How do I account for year 3 in contract costing? This question often arises in long-term projects, where the third year presents unique challenges. It’s a crucial point in the project lifecycle, often marked by shifts in project scope, resource allocation, and risk profiles. Understanding how contract terms, potential variations, and evolving project needs impact cost accounting during this phase is essential for accurate financial reporting and successful project completion.

This exploration will delve into the intricacies of managing costs during year three, equipping you with the knowledge and strategies for navigating this critical period effectively.

We will examine practical budgeting techniques for year three, considering potential cost overruns and unforeseen circumstances. We’ll discuss methods for forecasting revenue and expenses, and explore the procedures for handling contract modifications and change orders. The importance of robust progress measurement and reporting, including key performance indicators (KPIs), will be highlighted, along with effective risk management and contingency planning strategies.

Finally, we will analyze year-end reporting and reconciliation processes, comparing year three’s performance to previous years to identify trends and areas for improvement.

Understanding Year 3 in Contract Costing

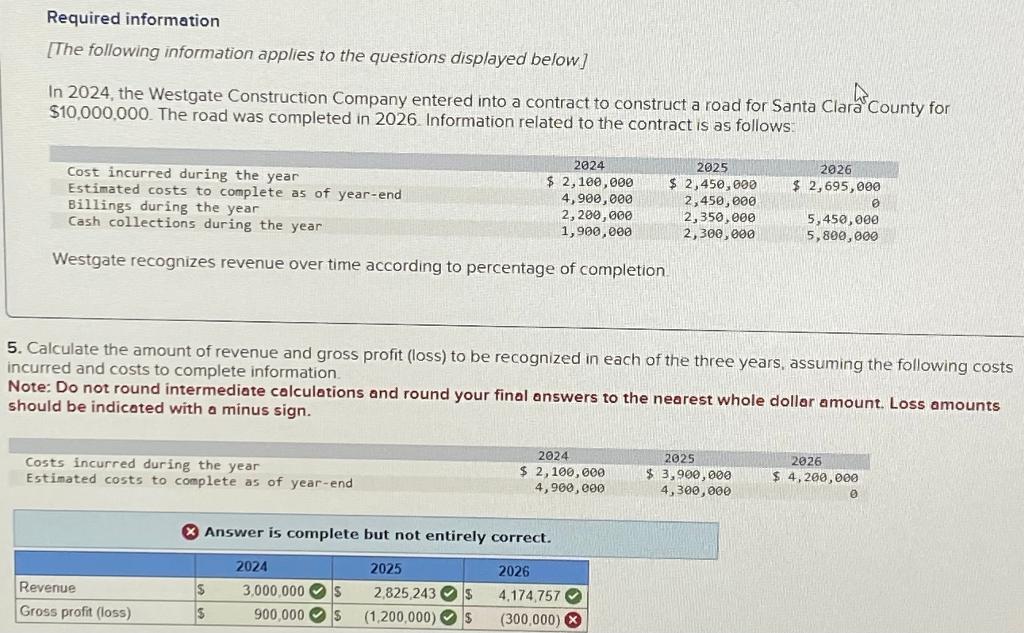

Year 3 of a long-term contract often represents a critical juncture in a project’s lifecycle. Unlike the initial phases focused on mobilization and early-stage execution, year 3 typically sees a shift towards sustained production, increased complexity, and heightened scrutiny of performance against contractual obligations. Understanding the unique financial and operational dynamics of this period is crucial for accurate cost accounting and effective project management.Project Characteristics in Year 3Year 3 is characterized by a transition from initial project setup to a more mature operational phase.

The initial uncertainties and learning curves of the first two years have largely been overcome, leading to a more predictable workflow. However, this stability is often offset by new challenges. Resource allocation may shift from initial development and infrastructure to ongoing maintenance and potential expansion activities. This phase might also reveal unforeseen complexities or hidden costs not initially accounted for in the project’s initial budget.

