What is sub contract in cost accounting – What is subcontract in cost accounting? It’s more than just hiring someone else; it’s a strategic decision impacting your project’s budget, timeline, and ultimate profitability. Understanding subcontracts means navigating a complex web of cost allocation, risk management, and contractual agreements. This thread unravels the intricacies, revealing how smart subcontracting can boost your bottom line—or sink your project.

From defining subcontracts and differentiating them from direct contracts, we’ll explore various types, delve into cost allocation methods, and examine risk mitigation strategies. We’ll also cover crucial elements of subcontract agreements, including negotiation tactics and crucial clauses. Finally, we’ll analyze the impact of subcontracting on your project’s overall profitability, providing you with the knowledge to make informed decisions.

Definition of Subcontract in Cost Accounting

In cost accounting, a subcontract represents a legally binding agreement between a primary contractor (the main entity undertaking a project) and a subcontractor (a separate entity). This agreement Artikels the subcontractor’s responsibility to perform a specific portion of the overall project, for which they receive agreed-upon compensation. The costs associated with this subcontracted work are then incorporated into the overall project cost accounting.

This differs from direct costs, which are directly incurred and controlled by the primary contractor.A subcontract differs from a direct contract in that a direct contract involves the primary contractor directly managing all aspects of the work, including labor, materials, and equipment. In contrast, a subcontract delegates a defined portion of the project to an independent entity, the subcontractor, who then manages their part of the work.

This division of responsibilities affects cost tracking and management. The primary contractor retains ultimate responsibility for the successful completion of the entire project, but the subcontractor is accountable for the specific tasks Artikeld in their agreement.

Examples of Subcontract Usage

Subcontracts are frequently employed in large-scale projects where specialized skills or resources are required. For example, in construction, a general contractor might subcontract electrical work to an electrical company, plumbing to a plumbing company, and HVAC to an HVAC specialist. Similarly, in software development, a company might subcontract specific modules or functionalities to specialized development teams. In manufacturing, a company might subcontract the production of specific components to another manufacturer.

These scenarios demonstrate how subcontracts allow for efficient task delegation and the utilization of specialized expertise.

Comparison of Direct Costs and Subcontracted Costs

The following table highlights the key differences between direct costs and subcontracted costs:

| Feature | Direct Costs | Subcontracted Costs |

|---|---|---|

| Control | Directly controlled by the primary contractor | Indirectly controlled; managed by the subcontractor |

| Labor | Employees of the primary contractor | Employees of the subcontractor |

| Materials | Purchased and managed by the primary contractor | Purchased and managed by the subcontractor (often specified in the contract) |

| Accounting | Directly tracked and accounted for by the primary contractor | Initially tracked by the subcontractor, then incorporated into the primary contractor’s cost accounting |

Types of Subcontracts

Subcontracts, in the context of cost accounting, represent a significant aspect of project management and financial control. Understanding the various types of subcontracts is crucial for accurate cost estimation, budgeting, and risk assessment. Different subcontract types carry distinct implications for cost allocation, responsibility, and potential liabilities. This section will explore three common types, highlighting their cost implications and prevalent industries.

The categorization of subcontracts can be complex and often depends on the specific contractual arrangements and the nature of the work being subcontracted. However, three common types offer a useful framework for understanding the cost implications involved.

Fixed-Price Subcontracts

Fixed-price subcontracts, also known as lump-sum contracts, stipulate a predetermined total price for the subcontracted work. The subcontractor assumes the risk of cost overruns, while the main contractor benefits from predictable costs. However, unforeseen circumstances or changes in scope can lead to disputes and potential renegotiations. Accurate cost estimation by the subcontractor is paramount.

The cost implications for the main contractor are relatively straightforward: a fixed, predictable cost. However, the main contractor must carefully evaluate the subcontractor’s bid to ensure it’s realistic and covers all necessary work. Changes to the scope of work often require formal change orders and can lead to increased costs for the main contractor if not carefully managed.

