How to calculate estimated profit in contract costing is a crucial skill for any business involved in project-based work. Understanding how to accurately predict your profitability is essential for making sound financial decisions, securing competitive bids, and ultimately, achieving your business goals.

This guide will take you through the step-by-step process of calculating estimated profit in contract costing, starting with the fundamental principles of contract costing and then delving into each key component that contributes to profitability. We will explore revenue streams, direct and indirect costs, profit margin calculation, forecasting techniques, and profitability analysis. By the end of this guide, you will have a comprehensive understanding of the factors that influence contract profitability and be equipped to make informed decisions that maximize your financial success.

Understanding Contract Costing

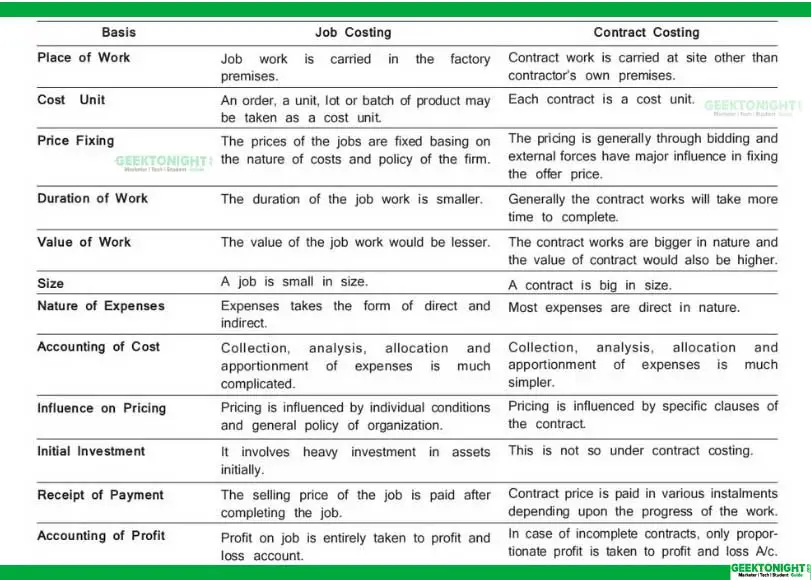

Contract costing is a method used to track and analyze the expenses incurred in fulfilling a contract. It is a crucial element in project management, particularly for businesses involved in construction, engineering, and other industries where projects are undertaken on a contractual basis.

Contract Costing Fundamentals

The foundation of contract costing lies in the principle of matching costs with revenues. This means that the expenses incurred in performing a contract should be recognized as costs only when the related revenue is earned. In essence, the goal is to accurately determine the profitability of each contract by aligning expenses with the work completed.

Elements of Contract Costs

The costs associated with a contract can be broadly categorized into:

- Direct Costs: These are costs directly attributable to the specific contract. Examples include materials, labor, and subcontract costs. These costs are easily traceable and are essential for completing the project.

- Indirect Costs: These costs are not directly linked to a specific contract but are necessary for overall project management and administration. Examples include overhead costs (rent, utilities, insurance), administrative salaries, and marketing expenses. These costs are usually allocated to projects based on a predetermined formula or rate.

- Other Costs: This category includes costs that are not directly related to the project but may be incurred as a result of contract execution. Examples include financing costs, taxes, and insurance premiums related to the project.

Contract Types and Cost Structures

Different types of contracts have distinct cost structures. Understanding these structures is vital for accurately estimating and controlling costs:

- Fixed-Price Contracts: In these contracts, the contractor agrees to complete the work for a fixed price, regardless of actual costs. The risk of cost overruns lies with the contractor. Cost structures in these contracts focus on efficient resource utilization and tight cost control.

- Cost-Plus Contracts: In this type of contract, the contractor is reimbursed for all actual costs incurred, plus a predetermined profit margin. The risk of cost overruns is transferred to the client. Cost structures in these contracts often involve detailed cost tracking and reporting to ensure transparency and accurate reimbursement.

- Time and Materials Contracts: These contracts involve charging the client for the actual time spent on the project and the materials used. The risk of cost overruns is shared between the contractor and the client. Cost structures in these contracts require meticulous time and material tracking to ensure accurate billing.