For example, a large-scale construction project might see a significant increase in labor costs in year 3 as the project moves from foundation work to intricate finishing and installation phases, necessitating specialized skilled labor. Similarly, a software development project might experience increased costs in year 3 due to the complexity of integrating various modules and conducting rigorous testing before release.

Project Scope Changes and Resource Allocation in Year 3

Changes in project scope are common in year 3, often driven by evolving client needs, technological advancements, or unforeseen circumstances. These changes can significantly impact resource allocation, requiring adjustments to budgets and timelines. For instance, a client might request additional features or functionalities in a software development project, necessitating the allocation of more developer time and potentially leading to cost overruns if not properly managed through change orders and contract amendments.

In contrast, a construction project might encounter unexpected geological challenges, requiring additional engineering and remediation work, impacting resource allocation and potentially increasing the overall project cost. Effective change management processes are critical in mitigating the financial consequences of such alterations.

Risk Factors and Mitigation Strategies in Year 3

Year 3 often presents a heightened exposure to various risks. While some risks might have been identified and mitigated in earlier years, new risks may emerge due to project complexity, prolonged duration, or external factors. These risks can range from cost overruns due to material price increases to delays caused by unforeseen supply chain disruptions. For example, a manufacturing project might face significant risk due to fluctuating raw material prices in year 3, potentially necessitating adjustments in procurement strategies and cost estimations.

Effective risk management involves proactive identification, assessment, and mitigation of potential risks through contingency planning, insurance coverage, and robust communication channels.

Contractual Influence on Year 3 Cost Accounting

Contract terms and conditions play a significant role in shaping the cost accounting practices in year 3. Payment schedules, change order procedures, and dispute resolution mechanisms defined in the contract directly impact how costs are recognized and accounted for. For example, a contract might stipulate specific payment milestones tied to the completion of certain deliverables. Failure to meet these milestones could delay payments, impacting cash flow and potentially necessitating adjustments to the project’s financial projections.

Similarly, the contract might Artikel a detailed process for handling change orders, specifying how additional costs incurred due to scope changes will be evaluated and approved. Accurate tracking and documentation of all changes are crucial for ensuring compliance with contractual obligations and avoiding disputes.

Cost Estimation and Budgeting for Year 3

Accurately forecasting costs for the third year of a contract is crucial for successful project completion. This involves a detailed analysis of historical data from the previous two years, a thorough understanding of the remaining scope of work, and a robust contingency plan to account for potential unforeseen issues. The process requires a blend of meticulous record-keeping, predictive modeling, and informed decision-making.Accurate cost estimation and budgeting are essential for maintaining profitability and avoiding financial setbacks.

The third year often presents unique challenges, as initial uncertainties have been largely resolved, but new complexities might arise. Therefore, a rigorous approach, combining bottom-up and top-down budgeting techniques, is highly recommended.

Direct Cost Breakdown for Year 3

Direct costs represent the expenses directly attributable to the project’s deliverables. For example, in a construction project, these would include the cost of materials, labor directly involved in construction, and specialized equipment rentals. In software development, this might encompass programmer salaries, specific software licenses, and cloud computing resources directly used for the project. A detailed breakdown allows for granular control and efficient resource allocation.

For a hypothetical large-scale software project, direct costs might be allocated as follows: 60% for personnel (salaries, benefits, and bonuses), 25% for software and cloud services, and 15% for specialized hardware and travel. This allocation can be further refined based on specific tasks and deliverables within the project’s scope.

Indirect Cost Allocation for Year 3

Indirect costs, unlike direct costs, are not directly tied to specific deliverables. These are overhead costs necessary for the project’s overall functioning. Examples include administrative salaries, rent for office space, utilities, and insurance. Accurate allocation of indirect costs is vital for a comprehensive budget. One common method is to allocate indirect costs based on a percentage of direct costs.

For instance, if the estimated indirect costs are 10% of the direct costs, a project with $1 million in direct costs would allocate $100,000 for indirect costs. Alternatively, a more sophisticated activity-based costing method might assign indirect costs based on the specific resources consumed by different project tasks. For example, a project requiring more administrative support would incur a higher allocation of administrative overhead.

