What is cost plus contract in cost accounting? It’s a question that pops up frequently in the world of project management and finance. Essentially, a cost-plus contract is a type of agreement where the buyer reimburses the seller for all allowable project costs, plus an agreed-upon fee. This fee can be a fixed amount, a percentage of costs, or even tied to performance incentives.

Understanding the nuances of these contracts – from negotiating the fee structure to managing risks – is crucial for both buyers and sellers to ensure a successful and profitable project.

This post will delve into the intricacies of cost-plus contracts, exploring the different types, the cost elements involved, the negotiation process, and the inherent risks and controls. We’ll compare them to other contract types, offering a comprehensive guide to help you navigate the complexities of this often-used, yet potentially tricky, contracting method. We’ll also look at real-world examples to bring the concepts to life.

Definition of Cost-Plus Contracts: What Is Cost Plus Contract In Cost Accounting

Cost-plus contracts represent a significant category within cost accounting, where the contractor’s compensation is directly tied to the actual costs incurred in fulfilling a project, augmented by a predetermined fee or percentage. This structure contrasts with fixed-price contracts, offering a different risk-reward profile for both the contractor and the client. The inherent flexibility allows for adjustments during project execution, accommodating unforeseen circumstances and changes in scope.

However, this flexibility also necessitates robust cost control mechanisms to prevent cost overruns.Cost-plus contracts are particularly valuable in situations where the project scope is uncertain, technological advancements are anticipated, or when a high degree of customization is required. The shared risk and reward dynamic often fosters a collaborative environment between the contractor and the client, promoting open communication and proactive problem-solving.

Types of Cost-Plus Contracts

Several variations of cost-plus contracts exist, each designed to address specific risk-sharing and profit-incentive considerations. The selection of a particular type depends heavily on the nature of the project, the relative bargaining power of the contracting parties, and the desired level of risk mitigation.

Cost-Plus-Fixed-Fee (CPFF) Contracts

In a CPFF contract, the contractor is reimbursed for all allowable costs incurred during the project, plus a fixed fee that is predetermined at the contract’s inception. The fixed fee represents the contractor’s profit and remains unchanged regardless of actual costs. This structure minimizes the contractor’s risk related to cost overruns, while the client retains a degree of cost certainty provided the contractor adheres to acceptable cost management practices.

For example, a government agency might use a CPFF contract for the development of a new weapon system where the exact specifications might evolve over time.

Cost-Plus-Incentive-Fee (CPIF) Contracts

CPIF contracts incorporate an incentive fee structure alongside the reimbursement of allowable costs. The incentive fee is contingent upon the contractor meeting predetermined performance targets, such as completing the project on time or under budget. This arrangement encourages cost efficiency and superior performance by aligning the contractor’s interests with those of the client. A prime example would be a construction project where the contractor receives a bonus for early completion, minimizing disruption to the client’s operations.

Cost-Plus-Percentage-of-Cost (CPPC) Contracts

Under a CPPC contract, the contractor’s fee is a percentage of the total allowable costs incurred during the project. While seemingly straightforward, this type is less frequently used due to the potential for cost escalation. The contractor’s profit is directly proportional to the project’s cost, creating an incentive to inflate costs, thus potentially increasing the overall project expense. This inherent risk to the client has largely led to the preference for CPFF and CPIF contracts in many industries.

Historically, this contract type was more common but has fallen out of favor due to its inherent conflict of interest.

Industries Utilizing Cost-Plus Contracts, What is cost plus contract in cost accounting

Cost-plus contracts find widespread application in various sectors characterized by complex projects with uncertain scopes or requirements. Government contracting, particularly for defense and research projects, frequently employs cost-plus contracts due to the inherent uncertainties and long-term nature of these endeavors. Similarly, the construction industry, especially for large-scale infrastructure projects, often utilizes these contracts to accommodate changing designs or unexpected site conditions.

The aerospace and pharmaceutical industries also leverage cost-plus contracts for research and development activities where the outcomes are difficult to predict with precision.

Comparison of Cost-Plus Contract Types

| Contract Type | Contractor Risk | Client Risk | Profit Potential |

|---|---|---|---|

| Cost-Plus-Fixed-Fee (CPFF) | Low | Moderate | Fixed |

| Cost-Plus-Incentive-Fee (CPIF) | Moderate | Moderate | Variable, potentially high |

| Cost-Plus-Percentage-of-Cost (CPPC) | Low | High | Variable, potentially high (but incentivizes cost inflation) |

Cost Elements Included in Cost-Plus Contracts

Cost-plus contracts, while offering flexibility, necessitate a clear understanding of the cost elements included for accurate reimbursement. This section details the types of costs typically included, differentiates between allowable and unallowable costs, and Artikels the process of cost auditing and verification. A clear definition of allowable costs is crucial to avoid disputes and ensure fair compensation for the contractor.

