Is child support considered income for food stamps sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. The Supplemental Nutrition Assistance Program (SNAP), commonly known as food stamps, provides vital assistance to low-income households in meeting their nutritional needs.

However, navigating the intricacies of SNAP eligibility can be challenging, particularly when it comes to understanding how child support payments are factored into the equation. This exploration delves into the complex world of SNAP eligibility, unraveling the nuances of child support income and its impact on accessing this essential program.

Understanding the rules surrounding child support income for SNAP is crucial for individuals and families seeking to maximize their benefits. This guide aims to shed light on the definition of income for SNAP, the classification of child support payments under SNAP regulations, and the impact of these payments on eligibility and benefit amounts.

We will also explore potential state variations, exceptions, and the potential implications for other government assistance programs.

Child Support as Income

Determining income for SNAP eligibility is crucial for individuals and families seeking assistance. Understanding how child support payments are classified under SNAP regulations is essential for navigating the program effectively.

Definition of Income for SNAP Eligibility

The SNAP program defines “income” broadly, encompassing various sources of financial resources. These sources include, but are not limited to, wages, salaries, tips, self-employment income, unemployment benefits, and pensions. The goal is to ensure that SNAP benefits are distributed fairly and only to those who truly need them.

Child Support Payments as Income for SNAP

Child support payments, whether received in cash or through direct deposit, are considered income for SNAP eligibility purposes. This means that these payments are factored into the household’s total income when determining eligibility and benefit levels.

Legal Basis for Including Child Support as Income

The inclusion of child support payments as income for SNAP is rooted in the legal framework of the program. The SNAP regulations explicitly state that child support payments are considered income. This principle is based on the idea that child support is intended to contribute to the child’s well-being and, by extension, the household’s overall financial stability.

Types of Child Support Payments and Their Impact on SNAP Eligibility

The type of child support payment can influence its impact on SNAP eligibility. Here are some examples:

- Regular, Recurring Payments:These payments are typically made on a monthly basis and are the most common type of child support. They are directly factored into the household’s income calculation for SNAP eligibility.

- Lump-Sum Payments:Large, one-time payments, such as arrears or back payments, are generally considered income for the month in which they are received. However, the SNAP regulations allow for some flexibility in how these payments are counted, potentially excluding them from income if they are used for specific expenses related to the child’s well-being.

- Payments Received Through State or Federal Programs:In cases where child support payments are received through state or federal programs, such as the Office of Child Support Enforcement (OCSE), these payments are still considered income for SNAP eligibility. The same rules apply as for regular, recurring payments.

Eligibility for SNAP Benefits

The Supplemental Nutrition Assistance Program (SNAP), formerly known as food stamps, provides food assistance to low-income individuals and families. To be eligible for SNAP benefits, individuals must meet certain income and asset requirements, as well as other criteria.

Calculating Child Support Income for SNAP Eligibility

Child support payments are considered income for SNAP eligibility purposes. However, the way child support income is calculated for SNAP eligibility differs from how it’s calculated for other income sources.

- Gross Child Support Income: The total amount of child support received is considered gross income. This includes all payments received, regardless of whether they are paid directly to the recipient or through a state or local agency.

- Net Child Support Income: The net child support income is calculated by subtracting certain allowable deductions from the gross child support income. These deductions include:

- Child Care Costs: Costs related to the care of the child for whom support is being paid.

- Medical Expenses: Medical expenses incurred for the child, that are not covered by insurance.

- Court-Ordered Payments: Payments that are court-ordered, such as child support for other children or alimony.

The net child support income is the amount used to determine SNAP eligibility and benefit amount.

Impact of Child Support Payments on SNAP Benefit Amount

The amount of SNAP benefits an individual or family receives is based on their income, household size, and other factors. Child support income is factored into the calculation of the SNAP benefit amount.

- Increased Income: If an individual receives child support payments, their total income will be higher, which could potentially reduce their SNAP benefit amount.

- Reduced Benefit Amount: The SNAP benefit amount is calculated based on a household’s net income. As child support payments are considered income, receiving them could result in a reduced SNAP benefit amount.

Comparison of Child Support Income Treatment in SNAP Eligibility with Other Income Sources

The treatment of child support income for SNAP eligibility differs from the treatment of other income sources.

- Earned Income: Earned income, such as wages or salaries, is considered gross income for SNAP eligibility. This means that the full amount of earned income is included in the income calculation.

- Unearned Income: Unearned income, such as Social Security benefits or unemployment benefits, is generally treated the same as child support income. This means that certain deductions are allowed before the income is included in the SNAP eligibility calculation.

State Variations and Exceptions

While federal guidelines provide a framework for considering child support as income for SNAP, individual states may have their own rules and exceptions. These variations can significantly impact an individual’s eligibility for benefits.

