Are salary contracts a fixed cost? This question is at the heart of many business decisions, from budgeting and financial planning to strategic hiring and investment. Salary contracts represent a significant expenditure for most companies, and understanding their fixed cost nature is crucial for ensuring financial stability and achieving long-term success.

In the realm of business operations, salary contracts serve as the foundation for employee compensation. They Artikel the terms of employment, including base salary, bonuses, benefits, and potential for raises. While the exact nature of salary contracts can vary depending on industry, company size, and employee experience, they all share a common thread: they represent a predictable and recurring cost for businesses.

Defining Salary Contracts

Salary contracts are the backbone of any employee-employer relationship. They Artikel the financial terms of employment, ensuring both parties are clear about their responsibilities and compensation. These contracts are essential for establishing a structured and transparent working environment, fostering trust and stability within the organization.

Key Components of a Salary Contract

The core components of a salary contract define the financial aspects of the employment relationship. These components are:

- Base Salary: This is the fixed amount of money an employee receives for their work, usually paid on a regular basis, such as monthly or bi-weekly. It’s the foundation of the employee’s compensation package.

- Bonuses: These are additional payments given to employees, often based on performance, company success, or achieving specific goals. Bonuses can be a significant part of an employee’s total compensation, motivating them to exceed expectations.

- Benefits: These are non-monetary perks offered by the employer to enhance the employee’s well-being and work-life balance. Benefits can include health insurance, retirement plans, paid time off, and employee discounts. They contribute to a more attractive and competitive employment package.

- Raises: These are increases in the employee’s base salary, often based on performance reviews, merit, or cost-of-living adjustments. Regular raises ensure employees are compensated fairly and that their earnings keep pace with inflation and market trends.

Types of Salary Contracts

Different types of salary contracts are used depending on the nature of the employment relationship and the industry. These include:

- Fixed-Term Contracts: These contracts have a defined start and end date. They are often used for temporary or project-based work. Examples include a contract for a specific marketing campaign or a temporary role during a busy season.

- Indefinite Contracts: These contracts have no fixed end date and continue until either party terminates the agreement. They are commonly used for permanent employment positions. These contracts provide stability and security for both the employer and employee.

- Performance-Based Contracts: These contracts link the employee’s compensation directly to their performance. This could include bonuses, commissions, or other incentives based on meeting specific targets or exceeding expectations. This type of contract motivates employees to strive for higher performance and achieve desired results.

