What is a tax stamp for a gun? This question delves into the often-overlooked world of the National Firearms Act (NFA), a complex web of regulations governing certain firearm types in the United States. Understanding these regulations is crucial for responsible gun ownership, as non-compliance can lead to serious legal repercussions. This exploration will unravel the mysteries surrounding gun tax stamps, from their historical context to the intricate application process and potential penalties for non-compliance.

We’ll examine the various firearms requiring these stamps, the associated costs, and the best practices for safe storage and handling.

The NFA, enacted in 1934, established a system of taxation and registration for specific firearm types deemed “dangerous” by the government. This act, along with subsequent amendments, dictates which firearms require a tax stamp before legal ownership and use. These regulated items include suppressors (silencers), machine guns, short-barreled rifles and shotguns, and destructive devices. The process of obtaining a tax stamp involves a rigorous background check and substantial fees, reflecting the stringent controls placed upon these items.

This guide will walk you through the complexities of the process, helping you navigate the legal landscape surrounding NFA-regulated firearms.

What is a Gun Tax Stamp?: What Is A Tax Stamp For A Gun

A gun tax stamp in the United States represents payment of a tax levied on certain firearms and firearm accessories deemed by the government to have a higher potential for misuse or to be particularly dangerous. This tax is administered by the Bureau of Alcohol, Tobacco, Firearms and Explosives (ATF). The stamp itself serves as proof of payment and legal authorization to possess the regulated item.

Purpose of Gun Tax Stamps

The primary purpose of the gun tax stamp is to generate revenue for the government and, more importantly, to regulate the manufacture, transfer, and possession of specific firearms and accessories considered to have increased potential for criminal use. This regulation aims to deter illegal activities and track the movement of these items. The revenue generated contributes to the ATF’s budget for enforcement and related activities.

Firearms Requiring Tax Stamps

Several categories of firearms require tax stamps. These include National Firearms Act (NFA) items, such as machine guns, short-barreled rifles (SBRs), short-barreled shotguns (SBSs), silencers (suppressors), and destructive devices (like grenades or certain types of bombs). These items are subject to stricter regulations than other firearms due to their potential for lethality and ease of use in committing crimes.

A separate tax stamp is required for each regulated item.

Historical Overview of Gun Tax Stamp Regulations

The foundation for gun tax stamps lies in the National Firearms Act of 1934 (NFA), enacted following the era of Prohibition and increased organized crime activity. This act imposed a tax on certain firearms and accessories deemed particularly dangerous, establishing a registration system to track their ownership. Subsequent legislation, such as the Gun Control Act of 1968, further refined and expanded these regulations.

The history reflects a continuing effort by the government to balance Second Amendment rights with public safety concerns.

Requirements for Different Classes of Firearms

The requirements for obtaining a tax stamp vary depending on the type of firearm. For example, the process for registering a machine gun involves a rigorous background check, fingerprinting, and a substantial waiting period. The application process for silencers is similar, but may have less stringent requirements depending on the specific circumstances. The requirements for destructive devices are typically even more stringent, often involving additional inspections and approvals.

These varying requirements reflect the differing levels of risk associated with each type of regulated item. The ATF provides detailed instructions and forms for each specific type of firearm.

The National Firearms Act (NFA) and Tax Stamps

The National Firearms Act (NFA) of 1934 regulates certain types of firearms considered particularly dangerous, imposing a tax on their manufacture, transfer, and possession. This tax is evidenced by a tax stamp, which serves as proof of compliance with the law. Understanding the NFA is crucial for anyone considering owning or transferring these regulated firearms.

Key Provisions of the National Firearms Act Related to Tax Stamps

The NFA’s core provision regarding tax stamps centers on the requirement to pay a special tax and obtain approval from the Bureau of Alcohol, Tobacco, Firearms and Explosives (ATF) before legally possessing certain firearms. This tax is not simply a revenue-generating measure; it’s a regulatory tool designed to control the distribution and ownership of potentially dangerous weapons. The process involves submitting an application, undergoing a background check, and paying the specified tax.

Failure to comply results in significant legal penalties.