Identifying Revenue Streams

In the world of contract costing, understanding where your money is coming from is paramount. It’s like knowing where the treasure is buried on an island; you need a map! This section explores the various revenue streams in a contract, the factors that influence them, and how contract terms play a crucial role in determining when you can actually claim your hard-earned cash.

Factors Influencing Revenue Generation, How to calculate estimated profit in contract costing

The amount of revenue you generate from a contract is influenced by several factors, including:

- Contract Scope: The more extensive the project, the greater the potential revenue. Think of it like building a house; a small bungalow will earn you less than a sprawling mansion.

- Pricing Strategy: Whether you’re using a fixed-price, cost-plus, or time-and-materials approach, the pricing model directly impacts revenue. It’s like choosing between a buffet, a set menu, or ordering à la carte.

- Market Demand: High demand for your services means higher potential revenue. Imagine being a plumber during a major water main break; you’re in high demand and can charge a premium.

- Client’s Budget: A client with a limited budget will likely limit your revenue potential. It’s like trying to buy a luxury car with a grocery store budget; you’ll have to make some compromises.

- Materials and Labor Costs: These costs directly impact your profit margin, which in turn affects your revenue. It’s like trying to make a profit selling cupcakes; the cost of ingredients and your time directly affect your earnings.

Contract Terms and Revenue Recognition

Contract terms play a critical role in determining when you can recognize revenue. It’s like having a treasure map with specific instructions on how to claim your riches.

- Payment Milestones: These milestones define specific stages of the project where you can bill for completed work. Think of it like getting paid in installments for a custom-made suit; you get paid for the fabric, tailoring, and finishing touches separately.

- Retention Clauses: These clauses hold back a portion of the payment until the project is complete. It’s like a security deposit for a rental property; you get your money back once you’ve moved out and everything is in order.

- Performance-Based Payments: These payments are linked to achieving specific project outcomes. Think of it like getting paid for a bonus based on exceeding sales targets; you only get the bonus if you reach your goals.

Revenue Recognition Principle: Revenue is recognized when it is earned and realized, meaning the goods or services have been delivered, and the payment is reasonably assured.

Calculating Direct Costs

Direct costs are the expenses directly associated with producing a specific good or service. In contract costing, accurately calculating direct costs is crucial for determining project profitability and making informed pricing decisions. These costs are often categorized as direct labor and direct materials, representing the core elements of a project’s expenditure.

Direct Labor Costs

Direct labor costs represent the wages and salaries paid to employees directly involved in the production or delivery of a specific project. These costs can be calculated using various methods, each with its own advantages and considerations.

- Time and Material Method: This method involves tracking the actual hours worked by employees and multiplying those hours by their hourly wage rate. It provides a straightforward and transparent calculation, but it can be labor-intensive to track time accurately, especially for large projects.

- Predetermined Overhead Rate Method: This method uses a predetermined rate to allocate indirect labor costs to specific projects. The rate is typically calculated by dividing total indirect labor costs by a predetermined activity base, such as direct labor hours or machine hours. This approach simplifies the calculation process but relies on accurate estimation of indirect labor costs.

- Activity-Based Costing (ABC) Method: ABC involves identifying and allocating costs based on specific activities related to a project. This method provides a more detailed and accurate cost allocation, especially for projects with complex processes or multiple activities.

Direct Material Costs

Direct materials are the raw materials, components, and supplies directly used in producing a specific product or service. Determining direct material costs involves identifying the specific materials needed, their quantities, and their unit prices.

- Bill of Materials (BOM): A BOM is a comprehensive list of all the raw materials and components required for a specific product or service. This list is crucial for accurate cost estimation, as it provides a detailed breakdown of material requirements.

- Supplier Quotations: Obtaining quotations from suppliers is essential for determining the unit prices of materials. Comparing quotes from multiple suppliers can help secure the best pricing and ensure the quality of materials.

- Inventory Management: Effective inventory management is crucial for controlling material costs. Maintaining optimal inventory levels minimizes waste and ensures timely availability of materials while avoiding unnecessary storage expenses.

Direct Cost Variability

Direct costs are not always static; they can fluctuate due to various factors, influencing project profitability.

“Understanding the factors contributing to direct cost variability is crucial for accurate forecasting and effective cost management.”

- Labor Rates: Fluctuations in labor rates due to factors like market demand, skill levels, and inflation can impact direct labor costs.