Types of Costs Included in Cost-Plus Contracts

Cost-plus contracts typically encompass direct and indirect costs incurred by the contractor in fulfilling the contract’s obligations. Direct costs are those directly attributable to the specific project, while indirect costs are those that benefit multiple projects. Examples of direct costs include materials directly used in the project, labor directly involved in the project, and equipment specifically rented or purchased for the project.

Indirect costs may include overhead expenses such as rent, utilities, and administrative salaries. The specific costs included are often defined in the contract itself, outlining the allowable cost categories.

Allowable and Unallowable Costs

The distinction between allowable and unallowable costs is paramount in cost-plus contracts. Allowable costs are those that are reasonable, allocable, and consistent with generally accepted accounting principles (GAAP). Unallowable costs are those deemed unreasonable, unallocable, or inconsistent with GAAP, or explicitly prohibited by the contract.

- Allowable Costs: Examples include direct materials, direct labor, reasonable overhead expenses (rent, utilities, administrative salaries), and reasonable travel expenses directly related to the project. For instance, the cost of steel beams used in a construction project is an allowable direct material cost. The wages of construction workers directly involved in the project are an allowable direct labor cost.

A portion of the office rent allocated to the project based on square footage utilized is an allowable indirect cost.

- Unallowable Costs: Examples include entertainment expenses, fines and penalties, interest expenses (unless specifically allowed in the contract), and costs associated with unapproved changes to the project scope. For example, the cost of a lavish company party is generally considered unallowable. Similarly, penalties incurred due to safety violations would typically be deemed unallowable. Costs related to a significant project scope change not formally approved through a change order would be unallowable.

Cost Auditing and Verification

To ensure accuracy and prevent cost overruns, cost-plus contracts typically involve a rigorous auditing process. This process verifies that all claimed costs are allowable, reasonable, and properly documented. Audits may involve examining invoices, time sheets, and other supporting documentation to ensure compliance with the contract terms and generally accepted accounting principles. The audit may be conducted by an independent third party, the contracting agency’s internal audit team, or a combination of both.

Discrepancies are identified and resolved through discussions between the contractor and the contracting agency. The audit trail provides transparency and accountability, protecting both parties’ interests.

Cost Accumulation and Reimbursement Flowchart

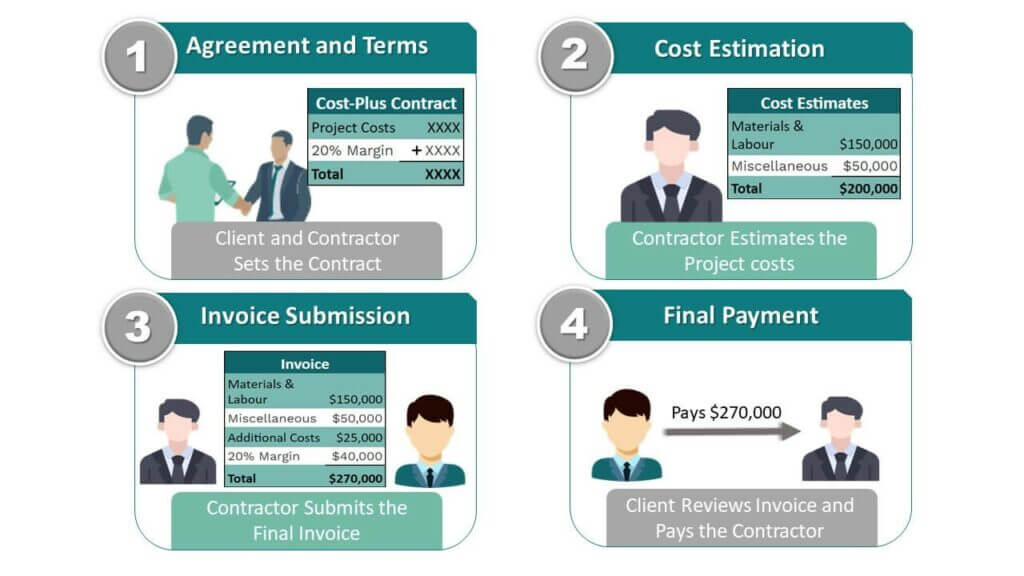

The following flowchart illustrates the process of cost accumulation and reimbursement in a typical cost-plus contract:[Descriptive Text of Flowchart]The flowchart begins with the contractor incurring costs associated with the project. These costs are meticulously documented and categorized (direct and indirect costs). The contractor then submits a claim for reimbursement to the contracting agency, supported by the detailed documentation.

