Can a foster parent get food stamps? This crucial question impacts the well-being of countless families navigating the complexities of foster care. The answer, however, isn’t a simple yes or no, but rather a nuanced exploration of eligibility requirements, income calculations, and state-specific variations in food assistance programs. Understanding the intricacies of these programs is vital for foster parents striving to provide nutritious meals for the children in their care, ensuring their health and development thrive.

Navigating the application process for food assistance can feel like traversing a maze, especially for foster parents already juggling multiple responsibilities. This guide aims to illuminate the path, providing a clear understanding of eligibility criteria, income considerations, and the role of the children in determining benefit amounts. We’ll explore how foster care payments, other income sources, and medical expenses impact eligibility, offering practical examples and step-by-step guidance to help foster parents determine their potential for receiving food assistance.

Eligibility Requirements for Foster Parents Receiving Food Assistance

Navigating the complexities of food assistance programs can be challenging, especially for foster parents who juggle numerous responsibilities. Understanding eligibility criteria is crucial to accessing these vital resources. This section clarifies the requirements for food assistance, specifically focusing on the unique circumstances of foster parents.

General Eligibility Criteria for Food Assistance Programs

Eligibility for food assistance programs, such as the Supplemental Nutrition Assistance Program (SNAP), is primarily determined by income and asset limits. Applicants must generally be U.S. citizens or qualified non-citizens, and meet residency requirements within their state. Income is calculated based on gross monthly income, considering all household members. Asset limits vary by state but generally restrict the amount of cash and savings an applicant can possess.

Certain deductions may be applied to income based on factors such as medical expenses or dependent care costs. For example, a family of four might have a gross monthly income limit of $3,000, with an asset limit of $2,000. These limits are adjusted periodically to account for inflation and cost of living changes. Failure to meet these criteria would result in ineligibility for benefits.

Specific Requirements for Foster Parents Applying for Food Benefits

Foster parents applying for food benefits often face unique considerations. While the general eligibility rules apply, the inclusion of foster children in the household significantly impacts income and household size calculations. The income of the foster children is generally not included in the calculation, but their presence increases the household size, potentially affecting the benefit amount. The state’s child welfare agency may provide additional documentation supporting the foster parent’s application, including details about the number of foster children in care and any financial support received for their care.

It is important to accurately report all income and assets, including any reimbursements or stipends received for fostering.

Examples of Income Limits and Asset Restrictions

Income and asset limits vary significantly by state and are adjusted annually. For illustrative purposes, let’s consider a hypothetical example: In State X, a single foster parent caring for two children might have a gross monthly income limit of $2,500 and an asset limit of $1,500. If the foster parent’s income exceeds this limit, they may be ineligible for SNAP benefits.

If their assets exceed the limit, they may also be ineligible. It is crucial to check the specific limits for the relevant state. Additional considerations might include whether the foster parent receives any other public assistance benefits, which could affect their eligibility for SNAP. The application process will clarify the exact thresholds that apply in a specific case.

Comparison of the Application Process for Foster Parents Versus Other Applicants

The application process for foster parents is generally similar to that of other applicants. However, the inclusion of foster children requires additional documentation. Foster parents may need to provide proof of foster care status from the state child welfare agency. This documentation may include case records or official letters confirming their role as foster parents and the number of children in their care.

The processing time for applications might also vary depending on the workload of the local agency and the completeness of the documentation provided. The need for additional documentation could potentially prolong the processing time compared to applications from individuals without foster children.

Summary of Eligibility Criteria

| Criterion | Requirement | Foster Parent Specifics | Additional Notes |

|---|---|---|---|

| Income | Below state-defined limits | Foster children’s income usually excluded, household size increased | Gross monthly income considered; deductions may apply. |

| Assets | Below state-defined limits | All assets considered, including those of foster children (in some states). | Cash, savings, and other liquid assets are typically included. |

| Residency | Meet state residency requirements | Same as other applicants. | Proof of residency may be required. |

| Citizenship/Immigration Status | U.S. citizen or qualified non-citizen | Same as other applicants. | Documentation of citizenship or immigration status is necessary. |

| Documentation | Provide required documentation | Requires additional documentation from child welfare agency | Proof of foster care status, case records, etc. |

Income and Resource Calculations for Foster Parents: Can A Foster Parent Get Food Stamps

Determining eligibility for food stamps (SNAP) for foster parents involves a careful calculation of income and resources. The process considers not only the foster parent’s own earnings but also the financial support provided for the foster children in their care. Understanding this process is crucial for ensuring foster parents receive the assistance they need.

Foster Care Payments in Income Calculations

Foster care payments are generally considered as income when determining SNAP eligibility. However, the specific treatment of these payments varies by state and can depend on the type of foster care arrangement (e.g., kinship care, agency-placed). Some states may exclude a portion or all of the foster care payment from income calculations, recognizing that these funds are intended to support the child’s needs, not the foster parent’s personal expenses.

