How do you cost a contract? This seemingly simple question unravels into a complex web of factors demanding meticulous planning and shrewd negotiation. Accurate contract costing isn’t merely about summing up expenses; it’s a strategic process encompassing a comprehensive understanding of project scope, resource allocation, risk mitigation, and ultimately, profitability. Ignoring any of these elements can lead to disastrous financial consequences, jeopardizing the entire venture.

This exploration delves into the intricacies of contract costing, highlighting the crucial steps involved in creating a robust and financially sound agreement.

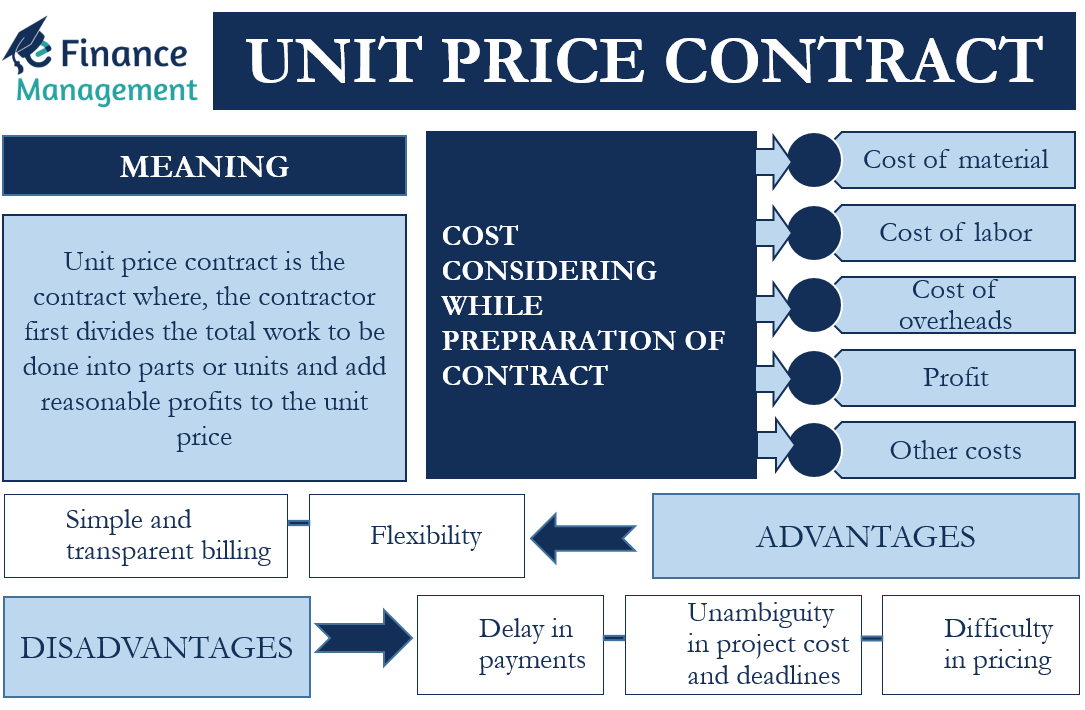

From defining the precise scope of work and meticulously estimating labor and material costs to accounting for overhead, indirect expenses, and potential risks, the path to accurate contract costing requires a multifaceted approach. Different contract types—fixed-price, time & materials, and cost-plus—each present unique costing challenges and necessitate distinct strategies for risk allocation. Furthermore, navigating the complexities of profit margin determination and employing effective pricing strategies are paramount to ensuring a profitable outcome.

Ultimately, successful contract costing hinges on a thorough understanding of these elements and a strategic approach to negotiation and finalization.

Defining the Scope of Work

The heart of accurate contract costing lies in a meticulously defined scope of work. It’s the compass guiding your journey through the project, preventing costly detours and ensuring everyone – from the client to the contractor – is on the same page. Without a clear scope, cost estimates become mere guesses, fraught with the risk of underestimation and subsequent financial ruin, or overestimation, leading to lost opportunities.The factors influencing contract costing are interwoven and complex, like the threads of a finely woven tapestry.

Project size directly impacts the resources required: a small website redesign demands far less than the construction of a skyscraper. Complexity adds another layer – a straightforward task will naturally cost less than one involving intricate, cutting-edge technology or highly specialized skills. Consider the expertise needed; a simple task might be handled by a junior team member, while a complex project necessitates the involvement of seasoned professionals, significantly altering the cost equation.