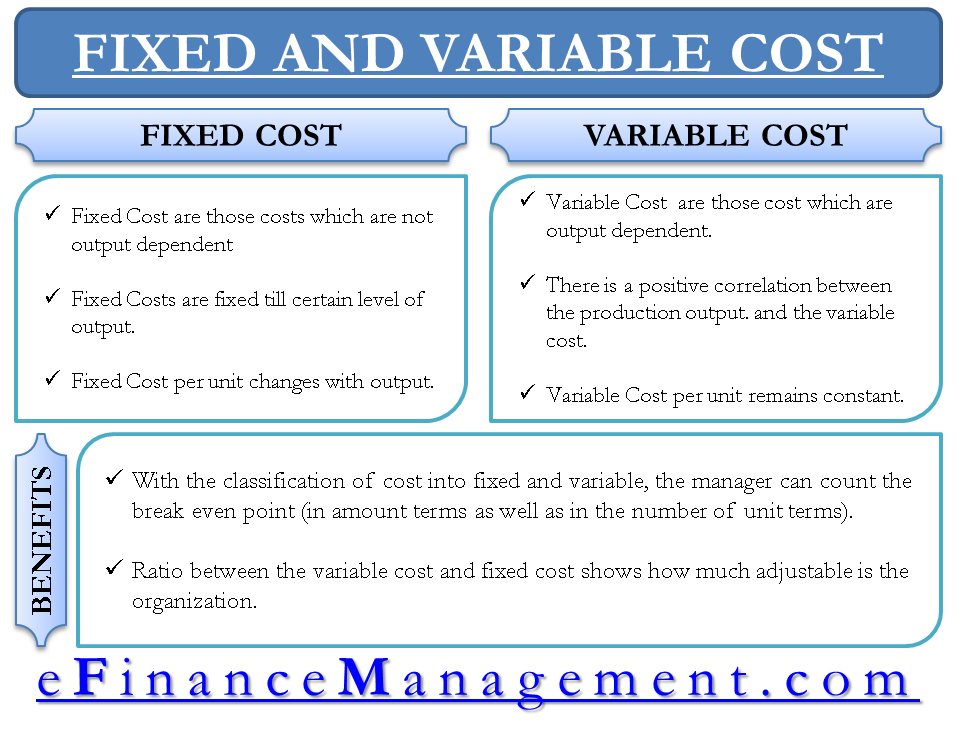

Fixed Costs in Business

Fixed costs are expenses that remain constant regardless of the level of production or sales. They are essential for a business to operate and are not directly tied to the volume of goods or services produced. Understanding fixed costs is crucial for businesses to make informed financial decisions, set realistic budgets, and ensure profitability.

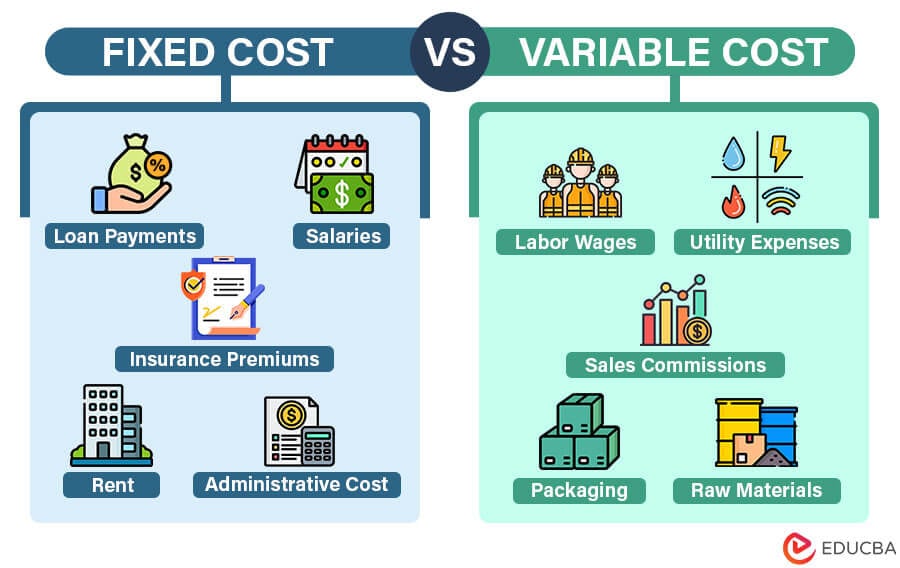

Examples of Fixed Costs in Various Industries

Fixed costs are prevalent across industries, affecting both small and large businesses. Here are some common examples:

- Rent: Businesses that operate in leased spaces have a fixed monthly rent payment, regardless of their sales volume.

- Salaries: Salaries of permanent employees are considered fixed costs, as they remain constant regardless of production levels.

- Insurance: Insurance premiums for property, liability, or health insurance are fixed costs, typically paid on a monthly or annual basis.

- Utilities: Essential utilities like electricity, gas, and water are generally fixed costs, with the exception of variable usage charges.

- Depreciation: The gradual decline in value of assets like machinery and equipment is considered a fixed cost, as it is spread out over the asset’s useful life.

- Interest: Interest payments on loans are fixed costs, as they are calculated based on a predetermined interest rate and loan amount.

- Software Subscriptions: Businesses that rely on software for operations typically pay fixed monthly or annual subscription fees.

