Are indirect cost allowed in cppc contracts – Are indirect costs allowed in CPPC contracts? This question arises frequently in the realm of cost-plus contracts, where the contractor is reimbursed for their direct costs plus a predetermined percentage for indirect expenses. Understanding the nuances of indirect cost allowability is crucial for both contractors and clients seeking to ensure fair and transparent pricing in CPPC agreements.

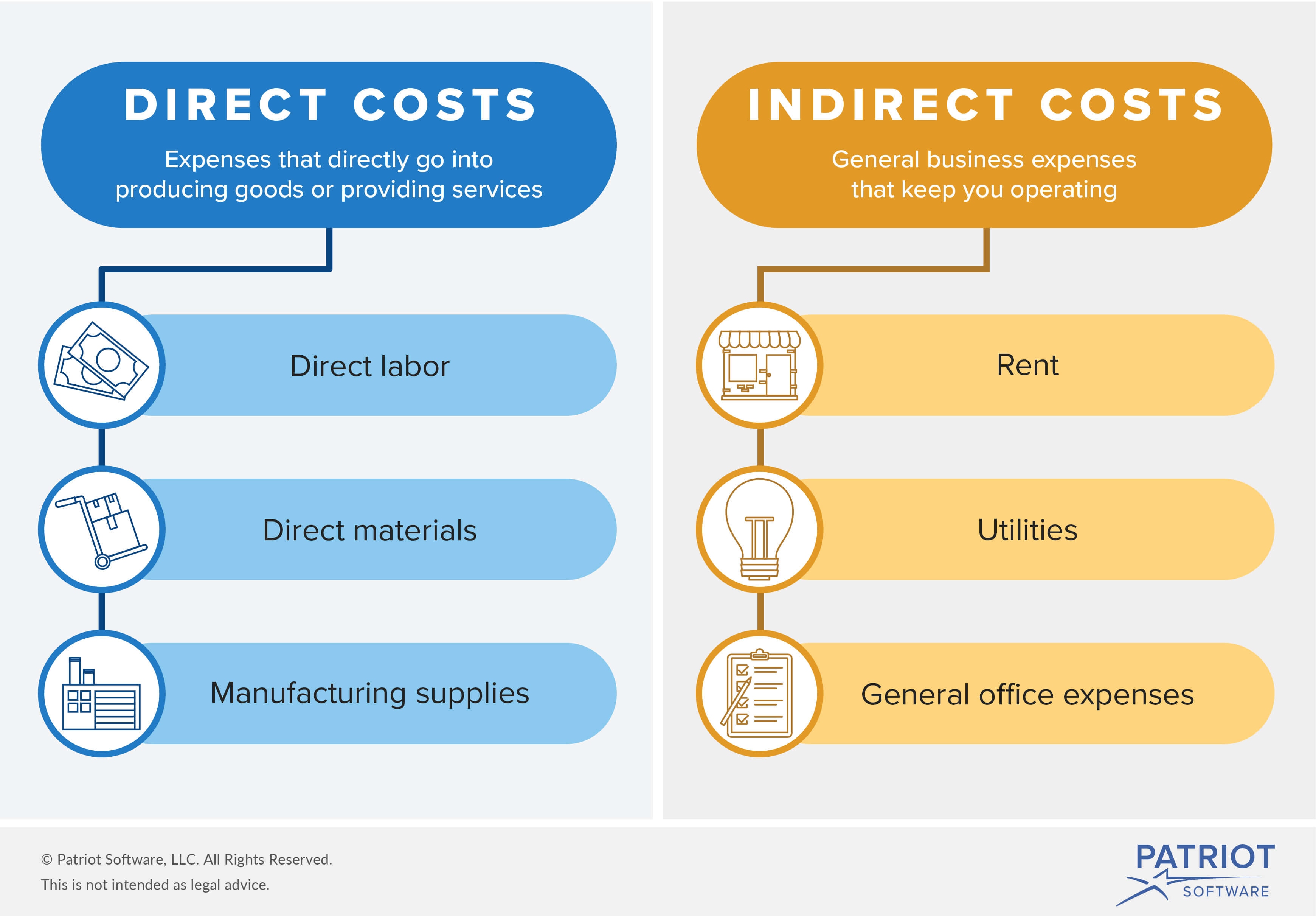

Indirect costs, often referred to as overhead expenses, are those not directly tied to a specific project but essential for the overall operation of the contractor’s business. These costs can include administrative expenses, marketing, insurance, and even a portion of executive salaries. While direct costs are typically straightforward, indirect costs can be more complex to allocate and justify, leading to potential disagreements between parties.