The availability of these specialists also impacts pricing; a scarce skillset commands a higher premium.

Contract Types and Costing Implications

Understanding the different contract types is crucial for effective cost management. Each approach carries its own risk profile and influences how costs are calculated and allocated.

| Contract Type | Costing Method | Risk Allocation | Suitability |

|---|---|---|---|

| Fixed-Price | Detailed upfront estimation based on defined scope. | Primarily on the contractor; requires accurate initial scoping. | Suitable for projects with well-defined requirements and minimal anticipated changes. Example: Building a website with pre-defined features. |

| Time & Materials | Based on hourly rates for labor and materials used. | Shared between client and contractor; client bears the risk of scope creep. | Suitable for projects with evolving requirements or where the exact scope is difficult to define upfront. Example: Software development with iterative features. |

| Cost-Plus | Reimburses the contractor for all allowable costs, plus a fixed fee or percentage markup. | Primarily on the client; contractor is incentivized to control costs but may lack motivation for efficiency. | Suitable for complex projects with high uncertainty or where a high degree of collaboration is required. Example: Large-scale infrastructure projects. |

Defining Deliverables and Milestones

Clearly defined deliverables and milestones are the cornerstones of accurate cost estimation. A deliverable is a tangible output—a finished product, a completed report, a functioning software module. Milestones mark significant progress points within the project, providing checkpoints for cost tracking and performance evaluation. Without these clearly defined targets, it’s impossible to accurately assess the resources required and the time needed for each stage.

Ambiguity in deliverables leads to disputes, cost overruns, and project delays. For instance, a vague deliverable like “improve website performance” is far less effective than specifying “increase website loading speed by 50% as measured by Google PageSpeed Insights.” The latter provides a concrete, measurable target, allowing for a more precise cost estimate.

Labor Cost Estimation

Accurately estimating labor costs is the backbone of any successful contract. It’s not just about adding up salaries; it’s about anticipating the unpredictable, understanding hidden costs, and building in a healthy margin for profit. Failing to do so can lead to financial strain, missed deadlines, and ultimately, a project that’s less profitable than hoped. Let’s delve into the intricacies of this crucial aspect of contract costing.Estimating labor costs involves a detailed breakdown of several key components.

This process requires meticulous planning and a realistic understanding of the project’s demands. Overlooking even small details can lead to significant discrepancies between projected and actual costs.

Labor Cost Components

A comprehensive labor cost estimate includes salaries, benefits, overhead, and profit margin. Salaries represent the base pay for each worker involved. Benefits encompass employer contributions to health insurance, retirement plans, paid time off, and other employee perks. Overhead covers indirect costs like office rent, utilities, administrative staff salaries, and software licenses—expenses necessary for the project but not directly tied to individual worker hours.

Finally, the profit margin ensures a healthy return on investment for the company. For example, a construction project might allocate 20% of the total labor cost as profit margin, while a software development project might allocate 30%. These percentages vary greatly depending on industry, project complexity, and risk.

Estimating Labor Hours

Accurately predicting the time required for each task is critical. Several methods can help achieve this.

The importance of accurate labor hour estimation cannot be overstated. Underestimating leads to losses, while overestimating can make your bid uncompetitive. A balance is crucial.

- Work Breakdown Structure (WBS): Decomposing the project into smaller, manageable tasks allows for more precise time estimations. Each task can then be assigned to specific workers, and time estimates can be aggregated to arrive at a total labor hour requirement.

- Historical Data: Past projects provide valuable insights. Analyzing similar tasks from previous contracts can help establish realistic benchmarks for time allocation. For example, if past projects show a consistent average of 10 hours per unit of work for a specific task, this can serve as a starting point for estimation.

- Expert Judgment: Experienced team members can offer valuable insights into potential challenges and time requirements. Their collective knowledge can help refine initial estimates and identify potential bottlenecks.

- Three-Point Estimation: This method involves identifying optimistic, pessimistic, and most likely estimates for each task. These estimates are then combined to arrive at a weighted average, offering a more robust prediction than a single-point estimate. For example, if the optimistic estimate is 5 hours, pessimistic 15 hours, and most likely 10 hours, the weighted average would be (5 + 4*10 + 15)/6 = 9.17 hours.