This type is common in construction, where a fixed price for a specific building component or phase of construction is agreed upon.

Examples of industries where fixed-price subcontracts are prevalent include construction (e.g., a subcontractor providing electrical work for a building project), manufacturing (e.g., a subcontractor supplying a specific component for a larger product), and information technology (e.g., a subcontractor developing a specific software module).

Cost-Plus Subcontracts

Cost-plus subcontracts reimburse the subcontractor for all allowable costs incurred, plus a predetermined fee or percentage markup. This type shifts the risk of cost overruns to the main contractor, but it offers greater flexibility for the subcontractor and can be beneficial for projects with uncertain scope or complex requirements. Careful monitoring of costs and adherence to agreed-upon cost accounting principles are essential.

The cost implications for the main contractor are less predictable than with fixed-price contracts. Costs can fluctuate depending on the subcontractor’s efficiency and unforeseen circumstances. The main contractor needs robust cost control mechanisms to mitigate potential cost overruns. Transparency and regular reporting from the subcontractor are crucial. This type of subcontract is often used in projects involving research and development, where the scope of work may evolve during the project lifecycle.

Examples of industries where cost-plus subcontracts are prevalent include aerospace (e.g., a subcontractor designing and manufacturing a specialized aircraft component), defense contracting (e.g., a subcontractor developing a complex weapons system), and engineering projects with significant design and development phases.

Time and Materials Subcontracts

Time and materials subcontracts charge the main contractor based on the actual time spent by the subcontractor’s personnel and the materials used. This type offers flexibility and is suitable for projects with undefined scope or those requiring ongoing maintenance or support. However, it requires close monitoring to prevent cost overruns. Accurate tracking of labor hours and material usage is crucial for both parties.

Cost implications for the main contractor are highly variable and depend directly on the duration of the project and the quantities of materials used. Effective cost control necessitates careful tracking of time sheets and material invoices. This contract type is susceptible to potential abuse if not properly monitored, as there is less incentive for the subcontractor to optimize efficiency and resource usage.

This contract type is frequently used in IT services, repairs, and maintenance where the exact scope of work is difficult to determine beforehand.

Examples of industries where time and materials subcontracts are prevalent include IT services (e.g., providing ongoing technical support), repair and maintenance (e.g., fixing a malfunctioning piece of equipment), and consulting (e.g., providing specialized expertise on an ad-hoc basis).

Cost Allocation and Subcontracts

Cost allocation in the context of subcontracts involves systematically assigning the expenses incurred by a prime contractor to specific subcontracts. Accurate cost allocation is crucial for effective project management, financial reporting, and profitability analysis. This process ensures that the costs associated with each subcontracted portion of a project are clearly identified and tracked, facilitating informed decision-making and fair compensation.

Cost Allocation Methods for Subcontracts

Several methods exist for allocating costs to subcontracts, each with its own strengths and weaknesses. The choice of method often depends on the complexity of the project, the nature of the subcontracted work, and the information available. Common methods include direct allocation, indirect allocation based on a predetermined percentage or ratio, and activity-based costing. Direct allocation is straightforward for clearly identifiable costs directly attributable to a specific subcontract.

Indirect allocation necessitates a carefully designed cost allocation base (e.g., labor hours, square footage, materials used) to distribute indirect costs equitably among multiple subcontracts. Activity-based costing offers a more sophisticated approach, allocating costs based on the specific activities performed by each subcontractor. For instance, a construction project might allocate direct material costs directly to the subcontractor responsible for that specific material installation.

Indirect costs, such as general overhead, might be allocated proportionally based on each subcontractor’s labor hours dedicated to the project.

Tracking and Managing Subcontractor Costs

Effective tracking and management of subcontractor costs require a robust system. This typically involves establishing clear contractual agreements specifying the scope of work, payment terms, and reporting requirements. Regular communication with subcontractors is essential to monitor progress, identify potential cost overruns, and address any discrepancies. Detailed records of all expenses incurred by subcontractors, including invoices, receipts, and timesheets, should be meticulously maintained.