Revenue Forecasting for Year 3

Forecasting revenue for the third year involves analyzing contract terms, considering the progress made in the previous years, and assessing the likelihood of potential delays or changes in scope. This involves considering both the fixed and variable components of the revenue stream. For example, a fixed-price contract will have a predictable revenue stream, while a time-and-materials contract requires a more nuanced forecast based on projected labor hours and material usage.

Historical data on project completion rates from similar projects can provide valuable insights for more accurate revenue projections. Consider a construction project with a total contract value of $5 million. If 60% of the work was completed in the first two years, the remaining 40% (equivalent to $2 million) would be the target revenue for the third year.

However, this needs adjustment to account for potential cost overruns or delays.

Contingency Planning and Risk Management for Year 3

Unforeseen circumstances, such as material shortages, unexpected technical difficulties, or changes in regulatory requirements, can significantly impact project costs. Building a contingency plan is paramount. This involves identifying potential risks, assessing their likelihood and potential impact, and allocating funds to mitigate those risks. For instance, a contingency of 5-10% of the total estimated cost is a common practice in many industries.

This buffer can absorb unexpected expenses without jeopardizing the project’s financial stability. The contingency plan should be regularly reviewed and updated as the project progresses, incorporating lessons learned and adapting to evolving circumstances. For example, if the project experiences an unexpected delay in obtaining a necessary permit, the contingency fund can cover the additional costs associated with the delay.

Accounting for Variations and Changes in Year 3

Contract costing, even with meticulous initial planning, rarely unfolds exactly as predicted. Year 3, often a period of significant progress and potential challenges, frequently necessitates adjustments due to unforeseen circumstances, client requests, or design modifications. Effectively managing these variations is crucial for maintaining project profitability and client satisfaction. This section details the procedures for handling such changes and their impact on the project budget.

Handling contract modifications and change orders requires a systematic approach. This involves clear documentation, prompt communication, and rigorous cost analysis. Each change order should be formally documented, including a detailed description of the alteration, its justification, and the associated cost implications. This ensures transparency and minimizes disputes.

Contract Modification Procedures

The process typically begins with a formal request from the client outlining the desired change. This request is then reviewed by the project team, who assess the technical feasibility, potential impact on the project timeline, and associated costs. A detailed cost analysis is performed, factoring in material costs, labor, equipment usage, and any potential indirect costs. This analysis forms the basis for a revised budget and a formal change order, which is presented to the client for approval.

Once approved, the change order becomes a legally binding amendment to the original contract, with the revised budget and timeline integrated into the project management system.

Cost Impacts of Variations, How do i account for year 3 in contract costing

Variations can significantly impact project costs, either positively or negatively. For example, a reduction in scope might lead to cost savings, while additions or significant design changes can inflate costs substantially. Accurate accounting for these impacts is essential for maintaining financial control. The impact should be meticulously calculated, detailing both direct and indirect costs. Direct costs encompass materials, labor, and equipment directly related to the change.

Indirect costs might include administrative overhead, project management adjustments, and potential delays impacting other aspects of the project. Failing to account for these indirect costs can lead to significant budget overruns. For instance, a seemingly minor change requiring specialized equipment might lead to significant rental costs and potential delays, impacting the overall project timeline and budget.

Budget and Cost Estimate Adjustments

Once the cost impact of a variation is determined, the project budget and cost estimates must be adjusted accordingly. This involves updating the cost breakdown structure (CBS) to reflect the changes, revising the project schedule, and potentially negotiating revised payment terms with the client. The revised budget should be thoroughly documented and approved by relevant stakeholders to ensure transparency and accountability.

Regular monitoring and reporting of the adjusted budget are essential to ensure the project remains on track. Sophisticated project management software can automate many of these processes, simplifying budget tracking and facilitating timely reporting of variances.