Accounting for Delays and Unforeseen Circumstances

Unforeseen events are inevitable. Several strategies help mitigate the impact of delays or unexpected issues on labor cost projections.

Building contingency into your labor cost estimates is not just prudent; it’s essential for financial stability. The unpredictable nature of projects demands this proactive approach.

- Contingency Buffer: Adding a percentage buffer (e.g., 10-20%) to the total labor cost estimate accounts for potential delays or unexpected complications. This buffer acts as a safety net, absorbing some of the financial impact of unforeseen circumstances.

- Risk Assessment: Identifying potential risks early in the project lifecycle allows for proactive mitigation strategies. For example, if a specific task relies on external factors (e.g., obtaining permits), incorporating buffer time accounts for potential delays in those areas.

- Agile Methodology: Adopting an agile approach allows for flexibility and adaptability. Regular progress reviews and adjustments to the project plan help identify and address issues early on, minimizing their impact on the overall timeline and budget.

Material and Resource Costing: How Do You Cost A Contract

Accurately estimating material and resource costs is crucial for a successful contract. Underestimating these costs can lead to significant financial losses, jeopardizing the entire project’s viability. Overestimating, on the other hand, can make your bid uncompetitive. Therefore, a thorough and meticulous approach is paramount.Material cost estimation involves more than simply adding up the prices of individual items.

It requires a deep understanding of market dynamics, potential supply chain disruptions, and the overall project requirements. This section will delve into effective strategies for accurate cost estimation and risk mitigation.

Potential Material Costs and Procurement Cost Estimation

Identifying all necessary materials is the first step. This requires a detailed review of the project specifications and blueprints. Consider not only the primary materials but also consumables, fasteners, and any specialized equipment needed. For instance, a construction project might need concrete, steel, wood, plumbing fixtures, electrical wiring, and various smaller components. An accurate bill of materials (BOM) is essential.

Once the BOM is complete, research current market prices from multiple suppliers. Consider factors like quantity discounts, transportation costs, and potential import duties. Software tools can assist in managing and analyzing this data, providing a more comprehensive picture of overall material costs. It’s vital to build in a contingency buffer to account for unforeseen price increases or material shortages.

For example, if the cost of lumber is currently $500 per cubic meter, adding a 10% contingency would mean budgeting $550 per cubic meter.

Sourcing Strategies and Their Cost Impact

The choice of sourcing strategy significantly influences the overall material cost. Different strategies offer varying degrees of control over price, delivery time, and risk.

| Sourcing Strategy | Cost Impact |

|---|---|

| Bulk Purchasing | Generally leads to lower per-unit costs due to economies of scale. However, increased storage costs and potential for obsolescence must be considered. For example, purchasing 1000 units of a specific brick might reduce the per-unit cost by 15% compared to buying 100, but you’ll need sufficient storage space and risk potential price drops before you use all the bricks. |

| Just-in-Time (JIT) Delivery | Minimizes storage costs and reduces the risk of obsolescence. However, it relies heavily on reliable suppliers and efficient logistics, potentially leading to higher transportation costs and increased vulnerability to supply chain disruptions. For instance, relying on JIT for crucial components could halt a project if a supplier faces delays. |

| Long-Term Contracts with Suppliers | Can secure stable prices and delivery schedules, offering predictability. However, this approach might limit flexibility in responding to changing market conditions or new technologies. Negotiating a long-term contract with a guaranteed price per unit can protect against inflation but might miss out on potential price decreases in the market. |

| Multiple Sourcing | Reduces dependence on a single supplier, mitigating risks associated with supply chain disruptions. However, it might increase administrative costs and complicate logistics. For instance, sourcing from three different suppliers for different components can increase administration but reduces the impact of any single supplier’s issues. |

Strategies for Mitigating Material Price Fluctuations

Material prices are subject to market volatility influenced by factors like raw material availability, global economic conditions, and currency exchange rates. Several strategies can mitigate these risks. Hedging, a financial strategy involving derivatives, can help lock in future prices, protecting against unexpected increases. For example, purchasing options or futures contracts on key materials can safeguard against price hikes.

Diversification of suppliers and materials, when feasible, reduces the impact of price fluctuations in a single source. Exploring alternative materials with similar functionalities can also provide a buffer against price shocks. Finally, strong contract negotiation with clear pricing terms and escalation clauses protects against unforeseen cost increases.

