Are prior year costs included inc completed contract method – Are prior year costs included in the completed contract method? This question unveils a critical aspect of long-term project accounting. Imagine a sprawling construction project, its foundations laid in a previous fiscal year. The completed contract method, a revenue recognition approach where revenue and expenses are recognized only upon project completion, presents unique challenges when dealing with costs incurred before the current accounting period.

Understanding how these prior year costs are handled is crucial for accurate financial reporting and strategic decision-making. This exploration will illuminate the complexities, offering a clear understanding of their integration into the final accounting picture.

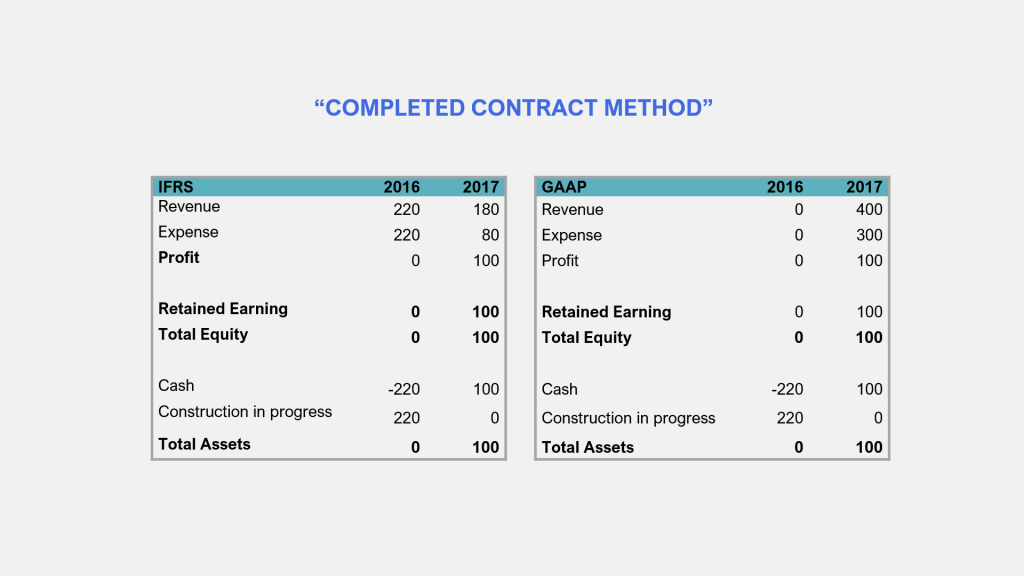

The completed contract method differs significantly from other methods like the percentage-of-completion method. While the latter recognizes revenue and expenses proportionally throughout the project’s lifecycle, the completed contract method defers recognition until the project’s final completion. This deferral impacts the timing of revenue and expense recognition, particularly when dealing with costs incurred in prior years. These costs, accumulated over time, represent a significant investment, and their proper accounting treatment is vital for maintaining financial transparency and regulatory compliance.

We’ll delve into the specific accounting rules, providing examples to clarify the process and its impact on financial statements.

Completed Contract Method Overview

The completed contract method is a revenue recognition method used in accounting. It defers recognizing revenue and associated costs until a project or contract is entirely finished. This approach offers a straightforward way to manage the complexities of long-term projects, especially those with inherent uncertainties. Understanding its principles and limitations is crucial for accurate financial reporting.The completed contract method’s fundamental principle is simple: revenue and expenses are recognized only upon the project’s completion.

This means that throughout the project’s lifecycle, no revenue is recognized, and all costs are accumulated as assets on the balance sheet. Only when the contract is finalized, and all obligations are met, are the revenue and the accumulated costs recognized in the income statement. This approach contrasts sharply with methods that recognize revenue and expenses progressively.

Applicability of the Completed Contract Method

The completed contract method is applicable under specific circumstances. It’s most suitable for projects with significant uncertainty regarding costs or revenue, where the outcome is difficult to predict with accuracy during the project’s execution. The uncertainty should be substantial enough to make the percentage-of-completion method unreliable. Additionally, the project’s duration should be relatively long, making the delay in revenue recognition a significant factor.

Finally, the contract must be legally binding and clearly defined, outlining the scope of work, payment terms, and completion criteria.