Specialized project management software can greatly assist in tracking costs, generating reports, and facilitating communication among all parties involved. For example, a spreadsheet could be used to track expenses categorized by subcontractor, with columns for invoice number, date, description, and amount. Regular reconciliation of subcontractor invoices against the project budget is crucial for identifying potential variances and taking corrective action.

Challenges in Accurate Cost Allocation to Subcontracts

Accurately allocating costs to subcontracts presents several challenges. One key challenge lies in the proper classification of costs as either direct or indirect. Determining the appropriate allocation base for indirect costs can also be complex and subjective, potentially leading to inaccuracies. Furthermore, unforeseen circumstances, such as changes in scope or material price fluctuations, can complicate cost allocation.

Lack of clear communication and coordination between the prime contractor and subcontractors can lead to disputes over cost responsibility. Finally, inadequate record-keeping practices can make accurate cost allocation nearly impossible. For example, a dispute might arise if a subcontractor claims that a specific cost is directly attributable to their work, while the prime contractor believes it should be allocated as an indirect cost.

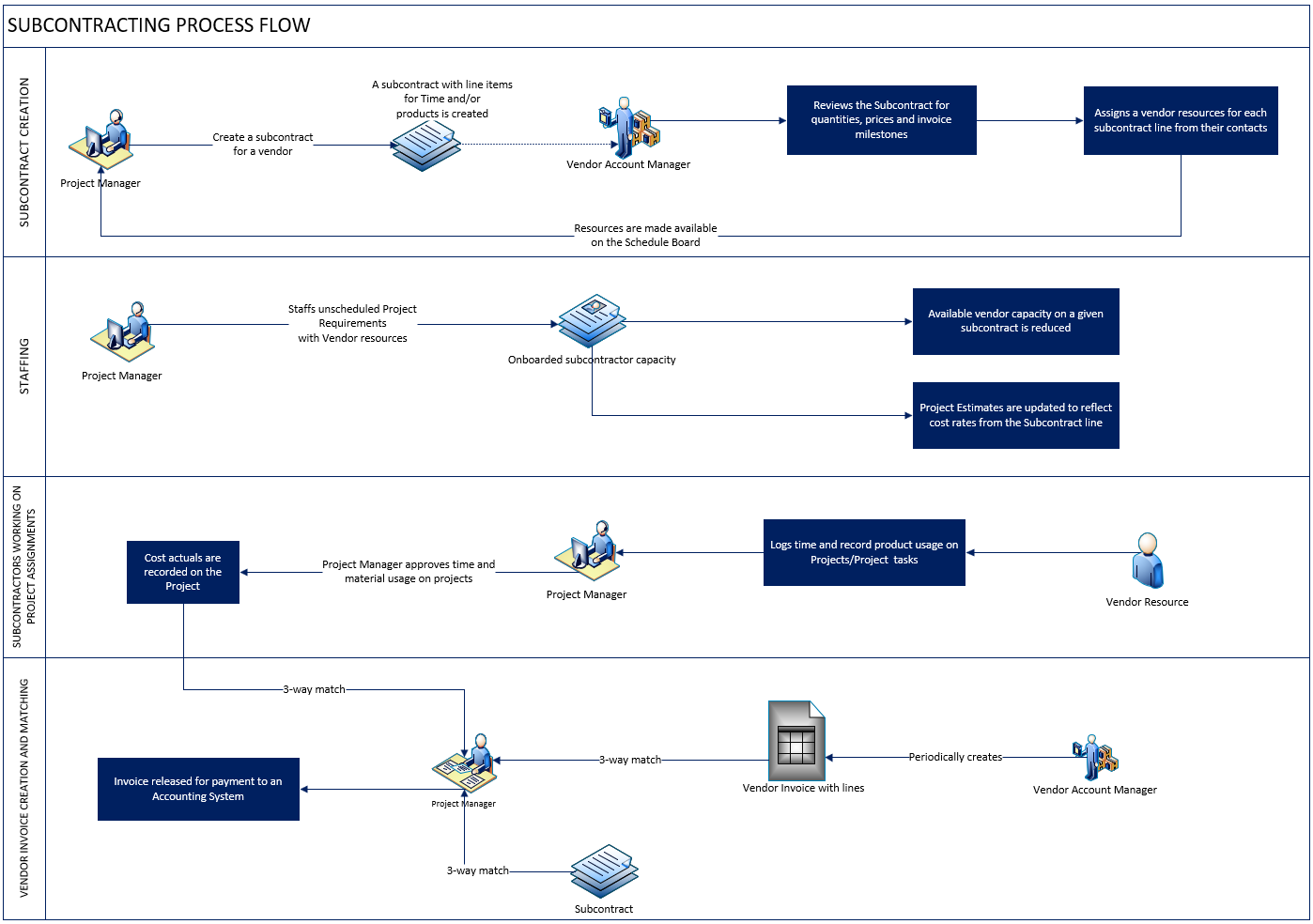

Simplified Process Flow Diagram for Cost Allocation to Subcontracts

1. Contract Negotiation & Scope Definition

Define the scope of work for each subcontractor and establish payment terms.

2. Subcontractor Cost Reporting

Subcontractors submit detailed invoices and expense reports.

3. Cost Data Collection & Verification

The prime contractor collects and verifies all cost data from subcontractors.

4. Cost Allocation

Costs are allocated to subcontracts using a chosen method (e.g., direct allocation, percentage of completion).

5. Cost Reconciliation

Compare allocated costs against the project budget and subcontractor contracts.

6. Reporting & Analysis

Generate reports to track costs, identify variances, and inform decision-making.

Risk Management and Subcontracts

Effective risk management is crucial when utilizing subcontracts in cost accounting. Failure to adequately assess and mitigate potential risks can lead to cost overruns, schedule delays, and even project failure. A comprehensive risk management strategy should be integrated into the subcontracting process from the initial selection phase through to final project completion.