Importance of Understanding Fixed Costs for Budgeting and Financial Planning

Understanding fixed costs is critical for businesses to:

- Develop Accurate Budgets: By accurately accounting for fixed costs, businesses can create realistic budgets that reflect their true operating expenses.

- Make Informed Pricing Decisions: Fixed costs are a significant factor in determining the selling price of goods or services. Businesses need to factor in fixed costs to ensure profitability.

- Assess Break-Even Point: The break-even point is the level of sales needed to cover all fixed and variable costs. Understanding fixed costs helps businesses determine their break-even point and make strategic decisions about pricing and sales targets.

- Manage Cash Flow: Fixed costs are predictable and consistent, making it easier for businesses to manage cash flow and ensure they have enough funds to cover their expenses.

- Analyze Profitability: By understanding fixed costs, businesses can calculate their profit margin and assess the profitability of different products or services.

Salary Contracts and Fixed Costs

Salary contracts are an integral part of any business, and understanding their relationship with fixed costs is crucial for effective financial planning and management. While salaries can fluctuate based on factors like performance bonuses or raises, the core contractual obligation of a salary payment remains constant, making it a predictable and reliable expense. This predictability is a defining characteristic of fixed costs.

The Relationship Between Salary Contracts and Fixed Costs

Salary contracts, particularly those with long-term commitments, are considered fixed costs for several reasons. These contracts establish a predetermined and consistent financial obligation for the employer. This means the company knows exactly how much it will need to pay its employees over a specified period, regardless of the company’s performance or changes in business conditions.

Impact of Salary Contracts on a Company’s Cost Structure

Salary contracts significantly impact a company’s overall cost structure. As fixed costs, they create a baseline expense that must be covered regardless of revenue generation. This can affect a company’s profitability, especially during periods of low sales or economic downturns.

The higher the proportion of fixed costs in a company’s overall cost structure, the greater the risk of financial instability during periods of low revenue.

However, fixed costs also offer stability and predictability, enabling companies to plan and budget more effectively. This predictability can be particularly beneficial for long-term projects or businesses with consistent demand.

Understanding the Impact of Salary Contracts

It’s crucial for businesses to carefully consider the impact of salary contracts on their cost structure. This includes analyzing the following:* Contract duration: Long-term contracts create more significant fixed costs, potentially impacting flexibility and adaptability.

Salary levels

Higher salaries contribute to a larger fixed cost burden, requiring higher revenue generation to maintain profitability.

Employee benefits

Benefits such as health insurance, retirement plans, and paid time off add to the overall fixed cost associated with salary contracts.

By carefully managing salary contracts, companies can mitigate the potential risks of high fixed costs while leveraging the benefits of predictable expenses for long-term planning.

Factors Influencing Salary Contract Costs

The cost of salary contracts is influenced by a multitude of factors that can vary significantly depending on the industry, company, and individual employee. These factors are interconnected and often work in tandem to shape the final salary package. Understanding these factors is crucial for both employers and employees in negotiating fair and competitive salary contracts.

Industry Standards

Industry standards play a significant role in determining salary contract costs. Salaries in certain industries are generally higher than others due to factors like skill requirements, demand for talent, and industry profitability. For example, the technology industry often has higher salaries compared to the retail industry.

- High-demand skills: Industries requiring specialized skills, such as software development or data science, tend to offer higher salaries to attract and retain talent.

- Industry profitability: Industries with higher profit margins can afford to pay higher salaries to attract and retain top talent.

- Competition: Industries with intense competition for talent may offer higher salaries to attract the best candidates.

Employee Experience

Employee experience is a key factor influencing salary contract costs. Individuals with more experience and expertise are typically compensated at higher rates. This is because they bring a greater value to the organization, possessing specialized knowledge, skills, and a proven track record.

- Years of experience: Generally, employees with more years of experience command higher salaries, reflecting their accumulated knowledge and skills.

- Education and qualifications: Higher levels of education and relevant qualifications often lead to higher salaries, as they indicate a greater depth of knowledge and skills.