Change Order Tracking Table

Maintaining a detailed record of all change orders is vital for effective project management and financial control. The table below demonstrates a sample format for tracking change orders, highlighting key information for each modification.

| Change Order Number | Description of Change | Cost Impact | Date Implemented |

|---|---|---|---|

| CO-12345 | Addition of a new feature to the software application as per client request. This involved additional coding, testing, and documentation. | +$15,000 | 2024-03-15 |

| CO-67890 | Revised material specifications due to supplier shortages. Substitution with an alternative material resulted in a minor cost increase. | +$500 | 2024-05-20 |

| CO-13579 | Reduction in scope: Client decided to eliminate a less critical component. | -$3,000 | 2024-07-10 |

Progress Measurement and Reporting in Year 3

Effective progress measurement and reporting are crucial for successful contract completion. Year 3, often a period of intense activity and potential challenges, necessitates rigorous monitoring of both progress against the project plan and the associated costs. This ensures timely identification of potential cost overruns and allows for proactive mitigation strategies.

Key performance indicators (KPIs) provide a quantifiable measure of progress and cost performance. Their selection should align with the specific goals and deliverables of the contract. Regular monitoring and analysis of these KPIs enable project managers to make informed decisions and keep the project on track.

Key Performance Indicators for Year 3

The choice of KPIs depends heavily on the nature of the contract. However, some universally applicable indicators include:

- Percentage of Work Completed: This simple metric tracks the completion of tasks and milestones, often expressed as a percentage of the total work scope. For example, if a construction project involves 100 tasks, and 75 are completed, the percentage of work completed is 75%.

- Schedule Variance: This KPI measures the difference between the planned schedule and the actual progress. A positive variance indicates ahead-of-schedule progress, while a negative variance indicates a delay. For instance, if a task was planned for completion in week 10 but finished in week 12, the schedule variance is -2 weeks.

- Cost Variance: This KPI compares the budgeted cost to the actual cost incurred. A positive variance signifies that the project is under budget, while a negative variance indicates a cost overrun. For example, if a task was budgeted at $10,000 and cost $12,000, the cost variance is -$2,000.

- Earned Value (EV): This sophisticated metric combines scope, schedule, and cost performance. It calculates the value of the work completed compared to the planned value. A positive EV indicates that the project is performing well, while a negative EV signals problems. The calculation often involves a formula such as: EV = % Complete x Budgeted Cost of Work Scheduled (BCWS).

Examples of Progress Reports Highlighting Cost Variances and Potential Risks

Progress reports should be concise yet comprehensive, providing a clear picture of the project’s status. They should include graphical representations of progress, such as Gantt charts or bar charts, alongside numerical data.

Example: A progress report for a software development project might show that module A is 90% complete and on schedule, while module B is only 60% complete and has incurred a cost overrun of $5,000 due to unforeseen technical challenges. This report could also highlight the risk of project delay if module B’s issues aren’t resolved promptly.

Another example: A construction project’s report might show that the foundation is complete and within budget, but the framing is behind schedule due to material delays, leading to a potential cost overrun of $10,000 if the delay isn’t addressed.

Analyzing the Effectiveness of Cost Control Measures

Analyzing the effectiveness of cost control measures requires a comparison of actual costs with budgeted costs, considering the implemented measures. This analysis should identify areas where cost control was successful and areas needing improvement.

For example, if a company implemented a new inventory management system to reduce material waste, the analysis would compare the material costs before and after the implementation. A reduction in material costs after implementation would demonstrate the effectiveness of the new system. Conversely, if cost overruns persist despite implemented measures, a review of the measures’ effectiveness and potential alternative strategies is necessary.

This might involve identifying and rectifying weaknesses in the implemented strategies, or exploring new approaches.

Risk Management and Contingency Planning in Year 3

Year 3 of a long-term contract often presents a unique set of risks, diverging from the challenges faced in the initial phases. Established processes might become less efficient, unforeseen circumstances may arise, and the cumulative effect of minor issues can snowball into significant problems. Proactive risk management and robust contingency planning are therefore crucial for successful completion and profitability.

Effective risk management in year 3 requires a shift from initial project setup to ongoing monitoring and adaptive control. This involves continuously assessing the likelihood and impact of potential problems, implementing mitigation strategies, and having plans in place to handle unexpected events. Failure to do so can lead to cost overruns, schedule delays, and ultimately, contract failure.