Overhead and Indirect Costs

The shimmering sea of profit, so often envisioned, can be quickly clouded by unforeseen expenses. Just as a fisherman must account for the cost of his nets and bait, so too must a contractor factor in overhead and indirect costs to accurately price a contract and ensure a successful venture. These costs, often overlooked, are the silent currents that can either buoy or sink a project’s financial health.

They represent the essential, yet often unseen, expenses necessary to keep the business afloat and allow for the completion of the project.Overhead and indirect costs are the unsung heroes, the supporting cast in the grand play of contract costing. They are not directly tied to a specific project but are essential for its successful execution. Accurate accounting for these costs is crucial for setting a profitable contract price and avoiding financial pitfalls.

Miscalculating these costs can lead to underbidding and, ultimately, financial losses. A careful and thorough assessment of these expenses is as important as meticulously calculating direct labor and material costs.

Administrative Expenses

Administrative expenses encompass the backbone of a business’s operational functionality. They include salaries for administrative staff (office managers, accountants, human resources personnel), office supplies (paper, ink, stationery), and communication costs (telephone, internet, postage). Consider, for example, a construction company bidding on a large-scale project. The administrative staff’s salaries, even though not directly involved in the construction itself, are a necessary overhead cost, ensuring the smooth running of the company and, consequently, the successful completion of the project.

These expenses, though not directly tied to the project, are essential for the project’s existence. A realistic allocation of these expenses, based on a percentage of total revenue or direct labor costs, is vital.

Rent and Utilities

Rent and utilities represent the fundamental costs of maintaining a physical workspace. Rent for office space, warehouse space, or even equipment storage facilities all fall under this category. Utilities such as electricity, water, and gas are essential for daily operations and contribute to the overall overhead. Imagine a landscaping company. Their overhead includes the rent for their office and warehouse, where they store equipment and supplies.

The cost of electricity to power their computers and tools is also included. These seemingly small costs, when aggregated across a year, become significant and must be accounted for in the overall project cost.

Allocation of Overhead Costs

Fairly allocating overhead costs across different projects is a crucial aspect of accurate costing. Several methods exist, each with its own strengths and weaknesses. One common approach is to allocate overhead based on direct labor hours. Projects requiring more labor hours would bear a larger share of the overhead costs. Another method involves allocating overhead based on the revenue generated by each project.

Projects with higher revenue contribute a larger portion of the overhead costs. The choice of method depends on the specific nature of the business and the projects undertaken. Consistency in the allocation method is key to ensuring fair and accurate cost accounting.

Examples of Indirect Costs and Their Incorporation

Indirect costs can encompass a wide range of expenses beyond administrative costs and rent. These can include professional fees (legal, accounting), insurance premiums, marketing and advertising expenses, and even costs associated with professional development for employees. Let’s consider a software development company. The cost of software licenses, professional development workshops for programmers, and marketing campaigns to attract new clients are all indirect costs.

To incorporate these costs into the overall estimate, a percentage markup on direct costs is often applied. For example, a 15% markup on direct costs might be added to account for all indirect costs. This percentage is determined based on historical data and industry benchmarks. Accurate assessment of indirect costs and their proper inclusion in the overall estimate are crucial for profitability.

Risk Assessment and Contingency Planning

The unpredictable nature of projects, much like the unpredictable currents of the sea, necessitates a careful assessment of potential risks. Ignoring these risks is akin to sailing without a compass, inviting disaster. A robust risk assessment, coupled with a well-defined contingency plan, is crucial for navigating the complexities of contract costing and ensuring the project stays on course, financially and otherwise.

This involves identifying potential pitfalls, evaluating their likelihood, and preparing a safety net to mitigate their impact.

Effective risk management isn’t about eliminating all uncertainty; it’s about understanding and preparing for the inevitable bumps in the road. It’s about building resilience into the project’s financial framework, allowing for unforeseen expenses and delays without derailing the entire operation. This section Artikels a structured approach to risk assessment and contingency planning, providing a practical framework for incorporating these crucial elements into your contract costing.

Risk Identification and Impact Analysis

Identifying potential risks is the first step in effective risk management. This involves brainstorming potential problems that could affect the project’s cost, considering factors such as material price fluctuations, labor shortages, unexpected delays, and changes in regulations. A systematic approach, perhaps involving a team discussion or a checklist, is essential to ensure comprehensive coverage. The following table presents a sample of potential risks, their likelihood, and potential impact.