Firearms Regulated Under the NFA

The NFA regulates a specific category of firearms deemed to have a heightened potential for harm. These include, but are not limited to, machine guns, short-barreled rifles (SBRs), short-barreled shotguns (SBSs), silencers (suppressors), and destructive devices (such as grenades and bombs). The categorization stems from the perceived increased lethality or ease of concealment associated with these weapon types.

The ATF maintains a detailed list of regulated items and their specific classifications.

The Application Process for Obtaining a Tax Stamp

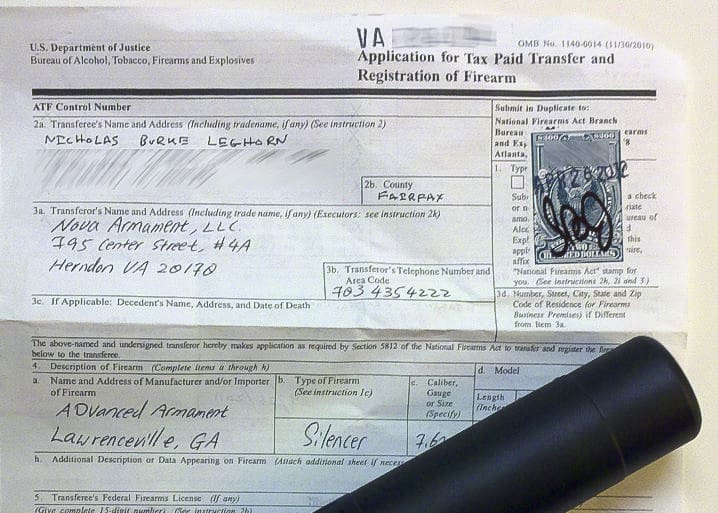

Obtaining an NFA tax stamp is a multi-step process that involves completing ATF Form 1 or Form 4, depending on whether the firearm is being manufactured (Form 1) or transferred (Form 4). These forms require detailed information about the applicant, the firearm, and the intended use. The application is then submitted to the ATF along with the required tax payment.

The ATF conducts a thorough background check, which can take several months to complete. Upon approval, the applicant receives a tax stamp, authorizing possession of the regulated firearm.

Examples of Common NFA-Regulated Firearms

Several examples illustrate the types of firearms regulated under the NFA. Machine guns, due to their rapid firing capability, are heavily restricted. Short-barreled rifles and shotguns, with their increased maneuverability and potential for close-quarters combat, also fall under this regulation. Silencers, which significantly reduce the sound of gunfire, are regulated to limit their use in covert operations or criminal activities.

Destructive devices encompass a broad range of items designed to cause widespread destruction. Each of these examples highlights the NFA’s focus on controlling weapons deemed to pose a higher risk.

The Process of Obtaining a Tax Stamp

Obtaining a tax stamp for a regulated firearm under the National Firearms Act (NFA) involves a multi-step process requiring careful attention to detail and adherence to specific regulations. Failure to comply with these regulations can result in delays or rejection of your application. This section provides a clear and concise guide to navigating this process successfully.The application process for a National Firearms Act (NFA) tax stamp is rigorous, designed to ensure responsible ownership of regulated firearms.

It involves completing specific forms, undergoing a thorough background check, and paying the applicable tax. Understanding each step is crucial for a smooth and timely approval.

Application Steps and Requirements

The following table Artikels the step-by-step process of obtaining a tax stamp, including required documentation and estimated timeframes. These timeframes are estimates and may vary depending on ATF processing times and individual circumstances.

| Step | Action | Required Documents | Timeframe |

|---|---|---|---|

| 1 | Complete ATF Form 1 (for homemade firearms) or ATF Form 4 (for purchasing NFA items from a licensed dealer). | Completed form with accurate information, photographs, fingerprints (Form 4 only requires fingerprints if the seller does not have them on file already), and payment. | Several hours to a few days (depending on the complexity of the item) |

| 2 | Gather supporting documentation. | This may include proof of identity, address, and any other documentation specified on the form. This might also include photographs of the firearm and its serial number, if applicable. | Varies depending on individual circumstances. |

| 3 | Submit the application package to the ATF. | The completed application, all required documents, and the applicable tax payment (check or money order). Applications can be submitted via mail. | 1-2 days for mailing |

| 4 | Await ATF processing and background check. | The ATF will conduct a thorough background check, including fingerprinting and review of criminal history. | This is the most variable step and can take several months, even years, depending on current ATF backlog. |

| 5 | Receive approval (or denial) notification. | The ATF will notify you via mail of the approval or denial of your application. | Several weeks to months, following the background check. |

| 6 | (If approved) Receive your tax stamp. | The approved tax stamp will be mailed to you. This stamp is proof that your application was approved. | A few days after approval notification. |