Potential Risks Specific to Year 3

The risks inherent in year 3 often stem from the prolonged nature of the project and the accumulation of smaller issues. These may include increased material costs due to inflation or supply chain disruptions, unexpected changes in regulatory requirements, key personnel leaving the project, or unforeseen technical challenges requiring rework. For example, a construction project might face unexpected soil conditions in year 3, requiring additional excavation and foundation work.

Similarly, a software development project might encounter unforeseen compatibility issues with third-party systems, necessitating extensive code modifications. These situations highlight the need for a dynamic risk assessment process that evolves with the project.

Contingency Planning for Cost Overruns and Delays

A comprehensive contingency plan should address potential cost overruns and project delays. This involves identifying potential cost drivers, such as material price fluctuations or labor shortages, and establishing reserve funds to absorb unexpected expenses. Delays can be mitigated through the implementation of robust scheduling tools, clear communication channels, and proactive problem-solving. For instance, a contingency plan might include provisions for expedited procurement of materials in case of supply chain disruptions, or for hiring additional skilled labor to accelerate progress if delays occur.

A well-defined escalation procedure, outlining steps to be taken when problems arise, is also essential.

Strategies for Mitigating Risks and Ensuring Cost Control

Several strategies can be employed to mitigate risks and maintain cost control. Regular progress monitoring and reporting are essential to identify potential problems early. This should be coupled with proactive communication with stakeholders, including clients and subcontractors, to ensure transparency and collaborative problem-solving. Value engineering, a systematic process for improving project value while reducing costs, can also be applied.

Furthermore, robust change management processes are crucial for handling variations and ensuring that any changes are properly documented, costed, and approved. This involves establishing a formal process for evaluating and approving change requests, including cost and schedule impacts. A crucial element is establishing clear lines of responsibility and accountability to ensure timely decision-making and problem resolution. This structured approach helps maintain control and prevent minor issues from escalating into major problems.

Year-End Reporting and Reconciliation

The culmination of a contract’s year, particularly the third and potentially final year, necessitates a meticulous process of financial reporting and reconciliation. This ensures accurate financial representation, facilitates informed decision-making, and provides a clear audit trail for stakeholders. The process involves compiling data from various sources, comparing actual expenditures against budgeted allocations, and generating comprehensive reports that highlight performance against projected outcomes.The preparation of year-end financial statements for a contract’s third year mirrors standard accounting practices but incorporates the unique complexities of long-term projects.

This involves gathering all relevant financial data, including direct costs (materials, labor), indirect costs (overhead), and any variations resulting from change orders or unforeseen circumstances. The accuracy of this data is paramount, as it forms the basis for assessing the contract’s profitability and overall financial health. Furthermore, the application of Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS), depending on the jurisdiction, ensures consistency and comparability across different projects and organizations.

Financial Statement Preparation

The year-end financial statements for the contract’s third year typically include an income statement, a balance sheet, and a statement of cash flows. The income statement will detail revenues earned during the year, the costs incurred in delivering the contract’s deliverables, and the resulting profit or loss. The balance sheet will present a snapshot of the contract’s assets, liabilities, and equity at the end of the year.

Finally, the statement of cash flows will track the movement of cash both into and out of the contract throughout the year. These statements should clearly reflect the contract’s financial position and performance, highlighting any significant variances from the original budget. For instance, a significant increase in material costs due to unexpected market fluctuations would be clearly noted and explained.

Cost Reconciliation

Reconciling actual costs with the budget is a crucial step in evaluating the contract’s financial performance. This involves a detailed comparison of planned versus actual expenditures across various cost categories. The process begins with gathering all actual cost data, which might be sourced from time sheets, purchase orders, invoices, and other relevant documentation. This data is then categorized and compared against the corresponding budget figures.