Understanding Cost-Plus Contracts (CPPC)

Cost-plus contracts, also known as CPPC contracts, are a type of agreement where the buyer pays the seller for all the actual costs incurred in completing a project, plus an agreed-upon fee or percentage for the seller’s profit and overhead. This type of contract is often used in situations where the scope of work is uncertain or subject to change, making it difficult to estimate the exact cost upfront.CPPC contracts offer several advantages, including:

Key Principles of CPPC Contracts

CPPC contracts are based on the principle of transparency and mutual trust between the buyer and seller. The buyer agrees to pay all the seller’s legitimate costs, while the seller is incentivized to control costs and maximize efficiency. This creates a collaborative relationship where both parties are invested in the project’s success.

Key Elements of CPPC Agreements

A CPPC agreement typically includes the following key elements:

- Cost Reimbursement: This defines how the buyer will reimburse the seller for all allowable costs incurred in the project. It may include direct costs (materials, labor, equipment) and indirect costs (overhead, administrative expenses).

- Fee Structure: This specifies the method of calculating the seller’s profit and overhead. It could be a fixed fee, a percentage of the total cost, or a combination of both.

- Cost Control Mechanisms: These are measures put in place to ensure that the seller’s costs are reasonable and necessary. They may include cost reporting requirements, audits, and approval processes for major expenses.

- Performance Incentives: These are optional clauses that can be included to motivate the seller to achieve specific project goals or milestones. They may involve bonuses or penalties based on performance metrics.

- Dispute Resolution: This section Artikels the process for resolving any disagreements between the buyer and seller regarding costs, payment, or performance.

Common Scenarios for CPPC Contracts

CPPC contracts are frequently used in the following situations:

- Research and Development (R&D) Projects: When the project involves significant uncertainty and innovation, it can be challenging to estimate costs accurately upfront. CPPC contracts allow the buyer to share the risk and reward of R&D.

- Construction Projects with Unpredictable Conditions: In cases where the project site conditions are unknown or subject to change, CPPC contracts can provide flexibility to adjust costs as needed.

- Government Contracts: Government agencies often use CPPC contracts for complex projects that require specialized expertise and involve high levels of oversight.

- Emergency Response Services: When immediate action is required, such as disaster relief or emergency repairs, CPPC contracts allow for quick mobilization and flexible cost adjustments.

Direct Costs in CPPC Contracts

Direct costs are the core expenses directly associated with the completion of a project. These costs are the tangible, measurable expenses that are directly tied to the work performed under the contract. They form the foundation of the cost-plus pricing model in CPPC contracts.Direct costs are typically calculated and documented based on actual expenses incurred, ensuring transparency and accountability in the project’s financial management.

Examples of Direct Costs

Direct costs in CPPC contracts encompass a wide range of expenses, including:

- Labor Costs: Salaries, wages, benefits, and payroll taxes paid to employees directly involved in the project. This includes the cost of skilled labor, such as engineers, technicians, and construction workers, as well as administrative and support staff directly contributing to the project.

- Materials: The cost of raw materials, components, and supplies used in the project. This can include everything from building materials and equipment to specialized components and consumables. For instance, in a construction project, direct materials would include concrete, steel, lumber, and paint.

- Equipment: The cost of equipment used in the project, including both purchased and leased equipment. This could encompass heavy machinery, specialized tools, and vehicles directly used for project execution. For example, a construction project might require cranes, excavators, and trucks for transportation and material handling.

- Subcontractor Costs: The cost of services performed by subcontractors, who are hired to complete specific tasks within the overall project. For example, a construction project might involve subcontractors for electrical work, plumbing, and HVAC installation. The cost of subcontracted work is included as a direct cost.

- Travel and Transportation: The cost of travel and transportation for employees and equipment related to the project. This includes airfare, hotel accommodations, rental cars, and transportation of materials and equipment to the project site.

