Does verizon no contract plans include taxes and fees – Does Verizon no-contract plans include taxes and fees? This is a crucial question for anyone considering switching to a flexible wireless plan. Understanding the true cost of a Verizon no-contract plan requires careful examination of the base price, plus the often-overlooked additions of taxes and various fees. This exploration will illuminate the pricing structure, allowing you to make an informed decision that aligns with your budget and needs.

We’ll delve into the specifics of Verizon’s billing practices, comparing no-contract plans to their contract counterparts and highlighting the impact of location on your final bill.

Navigating the world of wireless plans can feel overwhelming, but with clarity and understanding, you can choose the option that best suits your financial situation. We will unpack the intricacies of Verizon’s pricing, offering practical examples and a transparent view of what you can expect to pay. By the end of this exploration, you’ll be empowered to make a confident choice, free from hidden costs and unexpected surprises.

Verizon No-Contract Plan Pricing Structure

Understanding Verizon’s no-contract plan pricing is crucial for choosing a plan that fits your budget. The pricing isn’t simply a flat monthly fee; several components contribute to the total cost. This includes the base plan price, various add-ons, taxes, and regulatory fees. Let’s break down each element.

Components of Verizon No-Contract Plan Pricing

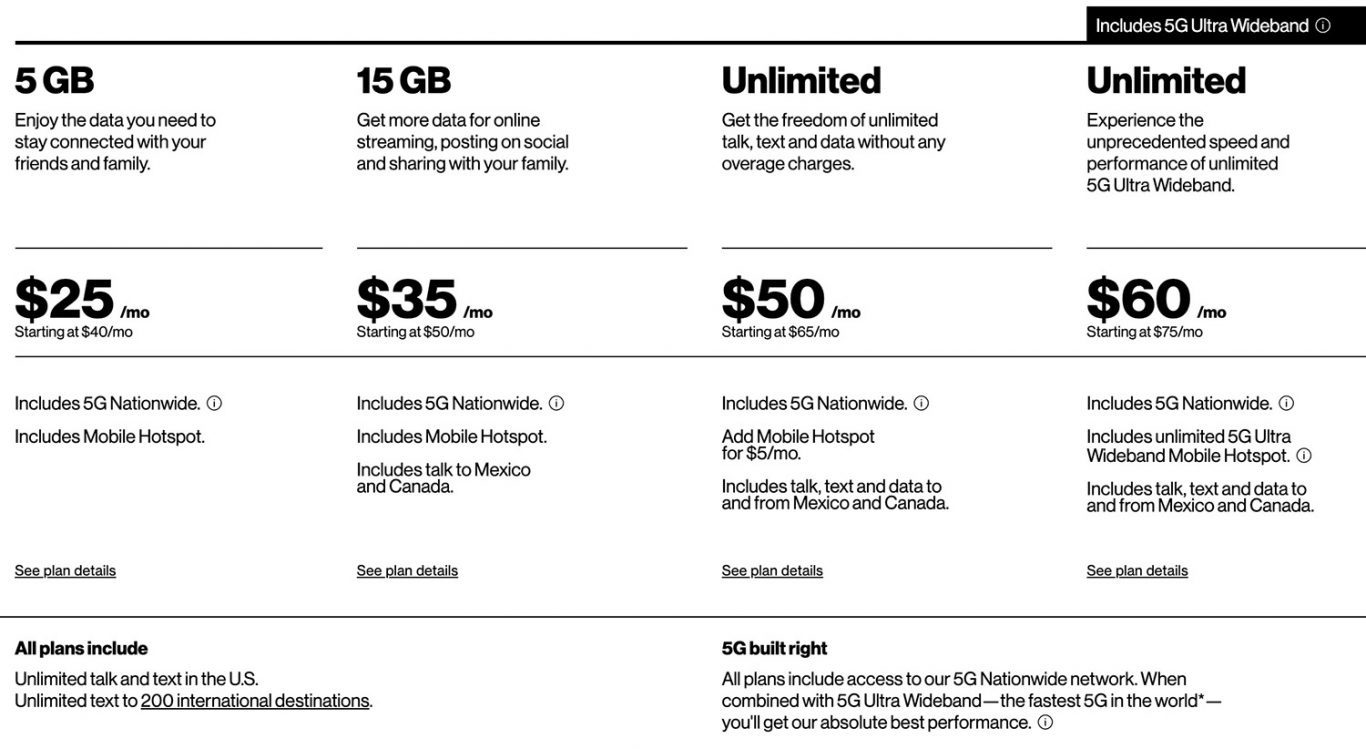

Verizon’s no-contract plans consist of a base price, which depends on the amount of data, 5G access, and other features included. Additional services, like international calling or extra data, increase the base price. Taxes and government-imposed regulatory fees are added on top of the base price and any add-ons. These taxes and fees vary by location. Finally, autopay discounts, if applicable, are subtracted from the total before the final bill is generated.

Taxes and Fees Calculation

Taxes and fees are calculated as a percentage of the base plan price plus any add-on charges. The exact percentage varies depending on your location and the specific services you’ve chosen. For instance, sales tax is generally calculated based on your state’s rate, while regulatory fees are set by federal and state governments. These charges are not included in the advertised plan price, so it’s essential to factor them into your budget.