Remember, this is not exhaustive, and your specific risks will vary depending on the nature of your project.

| Risk | Likelihood | Impact |

|---|---|---|

| Significant increase in material costs due to supply chain disruptions | Medium | High (potential cost overrun of 10-20%) |

| Unexpected delays due to unforeseen weather conditions (for outdoor projects) | Low | Medium (potential cost overrun of 5-10%) |

| Labor strikes or significant increase in labor costs | Low | High (potential cost overrun of 15-25%) |

| Changes in regulations or permits leading to project delays | Medium | Medium (potential cost overrun of 5-15%) |

| Unforeseen site conditions requiring additional excavation or remediation | Medium | High (potential cost overrun of 10-20%) |

Contingency Buffer Incorporation, How do you cost a contract

Once potential risks have been identified and their potential impact assessed, it’s time to build in contingency buffers. This involves adding a percentage to the overall cost estimate to account for unforeseen expenses. The size of the buffer should be proportionate to the overall risk assessment. For example, a project with a high likelihood of significant risks might require a larger contingency buffer (perhaps 15-20%) compared to a low-risk project (5-10%).

It’s crucial to clearly document the rationale behind the chosen buffer percentage. This transparency ensures accountability and facilitates discussions with stakeholders. For instance, if material costs are volatile, a larger buffer might be allocated to this specific area.

Communication of Potential Cost Overruns

Open and transparent communication is paramount. Regular updates to stakeholders, including potential cost overruns and associated risks, are essential. This proactive approach fosters trust and allows for timely adjustments. This communication should not only highlight potential problems but also propose mitigation strategies. Consider using visual aids like charts and graphs to clearly present the information and make it easily understandable.

Regular progress reports, coupled with transparent financial statements, are crucial in managing expectations and avoiding surprises. A clear, concise, and factual approach, avoiding jargon and technicalities, is key to effective communication.

Profit Margin and Pricing Strategy

Profitability, the lifeblood of any contracting business, hinges on a carefully calculated interplay between costs and pricing. Understanding the factors that influence profit margins and employing a strategic pricing model are crucial for long-term success. This section delves into the intricacies of profit margin determination and explores various pricing strategies, illustrating how the right approach can significantly impact a company’s bottom line.

Factors Determining Appropriate Profit Margins

The appropriate profit margin for a contract isn’t a fixed number; it’s a dynamic variable influenced by several factors. The inherent risk associated with a project, the client’s reputation, the complexity of the work, and market competition all play a role. Higher-risk projects, those involving innovative technologies or tight deadlines, often necessitate larger profit margins to compensate for potential unforeseen expenses.

Conversely, contracts with established clients who have a history of smooth collaborations may allow for slightly lower margins, fostering a mutually beneficial relationship. The competitive landscape also plays a crucial role; in highly competitive markets, profit margins might be squeezed, whereas in niche markets with limited competition, higher margins might be feasible.

Comparison of Pricing Strategies

Several pricing strategies exist, each with its own advantages and disadvantages. Cost-plus pricing, a straightforward approach, involves calculating all direct and indirect costs and adding a predetermined percentage markup for profit. This method offers transparency but can lack competitiveness if the cost estimations are inaccurate or if the markup is too high. Value-based pricing, on the other hand, focuses on the perceived value the project delivers to the client.

This strategy allows for higher profit margins if the value proposition is strong, but it requires a thorough understanding of the client’s needs and a persuasive ability to articulate the value offered. Consider a software development contract: a cost-plus approach might focus on hours billed and expenses incurred, while value-based pricing would highlight the software’s impact on the client’s efficiency and revenue generation, justifying a higher price.

Factors to Consider When Setting a Final Contract Price

Before finalizing a contract price, several factors must be meticulously considered. This ensures that the price reflects the true cost of the project while securing a healthy profit margin.

- Direct Costs: These include labor, materials, and equipment directly used in the project. Accurate estimation is paramount.

- Indirect Costs: These encompass overhead expenses such as rent, utilities, and administrative salaries. They should be allocated proportionally to the project.

- Profit Margin: This should be determined based on the factors discussed earlier, considering risk, competition, and client relationships. A realistic profit margin ensures long-term sustainability.

- Contingency Planning: A buffer should be included to cover unforeseen expenses or delays. This mitigates financial risk and protects against unexpected setbacks.