The contracting agency reviews the claim, verifying the costs against the contract terms and conducting any necessary audits. If the claim is approved, the agency reimburses the contractor. If the claim is rejected or partially rejected, the reasons are communicated to the contractor, allowing for discussion and resolution. The process then repeats for subsequent claims until the project’s completion.

This cyclical process ensures continuous monitoring and transparency throughout the project lifecycle.

Negotiating Cost-Plus Contracts

Negotiating a cost-plus contract requires careful consideration of various factors to ensure a fair and mutually beneficial agreement for both the buyer and the contractor. The process involves establishing a clear understanding of the project scope, defining allowable costs, and determining a fair and reasonable fee structure. Effective negotiation balances the buyer’s need for cost control with the contractor’s need for adequate compensation and risk mitigation.The Fee Structure in Cost-Plus ContractsThe fee structure in a cost-plus contract typically consists of a fixed fee, a percentage of allowable costs, or a combination of both.

Negotiation focuses on the size of this fee, considering the complexity of the project, the contractor’s expertise, and the level of risk involved. The fixed fee compensates the contractor for their management and overhead costs, regardless of the actual project costs. A percentage-based fee adds an incentive for cost control, but may also disincentivize the contractor from being overly efficient.

The negotiation process involves presenting justifications for the proposed fee, referencing comparable projects and market rates. A thorough review of the contractor’s cost proposal is crucial, ensuring accuracy and avoiding any potential cost overruns. Ultimately, the agreed-upon fee should reflect a balance between the buyer’s budget and the contractor’s justifiable expenses and profit margin.

Factors Influencing Cost-Plus Contract Negotiation

Several key factors significantly impact the negotiation of cost-plus contracts. Market conditions, including the availability of skilled labor and materials, directly influence the contractor’s costs and, consequently, the negotiated fee. A competitive market may lead to lower fees, while a constrained market with high demand may necessitate higher fees. The contractor’s expertise and experience also play a vital role.

A highly specialized contractor with a proven track record may command a higher fee compared to a less experienced contractor. Finally, risk assessment is paramount. Projects with higher inherent risks, such as complex technical challenges or uncertain regulatory environments, typically warrant higher fees to compensate for the increased uncertainty. A detailed risk assessment should be conducted by both parties to identify and quantify potential risks, leading to a more informed negotiation process.

Best Practices for Negotiating Favorable Terms

Effective negotiation requires a strategic approach from both the buyer and the seller. For the buyer, thorough due diligence is essential, including a comprehensive review of the contractor’s qualifications, cost proposals, and past performance. Clearly defining the project scope and deliverables minimizes ambiguities and potential disputes. Establishing a transparent cost accounting system ensures that only allowable costs are reimbursed.

Negotiating a ceiling price, or a maximum allowable cost, protects against runaway costs. For the contractor, presenting a detailed and justified cost proposal is crucial, showcasing their expertise and the value they bring to the project. Open communication and transparency regarding potential risks and cost contingencies are essential to build trust and facilitate a smooth negotiation process.

Demonstrating a commitment to efficient cost management enhances the contractor’s credibility and strengthens their negotiating position.

Cost-Plus versus Fixed-Price Contract Negotiation

Negotiating a cost-plus contract differs significantly from negotiating a fixed-price contract. In a fixed-price contract, the focus is primarily on defining the scope of work and agreeing on a predetermined price. The contractor bears the risk of cost overruns, incentivizing efficient cost management. Negotiation centers on achieving a price that is both competitive and profitable for the contractor.

In contrast, cost-plus contracts place a greater emphasis on defining allowable costs and establishing a fair fee structure. The risk of cost overruns is shared between the buyer and the contractor, but the buyer retains greater control over the project’s cost through the oversight of allowable costs. Consequently, cost-plus contract negotiations are more focused on establishing clear cost accounting procedures and transparent communication mechanisms.

The choice between a cost-plus and fixed-price contract depends on the specific project circumstances, the risk tolerance of both parties, and the level of uncertainty surrounding the project scope and costs.

Risk and Control in Cost-Plus Contracts

Cost-plus contracts, while offering flexibility and shared risk, present inherent risks for both the buyer and the seller. Understanding these risks and implementing effective control mechanisms is crucial for successful project execution and mutual satisfaction. This section details the potential risks and Artikels strategies for mitigation and effective cost control.