Any significant variances are investigated to determine their root causes. For example, a variance in labor costs might be due to unforeseen delays, requiring additional overtime hours, or it could reflect a more efficient workflow than initially anticipated. A detailed explanation of each variance is critical for transparency and informed decision-making. This reconciliation process is typically performed using spreadsheet software or dedicated accounting systems.

Sample Year-End Report

A sample year-end report might include the following sections:

| Section | Description | Example Data |

|---|---|---|

| Executive Summary | A concise overview of the contract’s financial performance in year 3. | “Year 3 concluded with a net profit of $150,000, exceeding the projected profit by $25,000. This positive variance is primarily attributable to efficient labor management.” |

| Income Statement | Details of revenues, costs, and profit/loss. | Revenue: $1,000,000; Direct Costs: $600,000; Indirect Costs: $100,000; Net Profit: $300,000 |

| Variance Analysis | Comparison of planned vs. actual costs for each cost category, with explanations for significant variances. | Material Costs: Planned $100,000, Actual $110,000 (Variance $10,000 – due to increased market prices); Labor Costs: Planned $200,000, Actual $180,000 (Variance -$20,000 – due to increased efficiency). |

| Balance Sheet | A snapshot of the contract’s assets, liabilities, and equity at year-end. | Assets: $50,000; Liabilities: $10,000; Equity: $40,000 |

Note: The accuracy of this report hinges on the meticulous collection and analysis of cost data throughout the year. Regular monitoring and timely identification of potential cost overruns are crucial for effective financial management.

Comparing Year 3 Performance to Previous Years

Analyzing the cost performance of a multi-year contract requires a longitudinal perspective, comparing Year 3’s data against the preceding years to identify trends and deviations from initial projections. This comparative analysis provides valuable insights into the project’s overall efficiency and helps refine future cost estimations. Effective cost control relies on understanding not just the current year’s figures, but also the historical context of the project’s financial performance.The following analysis compares the cost performance of Year 3 to that of Years 1 and 2, highlighting significant differences and exploring contributing factors.

We will utilize a hypothetical example to illustrate the process, focusing on key cost categories and their variations across the three years.

Cost Performance Comparison Across Three Years

Let’s consider a hypothetical construction project with a three-year timeline. We will examine three key cost categories: labor, materials, and equipment. Assume that the initial budget for each category was as follows: Labor: $500,000; Materials: $300,000; Equipment: $200,

000. The actual costs incurred in each year might look like this

| Cost Category | Year 1 Actual Cost | Year 2 Actual Cost | Year 3 Actual Cost |

|---|---|---|---|

| Labor | $480,000 | $520,000 | $550,000 |

| Materials | $280,000 | $310,000 | $330,000 |

| Equipment | $190,000 | $210,000 | $230,000 |

As the table shows, all three cost categories experienced a gradual increase across the three years. This trend could be attributed to several factors, including inflation, unforeseen project complexities, or changes in market conditions.

Factors Contributing to Cost Variations

Several factors can explain the observed cost increases. Inflation, a persistent increase in the general price level of goods and services, is a common culprit in long-term projects. For instance, the cost of labor and materials typically increases annually due to inflation. Unexpected project complexities, such as unforeseen geological conditions in a construction project or the need for design modifications, can also significantly impact costs.Furthermore, changes in market conditions, such as fluctuations in material prices or labor availability, can influence the project’s overall cost.

For example, a sudden increase in the demand for specific construction materials might lead to higher prices, impacting the material cost category. These factors, when combined, can lead to a significant deviation from the initial budget.

Analysis of Cost Overruns and Efficiency

The data reveals a consistent cost overrun across all three years. While the initial budget was $1,000,000, the actual costs incurred show a steady increase. This suggests a need for more rigorous cost control measures and more accurate initial cost estimations. Further investigation into the specific causes of the overruns in each cost category is crucial for improving future project planning and execution.

This might involve reviewing procurement strategies, improving project management practices, and implementing more robust risk management plans.

