions, and a focus on financial performance. These factors influence contract fees, which can vary depending on the type of financial service, the size and complexity of the transaction, and the level of expertise required.

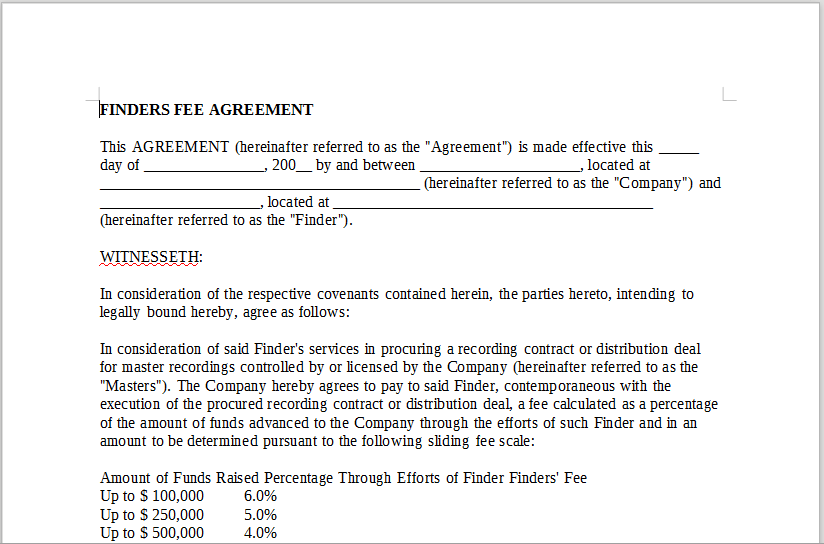

Examples of Contract Fees in Finance

- Investment Banking: Investment banking services involve providing financial advisory services to corporations and governments. Contract fees for investment banking services typically range from 1% to 3% of the transaction value. For example, an investment bank might charge a fee of $10 million to $30 million for advising a company on a $1 billion merger or acquisition.

- Financial Consulting: Financial consulting services involve providing expert advice and guidance on financial matters, such as budgeting, investment strategies, and risk management. Contract fees for financial consulting typically range from $200 to $500 per hour, depending on the experience and expertise of the consultant. For example, a financial consultant might charge a fee of $50,000 to $100,000 for developing a financial plan for a high-net-worth individual.

- Wealth Management: Wealth management services involve providing financial advice and investment management to individuals and families. Contract fees for wealth management services typically range from 1% to 2% of the assets under management. For example, a wealth management firm might charge a fee of $10,000 to $20,000 per year for managing a portfolio of $1 million.

Navigating the world of contract fees requires careful consideration and clear communication. By understanding the key factors, exploring various payment structures, and addressing legal implications, you can ensure a mutually beneficial agreement that safeguards your interests and fosters successful partnerships. Whether you’re a seasoned professional or just starting out, mastering the art of contract fees empowers you to confidently navigate the business landscape.

Detailed FAQs

What is the difference between a contract fee and a retainer?

A contract fee is the total payment for a specific project or service, while a retainer is an upfront payment that secures the availability of a professional for a set period of time.

How do I determine a fair contract fee?

Research industry standards, consider your experience level, and factor in the complexity and scope of the project. Don’t be afraid to negotiate to find a price that works for both parties.

What are some common contract fee structures?

Common structures include lump sum, hourly rate, milestone payments, and percentage-based fees. The best structure depends on the nature of the work and the preferences of both parties.