- Direct Project Expenses: This category encompasses various expenses directly related to the project, such as permits, licenses, insurance premiums, and project-specific training. These expenses are directly incurred to facilitate the project’s execution.

Calculating and Documenting Direct Costs

Direct costs are typically calculated and documented based on actual expenses incurred. This process involves meticulous tracking of all project-related expenses, ensuring accurate record-keeping and detailed documentation.

“Direct costs are calculated by adding up the actual expenses incurred for each category of direct cost, such as labor, materials, equipment, and subcontractor costs.”

- Time and Materials: This method tracks the time spent by employees on specific tasks and the materials used in the project. This information is used to calculate the actual cost of labor and materials. For instance, a construction project might track the hours worked by electricians and the amount of wiring used in the project. The actual cost of labor and materials is then calculated based on these records.

- Cost Codes: Each direct cost category is assigned a unique cost code for tracking purposes. This allows for easy categorization and aggregation of expenses, simplifying the process of calculating and documenting direct costs. For example, a cost code might be assigned to labor, materials, equipment, and subcontractor costs, facilitating efficient tracking and analysis.

- Invoices and Receipts: All invoices and receipts for direct costs are carefully documented and stored. This provides a detailed record of expenses, ensuring accuracy and transparency in cost calculations. The invoices and receipts serve as supporting documentation for the direct costs incurred in the project.

Indirect Costs in CPPC Contracts

Indirect costs, also known as overhead costs, are expenses incurred in supporting the overall project but not directly tied to specific deliverables. These costs are crucial in CPPC contracts because they are factored into the reimbursement calculation, impacting the contractor’s overall profit.

In CPPC agreements, the contractor is reimbursed for both direct and indirect costs. The allowance for indirect costs can vary depending on the contract’s specific terms, the nature of the project, and industry practices. The contractor is usually required to provide detailed documentation and justification for these costs. This ensures transparency and accountability in the reimbursement process.

Examples of Indirect Costs in CPPC Contracts

Indirect costs encompass a wide range of expenses that support the project’s overall execution. Here are some common examples:

- Administrative Costs: Salaries of administrative staff, rent, utilities, insurance, office supplies, and other expenses related to managing the project.

- General and Administrative Costs (G&A): Costs associated with the overall operation of the contractor’s business, such as executive salaries, legal fees, accounting services, and marketing expenses.

- Marketing and Sales Costs: Expenses incurred in promoting the contractor’s services and securing new contracts.

- Quality Control Costs: Expenses associated with ensuring the project meets quality standards, including inspection, testing, and certification.

- Training and Development Costs: Expenses incurred in training employees on project-related skills and ensuring compliance with safety regulations.

- Travel and Subsistence Costs: Expenses incurred for travel and accommodation related to project meetings, site visits, and inspections.

- Depreciation and Amortization: Costs associated with the decline in value of assets used in the project, such as equipment and software.

- Interest Expense: Costs incurred on borrowing funds for the project.

- Insurance: Costs associated with various insurance policies, such as general liability, workers’ compensation, and property insurance.

Rationale for Allowing or Disallowing Indirect Costs

The allowance or disallowance of specific indirect costs depends on the contract’s specific terms and the nature of the project. The following factors are typically considered:

- Reasonableness: The indirect costs should be reasonable and necessary for the successful execution of the project. Costs that are deemed excessive or unnecessary are likely to be disallowed.

- Direct Relationship to the Project: The indirect costs should have a direct relationship to the project. Costs that are unrelated to the project, such as personal expenses or entertainment costs, are typically disallowed.

- Industry Practices: The allowance or disallowance of specific indirect costs may be influenced by industry practices and standards. For example, certain types of indirect costs may be routinely allowed in specific industries.

- Contractual Provisions: The contract may specify the types of indirect costs that are allowable and the methods for calculating them. The contractor must adhere to these provisions.

- Government Regulations: Government contracts often have specific rules and regulations regarding the allowance of indirect costs. Contractors must comply with these regulations.

In general, indirect costs that are directly related to the project and are reasonable in amount are more likely to be allowed. Costs that are unrelated to the project, are excessive, or are not properly documented are likely to be disallowed. The contractor should be prepared to provide detailed documentation and justification for all indirect costs claimed.