Illustrative Scenario: Year 3 Cost Challenges: How Do I Account For Year 3 In Contract Costing

Consider a hypothetical large-scale infrastructure project, a new highway spanning 100 kilometers, contracted over five years. Year 3 involves significant earthworks, bridge construction, and the laying of substantial sections of roadway. Unexpected geological conditions, specifically the discovery of unstable bedrock formations at multiple bridge sites, represent a major unforeseen challenge. This leads to substantial cost overruns, exceeding the initially budgeted amount by 15%.This scenario highlights the inherent risks associated with large-scale projects, particularly those involving complex geological considerations.

The unpredictable nature of subsurface conditions can significantly impact project timelines and budgets. Accurate geological surveys, although expensive, are crucial for mitigating such risks. This particular case demonstrates the financial and operational ramifications of inadequate pre-project geological assessment.

Investigation of Cost Overrun

The first step involves a thorough investigation into the causes of the cost overrun. This requires a multi-faceted approach, combining field observations with detailed analysis of project documentation. The investigation team should include engineers, geologists, and cost accountants. They would examine the original geological surveys, compare them to the actual conditions encountered, and analyze the additional costs incurred due to the unexpected geological challenges.

This would include evaluating the extra labor, materials, and equipment required to address the unstable bedrock. The team would also review the project management practices to identify any procedural inefficiencies that might have exacerbated the cost overrun. Detailed records, including daily reports, invoices, and change orders, would be meticulously examined to pinpoint the specific areas contributing to the cost increase.

Addressing the Cost Overrun

Once the causes are identified, a comprehensive plan is needed to address the cost overrun. This plan should involve renegotiating the contract with the client, outlining the unforeseen circumstances and justifying the additional costs. This negotiation would involve presenting the findings of the investigation, including photographic and geological evidence supporting the claim of unexpected conditions. Simultaneously, the project team needs to implement cost-saving measures without compromising the quality of the final product.

This could involve optimizing construction methods, exploring alternative materials, and streamlining workflows. A detailed cost-benefit analysis should guide these decisions, ensuring that any cost-saving measure does not introduce further risks or delays.

Preventing Future Cost Overruns

To prevent similar problems in the future, several proactive measures should be implemented. This begins with more robust pre-project planning, including more extensive and detailed geological surveys utilizing advanced techniques like ground-penetrating radar and seismic surveys. Improved risk assessment and contingency planning are also critical. This involves identifying potential risks early in the project lifecycle and developing mitigation strategies to minimize their impact.

Regular monitoring and reporting mechanisms should be in place to track project progress against the budget and schedule, allowing for early detection of potential problems. Furthermore, improved communication and collaboration between different project stakeholders, including the client, contractors, and subcontractors, are essential for effective problem-solving and risk management. Finally, incorporating lessons learned from this project into future projects’ planning and execution phases will significantly reduce the likelihood of similar cost overruns.

Successfully navigating the complexities of year three in contract costing requires a proactive and multifaceted approach. By carefully planning, monitoring, and adapting your strategies throughout the year, you can minimize risks, maintain accurate financial records, and ensure the project’s long-term success. Remember that thorough budgeting, effective communication, and a robust risk management plan are key elements in mitigating potential cost overruns and ensuring the project remains on track.

Regular review and analysis of your cost performance, in comparison to previous years, will provide valuable insights and allow for course correction when needed. This process ensures financial stability and sets the stage for a successful project conclusion.

FAQ Overview

What if a key resource unexpectedly leaves the project during year 3?

Assess the impact on the project timeline and budget. Explore options like hiring a replacement, re-allocating existing resources, or adjusting the project scope to mitigate the impact. Document all changes and their associated costs.

How do I handle disputes with the client regarding cost changes in year 3?

Refer to the contract’s change order process. Maintain detailed records of all communications and agreements. If necessary, seek legal counsel to resolve the dispute.

What are some common causes of cost overruns in year 3?

Common causes include unforeseen circumstances, scope creep, inaccurate initial estimations, inadequate risk management, and poor communication.

How can I improve forecasting accuracy for year 3?

Utilize historical data from previous years, incorporate lessons learned, involve experienced team members in the forecasting process, and use more sophisticated forecasting techniques like scenario planning.