Potential Risks for Buyers and Sellers

Buyers and sellers face distinct risks in cost-plus contracts. Buyers risk cost overruns stemming from poor cost estimation or lack of seller accountability. They also risk delays and potential quality issues if the seller lacks sufficient incentive to control costs or maintain quality. Sellers, conversely, risk insufficient profit if costs exceed expectations or if the contract’s pricing mechanisms are inadequately defined.

They may also face challenges in accurately forecasting costs, leading to financial losses. The potential for disputes regarding allowable costs further complicates the relationship.

Risk Mitigation Strategies

Several strategies can mitigate the risks inherent in cost-plus contracts. For buyers, these include rigorous pre-contract cost estimation and review, clear and detailed contract specifications, regular cost reporting and audits, and the establishment of a strong project management structure to oversee the seller’s performance. For sellers, effective risk mitigation involves thorough cost estimation, efficient project management, and open communication with the buyer regarding potential cost changes.

The use of independent cost estimators can enhance transparency and build trust between both parties. Furthermore, incorporating incentives for cost efficiency and quality performance can align the interests of both parties.

Effective Cost Control Mechanisms

Effective cost control is paramount in cost-plus contracts. This involves establishing clear cost accounting procedures, regular cost monitoring and reporting, and implementing variance analysis to identify and address cost overruns promptly. Pre-approved cost categories and a well-defined change management process are essential to prevent uncontrolled cost escalation. Regular meetings between the buyer and seller to review progress and costs further enhance cost control.

Buyers should consider incorporating clauses that limit the seller’s ability to increase costs without prior approval. These mechanisms provide transparency and accountability, preventing uncontrolled cost growth.

Key Performance Indicators (KPIs) for Cost-Plus Contracts

Effective monitoring of a cost-plus contract requires the tracking of relevant KPIs. These metrics provide insights into project performance and highlight potential issues early on.

- Actual vs. Budgeted Costs: A comparison of actual costs incurred against the initial budget provides a clear picture of cost performance.

- Cost Variance: The difference between actual and budgeted costs, expressed as a percentage or monetary value, indicating cost overruns or underruns.

- Schedule Adherence: Tracking project milestones against the agreed-upon schedule identifies potential delays and their impact on costs.

- Quality Metrics: Monitoring quality indicators ensures the project meets the required standards and avoids costly rework.

- Completion Rate: Measuring the percentage of work completed against the total scope provides insights into project progress and potential cost implications.

- Change Order Management: Tracking the number and cost of change orders provides insight into the efficiency of the change management process and its impact on the overall budget.

Cost-Plus Contracts vs. Other Contract Types

Cost-plus contracts, while offering flexibility, differ significantly from other common contract types in their approach to pricing and risk allocation. Understanding these differences is crucial for selecting the most appropriate contract for a given project. This section will compare and contrast cost-plus contracts with fixed-price and time-and-materials contracts, highlighting scenarios where a cost-plus approach might be preferable.

Comparison of Cost-Plus and Fixed-Price Contracts

Fixed-price contracts, also known as lump-sum contracts, specify a predetermined total price for the project, regardless of actual costs incurred. In contrast, cost-plus contracts reimburse the contractor for all allowable costs plus a predetermined fee or percentage markup. This fundamental difference impacts risk allocation: the contractor bears significant cost risk in a fixed-price contract, while the buyer assumes more cost risk in a cost-plus contract.

Fixed-price contracts incentivize efficient cost management by the contractor, while cost-plus contracts may reduce this incentive.

Comparison of Cost-Plus and Time-and-Materials Contracts

Both cost-plus and time-and-materials contracts reimburse the contractor for actual costs. However, time-and-materials contracts typically charge for labor and materials on an hourly or per-unit basis, without a pre-defined profit margin. The profit is directly related to the time spent on the project. A cost-plus contract, on the other hand, includes a predetermined fee or percentage markup on top of the allowable costs, providing a more predictable profit for the contractor.

Time-and-materials contracts are often used for projects with uncertain scopes, while cost-plus contracts are more suitable for larger, complex projects with defined scopes but uncertain costs.

Situations Favoring Cost-Plus Contracts

Cost-plus contracts are advantageous in situations where project scope is well-defined but cost estimation is challenging. This often occurs in research and development projects, complex engineering undertakings, or projects involving significant technological uncertainty. They are also beneficial when a high degree of collaboration and flexibility is required between the buyer and the contractor, allowing for changes and adjustments throughout the project lifecycle.

The buyer’s ability to influence cost control through oversight and approval processes is crucial for mitigating potential cost overruns.