Examples of Industries Using the Completed Contract Method

This method is frequently employed in industries characterized by long-term, complex projects with considerable inherent uncertainty. Construction is a prime example; large-scale building projects often involve unpredictable delays, material cost fluctuations, and unforeseen challenges. Shipbuilding, heavy engineering projects (like bridge construction or dam building), and large-scale software development projects also commonly utilize this method. The uncertainty surrounding timelines, material costs, and potential changes in project scope makes it difficult to reliably estimate progress and thus revenue recognition until completion.

Comparison of Revenue Recognition Methods

| Method | Revenue Recognition | Cost Recognition | Applicability |

|---|---|---|---|

| Completed Contract | Upon project completion | Upon project completion | Long-term projects with significant uncertainty |

| Percentage-of-Completion | Proportionally throughout the project | Proportionally throughout the project | Long-term projects with reasonably estimable costs and revenue |

| Installment Sales Method | As cash is received | As expenses are incurred | Sales with significant risk of non-collection |

| Cash Basis | When cash is received | When cash is paid | Small businesses or situations where accrual accounting is impractical |

Cost Recognition under the Completed Contract Method: Are Prior Year Costs Included Inc Completed Contract Method

The completed contract method offers a straightforward approach to recognizing revenue and expenses. Unlike other methods, it defers the recognition of both revenue and costs until the contract is entirely finished. This approach provides a clear picture of project profitability only after completion, eliminating the complexities of interim estimations. This can be particularly useful for long-term projects with significant uncertainties.

Under the completed contract method, costs are accumulated throughout the project’s lifecycle but are not recognized as expenses until the project is deemed complete. This means that all costs, both direct and indirect, are accumulated in a project-specific account until the contract’s completion. Only upon completion are these costs expensed, and the related revenue is recognized. This approach avoids the potential for misrepresentation of project profitability during its progress.

Direct and Indirect Cost Treatment

Direct costs are those directly attributable to a specific contract. These costs are easily traceable and are directly included in the total project costs accumulated for recognition upon completion. Indirect costs, on the other hand, are those that support multiple projects or are not easily attributable to a single contract. These costs, while not directly tied to a specific project, are still necessary for its completion and are included in the overall cost accumulation.

The allocation of indirect costs to specific contracts often follows a pre-determined formula or method, ensuring equitable distribution. For example, a company might allocate overhead based on direct labor hours worked on each project.

Types of Costs Typically Included, Are prior year costs included inc completed contract method

The completed contract method encompasses a wide range of costs. These typically include materials directly used in the project, labor costs specifically assigned to the project, and other direct expenses such as subcontractor fees. Indirect costs such as general and administrative expenses (rent, utilities, salaries of administrative staff), and a portion of marketing costs (if directly related to the specific project), are also included.

Depreciation on equipment used specifically for the project is another example of a cost that is accumulated.

Examples of Costs Typically Excluded

Certain costs are generally excluded under this method. For instance, costs incurred due to unforeseen circumstances like project delays resulting from external factors (e.g., natural disasters, unforeseen regulatory changes) might be separately accounted for and not included in the project’s accumulated costs. Similarly, interest expenses on borrowed funds, unless specifically required by the contract, are usually excluded. Penalties for contract breaches are also typically treated separately and not incorporated into the accumulated project costs.

Cost Accumulation and Recognition Flowchart

The following describes a flowchart illustrating the process:

1. Initiation

A new contract is signed. A separate cost accumulation account is created for this specific contract.

2. Cost Incurrence

Throughout the project’s duration, all direct and indirect costs related to the contract are recorded and added to the designated account. This includes tracking material purchases, labor hours, subcontractor payments, and allocated overhead.

3. Project Completion

The contract is completed and accepted by the client. All costs are finalized and reconciled.

4. Cost Recognition

The total accumulated costs in the project account are recognized as expenses on the income statement. The related revenue from the contract is recognized simultaneously.

5. Account Closure

The project account is closed, transferring the accumulated costs and revenue to the company’s general ledger.

Prior Year Costs and Their Treatment

:max_bytes(150000):strip_icc()/CompletedContractMethod_final-a71253aff470483bb34d9222a9a46969.jpg)

Understanding the treatment of prior year costs is crucial for accurate financial reporting under the completed contract method. This method recognizes revenue and expenses only when a contract is fully completed, meaning that costs incurred in prior years become a significant factor in determining the final profit or loss. Let’s explore how these costs are managed and the implications for financial statements.