Potential Risks Associated with Subcontracts

Several inherent risks are associated with subcontracting. These risks can be broadly categorized as financial, operational, and legal. Financial risks include cost overruns stemming from inaccurate subcontractor estimations, unforeseen expenses, or disputes over payment terms. Operational risks encompass issues such as subpar workmanship, schedule delays due to subcontractor inefficiencies, and difficulties in coordinating activities between the prime contractor and the subcontractor.

Legal risks encompass potential breaches of contract, liability for subcontractor negligence, and compliance issues related to labor laws and regulations. For instance, a subcontractor failing to meet safety standards could result in significant legal and financial repercussions for the prime contractor.

Strategies for Mitigating Subcontract Risks

Mitigating risks requires a proactive and multi-faceted approach. Thorough due diligence in subcontractor selection is paramount. This includes verifying their financial stability, reviewing their past performance, and assessing their technical capabilities. Clearly defined contracts with detailed specifications, payment terms, and performance expectations are essential. Regular monitoring and communication with subcontractors throughout the project lifecycle are vital to identify and address potential problems early.

Implementing robust change management procedures allows for efficient handling of unforeseen circumstances and prevents disputes. Furthermore, establishing clear escalation paths for resolving conflicts ensures timely intervention and prevents minor issues from escalating into major problems. For example, regular progress meetings and documented communication trails can significantly reduce misunderstandings and disputes.

Comparison of Risk Management Approaches

Different risk management approaches can be adopted depending on the nature and complexity of the project and the risk appetite of the prime contractor. A qualitative approach might involve using expert judgment and experience to assess risks, while a quantitative approach might employ statistical methods and data analysis to estimate probabilities and potential impacts. A hybrid approach, combining both qualitative and quantitative methods, is often the most effective.