Allowability of Indirect Costs

The allowability of indirect costs in CPPC contracts is a crucial aspect of cost control and contract administration. It involves ensuring that only eligible and reasonable indirect costs are included in the contract price. These costs, unlike direct costs, are not directly associated with a specific deliverable but are necessary for the overall project execution.

Factors Influencing Allowability

The allowability of indirect costs in CPPC contracts is influenced by several factors, including:

- Contract Clauses: The contract itself Artikels the specific terms and conditions governing the allowability of indirect costs. It may specify acceptable cost categories, allocation methods, and limitations on the amount of indirect costs that can be claimed.

- Government Regulations: For government contracts, federal regulations, such as the Federal Acquisition Regulation (FAR), define the criteria for allowable indirect costs. These regulations ensure fairness and consistency in cost accounting practices.

- Industry Practices: Common industry practices and standards can also influence the allowability of indirect costs. For example, certain accounting methods or cost allocation principles may be widely accepted within a particular industry.

- Cost Reasonableness: The ultimate test of allowability is whether the indirect costs are reasonable and necessary for the performance of the contract. This involves examining the relationship between the costs incurred and the work performed.

Role of Contract Clauses and Regulations

Contract clauses and regulations play a pivotal role in defining the allowable indirect costs in CPPC contracts. They provide a framework for cost accounting and ensure that the costs claimed are reasonable and consistent with the terms of the agreement.

Contract Clauses

Contract clauses often include specific provisions related to indirect costs, such as:

- Cost Categories: The contract may list the specific categories of indirect costs that are allowable, such as overhead, general and administrative expenses, and fringe benefits.

- Allocation Methods: Contract clauses may specify the acceptable methods for allocating indirect costs to specific tasks or deliverables. This could involve using a predetermined rate or a cost-based allocation method.

- Cost Limitations: The contract may set limits on the total amount of indirect costs that can be claimed, either as a percentage of direct costs or a fixed amount.

Government Regulations

For government contracts, the FAR provides comprehensive guidance on the allowability of indirect costs. Key aspects of the FAR related to indirect costs include:

- Cost Principles: The FAR Artikels specific cost principles that define the criteria for allowable costs, including indirect costs.

- Cost Accounting Standards (CAS): The CAS establish uniform cost accounting practices for government contractors, ensuring consistency and transparency in cost reporting.

- Audit Requirements: The FAR mandates that government contractors be subject to audits to verify the accuracy and allowability of their costs, including indirect costs.

Impact of Cost Accounting Methods

Different cost accounting methods can impact the allowability of indirect costs. The choice of accounting method can influence the allocation of costs and the overall amount of indirect costs that are claimed.

Traditional Cost Accounting

Traditional cost accounting methods, such as job costing or process costing, often rely on historical data and predetermined overhead rates to allocate indirect costs. These methods can be relatively simple to implement but may not accurately reflect the actual costs incurred on a particular project.

Activity-Based Costing (ABC)

ABC is a more sophisticated cost accounting method that allocates indirect costs based on the activities that drive those costs. This method can provide a more accurate allocation of costs, especially in projects with complex activities and multiple cost drivers. However, ABC can be more complex and time-consuming to implement.

Impact on Allowability

The choice of cost accounting method can influence the allowability of indirect costs in CPPC contracts. If a contractor uses a method that results in an unreasonable allocation of costs, it may be challenged by the contracting officer or the government auditor. For example, using a predetermined overhead rate that is significantly higher than the actual costs incurred could result in the disallowance of a portion of the indirect costs.

Commonly Allowed Indirect Costs

Indirect costs, also known as overhead costs, are expenses incurred by a contractor that cannot be directly attributed to a specific project or task. They are essential for the overall operation of the business and are necessary for the successful completion of projects. These costs are often allocated to projects based on a predetermined method, such as a percentage of direct costs or a specific allocation formula.

Commonly Allowed Indirect Costs

The following table Artikels common indirect costs that are typically allowed in CPPC contracts. It includes a description of each indirect cost and its typical allocation method, along with examples of how these costs might be documented and supported.| Indirect Cost | Description | Typical Allocation Method | Documentation and Support ||—|—|—|—|| Administrative and General (A&G) Expenses | These costs are incurred in the overall administration and management of the contractor’s business.