- Previous roles and responsibilities: Individuals with previous roles and responsibilities that demonstrate leadership, problem-solving, or strategic thinking abilities may command higher salaries.

Company Size, Are salary contracts a fixed cost

Company size is another factor that can influence salary contract costs. Larger companies often have more resources and can afford to offer higher salaries to attract and retain top talent. However, smaller companies may offer competitive salaries, especially if they are in high-growth industries or have a strong reputation for innovation.

- Revenue and profitability: Larger companies with higher revenue and profitability can often afford to pay higher salaries.

- Company culture and benefits: Smaller companies may offer competitive salaries and benefits to attract and retain talent, especially if they have a strong company culture or offer unique opportunities for growth and development.

- Industry and location: The industry and location of the company can also influence salary contract costs, regardless of size.

Inflation and Economic Conditions

Inflation and economic conditions can significantly impact salary contract costs. During periods of high inflation, employers may need to increase salaries to keep pace with the rising cost of living. Economic downturns can lead to salary freezes or even reductions, as companies try to cut costs.

- Cost of living adjustments: Some companies offer cost of living adjustments (COLAs) to compensate for inflation and ensure that employees’ purchasing power remains relatively stable.

- Economic growth: During periods of economic growth, companies may be more likely to offer salary increases to attract and retain talent.

- Recessions: During economic downturns, companies may freeze or reduce salaries to cut costs. This can lead to a decrease in purchasing power for employees.

Labor Market Dynamics

Labor market dynamics play a crucial role in determining salary contract costs. Factors like the supply and demand for specific skills, unemployment rates, and government regulations can all influence salary levels.

- Supply and demand: When the demand for a particular skill set is high and the supply of qualified workers is low, employers may need to offer higher salaries to attract and retain talent. Conversely, if the supply of workers exceeds demand, salaries may be lower.

- Unemployment rates: High unemployment rates can lead to lower salaries, as employers have a larger pool of potential candidates to choose from.

- Government regulations: Minimum wage laws, overtime regulations, and other government regulations can impact salary contract costs. For example, minimum wage laws can set a floor for salaries, while overtime regulations can increase the cost of hiring employees who work long hours.

Managing Salary Contract Costs

Managing salary contract costs is crucial for businesses to maintain profitability and remain competitive. It involves implementing strategies that optimize spending on employee compensation while ensuring employee satisfaction and retention.

Negotiating Salary Terms

Negotiating salary terms is a fundamental aspect of managing salary contract costs. By engaging in constructive discussions with potential employees, businesses can reach mutually beneficial agreements that align with both the company’s budget and the employee’s expectations. This process often involves:

- Researching industry benchmarks: Understanding prevailing salary ranges for similar positions within the industry provides a solid foundation for negotiations.

- Evaluating the candidate’s skills and experience: Assessing the candidate’s qualifications and potential contribution to the company allows for a more accurate determination of their worth.

- Considering the company’s budget constraints: Businesses need to balance attracting top talent with their financial limitations.

- Offering competitive benefits packages: Beyond salary, attractive benefits such as health insurance, retirement plans, and paid time off can enhance the overall compensation package.

Implementing Performance-Based Compensation

Performance-based compensation aligns employee compensation with their contributions to the organization’s success. This approach can motivate employees to achieve higher levels of performance, leading to improved productivity and profitability. Here’s how it works:

- Defining clear performance metrics: Establishing measurable goals and objectives allows for the accurate evaluation of individual and team performance.

- Developing performance-based bonus structures: Linking compensation to the achievement of specific performance targets can incentivize employees to strive for excellence.

- Providing regular feedback and recognition: Regular performance reviews and acknowledging employee achievements contribute to a culture of accountability and motivation.

Offering Alternative Benefits

Beyond traditional benefits like health insurance and retirement plans, businesses can explore alternative benefits that cater to employees’ diverse needs and preferences. These can include:

- Flexible work arrangements: Options such as remote work or flexible hours can enhance work-life balance and attract talent seeking greater autonomy.