For instance, a qualitative assessment might identify potential delays, while a quantitative analysis might estimate the cost impact of those delays based on historical data. Choosing the appropriate approach depends on the available resources, the complexity of the project, and the level of accuracy required.

Best Practices for Managing Subcontractor Risks

The effective management of subcontractor risks requires adherence to best practices. A proactive approach is essential:

- Conduct thorough due diligence on potential subcontractors before awarding contracts.

- Develop clear, comprehensive, and legally sound contracts.

- Establish regular communication channels and monitoring mechanisms.

- Implement a robust change management process.

- Maintain detailed records of all communications and transactions.

- Establish clear escalation procedures for resolving disputes.

- Regularly review and update the risk management plan.

- Ensure adequate insurance coverage to protect against potential losses.

- Incorporate risk mitigation strategies into the project budget.

- Foster a collaborative relationship with subcontractors based on mutual trust and respect.

Subcontract Negotiation and Contractual Agreements: What Is Sub Contract In Cost Accounting

Effective subcontract negotiation and the subsequent contractual agreement are crucial for successful cost management in any project. A well-structured agreement protects both the prime contractor and the subcontractor, ensuring clarity on responsibilities, payment terms, and risk allocation, ultimately contributing to the overall project profitability. This section details key elements of a subcontract agreement from a cost accounting perspective, provides examples of clauses addressing cost control and payment terms, explains the negotiation process, and presents a sample clause addressing cost overruns.

The key elements of a subcontract agreement from a cost accounting perspective revolve around clearly defining the scope of work, payment mechanisms, and risk allocation. Ambiguity in any of these areas can lead to disputes, cost overruns, and project delays. A robust agreement should include detailed specifications of the subcontracted work, including deliverables, timelines, and performance metrics. This ensures both parties understand their obligations and allows for accurate cost estimation and tracking.

Key Elements of Subcontract Agreements

A comprehensive subcontract agreement should incorporate several key elements to mitigate risks and ensure efficient cost management. These elements include a detailed description of the work to be performed, a clear payment schedule linked to milestones or deliverables, defined change order procedures, and clauses addressing intellectual property rights, liability, and dispute resolution. Specific attention should be given to clauses that address potential cost overruns and the responsibility for managing them.

Cost Control and Payment Terms Clauses

Effective cost control clauses should establish a clear methodology for tracking and reporting costs. This often involves regular submission of cost reports by the subcontractor, adherence to a pre-agreed budget, and a mechanism for reviewing and approving any proposed changes to the scope of work. Payment terms should be clearly defined, specifying the payment schedule, methods of payment, and any applicable retainage.

Examples of such clauses include:

PAYMENT SCHEDULE: The Prime Contractor shall pay the Subcontractor [Percentage]% of the agreed-upon price upon completion of each milestone as Artikeld in Exhibit A. Final payment shall be made within [Number] days of the Subcontractor's submission of a satisfactory completion report. CHANGE ORDER PROCEDURE: Any changes to the scope of work must be documented in writing as a formal Change Order, signed by both parties.The Change Order shall include a revised price and schedule. No work shall commence on a Change Order until it has been formally approved.

Negotiating Favorable Subcontract Terms

Negotiating favorable subcontract terms requires a thorough understanding of the market, the subcontractor’s capabilities, and the project’s requirements. Effective negotiation involves a collaborative approach, focusing on mutual benefit rather than adversarial tactics.

The negotiation process should involve a clear articulation of the project’s needs and expectations, a detailed analysis of the subcontractor’s proposal, and a willingness to compromise on mutually agreeable terms. Thorough due diligence on the subcontractor’s financial stability and past performance is also crucial. Leveraging competitive bids from multiple subcontractors can significantly improve negotiation leverage.