Background Check Process

The background check conducted by the ATF is a comprehensive process designed to ensure that individuals seeking to own NFA firearms are not prohibited persons. This includes a review of criminal history, mental health records, and other relevant information. The process can take a considerable amount of time, and any discrepancies or issues can significantly delay the approval process.

The specific details of the background check are confidential and not typically disclosed to the applicant.

Costs and Fees Associated with Gun Tax Stamps

The cost of a National Firearms Act (NFA) tax stamp is a significant factor to consider before purchasing a regulated firearm. These fees are set by the federal government and cover the administrative costs associated with processing applications and maintaining the registry of NFA items. Understanding these costs is crucial for responsible ownership.The fees associated with NFA tax stamps are determined by the Bureau of Alcohol, Tobacco, Firearms and Explosives (ATF).

The amount is fixed by law and subject to change, so it’s always best to check the ATF website for the most up-to-date information. These fees are not dependent on the specific make, model, or condition of the item, but rather on the category of NFA item. Factors influencing the overall cost, however, can include additional fees from third-party services such as fingerprints and photographs required for the application process.

NFA Item Tax Stamp Costs

The cost varies depending on the type of NFA item. For example, the tax for a suppressor (silencer) is different from the tax for a short-barreled rifle (SBR). These differences reflect the varying levels of administrative oversight and regulatory complexity associated with each item category. Furthermore, any additional fees, such as those charged by third-party services used to facilitate the application process, will add to the overall expense.

| NFA Item Type | Tax Stamp Cost (as of October 26, 2023 –

|

|---|---|

| Suppressor (silencer) | $200 |

| Short-Barreled Rifle (SBR) | $200 |

| Short-Barreled Shotgun (SBS) | $200 |

| Machine Gun | $200 |

| Destructive Device | $200 |

| Any Other Weapon (AOW) | $200 |

*Note: These costs are subject to change and do not include any additional fees charged by third-party services for fingerprint processing or photographs, which are often required components of the application process.*

Legal Ramifications of Non-Compliance

Possessing National Firearms Act (NFA) items without the required tax stamps carries significant legal consequences. Failure to comply with NFA regulations can result in severe penalties, impacting both personal freedom and financial stability. Understanding these ramifications is crucial for responsible firearm ownership.The penalties for failing to comply with NFA regulations are substantial and can vary depending on the specific violation and the jurisdiction.

These penalties are not merely administrative; they constitute serious criminal offenses.

Potential Criminal Charges and Fines, What is a tax stamp for a gun

Non-compliance with NFA regulations can lead to several criminal charges, including but not limited to, unlawful possession of unregistered firearms, and violations of federal firearms laws. These charges can result in significant fines, ranging from thousands to hundreds of thousands of dollars, depending on the severity of the offense and the number of unregistered items involved. Furthermore, imprisonment is a very real possibility, with sentences ranging from several years to decades in federal prison.

The severity of the sentence is influenced by factors such as prior criminal history, the type of NFA item involved, and the intent behind the violation. For instance, possession of an unregistered machine gun will likely result in a harsher penalty than possession of an unregistered silencer.

Examples of Legal Cases

While specific details of legal cases are often complex and vary by jurisdiction, numerous examples illustrate the serious consequences of NFA violations. Cases involving individuals found in possession of unregistered silencers, short-barreled rifles or shotguns, or unregistered destructive devices frequently result in substantial fines and prison sentences. Court records often detail the investigative process, the evidence presented, and the resulting judgments.

These cases consistently demonstrate the serious nature of NFA violations and the determined enforcement efforts by federal agencies. One could research publicly available court documents to find specific examples. These records often provide details on the charges, the sentencing, and the specific circumstances surrounding the violation. The information gathered from these cases underlines the importance of strict adherence to NFA regulations.