They include expenses related to executive salaries, accounting, legal, human resources, and other general overhead. | A&G expenses are typically allocated to projects based on a percentage of direct costs or a specific allocation formula. | Documentation of A&G expenses should include invoices, payroll records, and other supporting documents. || Marketing and Sales Expenses | These costs are incurred in promoting and selling the contractor’s services.

They include expenses related to advertising, sales commissions, and marketing materials. | Marketing and sales expenses are typically allocated to projects based on a percentage of direct costs or a specific allocation formula. | Documentation of marketing and sales expenses should include invoices, marketing campaign reports, and sales records. || Insurance Expenses | These costs cover various types of insurance, including general liability, workers’ compensation, and property insurance.

| Insurance expenses are typically allocated to projects based on a percentage of direct costs or a specific allocation formula. | Documentation of insurance expenses should include insurance policies and premium invoices. || Rent and Utilities | These costs cover the rent and utilities for the contractor’s office space and other facilities. | Rent and utilities are typically allocated to projects based on a percentage of direct costs or a specific allocation formula.

| Documentation of rent and utilities should include lease agreements and utility bills. || Depreciation and Amortization | These costs represent the decline in value of the contractor’s assets, such as equipment and furniture. | Depreciation and amortization are typically allocated to projects based on a percentage of direct costs or a specific allocation formula. | Documentation of depreciation and amortization should include asset purchase records and depreciation schedules.

|| Travel and Subsistence | These costs cover travel expenses incurred by the contractor’s employees, including airfare, lodging, and meals. | Travel and subsistence expenses are typically allocated to projects based on a percentage of direct costs or a specific allocation formula. | Documentation of travel and subsistence expenses should include airline tickets, hotel receipts, and meal receipts. || Professional Fees | These costs cover fees paid to external professionals, such as lawyers, accountants, and consultants.

| Professional fees are typically allocated to projects based on a percentage of direct costs or a specific allocation formula. | Documentation of professional fees should include invoices from professional service providers. || Training and Education | These costs cover the training and education of the contractor’s employees. | Training and education costs are typically allocated to projects based on a percentage of direct costs or a specific allocation formula.

| Documentation of training and education costs should include training course materials and invoices from training providers. || Other Indirect Costs | This category includes a wide range of other indirect costs that are not specifically listed above, such as interest expense, taxes, and bad debt expense. | Other indirect costs are typically allocated to projects based on a percentage of direct costs or a specific allocation formula.

| Documentation of other indirect costs should include invoices, bank statements, and tax returns. |

The specific indirect costs that are allowed in a CPPC contract will vary depending on the specific terms of the contract. It is important to carefully review the contract to determine which indirect costs are allowed and how they should be allocated.

Challenges in Determining Allowable Indirect Costs

Determining the allowability of indirect costs in CPPC contracts can be a complex and challenging task. While the general principle is that only reasonable and allocable costs are allowed, the application of this principle can lead to disputes between the parties.

Common Areas of Dispute, Are indirect cost allowed in cppc contracts

The following are common areas of dispute between parties regarding indirect costs:

- Allocation Methods: Disputes can arise over the allocation methods used to assign indirect costs to specific contract tasks. For example, a contractor may use a percentage-of-direct-cost allocation method, while the government may prefer a more detailed activity-based costing method.

- Cost Pools: The composition of cost pools, which are groups of indirect costs that are allocated together, can also be a source of disagreement. For example, the contractor may include costs related to employee benefits in the overhead cost pool, while the government may argue that these costs should be allocated separately.

- Allowable Costs: The specific costs that are considered allowable under the contract can be a subject of debate. For example, the contractor may argue that certain marketing costs are allowable, while the government may contend that they are not directly related to the contract.

- Documentation: The level of documentation required to support the allowability of indirect costs can also be a source of dispute. The government may require detailed documentation, such as invoices and time sheets, while the contractor may argue that less detailed documentation is sufficient.

Best Practices for Minimizing Disputes

To minimize disputes and ensure transparency in the allocation of indirect costs, it is essential to follow these best practices:

- Clear Contractual Provisions: The contract should clearly define the allowable indirect costs, the allocation methods to be used, and the documentation requirements. This helps to avoid ambiguity and reduce the potential for disputes.