Cost Overrun Clause Example, What is sub contract in cost accounting

A well-defined clause addressing cost overruns is essential to prevent disputes and maintain project control. The clause should clearly define the circumstances under which cost overruns are permissible, the process for evaluating and approving cost increases, and the responsibility for managing and mitigating overruns. This might involve establishing a threshold for allowable cost increases, beyond which additional approvals are required, or a mechanism for shared responsibility for cost overruns exceeding a certain percentage.

COST OVERRUNS: The Subcontractor shall be responsible for managing costs within the agreed-upon budget. Any cost overrun exceeding [Percentage]% requires prior written approval from the Prime Contractor. The approval process shall involve a detailed justification of the cost overrun, including evidence of unforeseen circumstances and a proposed mitigation plan. Any cost overrun approved by the Prime Contractor shall be subject to negotiation and may be subject to a percentage cost-sharing agreement between the parties.

Subcontract Cost Reporting and Auditing

Effective subcontract cost reporting and auditing are crucial for maintaining financial accuracy, ensuring compliance, and managing project risks. Comprehensive reporting provides a clear picture of project expenditures, facilitating informed decision-making and preventing cost overruns. Regular auditing procedures verify the accuracy and legitimacy of reported costs, protecting the interests of both the prime contractor and the subcontractor.

Subcontractor Cost Reporting Methods

Several methods exist for reporting subcontractor costs, each offering varying levels of detail and complexity. The chosen method often depends on the size and complexity of the project, the contractual agreements, and the reporting requirements of regulatory bodies. Common methods include detailed cost breakdowns categorized by specific cost elements (labor, materials, equipment, etc.), summary reports aggregating costs into broader categories, and electronic data interchange (EDI) systems for automated reporting.

The level of detail required is usually specified within the subcontract agreement. For instance, a large-scale construction project might necessitate a highly detailed breakdown of costs, while a smaller project might only require summary reports. Regardless of the method, consistency and adherence to the agreed-upon reporting format are essential.

Importance of Accurate and Timely Reporting

Accurate and timely subcontract cost reporting is paramount for several reasons. Firstly, it allows for real-time monitoring of project budgets, enabling prompt identification and mitigation of potential cost overruns. Secondly, it facilitates accurate forecasting and financial planning, contributing to better resource allocation and project management. Thirdly, timely reporting ensures compliance with contractual obligations and regulatory requirements, avoiding potential penalties or disputes.

Delays in reporting can hinder project progress and create ambiguities, leading to misunderstandings and potential conflicts between the prime contractor and the subcontractor. Inaccurate reporting can result in financial losses and reputational damage. For example, if a subcontractor consistently underreports costs, the prime contractor might face unexpected expenses during project completion.

The Role of Auditing in Verifying Subcontractor Costs

Subcontractor cost auditing plays a vital role in verifying the accuracy, completeness, and legitimacy of reported costs. Independent audits provide an objective assessment of the subcontractor’s financial records, ensuring compliance with contractual agreements and applicable regulations. Audits identify any discrepancies or inconsistencies, helping to prevent fraud and ensure fair pricing. The audit process involves examining supporting documentation, such as invoices, receipts, timesheets, and contracts, to verify the reported costs.

The scope and depth of the audit depend on the risk profile of the subcontractor and the project’s complexity. A high-risk subcontractor might necessitate a more thorough and extensive audit than a low-risk one.

Subcontractor Cost Audit Procedure

A typical subcontractor cost audit involves a systematic, step-by-step procedure. The process begins with planning and scoping the audit, defining its objectives, and determining the audit’s timeframe and resources. This is followed by the data collection phase, where relevant financial records and supporting documentation are gathered from the subcontractor. Next, the audit team analyzes the collected data, comparing reported costs with supporting documentation to identify any discrepancies or irregularities.

The findings are then documented in a formal audit report, which includes a summary of the audit process, identified issues, and recommendations for improvement. Finally, the audit report is reviewed and approved by relevant stakeholders, and corrective actions are implemented to address any identified problems. This rigorous process ensures the accuracy and reliability of the subcontractor’s cost reporting.