State-Specific Rules

States have the flexibility to establish their own policies regarding child support income for SNAP. Some states may have stricter rules than others, potentially excluding certain types of child support payments from income calculations. For instance, some states may exclude child support payments that are specifically designated for a child’s educational expenses or medical needs.

Potential Exceptions and Exemptions

Several exceptions or exemptions may apply to child support payments, impacting their inclusion in SNAP income calculations. These can include:

- Payments from a non-custodial parent who is also receiving SNAP benefits:In such cases, the child support payments may be considered income for the receiving parent but not counted towards the non-custodial parent’s SNAP eligibility.

- Child support payments received as part of a court-ordered settlement:Some states may exclude child support payments that are part of a larger settlement agreement, especially if the settlement involves other assets or financial arrangements.

- Child support payments received from a parent who is incarcerated:States may have specific rules regarding child support payments received from incarcerated parents, potentially excluding them from income calculations for SNAP eligibility.

Examples of Situations Where Child Support May Not Be Considered Income

Here are some examples of situations where child support payments may not be considered income for SNAP purposes:

- Payments designated for a child’s specific needs, such as medical expenses or educational costs:These payments may be excluded from income calculations if they are clearly designated for these specific purposes and are not used for general household expenses.

- Payments received as part of a court-ordered visitation schedule:In some cases, child support payments received as part of a visitation schedule may be considered a reimbursement for the costs associated with the child’s care during the visitation period and may not be included as income for SNAP eligibility.

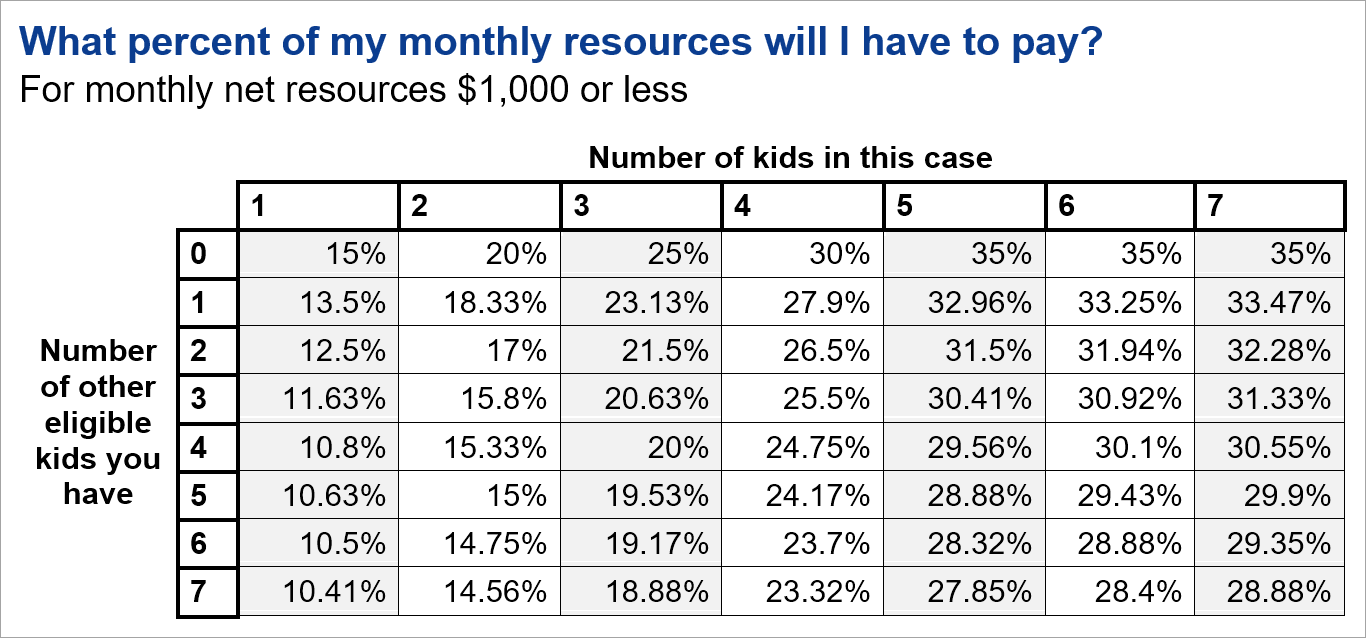

State Variations in Child Support Treatment

The following table summarizes key differences in child support treatment across different states:

| State | Child Support Considered Income | Exceptions or Exemptions |

|---|---|---|

| California | Yes, generally | Payments designated for specific needs, such as medical expenses or educational costs. |

| Texas | Yes, generally | Payments received as part of a court-ordered settlement. |

| New York | Yes, generally | Payments received from a parent who is incarcerated. |

Impact on Other Benefits

Receiving child support payments can influence your eligibility for other government assistance programs. The way child support is treated varies depending on the program, so understanding how it affects your benefits is crucial.