- Negotiation and Agreement: The parties should negotiate and agree on the specific terms related to indirect costs before the contract is awarded. This helps to ensure that both parties understand their obligations and responsibilities.

- Detailed Cost Breakdown: The contractor should provide a detailed breakdown of its indirect costs, including the basis for allocation. This allows the government to verify the reasonableness and allocability of the costs.

- Open Communication: Open communication between the parties is essential throughout the contract period. This allows for timely resolution of any issues or disputes that may arise.

Examples of Indirect Cost Allowability: Are Indirect Cost Allowed In Cppc Contracts

In CPPC contracts, the allowance of indirect costs is crucial for ensuring the contractor’s ability to operate effectively and complete the project successfully. Understanding the specific scenarios where indirect costs are deemed allowable is essential for both the contractor and the client. This section explores various scenarios that illustrate the allowability of indirect costs in CPPC contracts.

Indirect Costs for Project Management

Indirect costs associated with project management are often allowed in CPPC contracts. These costs are essential for the efficient planning, execution, and monitoring of the project.

- Scenario: A contractor is hired for a construction project using a CPPC contract. The contractor has a dedicated project manager responsible for overseeing the project’s progress, coordinating with subcontractors, and ensuring compliance with project specifications. The project manager’s salary and benefits are considered indirect costs.

- Rationale: The project manager’s role is crucial for the successful completion of the project.

Their expertise and oversight ensure that the project remains on schedule and within budget.

- Documentation: The contractor can support the allowability of these costs by providing documentation of the project manager’s responsibilities, time spent on the project, and salary and benefits information.

Indirect Costs for General and Administrative Expenses

General and administrative (G&A) expenses are often considered allowable indirect costs in CPPC contracts. These expenses represent the overhead costs associated with running the contractor’s business.

- Scenario: A contractor is engaged in a CPPC contract for the development of a software application. The contractor incurs expenses related to rent, utilities, insurance, and administrative staff salaries. These costs are considered G&A expenses.

- Rationale: G&A expenses are essential for the contractor’s ongoing operations and support the overall project effort. Without these expenses, the contractor would be unable to maintain its business infrastructure and support its project teams.

- Documentation: The contractor can support the allowability of G&A expenses by providing documentation of rent agreements, utility bills, insurance policies, and payroll records.

Indirect Costs for Quality Assurance

Quality assurance (QA) activities are essential for ensuring that the project deliverables meet the required standards. Indirect costs associated with QA are typically allowed in CPPC contracts.

- Scenario: A contractor is building a custom software system for a client using a CPPC contract. The contractor has a dedicated QA team responsible for testing the software, identifying defects, and ensuring that the system meets the client’s requirements. The QA team’s salaries and testing equipment costs are considered indirect costs.

- Rationale: QA activities are crucial for ensuring the quality and functionality of the project deliverables.

By investing in QA, the contractor demonstrates its commitment to delivering a high-quality product.

- Documentation: The contractor can support the allowability of these costs by providing documentation of the QA team’s responsibilities, testing procedures, and equipment purchase records.

Indirect Costs for Training and Development

Training and development activities are often considered allowable indirect costs in CPPC contracts. These activities enhance the skills and knowledge of the contractor’s workforce, improving project performance and efficiency.

- Scenario: A contractor is working on a complex engineering project under a CPPC contract. The contractor provides training to its engineers on the latest software tools and engineering methodologies. The training costs, including instructor fees and materials, are considered indirect costs.

- Rationale: Training and development activities contribute to the contractor’s overall expertise and ability to execute projects effectively.

By investing in training, the contractor ensures that its employees have the necessary skills to deliver high-quality work.

- Documentation: The contractor can support the allowability of these costs by providing documentation of training programs, attendance records, and associated expenses.

Examples of Indirect Cost Disallowance

In CPPC contracts, the contractor is reimbursed for direct costs and a portion of indirect costs. However, not all indirect costs are allowable. The contract typically specifies which indirect costs are allowable and the methods for calculating them. Understanding the reasons for disallowing specific indirect costs is crucial for contractors to ensure they are not penalized for inappropriate expenses.