Under the completed contract method, costs incurred in prior years are simply carried forward and added to the costs incurred in the current year. These accumulated costs are then matched against the revenue recognized upon project completion. This differs significantly from other methods, such as the percentage-of-completion method, which recognizes revenue and expenses proportionally throughout the project’s life.

Therefore, the impact of prior year costs is fully realized only at the end of the contract.

Handling Prior Year Costs in Multi-Year Contracts

For contracts spanning multiple years, the accounting treatment remains consistent. All costs, regardless of when they were incurred, are accumulated until the contract is completed. This includes direct materials, direct labor, and overhead costs. The company maintains a detailed record of all costs associated with the contract, irrespective of the fiscal year in which they were incurred.

This cumulative cost figure is then used to calculate the profit or loss upon completion. Imagine a construction project started in 2022 and completed in 2024. Costs from 2022 and 2023 would be added to 2024 costs before calculating the final profit or loss in 2024.

Comparison with Other Cost Accounting Methods

The completed contract method’s treatment of prior year costs contrasts sharply with other methods. The percentage-of-completion method, for example, recognizes revenue and expenses proportionally throughout the project. Prior year costs are thus incorporated into the financial statements gradually as the project progresses. Similarly, the installment method recognizes revenue as payments are received, spreading the recognition of expenses over the payment period.

In contrast, the completed contract method delays recognition until project completion, resulting in a potentially volatile fluctuation in profitability from year to year.

Examples of Prior Year Costs’ Impact on Financial Statements

Let’s consider a hypothetical construction project with a contract value of $1,000,000. Costs incurred in year 1 were $300,000, and costs incurred in year 2 were $400,000. Under the completed contract method, the total cost of $700,000 would be recorded as an expense only in year 2 (assuming completion in year 2), resulting in a profit of $300,000 ($1,000,000 – $700,000).

If the project had instead been completed in year 3, with additional costs of $100,000 incurred in that year, the total cost would be $800,000, resulting in a profit of $200,000 in year 3. This demonstrates how prior year costs impact the profitability reported in the year of completion.

Potential Issues Related to Prior Year Cost Accounting

Accurate tracking and allocation of costs across multiple years is paramount. Several potential issues can arise:

Maintaining detailed and accurate cost records across multiple years is essential for proper application of the completed contract method. Inaccurate or incomplete records can lead to misstated financial results upon project completion.

- Inaccurate cost allocation: Incorrect assignment of costs to specific contracts can distort profitability.

- Difficulty in estimating costs: If cost estimates are inaccurate at the outset, it can lead to unexpected losses or gains upon project completion.

- Risk of losses being deferred: If a project is significantly unprofitable, the losses are only recognized at the end, potentially impacting financial stability.

- Challenges in forecasting profitability: The deferred recognition of revenue and expenses makes it difficult to predict profitability in the short term.

Impact on Financial Statements

Understanding how prior year costs impact financial statements under the completed contract method is crucial for accurate financial reporting. The inclusion or exclusion of these costs significantly alters the presentation of financial performance and position, potentially influencing key decision-making processes for stakeholders. This section will detail the effects on the income statement and balance sheet, along with their implications for common financial ratios.

Income Statement Impact

The completed contract method recognizes revenue and expenses only upon project completion. Including prior-year costs defers their recognition until the project’s conclusion. This means that the income statement will show a lower net income in the year the costs are incurred (if they are not recognized) and a higher net income in the year of completion (when they are recognized along with the revenue).

Conversely, excluding prior-year costs from the year of completion would result in a lower net income that year. This deferral can significantly impact the year-to-year comparability of financial performance, especially for companies with long-term projects. For instance, a construction company might report a loss in a year if prior year costs are not included, only to show a substantial profit in the completion year when they are finally recognized.

Balance Sheet Impact

The balance sheet reflects the financial position of a company at a specific point in time. The inclusion of prior-year costs under the completed contract method impacts the balance sheet by increasing the value of work-in-progress (WIP) assets. This increases current assets until the project is complete. Once the project is completed, the WIP asset is reduced, and the related revenue and expenses are recognized.

Conversely, excluding prior-year costs would result in a lower WIP asset balance. This difference in WIP can affect the company’s current ratio and working capital, which are important indicators of liquidity and short-term financial health.