Examples of Verizon No-Contract Plans and Costs, Does verizon no contract plans include taxes and fees

To illustrate, let’s consider a few hypothetical examples. These are for illustrative purposes only and may not reflect current Verizon pricing. Always check the Verizon website for the most up-to-date information.

| Plan Name | Base Price | Taxes & Fees | Total Price |

|---|---|---|---|

| Start Unlimited | $70 | $10 | $80 |

| Play More Unlimited | $80 | $12 | $92 |

| Do More Unlimited | $90 | $14 | $104 |

| Get More Unlimited | $100 | $15 | $115 |

Note: These are simplified examples. Actual taxes and fees can vary significantly based on your location and selected add-ons.

Comparison with Contract Plans

Choosing between a Verizon no-contract plan and a contract plan involves carefully weighing the long-term costs. While no-contract plans offer flexibility, contract plans often present lower monthly payments initially. This comparison will help you understand the financial implications of each choice over a two-year period.Let’s analyze the total cost of each plan type, factoring in the base price, taxes, and fees.

We’ll use a hypothetical example to illustrate the differences.

Two-Year Cost Comparison: No-Contract vs. Contract

We’ll compare a hypothetical no-contract plan with a comparable contract plan. Assume a no-contract plan costs $70 per month, while a comparable contract plan has a monthly base price of $50. Both plans include the same data allowance and features. Remember that taxes and fees vary by location, so we’ll use an estimated 15% for this example.

| Plan Type | Monthly Base Price | Estimated Monthly Taxes & Fees (15%) | Total Monthly Cost | Total Cost Over Two Years | Pros | Cons |

|---|---|---|---|---|---|---|

| No-Contract Plan | $70 | $10.50 | $80.50 | $1932 | Flexibility, no early termination fees | Higher monthly cost |

| Contract Plan | $50 | $7.50 | $57.50 | $1380 | Lower monthly cost | Less flexibility, potential early termination fees |

This table demonstrates that, in this hypothetical scenario, the contract plan results in lower total cost over two years. However, the no-contract plan offers greater flexibility. The specific cost difference will vary based on the chosen plans and your location’s taxes and fees. It’s crucial to check Verizon’s current pricing and add your local taxes and fees for an accurate comparison tailored to your situation.

For instance, a higher data allowance on either plan will increase the base price and thus the overall cost. Similarly, a lower tax rate in your area would decrease the overall cost for both plans.

Cost Breakdown: A Detailed Look

To further illustrate, let’s break down the cost components for each plan type over a single month:

| Cost Component | No-Contract Plan | Contract Plan |

|---|---|---|

| Base Plan Price | $70 | $50 |

| Taxes | $7 (example) | $5 (example) |

| Fees | $3.50 (example) | $2.50 (example) |

| Total Monthly Cost | $80.50 | $57.50 |

Note: These tax and fee amounts are examples only and will vary depending on your location and specific plan. Always check Verizon’s website or contact customer service for the most up-to-date pricing in your area.

Understanding Verizon’s Fee Breakdown

So you’ve chosen a Verizon no-contract plan, thinking you’re getting a straightforward price. While the advertised price is a good starting point, it’s crucial to understand that several additional fees can significantly impact your final bill. Let’s break down the common charges you might encounter.Verizon, like other carriers, adds various fees beyond the base plan cost. These aren’t always clearly advertised upfront, so it’s essential to understand what to expect.

Knowing these fees helps you budget accurately and avoid unexpected charges.

Regulatory Fees

Regulatory fees cover costs associated with government mandates and compliance. These fees are passed on to consumers and are typically not negotiable. They fund various government programs related to telecommunications. The exact amount varies by location and can change over time. For example, a state might impose a specific fee to support emergency services or universal service funds.

These fees are often shown separately on your bill.

Administrative Fees

Administrative fees cover the costs associated with managing your account. These might include charges for account maintenance, billing, and customer service. While these fees are generally smaller than regulatory fees, they still contribute to your overall monthly expense. For instance, a fee might be applied for processing a payment outside of the standard methods.

Miscellaneous Charges

This category encompasses various other fees that might arise depending on your usage and plan specifics. Examples include charges for international calls, roaming fees (if applicable), and potentially fees for add-on services. If you use your phone extensively for international travel, you might find this section of your bill to be substantial. Similarly, if you choose to add features like extra data or a premium messaging service, you will see these charges here.

- Regulatory Fees: Government-mandated charges supporting telecommunications programs. Impact: Adds a fixed amount to your monthly bill, varying by location.

- Administrative Fees: Costs associated with account management and billing. Impact: A small, usually fixed, addition to your monthly bill.

- Miscellaneous Charges: Fees for add-on services, international calls, roaming, etc. Impact: Variable costs depending on your usage and chosen services; can significantly increase your bill if you utilize these features.

Impact of Location on Pricing

Your Verizon no-contract plan’s final price isn’t just determined by the plan itself; your location plays a significant role, impacting the taxes and fees you’ll pay. These variations stem from differences in state and local regulations, resulting in a range of final costs depending on where you live.Understanding these regional differences is crucial for budgeting accurately. Taxes, in particular, can vary wildly across the country, adding a substantial amount to your monthly bill.