Costs Incurred for Unallowable Activities

Costs incurred for activities that are not directly related to the contract work are generally disallowed. These activities may include:

- Marketing and advertising: Costs associated with promoting the contractor’s business or products are typically not allowable, unless directly related to the contract work.

- Entertainment and recreation: Costs related to social events, travel, or entertainment are generally not allowable unless directly related to the contract work.

- Political contributions: Costs associated with political campaigns or lobbying efforts are generally not allowable.

- Bad debts: Costs related to uncollectible accounts receivable are typically not allowable.

- Penalties and fines: Costs associated with penalties or fines imposed on the contractor for non-compliance with regulations are generally not allowable.

The rationale for disallowing these costs is to ensure that the contractor is not reimbursed for expenses that are not directly related to the contract work. This helps to maintain the integrity of the cost-plus contract and prevent contractors from inflating their costs.

Documentation and support for these costs would typically include invoices, receipts, and other supporting documentation that clearly demonstrates the connection between the expense and the contract work. If the documentation does not adequately support the expense, it is likely to be disallowed.

Costs Exceeding Reasonable Limits

Indirect costs that exceed reasonable limits are often disallowed. These limits may be specified in the contract or determined by industry standards.

- Excessive salaries: Salaries for employees that are significantly higher than industry standards are often disallowed. This is particularly true for executive salaries or salaries for employees with limited experience or responsibility.

- Unreasonable travel expenses: Travel expenses that are excessive or not justified by the nature of the work are often disallowed. This includes travel to luxurious destinations, first-class airfare, or extended stays at hotels.

- Unnecessary equipment purchases: Purchases of equipment that are not directly related to the contract work or that exceed the reasonable needs of the project are often disallowed.

The rationale for disallowing these costs is to prevent contractors from inflating their costs by charging unreasonable amounts for salaries, travel, and equipment. This helps to ensure that the contractor is only reimbursed for costs that are directly related to the contract work and are necessary to complete the project.

Documentation and support for these costs would typically include pay stubs, travel itineraries, and equipment purchase orders. The documentation should clearly demonstrate the reasonableness of the costs and their connection to the contract work. If the documentation does not adequately support the expense, it is likely to be disallowed.

Costs Incurred for Inefficient Operations

Indirect costs incurred due to inefficient operations are generally disallowed. These costs may include:

- Overhead expenses: Costs associated with inefficient management practices, such as excessive administrative staff, inefficient scheduling, or poor resource allocation, are often disallowed.

- Duplication of effort: Costs associated with overlapping tasks or unnecessary work are generally disallowed.

- Lack of cost control: Costs associated with poor cost control practices, such as inadequate tracking of expenses, poor budgeting, or a lack of oversight, are often disallowed.

The rationale for disallowing these costs is to incentivize contractors to operate efficiently and to prevent them from being reimbursed for costs that are avoidable. This helps to ensure that the contractor is only reimbursed for costs that are necessary to complete the contract work.

Documentation and support for these costs would typically include financial statements, budget reports, and other records that demonstrate the efficiency of the contractor’s operations. If the documentation indicates that the contractor’s operations are inefficient, it is likely that some of the indirect costs will be disallowed.

Impact of Indirect Costs on Contract Pricing

Indirect costs play a significant role in determining the final price of CPPC contracts. Understanding how these costs are allocated and their impact on pricing is crucial for both contractors and clients.

Impact of Allowable Indirect Costs on Contract Pricing

Allowable indirect costs directly influence the overall cost of a CPPC contract. These costs, such as overhead expenses, are added to the direct costs to determine the total project cost. As the amount of allowable indirect costs increases, the final contract price also tends to increase. This is because the contractor is reimbursed for these costs, which are not directly related to the specific work performed but are essential for running the business.

Influence of Specific Indirect Costs on Contract Price

The inclusion or exclusion of specific indirect costs can significantly affect the final contract price. For example, if a contract allows for the inclusion of marketing and advertising expenses as indirect costs, the total cost of the project will be higher compared to a contract that excludes these expenses. Conversely, if a contract excludes the cost of employee benefits as an indirect cost, the total cost will be lower.