Examples Illustrating Contract Type Advantages and Disadvantages

| Contract Type | Advantages | Disadvantages | Example |

|---|---|---|---|

| Fixed-Price | Clear pricing, strong contractor incentive for cost control, predictable budget. | Difficult to estimate costs accurately upfront, limited flexibility for changes, risk of cost overruns for the contractor. | Construction of a standard residential house with well-defined specifications. |

| Cost-Plus | Flexibility for changes, reduced risk for the buyer in uncertain projects, easier cost tracking for the buyer. | Potential for cost overruns, less incentive for contractor cost control, less predictable budget. | Development of a new software application with evolving requirements. |

| Time-and-Materials | Suitable for projects with undefined scope, easy to administer, simple billing. | Unpredictable total cost, potential for cost overruns, less incentive for efficient work by the contractor. | Repairing a damaged computer system where the extent of damage is unknown. |

Illustrative Example of a Cost-Plus Contract

This example details a hypothetical cost-plus contract between a software development company, “TechSolutions,” and a client, “Acme Corp,” for the development of a custom inventory management system. The contract Artikels the cost elements, fee structure, and potential scenarios affecting the final cost.

TechSolutions agrees to develop a bespoke inventory management system for Acme Corp. The contract is structured as a cost-plus-fixed-fee arrangement. This means Acme Corp will reimburse TechSolutions for all allowable costs incurred during development, plus a fixed fee representing TechSolutions’ profit margin.

Cost Elements Included in the Contract

The allowable costs included in the contract are explicitly defined and categorized to ensure transparency and prevent disputes. These costs encompass direct labor, materials, and overhead. Direct labor includes salaries of developers, project managers, and testers directly involved in the project. Materials encompass software licenses, cloud computing services, and any other necessary resources. Overhead costs represent a portion of TechSolutions’ general administrative expenses allocated to the project, based on a pre-agreed percentage of direct labor costs.

Fee Structure and Calculation of Final Contract Price

TechSolutions will receive a fixed fee of $50,000 in addition to all allowable costs. The project’s initial cost estimate, based on detailed planning and resource allocation, is $200,

000. This estimate includes

| Cost Element | Estimated Cost |

|---|---|

| Direct Labor | $120,000 |

| Materials | $50,000 |

| Overhead (20% of Direct Labor) | $24,000 |

Therefore, the initial projected final contract price is $200,000 (allowable costs) + $50,000 (fixed fee) = $250,000.

Potential Scenarios Affecting Final Cost

Several scenarios could influence the project’s final cost. For example, unforeseen technical challenges might require additional development time and resources, increasing direct labor costs. Changes in market prices for software licenses or cloud services could impact material costs. Acme Corp might also request scope changes during the development process, adding further costs.

Cost Overruns and Their Management

The contract includes a mechanism to manage cost overruns. While a fixed fee incentivizes efficient cost management by TechSolutions, significant deviations from the initial estimate require mutual agreement between both parties. Any cost increase exceeding 10% of the initial estimate ($20,000) needs written approval from Acme Corp. This approval process involves a detailed justification from TechSolutions explaining the reasons for the cost increase, along with a revised project schedule.

The contract also specifies a dispute resolution process, possibly involving arbitration, to address any disagreements concerning cost overruns. For instance, if unforeseen technical complexities increase direct labor costs by $30,000, TechSolutions would need to present a compelling case to Acme Corp for the additional expenditure. If Acme Corp approves, the final contract price would be adjusted accordingly.

If Acme Corp rejects the justification, a dispute resolution process would be initiated.

So, navigating the world of cost-plus contracts requires careful planning, clear communication, and a strong understanding of the risks involved. While offering flexibility, they demand robust cost control mechanisms and transparent accounting practices. By understanding the various types, negotiating effectively, and implementing appropriate risk mitigation strategies, both buyers and sellers can leverage the benefits of cost-plus contracts while minimizing potential downsides.

Ultimately, a well-structured cost-plus contract can foster collaboration and lead to successful project outcomes.

Frequently Asked Questions

What happens if costs exceed the initial estimate in a cost-plus contract?

The buyer typically reimburses the seller for allowable costs, even if they exceed the initial projection. However, the contract should Artikel specific clauses regarding cost overruns and potential dispute resolution mechanisms.

Are there any legal implications to consider with cost-plus contracts?

Yes, it’s crucial to ensure the contract complies with all relevant laws and regulations, particularly regarding transparency, accounting standards, and potential antitrust issues. Seeking legal counsel is highly recommended.

How can I ensure fair pricing in a cost-plus contract?

Thorough due diligence, independent cost estimations, and clearly defined allowable and unallowable costs are crucial. Regular audits and transparent communication between buyer and seller are also essential.