Impact on Financial Ratios

The inclusion or exclusion of prior-year costs directly affects several key financial ratios. For example, the gross profit margin (Gross Profit / Revenue) will be lower in the year of completion if prior-year costs are included, as the revenue is spread over multiple years, whereas the gross profit is recognized only at the end. Similarly, the return on assets (Net Income / Total Assets) will also be affected, as both net income and total assets are impacted by the treatment of prior-year costs.

The current ratio (Current Assets / Current Liabilities) might increase temporarily due to higher WIP assets if prior-year costs are included, but this effect will be reversed upon project completion.

Illustrative Example

Let’s consider a hypothetical construction contract with total costs of $1,000,000, completed over two years. $400,000 in costs were incurred in year 1 and $600,000 in year 2. The contract revenue is $1,200,000.

| Metric | With Prior Year Costs | Without Prior Year Costs | Difference |

|---|---|---|---|

| Year 1 Net Income | $0 | $0 | $0 |

| Year 2 Net Income | $200,000 ($1,200,000 – $1,000,000) | $200,000 ($1,200,000 – $1,000,000) | $0 |

| Year 1 WIP | $400,000 | $0 | $400,000 |

| Year 2 WIP | $0 | $0 | $0 |

| Year 2 Gross Profit Margin | 16.7% ($200,000/$1,200,000) | 16.7% ($200,000/$1,200,000) | 0% |

Potential Issues and Considerations

The completed contract method, while seemingly straightforward, presents unique challenges when incorporating prior year costs. Accurate cost accounting and meticulous record-keeping are paramount to avoid significant financial reporting errors and potential audit issues. Understanding these potential pitfalls is crucial for ensuring the financial health and stability of a project and the organization as a whole.Accurate Cost Tracking and Allocation is EssentialPrecise cost tracking and allocation are fundamental to the successful application of the completed contract method.

Any inaccuracies can lead to material misstatements in the financial statements, impacting profitability and potentially misleading investors and stakeholders. This requires a robust system capable of differentiating between direct and indirect costs, properly assigning costs to specific projects, and maintaining a detailed audit trail for all transactions. Without this level of precision, the reliability of the financial reporting is significantly compromised.

For example, failure to accurately track labor hours or material usage could lead to an understatement or overstatement of project costs, ultimately affecting the reported profit margin.

Implications of Cost Recognition Errors

Errors in cost recognition under the completed contract method can have far-reaching consequences. Overstating costs can artificially deflate reported profits, potentially misleading investors and affecting the company’s creditworthiness. Conversely, understating costs can inflate profits, leading to inaccurate financial projections and potentially impacting future investment decisions. Such errors can also lead to disputes with clients, particularly if the contract includes performance-based incentives tied to cost overruns or under-runs.

For instance, a construction company that underestimates the costs associated with material procurement might find itself significantly under budget, leading to a reduction in profit margins and possibly financial instability.

Best Practices for Cost Management and Reporting

Implementing best practices is crucial for mitigating the risks associated with prior year cost inclusion. This involves establishing a clear and comprehensive cost accounting system that adheres to generally accepted accounting principles (GAAP) or International Financial Reporting Standards (IFRS). Regular reconciliation of costs against budgets is vital, along with timely identification and investigation of any significant variances. Furthermore, strong internal controls, including segregation of duties and regular audits, should be implemented to prevent and detect errors.

The use of project management software capable of detailed cost tracking and reporting can significantly enhance the accuracy and efficiency of the process.

Potential Audit Concerns

Auditors will scrutinize the treatment of prior year costs under the completed contract method. Key areas of concern include the completeness and accuracy of cost records, the appropriate allocation of costs to specific projects, and the consistency of accounting practices over time. The auditor will assess the adequacy of the internal controls designed to prevent and detect errors.

They will also pay close attention to the justification for any significant adjustments made to prior year costs. Failure to adequately document and justify such adjustments could lead to significant audit findings and potential restatements of financial statements. For example, an auditor might question the inclusion of certain costs if they are deemed to be immaterial or if proper documentation supporting their allocation to the specific project is lacking.