Impact on Gun Ownership Rights

A conviction for NFA violations can have long-lasting repercussions, extending far beyond the immediate penalties. A criminal record related to firearms offenses can permanently restrict future gun ownership rights, impacting an individual’s ability to legally possess firearms in the future, even those not covered by the NFA. This impact extends beyond the individual, potentially affecting employment opportunities, professional licenses, and other aspects of daily life.

The severity of these long-term consequences emphasizes the importance of proactive compliance with all relevant firearm regulations.

Storage and Handling of NFA Firearms

Responsible storage and handling of National Firearms Act (NFA) regulated firearms are paramount for both legal compliance and personal safety. Improper storage can lead to accidental discharge, theft, and serious legal consequences. This section details the legal requirements and best practices for securing these weapons.

Legal Requirements for Storing and Handling NFA Firearms

Federal law mandates that NFA firearms be stored securely to prevent unauthorized access. Specific regulations vary depending on the type of NFA item (e.g., suppressors, machine guns, short-barreled rifles/shotguns), but the overarching principle is to prevent theft and accidental use. This often involves using a locked container, such as a gun safe or a securely fastened cabinet, and adhering to all applicable state and local laws, which may impose stricter requirements.

Failure to comply with these regulations can result in significant penalties, including fines and imprisonment.

Safe Storage Practices to Prevent Accidental Discharge or Theft

Safe storage practices go beyond simply locking up an NFA firearm. It encompasses a comprehensive approach to risk mitigation. This includes choosing a high-quality, appropriately sized safe that is resistant to both forced entry and fire. The safe should be bolted to the floor or wall for added security. Ammunition should be stored separately from the firearm, ideally in a different locked container.

Furthermore, owners should familiarize themselves with the safe’s operation and regularly test its functionality to ensure it remains secure. Regular inspections of the storage area can also help identify any potential vulnerabilities.

Maintaining Proper Documentation for NFA Items

Maintaining accurate and up-to-date records for all NFA items is a critical aspect of responsible ownership. This documentation serves as proof of legal ownership and facilitates compliance with ATF regulations. It’s essential to keep a record of the firearm’s serial number, the date of acquisition, the ATF registration number (if applicable), and any relevant transfer documentation. This documentation should be stored securely, preferably in a separate location from the firearm itself, to protect it from loss or damage.

Digital copies are acceptable, but hard copies are recommended as a backup.

Best Practices for the Safe Storage and Handling of NFA Firearms

Safe and responsible handling of NFA firearms is critical for preventing accidents and maintaining legal compliance. Below are some best practices:

- Always store NFA firearms in a locked, secure container, separate from ammunition.

- Use a high-quality gun safe that is appropriately sized and resistant to forced entry and fire.

- Secure the safe to the floor or wall to prevent theft.

- Keep accurate and up-to-date records of all NFA items, including serial numbers, acquisition dates, and ATF registration numbers.

- Regularly inspect the storage area and the safe to ensure it remains secure and functioning properly.

- Never leave loaded NFA firearms unattended.

- Familiarize yourself with all applicable federal, state, and local laws and regulations.

- Understand the safe handling procedures for your specific NFA firearm.

- Consider using trigger locks or other safety devices when the firearm is not in use.

- Ensure that only authorized individuals have access to the NFA firearms and their storage location.

ATF Regulations and Updates

The Bureau of Alcohol, Tobacco, Firearms and Explosives (ATF) is the primary agency responsible for enforcing the National Firearms Act (NFA) regulations in the United States. Understanding their role and the processes involved in navigating their regulations is crucial for responsible NFA firearm ownership.The ATF plays a vital role in regulating NFA firearms and the associated tax stamps. This includes processing applications for tax stamps, conducting background checks on applicants, inspecting registered NFA items, and investigating violations of NFA regulations.

Their oversight ensures compliance with federal law and contributes to public safety.