- Material Prices: Material prices are subject to market volatility, supply chain disruptions, and changes in commodity prices.

- Project Complexity: The complexity of a project can influence both labor and material costs. More intricate projects often require specialized skills and higher-quality materials, leading to higher direct costs.

- Project Scope Changes: Changes in project scope, such as adding features or modifying requirements, can significantly impact direct costs by requiring additional labor, materials, or time.

Estimating Indirect Costs

Indirect costs, also known as overhead costs, are expenses that cannot be directly traced to a specific product or service. In contract costing, understanding and accurately estimating these costs is crucial for determining the overall profitability of a project.

Major Categories of Indirect Costs

Indirect costs can be broadly classified into various categories, each contributing to the overall project expenditure.

- Administrative Costs: These costs are associated with the general management and administration of the business, including salaries of administrative staff, rent, utilities, and insurance. These costs are essential for the smooth functioning of the business but are not directly linked to a specific project.

- Marketing and Sales Costs: These costs include expenses incurred in promoting and selling products or services. They encompass advertising, sales commissions, and market research. While these costs contribute to generating business, they are not directly attributable to a specific project.

- Finance Costs: These costs include interest payments on loans, bank charges, and other financial expenses. These costs are incurred to finance the business operations and are not directly linked to specific projects.

- Research and Development Costs: These costs are associated with developing new products or processes. While they may contribute to future projects, they are not directly related to current projects.

Allocation Methods for Indirect Costs

Once the indirect costs are identified, they need to be allocated to specific projects to determine their impact on profitability. Several methods are used for this allocation:

- Activity-Based Costing (ABC): This method assigns indirect costs based on the activities that consume resources. For instance, if a project requires extensive design work, a portion of the design department’s overhead costs would be allocated to that project. ABC is more precise than traditional methods but requires more data and effort.

- Direct Labor Hours: This method allocates indirect costs based on the number of direct labor hours worked on a project. For example, if a project requires 100 direct labor hours, a portion of the overhead costs would be allocated to that project based on the total direct labor hours worked across all projects. This method is simpler than ABC but may not be as accurate.

- Machine Hours: This method allocates indirect costs based on the number of machine hours used on a project. For example, if a project requires 50 machine hours, a portion of the overhead costs would be allocated to that project based on the total machine hours used across all projects. This method is suitable for projects that heavily rely on machinery but may not be appropriate for projects with minimal machine usage.

Impact of Overhead on Estimated Profit

Overhead costs significantly impact estimated profit. If overhead costs are not accurately estimated or allocated, the project’s profitability can be miscalculated.

For example, if a project’s estimated overhead is $10,000, but the actual overhead incurred is $15,000, the project’s profit will be $5,000 lower than anticipated.

Therefore, it is crucial to accurately estimate overhead costs and allocate them to projects using appropriate methods to ensure that the project’s profitability is accurately reflected in the estimated profit.

Determining Profit Margin: How To Calculate Estimated Profit In Contract Costing

The profit margin is a crucial metric in contract costing, as it represents the financial reward for your hard work and expertise. It’s the difference between your total revenue and total costs, expressed as a percentage of revenue. A healthy profit margin ensures that your business is sustainable and allows you to invest in future projects.

Methods for Calculating Profit Margin

To calculate the profit margin, you need to know your total revenue and total costs. The most common methods for calculating profit margin are:

- Gross Profit Margin: This measures the profitability of your core business operations. It’s calculated by dividing your gross profit (revenue minus direct costs) by your total revenue.

- Operating Profit Margin: This reflects the profitability of your business after accounting for operating expenses, such as administrative and marketing costs. It’s calculated by dividing your operating profit (gross profit minus operating expenses) by your total revenue.

- Net Profit Margin: This is the most comprehensive profit margin, as it considers all expenses, including taxes and interest. It’s calculated by dividing your net profit (operating profit minus interest and taxes) by your total revenue.

Factors Influencing Desired Profit Margins

The desired profit margin for a contract can vary depending on several factors:

- Industry: Different industries have different profit margin norms. For example, construction projects often have lower profit margins compared to software development projects.

- Project Complexity: Complex projects with higher risks and uncertainties usually require a higher profit margin to compensate for potential challenges.