Impact of Different Indirect Cost Allocation Methods on Contract Pricing

The method used to allocate indirect costs to a CPPC contract can also impact the final price. Different allocation methods, such as the percentage-of-direct-cost method or the activity-based costing method, can result in different cost allocations and, consequently, different contract prices.

- Percentage-of-direct-cost method: This method allocates indirect costs based on a percentage of the direct costs incurred on a project. A higher percentage will result in a higher allocation of indirect costs and, therefore, a higher contract price.

- Activity-based costing method: This method allocates indirect costs based on the activities performed on a project. This method can be more accurate than the percentage-of-direct-cost method, as it considers the specific activities that contribute to the indirect costs. However, it can also be more complex and time-consuming to implement.

For instance, a project with a high proportion of labor-intensive activities might result in a higher allocation of indirect costs using the activity-based costing method compared to the percentage-of-direct-cost method, leading to a higher contract price.

Best Practices for Managing Indirect Costs

Managing indirect costs effectively is crucial in CPPC contracts, as they can significantly impact project profitability. By implementing best practices, contractors can minimize unnecessary expenses, optimize resource allocation, and ensure fair reimbursement for legitimate costs.

Strategies for Minimizing Unnecessary Indirect Costs

To effectively manage indirect costs, contractors should implement strategies aimed at reducing unnecessary expenses. These strategies can involve streamlining processes, optimizing resource utilization, and fostering a culture of cost-consciousness.

- Process Optimization: Regularly reviewing and streamlining administrative and operational processes can identify areas where inefficiencies exist. Automating tasks, implementing digital workflows, and eliminating redundant steps can significantly reduce indirect costs associated with administrative overhead.

- Resource Optimization: Effective resource management is essential. This involves optimizing the use of personnel, equipment, and facilities. Utilizing technology for task management, scheduling, and resource allocation can improve efficiency and reduce waste. Implementing cost-effective procurement strategies for supplies and services can also contribute to cost savings.

- Cost-Conscious Culture: Fostering a culture of cost-consciousness among employees is crucial. Regular training and communication programs can educate staff on the importance of cost management and encourage them to identify potential cost-saving opportunities. Establishing clear cost-control guidelines and performance metrics can reinforce the importance of responsible spending.

Importance of Accurate Cost Tracking and Documentation

Accurate cost tracking and documentation are essential for managing indirect costs effectively. This involves maintaining detailed records of all indirect expenses, including supporting documentation to justify their allowability.

- Transparent Cost Tracking: Comprehensive and accurate cost tracking systems are essential. These systems should capture all indirect costs incurred, including personnel, utilities, rent, and other overhead expenses. Regularly reviewing and analyzing cost data can identify trends, potential cost overruns, and areas for improvement.

- Detailed Documentation: Supporting documentation is crucial for justifying the allowability of indirect costs. This includes invoices, receipts, time sheets, and other relevant records that demonstrate the legitimacy and necessity of each expense. Maintaining organized and readily accessible documentation can facilitate audits and ensure accurate reimbursement.

Navigating the allowance of indirect costs in CPPC contracts requires a thorough understanding of the contract terms, relevant regulations, and industry best practices. By carefully defining the scope of allowable indirect costs, establishing clear documentation procedures, and fostering open communication, parties can minimize disputes and ensure fair compensation for both the contractor and the client. Ultimately, a collaborative approach to managing indirect costs promotes transparency, accountability, and successful project completion.

Questions Often Asked

What are some examples of commonly allowed indirect costs in CPPC contracts?

Commonly allowed indirect costs include administrative expenses, marketing and advertising, insurance premiums, utilities, and a portion of executive salaries. These costs are typically allocated to projects based on a predetermined method, such as a percentage of direct costs or a specific allocation rate.

How can disputes over indirect costs be minimized?

Disputes can be minimized by clearly defining allowable indirect costs in the contract, establishing a transparent cost accounting system, and providing detailed documentation for all expenses. Regular communication and open dialogue between the parties are also essential for resolving any disagreements that may arise.

What is the impact of indirect costs on the overall contract price?

The inclusion or exclusion of specific indirect costs can significantly affect the final contract price. Higher indirect cost allowances can result in a higher overall contract price, while more restrictive allowances can lead to lower costs. It is important to carefully consider the impact of indirect costs on the project budget and negotiate a fair and reasonable agreement.