Impact on TANF

TANF (Temporary Assistance for Needy Families) is a program that provides financial assistance to low-income families with children. Child support income is considered countable incomefor TANF eligibility. This means that the amount of child support you receive can reduce your TANF benefits.

For example, if your TANF benefit is $500 per month and you receive $200 in child support, your TANF benefit may be reduced to $300.

Impact on Medicaid

Medicaid is a health insurance program for low-income individuals and families. Child support income is not consideredincome for Medicaid eligibility. This means that receiving child support will not affect your eligibility for Medicaid.

Impact on Other Programs

The impact of child support income on other government assistance programs varies. For example, it may affect your eligibility for:

- Food Stamps (SNAP):Child support income is considered countable incomefor SNAP eligibility, so it can affect the amount of benefits you receive.

- Housing Assistance:Child support income is typically consideredincome for housing assistance programs, potentially affecting your eligibility or the amount of assistance you receive.

- Energy Assistance:Child support income may be consideredincome for energy assistance programs, impacting your eligibility or the amount of benefits you receive.

Resources and Information

Navigating the complexities of SNAP eligibility and child support income can be challenging. Fortunately, various resources and organizations offer valuable information and support.

Official Websites and Government Agencies

Accessing official websites and government agencies provides accurate and up-to-date information regarding SNAP eligibility and child support income. These platforms offer comprehensive resources, including eligibility criteria, application procedures, and contact information for assistance.

- United States Department of Agriculture (USDA) Food and Nutrition Service (FNS):The USDA FNS oversees the SNAP program nationwide. Their website provides detailed information on SNAP eligibility, benefits, and program guidelines. https://www.fns.usda.gov/snap

- Centers for Medicare & Medicaid Services (CMS):CMS provides information on Medicaid, a program that often complements SNAP benefits. https://www.cms.gov/

- State Human Services Agencies:Each state administers its own SNAP program, with variations in eligibility and benefit levels. State human services agencies provide specific information on SNAP in their respective states. https://www.fns.usda.gov/snap/state-directory

Key Organizations and Contact Information, Is child support considered income for food stamps

A variety of organizations specialize in assisting individuals with SNAP and child support issues. These organizations offer valuable resources, including information, advocacy, and support services.

| Organization | Website | Phone Number |

|---|---|---|

| National Center for Law and Economic Justice (NCLEJ) | https://www.nclej.org/ | (202) 662-1600 |

| National Domestic Violence Hotline | https://www.thehotline.org/ | 1-800-799-SAFE (7233) |

| Legal Aid Services of North Carolina | https://www.legalaidnc.org/ | (800) 662-HELP (4357) |

SNAP Eligibility Flowchart

A flowchart provides a visual representation of the steps involved in determining SNAP eligibility based on child support income. This flowchart can be helpful for understanding the process and identifying potential eligibility challenges.

- Step 1: Determine Household Income: This includes all sources of income, including child support payments received.

- Step 2: Apply for SNAP: Submit an application to your state’s human services agency.

- Step 3: Verify Income: The state agency will verify your income, including child support payments.

- Step 4: Calculate Net Income: Subtract allowable deductions from your gross income.

- Step 5: Compare Net Income to Eligibility Threshold: If your net income meets the SNAP eligibility threshold, you may be eligible for benefits.

- Step 6: Determine Benefit Amount: The amount of SNAP benefits you receive is based on your household size and net income.

Wrap-Up

Navigating the complex landscape of SNAP eligibility, particularly when it comes to child support income, can be a daunting task. This exploration has aimed to provide a comprehensive overview of the relevant regulations, highlighting key considerations and potential pitfalls. By understanding the nuances of how child support is treated under SNAP, individuals and families can make informed decisions about their eligibility and maximize their access to this vital program.

Remember, seeking guidance from reputable resources and official agencies is essential for ensuring accurate information and maximizing your chances of success.

Answers to Common Questions: Is Child Support Considered Income For Food Stamps

What if I receive child support payments from multiple sources?

All child support payments you receive, regardless of the source, are considered income for SNAP eligibility purposes.

Can I deduct child support payments I make from my income for SNAP?

No, child support payments you make are not deductible from your income for SNAP eligibility.

What if I receive child support payments that are irregular or inconsistent?

SNAP agencies typically consider the average amount of child support you receive over a specified period, such as the past three months, to determine your eligibility.

How do I report child support payments to the SNAP agency?

You will need to provide documentation of your child support payments, such as court orders or payment records, to the SNAP agency when applying for or renewing your benefits.