- Client Relationship: A strong client relationship can influence pricing decisions. Long-term partnerships might justify slightly lower margins for mutual benefit.

- Market Conditions: Understanding the prevailing market rates and competitive landscape is essential for setting a competitive yet profitable price.

- Payment Terms: The payment schedule and terms should be clearly defined and factored into the overall pricing strategy. Longer payment terms might necessitate a higher price to compensate for delayed revenue.

Contract Negotiation and Finalization

The culmination of meticulous cost estimation and planning arrives at the negotiation table. This phase, far from a mere formality, is a delicate dance of compromise and strategic maneuvering, ultimately shaping the contract’s success or failure. It’s where the meticulously crafted cost proposal meets the client’s expectations and budgetary constraints. Navigating this process requires both firmness and flexibility, a balance that only experience can truly teach.Negotiating contract terms and conditions with clients involves a systematic approach.

It’s not simply a matter of presenting a price; it’s about understanding the client’s needs and priorities, and finding common ground that benefits both parties. This process often involves several iterations, with each party making adjustments to arrive at a mutually agreeable arrangement. Open communication is paramount, ensuring transparency and fostering a collaborative environment.

Negotiation Strategies and Techniques

Effective negotiation requires a blend of preparation and adaptability. Before entering negotiations, thoroughly review the cost proposal, anticipating potential areas of contention. Identify the client’s key concerns – are they focused on price, timeline, or specific deliverables? Develop alternative solutions to address potential objections, providing flexibility without compromising the project’s viability. For instance, if the client is concerned about the project timeline, you might propose a phased approach, delivering key milestones earlier in exchange for a slightly higher overall cost.

Conversely, if the client is primarily focused on cost reduction, consider suggesting adjustments to the scope of work, or exploring alternative materials or technologies.

Handling Disputes and Disagreements

Disagreements are inevitable during contract negotiations. The key lies in managing these conflicts constructively. Active listening is crucial; understanding the client’s perspective, even if you don’t agree with it, is essential to finding a solution. Maintain a professional and respectful demeanor throughout the process, even when facing challenging objections. Focus on finding common ground, emphasizing mutual benefit.

If a deadlock arises, consider employing mediation or arbitration as neutral third-party solutions to facilitate a resolution. Documenting all discussions and agreements is essential to avoid future misunderstandings. For example, if a disagreement arises regarding payment terms, referencing prior email correspondence or meeting minutes can provide clear evidence of agreed-upon terms.

Contract Finalization and Signing

Once a mutually agreeable agreement is reached, the contract must be meticulously reviewed and finalized. This often involves legal counsel to ensure all clauses are clear, unambiguous, and protect the interests of both parties. All agreed-upon terms, including payment schedules, deliverables, timelines, and dispute resolution mechanisms, must be accurately reflected in the final document. Before signing, both parties should have ample time to review the contract thoroughly.

Any remaining questions or concerns should be addressed before the contract is signed. The final signed contract represents a legally binding agreement, signifying the commencement of the project. A well-drafted and finalized contract safeguards the interests of all parties involved, ensuring a smooth and successful project execution.

Accurately costing a contract is not a simple calculation but a crucial strategic exercise demanding meticulous attention to detail. It requires a thorough understanding of project scope, resource requirements, risk assessment, and market dynamics. By carefully considering all contributing factors—labor costs, material expenses, overhead, and potential risks—and employing appropriate pricing strategies, businesses can establish a realistic budget, manage expectations, and ultimately safeguard their profitability.

Failing to adequately address these elements can lead to financial losses and jeopardize the success of the entire project. Therefore, a proactive and comprehensive approach to contract costing is not just advisable; it is essential for long-term financial health and sustainable growth.

FAQ Compilation

What happens if I underestimate the project’s scope?

Underestimating scope invariably leads to cost overruns and potential project delays. It erodes profit margins and can damage client relationships.

How can I account for unforeseen circumstances in my cost estimate?

Incorporate a contingency buffer in your cost estimate to account for unforeseen issues. This percentage should be based on a risk assessment.

What are the implications of choosing the wrong contract type?

Selecting an inappropriate contract type can expose your business to significant financial risks, potentially leading to losses or disputes.

How do I negotiate a fair contract price with a client?

Thorough preparation, clear communication, and a justified cost breakdown are essential for successful contract price negotiation.