ATF Decision Appeal Process

Appealing an ATF decision regarding a tax stamp application or other NFA-related matter involves a multi-step process. First, an applicant must submit a formal request for reconsideration to the ATF, clearly outlining the grounds for appeal. This request must be detailed and supported by evidence. If the reconsideration is denied, the applicant can then pursue an appeal through the administrative process within the Department of Justice.

This may involve hearings and further review of the case before a final decision is rendered. Legal counsel is often recommended during this process.

Recent Updates to NFA Regulations

The ATF periodically updates its regulations and guidance concerning NFA firearms. These updates can address various aspects, including clarification of existing rules, changes to application procedures, and responses to emerging technologies or legal challenges. Staying informed about these changes is critical for maintaining compliance. For example, recent updates might involve modifications to the definition of certain firearm components, adjustments to the application process for specific NFA items, or changes in the types of documentation required for registration.

It is imperative to consult the official ATF website and relevant publications for the most current information. Failure to stay abreast of these changes can lead to unintentional violations and potential legal consequences.

Illustrative Examples of NFA Items

The National Firearms Act (NFA) regulates certain firearm accessories and weapons due to their potential for increased lethality or concealment. Understanding the features and characteristics of these items is crucial for compliance with the law. This section will detail three examples: silencers, automatic weapons, and short-barreled shotguns.

Silencers

Silencers, also known as suppressors, are devices designed to reduce the sound of a firearm’s discharge. Their construction typically involves a cylindrical tube containing a series of baffles or chambers. These baffles are strategically designed to redirect and dissipate the expanding gases produced by the firing of a cartridge. The gases are forced to travel a longer, more convoluted path, reducing the pressure and velocity of their release, thereby significantly diminishing the sound.

Different silencer designs employ varying baffle configurations to optimize sound reduction for specific calibers and firearm types. The effectiveness of a silencer varies depending on its design, construction, and the firearm it’s used with.

Automatic Weapons

Automatic weapons are firearms that continue to fire as long as the trigger is depressed and ammunition is available. Unlike semi-automatic weapons, which fire one round per trigger pull, automatic weapons utilize a mechanism that continuously feeds ammunition and cycles the action, resulting in a rapid rate of fire. The firing mechanism varies depending on the design of the weapon, but commonly involves a system of springs, levers, and gas pistons or blowback systems that extract spent cartridges, load new rounds, and cock the firing pin.

The rate of fire can range significantly depending on the weapon’s design and can be measured in rounds per minute (RPM). High rates of fire can exceed several hundred RPM, making automatic weapons particularly lethal in sustained fire situations.

Short-Barreled Shotguns

A short-barreled shotgun (SBS) is defined as a shotgun with a barrel less than 18 inches in length. The design is essentially a standard shotgun, but with a significantly shortened barrel. This shorter barrel reduces the overall length of the weapon, making it more compact and maneuverable. The reduced barrel length also affects the shotgun’s characteristics, including its effective range and pattern spread.

While the shorter barrel may provide advantages in close-quarters combat or concealed carry scenarios, the reduced barrel length also decreases the effectiveness at longer ranges, as the shot pattern spreads more rapidly. SBSs are often used for home defense or specialized tactical applications.

Navigating the world of NFA-regulated firearms and tax stamps requires meticulous attention to detail and a thorough understanding of the relevant laws. While the process may seem daunting, careful preparation and adherence to the regulations will ensure compliance and responsible ownership. Remember, the penalties for non-compliance are severe, underscoring the importance of understanding and following the procedures Artikeld by the ATF.

This guide provides a comprehensive overview, but consulting with legal professionals specializing in firearms law is always recommended for personalized guidance.

FAQ Explained

What happens if my tax stamp application is denied?

If your application is denied, you will receive notification outlining the reasons for denial. You have the right to appeal the decision through the ATF’s established appeals process.

Can I transfer an NFA item to another person?

Yes, but the transfer process is also regulated by the NFA and requires the completion of additional paperwork and ATF approval. This involves another tax stamp application and background check.

How long does the tax stamp approval process typically take?

Processing times vary but can range from several months to over a year, depending on current ATF workload and other factors.

What are the storage requirements for NFA firearms?

NFA firearms must be stored securely to prevent theft or unauthorized access. Specific requirements may vary by state and local laws, but generally involve locked containers and compliance with all applicable regulations.