- Competition: In a highly competitive market, companies may have to accept lower profit margins to secure contracts.

- Market Demand: High demand for specific skills or services can allow companies to command higher profit margins.

- Economic Conditions: During economic downturns, companies may have to lower their profit margins to remain competitive.

“A good profit margin is like a well-balanced meal – it’s not just about the main course (revenue), but also about the sides (costs) that make it truly satisfying.”

Forecasting Revenue and Costs

Forecasting revenue and costs is a crucial step in contract costing. It helps businesses estimate their profitability and make informed decisions about project bids and resource allocation. This process involves analyzing historical data, market trends, and other relevant factors to predict future revenue and cost patterns.

Techniques for Forecasting Revenue and Costs

Forecasting techniques are essential for accurately predicting future revenue and costs. They provide a framework for analyzing historical data, identifying trends, and making informed projections.

- Trend Analysis: This technique involves analyzing historical data to identify patterns and trends. By plotting data points over time, businesses can determine if revenue or costs are increasing, decreasing, or remaining stable. This information can then be used to project future values. For example, if a construction company has consistently seen a 5% increase in revenue each year, it can use this trend to forecast revenue for the next year.

- Regression Analysis: This statistical technique uses historical data to identify relationships between variables. By analyzing the relationship between revenue and factors like market demand or cost and material prices, businesses can develop models to predict future values. For instance, a software development company might use regression analysis to predict the cost of a project based on the number of lines of code required.

- Expert Opinion: This method involves gathering insights from industry experts and professionals who have knowledge and experience in the relevant field. By soliciting opinions and predictions from these individuals, businesses can obtain valuable perspectives on future market conditions and potential revenue and cost fluctuations. For example, a consulting firm might consult with industry experts to forecast the demand for their services in a specific market.

- Market Research: This technique involves collecting and analyzing data about market conditions, competitor activities, and customer preferences. By understanding the market dynamics, businesses can make more informed projections about revenue and costs. For example, a retail company might conduct market research to assess the demand for a new product line and forecast its potential revenue.

Impact of Market Conditions on Revenue and Cost Estimates

Market conditions play a significant role in influencing revenue and cost estimates. Fluctuations in factors such as demand, competition, and material prices can significantly impact a business’s profitability.

- Demand Fluctuations: Changes in market demand can directly affect revenue estimates. For example, if there is a sudden increase in demand for a product or service, a business can expect to see higher revenue. Conversely, a decrease in demand can lead to lower revenue.

- Competitive Landscape: The competitive landscape can influence both revenue and cost estimates. If new competitors enter the market, a business might need to adjust its pricing strategies to remain competitive, potentially affecting its revenue. Additionally, increased competition can lead to higher costs as businesses invest in marketing and other strategies to attract customers.

- Material Price Fluctuations: Changes in material prices can significantly impact cost estimates. For example, if the price of steel increases, a construction company will need to adjust its cost estimates for projects involving steel construction.

Importance of Accurate Forecasting for Profit Estimation

Accurate forecasting is crucial for profit estimation. By accurately predicting revenue and costs, businesses can make informed decisions about pricing, resource allocation, and project bids.

Accurate forecasting helps businesses to avoid costly mistakes, such as underbidding projects or overestimating revenue, which can lead to financial losses.

Analyzing Profitability

After carefully calculating your estimated profit, it’s time to put on your detective hat and delve into the exciting world of analyzing profitability. This crucial step helps you understand what’s working, identify potential pitfalls, and ultimately, maximize your earnings.

Key Performance Indicators for Contract Profitability

Understanding your contract’s profitability requires looking beyond just the bottom line. Key performance indicators (KPIs) provide valuable insights into the health of your contract and highlight areas for improvement. Here are some important KPIs to consider:

- Gross Profit Margin: This metric reveals how much profit you’re making on each dollar of revenue. It’s calculated by dividing gross profit by total revenue. A higher gross profit margin indicates greater profitability.

- Return on Investment (ROI): This KPI measures the profitability of your investment in the contract. It’s calculated by dividing the net profit by the total investment. A higher ROI indicates a more successful investment.

- Contract Completion Rate: This KPI measures the percentage of contracts that are completed on time and within budget. A high completion rate indicates efficient project management and a strong track record.