Illustrative Example

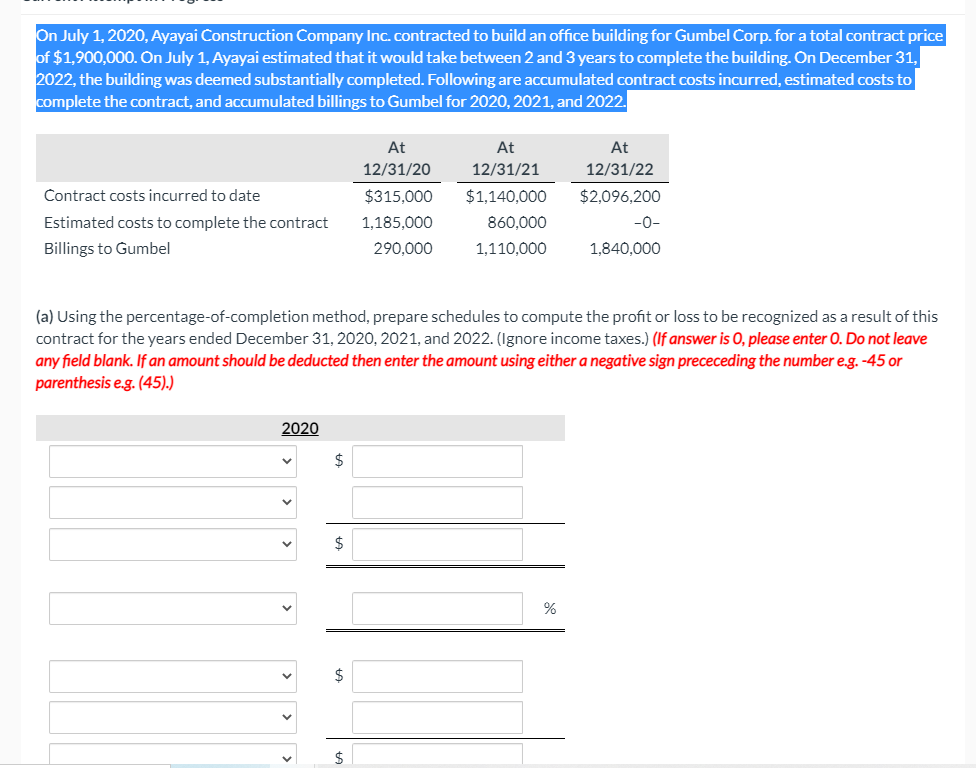

Let’s consider a construction company undertaking a large-scale project, a new office building, contracted over three years. This example will illustrate how costs are accounted for under the completed contract method, with a focus on the treatment of prior-year costs. We’ll walk through each year, detailing costs and profit recognition.

Project Costs and Revenue

The total contract price for the office building is $10,000,000. The project is expected to take three years to complete. The following table Artikels the costs incurred each year. Note that under the completed contract method, no profit or loss is recognized until the project is complete. All costs are accumulated until the project’s finalization.

| Year | Direct Costs | Indirect Costs | Total Costs |

|---|---|---|---|

| Year 1 | $2,500,000 | $500,000 | $3,000,000 |

| Year 2 | $3,000,000 | $600,000 | $3,600,000 |

| Year 3 | $2,000,000 | $400,000 | $2,400,000 |

Mastering the complexities of the completed contract method, especially concerning prior year costs, is paramount for accurate financial reporting. We’ve journeyed through the intricacies of cost recognition, exploring the accounting treatment of costs incurred across multiple years. Understanding how these costs influence financial statements—the income statement, balance sheet, and key financial ratios—is crucial. By carefully tracking and allocating costs, adhering to best practices, and being mindful of potential audit concerns, businesses can navigate the challenges of this accounting method and present a true and fair view of their financial performance.

The impact of correctly accounting for these prior-year costs directly influences the bottom line and provides a clearer picture of the project’s overall profitability.

FAQ Resource

What happens if a contract is terminated before completion under the completed contract method?

Revenue and expenses are recognized at the point of termination, reflecting the work completed to date. Any losses are recognized immediately.

How are changes in estimates of costs handled under the completed contract method?

Changes in cost estimates are typically recognized in the period the change is discovered. This can impact the final profit or loss recognized upon completion.

Can prior year costs be capitalized under the completed contract method?

Yes, prior year costs are generally included as part of the total project costs and are expensed only upon project completion.

Are there any specific industry regulations that impact the application of the completed contract method?

Yes, specific industry regulations may exist. Consult relevant accounting standards and industry-specific guidance for detailed requirements.