Local regulations also influence the types and amounts of fees you might encounter.

State and Regional Tax Variations

State sales taxes are the primary driver of pricing differences. These taxes, levied on the service itself, differ greatly from state to state. For example, a state with a high sales tax rate, like California, will result in a higher final bill compared to a state with a lower rate, like Alaska. Additionally, some localities add their own local taxes on top of the state sales tax, further increasing the cost.

This means that even within a single state, you could see variations in pricing based on your city or county.

Influence of Local Regulations on Pricing

Beyond sales taxes, local regulations can impact pricing in several ways. For instance, some municipalities may impose additional fees to support specific local initiatives or infrastructure projects. These fees, which are often not directly related to the service itself, can add a few dollars to your monthly bill. Furthermore, certain areas may have stricter regulations concerning infrastructure, potentially leading to higher operational costs for Verizon, which could indirectly influence pricing.

For example, areas with stringent environmental regulations might lead to higher expenses for Verizon in maintaining its infrastructure.

Illustrative Tax Map

Imagine a map of the United States. The states are color-coded to represent the total taxes and fees associated with a standard Verizon no-contract plan. States like Alaska, Delaware, and Montana are shaded in a light green, indicating lower overall taxes and fees. In contrast, states like California, New York, and Illinois are shown in a darker shade of red, representing higher tax burdens.

The map also shows subtle variations within states, with some counties or cities depicted in slightly lighter or darker shades to reflect local tax differences. For instance, within California, some coastal areas might be a slightly darker red than inland areas, representing potentially higher local taxes. This visual representation highlights the significant geographic disparities in pricing.

Transparency in Verizon’s Billing Practices: Does Verizon No Contract Plans Include Taxes And Fees

Understanding Verizon’s billing practices is crucial for managing your monthly expenses effectively. Verizon aims for transparency, but navigating the details of taxes and fees can still be challenging. This section clarifies how Verizon presents pricing information and how you can easily calculate your total monthly cost.Verizon presents its pricing information primarily online, through its website and app. They showcase plan options with their base prices prominently displayed.

However, the crucial detail of taxes and fees is often presented separately, requiring a closer look. This separation can be misleading if you’re not aware of the additional costs involved. It’s important to note that Verizon’s commitment to transparency is a work in progress, and while improvements have been made, the process can still be confusing for some customers.

Verizon’s Pricing Information Presentation

Verizon’s website and app usually display the base price of a plan clearly. However, the presentation of taxes and fees requires more attention. Often, a small asterisk or footnote directs you to a separate section detailing these additional charges. This section typically lists the applicable taxes based on your location and any regulatory fees. It’s vital to carefully review this supplemental information to understand the complete cost before committing to a plan.

The detailed breakdown of these fees often appears later in the signup process or within the plan’s terms and conditions.

Determining Total Plan Cost

To determine the total cost of a Verizon no-contract plan before signing up, you must actively seek out the tax and fee information. This usually involves clicking on a small asterisk or link next to the base price, or navigating to a separate “fees and taxes” section. Once you locate this information, add the listed taxes and fees to the advertised base price to get the accurate total monthly cost.

Remember that the total cost can vary depending on your location, as local and state taxes differ. Use the online plan comparison tools on Verizon’s website, inputting your address, to obtain a personalized estimate.

Examples of Verizon Billing Statements

While specific billing statement formats can change, a typical Verizon bill will generally have a clear section detailing charges. This section would typically list the base plan price, followed by separate lines for federal, state, and local taxes. Regulatory fees, such as those related to universal service funds, would also be itemized separately. A summary section at the bottom usually provides the total amount due.

The placement of these items may vary slightly depending on the billing cycle and the specific plan. For example, a line item might read “State Sales Tax: $5.00” or “Federal Universal Service Fee: $2.50”. These items are clearly labeled and added to the base plan price to arrive at the final total.

Ultimately, understanding the total cost of a Verizon no-contract plan—including taxes and fees—is paramount to making a wise financial decision. While the initial price might seem attractive, remember to factor in all associated costs. By carefully comparing plans, understanding the fee breakdown, and acknowledging the influence of location, you can confidently select a plan that meets your needs without financial strain.

Embrace the power of informed choices, and navigate the world of wireless plans with clarity and peace of mind.

Questions and Answers

What types of taxes are included in Verizon’s no-contract plans?

Sales tax, which varies by state and local jurisdiction, is typically included. There may also be other regulatory or government-mandated taxes.

Can I negotiate the fees on my Verizon no-contract plan?

Negotiating fees on no-contract plans is generally more difficult than with contract plans. However, contacting customer service to inquire about potential discounts or promotions is always worthwhile.

How often does Verizon update its pricing and fee structures?

Verizon’s pricing and fee structures can change periodically. It’s essential to review your plan details regularly to stay informed about any updates.

Does Verizon offer any discounts for no-contract plans?

Verizon occasionally offers discounts or promotions on no-contract plans, particularly for bundling services or for specific customer groups (e.g., students, military).