- Customer Satisfaction: Happy customers are more likely to become repeat clients and refer others. Track customer satisfaction through surveys, feedback forms, and reviews to identify areas for improvement.

Factors Affecting Contract Profitability

While your meticulous calculations may have produced an estimated profit, several factors can impact the actual profitability of your contract. It’s essential to consider these factors during the planning and execution phases to mitigate potential risks.

- Changes in Market Conditions: Fluctuations in material costs, labor rates, and competition can all affect profitability. Staying informed about market trends and incorporating contingency plans into your budget can help you navigate these uncertainties.

- Project Scope Creep: Unforeseen changes to the project scope can lead to increased costs and delays. Clearly defining the scope of work upfront and implementing change management processes can help prevent scope creep.

- Unexpected Delays: Delays caused by weather, equipment failures, or unforeseen circumstances can disrupt project timelines and increase costs. Building buffer time into your schedule and having contingency plans in place can help minimize the impact of delays.

- Contractual Issues: Disputes over contract terms, payment schedules, or deliverables can lead to costly legal battles. Thoroughly reviewing and understanding all contract terms before signing is crucial.

Strategies for Improving Contract Profitability

Armed with the knowledge of key KPIs and potential profitability pitfalls, you can implement strategies to improve your contract performance and maximize your earnings.

- Optimize Resource Allocation: Efficiently allocating your resources, including labor, materials, and equipment, can significantly impact profitability. Use project management tools to track resource utilization and identify areas for optimization.

- Negotiate Favorable Contract Terms: Thoroughly negotiate contract terms, including payment schedules, milestones, and change order provisions, to ensure favorable conditions for profitability.

- Implement Strong Project Management: Effective project management, including clear communication, timely updates, and proactive risk management, can significantly improve project efficiency and profitability.

- Foster Client Relationships: Building strong relationships with clients can lead to repeat business, positive referrals, and a more collaborative environment for achieving project success.

Example Contract Costing Calculation

Let’s dive into the deep end of contract costing with a hypothetical scenario that will help us visualize how to calculate estimated profit. Imagine you’re a construction company bidding on a project to build a new office building. This is where the magic of contract costing comes into play, helping you determine if the project is worth your time and effort.

Contract Scenario

Our construction company is bidding on a contract to build a new office building for a tech company. The client has provided a detailed scope of work, and we need to calculate our estimated profit based on the expected costs and revenue.

Calculating Estimated Profit

To calculate the estimated profit, we’ll need to gather information about the project’s costs and revenue. Here’s a table that breaks down the key elements:

| Category | Description | Amount |

|---|---|---|

| Revenue | Contract price | $10,000,000 |

| Direct Costs | Labor | $3,000,000 |

| Materials | $2,000,000 | |

| Equipment | $1,000,000 | |

| Subcontractor Costs | $500,000 | |

| Total Direct Costs | $6,500,000 | |

| Indirect Costs | Project Management | $500,000 |

| Insurance | $200,000 | |

| Utilities | $100,000 | |

| Total Indirect Costs | $800,000 | |

| Total Costs | Sum of Direct and Indirect Costs | $7,300,000 |

| Estimated Profit | Revenue – Total Costs | $2,700,000 |

Estimated Profit = Revenue – Total Costs

In this example, our estimated profit for the office building project is $2,700,000. This profit margin represents the company’s potential earnings after covering all project expenses.

Mastering the art of calculating estimated profit in contract costing empowers businesses to make informed decisions, secure lucrative contracts, and ultimately achieve their financial objectives. By meticulously analyzing revenue streams, costs, and profit margins, you can navigate the complexities of project-based work with confidence and achieve sustainable growth.

Common Queries

What is the difference between direct and indirect costs in contract costing?

Direct costs are directly related to the production of a specific project, such as labor and materials. Indirect costs, also known as overhead costs, are not directly tied to a specific project and include expenses like rent, utilities, and administrative salaries.

How do I determine the appropriate profit margin for my contract?

The ideal profit margin depends on several factors, including industry standards, competition, project complexity, and your desired return on investment. Researching industry benchmarks and analyzing your own historical data can help you establish a realistic and achievable profit margin.

What are some strategies for improving contract profitability?

Strategies for improving contract profitability include optimizing resource allocation, negotiating favorable terms with suppliers, streamlining processes, reducing waste, and implementing effective cost control measures.