- Professional development opportunities: Investing in employee training and development can enhance skills and boost career advancement prospects, ultimately increasing employee retention.

- Wellness programs: Initiatives focused on employee well-being, such as fitness programs or stress management workshops, can improve employee health and reduce absenteeism.

The Impact of Salary Contract Costs on Business Decisions: Are Salary Contracts A Fixed Cost

Salary contract costs, a significant expense for any business, exert a substantial influence on various crucial business decisions. Understanding how these costs impact different areas of operation is essential for effective strategic planning and achieving long-term profitability.

The Influence of Salary Contract Costs on Key Business Decisions

Salary contract costs can significantly affect a company’s decisions regarding hiring, investment, and pricing strategies.

- Hiring: When salary contract costs are high, businesses may be more cautious about hiring new employees. They might prioritize hiring only essential personnel, opting for part-time or contract workers instead of full-time employees. This strategy helps to control labor costs and maintain a lean workforce. For example, a startup company with limited funding may prioritize hiring experienced professionals with proven track records to minimize training costs and maximize efficiency.

- Investment: High salary contract costs can limit a company’s ability to invest in new projects, technologies, or expansion. Businesses may prioritize allocating funds to cover existing salary obligations, leaving less room for growth initiatives. For instance, a manufacturing company facing high labor costs might delay the purchase of new equipment or postpone expansion plans to ensure financial stability.

- Pricing: To offset high salary contract costs, businesses may consider raising product or service prices. However, this can affect competitiveness and potentially alienate price-sensitive customers. Companies might instead focus on improving efficiency, reducing operational costs, or exploring alternative pricing models to maintain profitability. A retail company with high employee wages might explore strategies like value-added services, loyalty programs, or targeted promotions to maintain customer engagement and profitability.

The Potential Consequences of High Salary Contract Costs

High salary contract costs can pose challenges to a company’s profitability and competitiveness.

- Reduced Profitability: Elevated salary costs can significantly reduce a company’s profit margins, impacting its overall financial health. Businesses might need to explore cost-cutting measures, increase revenue generation, or adjust their operational strategies to mitigate the impact of high labor costs. For example, a restaurant facing rising minimum wage requirements might need to implement cost-saving measures like streamlining menu options, optimizing staff schedules, or exploring alternative food sourcing options.

- Decreased Competitiveness: High salary contract costs can make it difficult for companies to compete with rivals who have lower labor expenses. Businesses might need to focus on offering higher value propositions, differentiating their products or services, or exploring niche markets to remain competitive. A tech startup with high employee salaries might need to focus on developing innovative products or services, establishing a strong brand identity, or targeting specific customer segments to compete effectively.

In the grand scheme of business operations, salary contracts are a vital component that impacts everything from financial planning to strategic decision-making. By understanding the relationship between salary contracts and fixed costs, businesses can effectively manage their expenses, optimize their workforce, and ultimately achieve their financial goals. As we’ve explored, the key lies in recognizing the predictability and recurring nature of salary contracts, and in implementing strategies that balance cost management with employee satisfaction and retention.

Ultimately, successful businesses are those that navigate the complexities of salary contracts with foresight and a commitment to both financial stability and workforce well-being.

Answers to Common Questions

What are some examples of salary contracts?

Examples of salary contracts include fixed-term contracts (for a specific duration), indefinite contracts (with no set end date), and performance-based contracts (where pay is tied to specific performance metrics).

How can I determine if a salary contract is a fixed cost?

A salary contract is generally considered a fixed cost if it’s for a specific duration, like a year, and the amount is predetermined. However, contracts with performance-based bonuses or raises might be considered semi-variable costs.

What are some strategies for managing salary contract costs?

Strategies include negotiating salary terms, implementing performance-based compensation, offering alternative benefits, and utilizing cost-effective hiring practices.