Impact of Subcontracts on Profitability

The decision to subcontract portions of a project significantly impacts overall profitability. Effective subcontract management can lead to increased efficiency and reduced costs, boosting profit margins. Conversely, poorly managed subcontracts can result in cost overruns, delays, and ultimately, reduced profitability. A comprehensive understanding of the factors influencing this impact is crucial for successful project management.

The use of subcontracts can affect overall project profitability in several ways. Subcontracting can reduce overhead costs by eliminating the need to hire and train additional in-house personnel. It can also provide access to specialized skills and equipment not readily available internally, leading to improved project quality and faster completion times. However, subcontracting also introduces potential risks, including higher costs than anticipated, quality control issues, and potential schedule delays.

Careful consideration of these factors is essential for maximizing profitability.

Factors Influencing Subcontracting Decisions

Several key factors must be weighed when determining whether to subcontract work. These include the availability of qualified subcontractors, their pricing and reputation, the complexity and specialized nature of the task, the company’s internal capacity and expertise, and the overall project timeline and budget constraints. A thorough cost-benefit analysis, comparing in-house performance costs against subcontractor quotes, is crucial in making an informed decision.

Furthermore, risk assessment, including potential delays and quality issues associated with subcontracted work, should be incorporated into this analysis.

Profitability Comparison: In-House vs. Subcontracted Work

Direct comparison of in-house versus subcontracted work profitability requires a detailed cost analysis for each option. In-house work considers direct labor costs, material costs, overhead allocation, and potential inefficiencies. Subcontracting involves the subcontractor’s quoted price, plus any management oversight costs incurred by the main contractor. The most profitable option depends on the specific project, the availability of internal resources, and the relative costs of each approach.

A scenario where in-house expertise is limited and specialized equipment is required might make subcontracting the more economically viable option, despite potentially higher direct costs. Conversely, if the company possesses the necessary in-house capabilities and resources, performing the work internally might prove more cost-effective.

Hypothetical Scenario: Subcontract Cost Impact on Profit Margins

Let’s consider a hypothetical construction project with a total budget of $1,000,000. The project includes both general construction and specialized electrical work.

| Task | In-House Cost | Subcontract Cost | Profit Margin (In-House) | Profit Margin (Subcontract) |

|---|---|---|---|---|

| General Construction | $600,000 | $650,000 | 15% | 10% |

| Specialized Electrical Work | $250,000 | $220,000 | 20% | 25% |

| Total Project Cost | $850,000 | $870,000 | 17.6% | 15% |

In this scenario, subcontracting the specialized electrical work proves more profitable due to the lower cost, while general construction is more profitable when performed in-house. However, the overall project profitability is slightly higher when general construction is performed in-house, despite the higher total cost. This illustrates the importance of a task-by-task analysis when deciding whether to subcontract. The overall impact on profitability is a function of the specific costs associated with each task and the relative efficiencies of both approaches.

Mastering the art of subcontracting in cost accounting is key to successful project management. By understanding the intricacies of cost allocation, risk management, and contract negotiation, you can leverage the benefits of outsourcing while mitigating potential pitfalls. Remember, a well-structured subcontract is your shield against cost overruns and a springboard to greater profitability. So, embrace the power of strategic subcontracting and watch your projects flourish!

Quick FAQs

Q: Can I subcontract all aspects of my project?

A: While possible, it’s generally not advisable. Retain core competencies in-house for better control and expertise.

Q: How do I choose a reliable subcontractor?

A: Thorough vetting is crucial. Check references, insurance, and past performance. Clear communication is key.

Q: What happens if a subcontractor goes bankrupt?

A: Your contract should Artikel contingencies, including insurance coverage and potential recovery options.

Q: Are there tax implications for using subcontractors?

A: Yes, consult a tax professional to ensure compliance with all relevant regulations and deductions.