It’s essential to consult with the local SNAP office for precise guidelines in your area. For example, in some states, a certain portion of the payment directly attributed to the child’s care might be excluded, while the remaining portion is included as income. This often involves a detailed breakdown of expenses associated with the foster child.

Inclusion of Other Income Sources

In addition to foster care payments, all other sources of income are factored into the SNAP eligibility calculation. This includes wages from employment, self-employment income, unemployment benefits, Social Security benefits, child support received, alimony, and any other regular cash income. Each income source is assessed based on its gross amount (before taxes and deductions) and frequency (e.g., monthly, weekly).

The SNAP agency will typically request documentation verifying these income sources. For instance, pay stubs, tax returns, or bank statements are common forms of proof.

Impact of Income Levels on Benefit Amounts

The amount of SNAP benefits received is inversely related to income. Higher income levels generally result in lower benefits, or even ineligibility. For example, a foster parent with a low income and significant foster care payments might receive the maximum SNAP benefit for their household size. Conversely, a foster parent with a higher income from employment might receive a reduced benefit, or be ineligible entirely.

The specific benefit amount is determined through a formula that considers household size, income, and applicable deductions. A household of four with a low income might receive $800 per month, whereas a household of the same size with a higher income might receive $400, or nothing at all. These figures are illustrative and vary significantly by state and household circumstances.

Medical Expenses and Other Deductions, Can a foster parent get food stamps

Medical expenses and certain other deductions can significantly impact eligibility. High medical expenses for the foster parent or the foster children can reduce the net income considered for SNAP eligibility. Other allowable deductions might include child care costs, dependent care expenses, and certain work-related expenses. Providing proper documentation of these expenses is crucial for obtaining the maximum possible benefit.

A foster parent with high medical bills for a foster child could see a substantial reduction in their calculated income, potentially increasing their SNAP benefit amount.

Step-by-Step Calculation Guide

- Gather Income Information: Compile all income sources for the household, including foster care payments, wages, self-employment income, and other benefits. Document the gross amount and frequency of each income source.

- Calculate Gross Monthly Income: Sum all gross monthly income from step 1.

- Determine Allowable Deductions: Identify and document all allowable deductions, such as medical expenses, child care costs, and work-related expenses. This often requires supporting documentation.

- Subtract Deductions from Gross Income: Deduct the allowable deductions from the gross monthly income calculated in step 2.

- Determine Net Monthly Income: The result from step 4 represents the net monthly income used to determine SNAP eligibility.

- Compare Net Income to Eligibility Limits: Compare the net monthly income to the SNAP income eligibility limits for the household size in the relevant state. This determines eligibility.

- Calculate Benefit Amount (if eligible): If eligible, the benefit amount is calculated based on the net income, household size, and state-specific guidelines.

The Role of the Child(ren) in Determining Eligibility

Eligibility for food stamps, or the Supplemental Nutrition Assistance Program (SNAP), for foster parents is significantly impacted by the number and characteristics of the children in their care. The presence of foster children fundamentally alters the income and resource calculations used to determine benefit levels. Understanding this interplay is crucial for foster parents navigating the application process.The number of children in foster care directly affects the household size, a key factor in calculating SNAP benefits.

A larger household size generally results in a higher maximum benefit amount. Conversely, fewer children may lead to a lower maximum benefit, even if the foster parent’s income remains the same. This is because SNAP benefits are designed to provide a minimum nutritional safety net, scaled to the needs of the household. Furthermore, the inclusion of children in the household also modifies the calculation of allowable income and resources.

Children’s Income and Resource Considerations

Children in foster care may have their own sources of income, such as Social Security benefits, child support, or trust funds. These income sources are typically considered in the calculation of the household’s total income. However, there are often specific rules regarding how these funds are treated. For example, some funds may be excluded or treated differently depending on whether they are earmarked for specific needs or are considered available for general household expenses.

It’s crucial for foster parents to accurately report all sources of income for the children in their care.

Examples of Situations Affecting Benefits

Consider two scenarios: In the first, a foster parent receives a child with a significant disability whose care requires substantial expenses. This increased cost of care might allow the foster parent to qualify for a higher SNAP benefit. In the second scenario, a child who previously received child support payments is adopted, and the payments cease. This loss of income may reduce the household income, potentially increasing the SNAP benefits received by the foster parent.

In both instances, the change in the children’s financial situation directly impacts the eligibility determination for the foster parent.

Impact of Children with Special Needs

Children with special needs often require additional resources and expenses. These expenses, however, are not directly factored into the SNAP benefit calculation. While the increased cost of care is not reflected in the SNAP benefit amount, the foster parent’s increased expenses may affect their overall financial stability, influencing their eligibility for other assistance programs alongside SNAP. Understanding available resources and how to access them is essential.

Flowchart: Number of Children and Eligibility Determination

The following flowchart illustrates how the number of children impacts the eligibility determination.[Descriptive Flowchart]Imagine a flowchart with two main branches stemming from “Start”. The left branch is labeled “Number of Foster Children: 0-2”. This branch leads to a box: “Lower Maximum Benefit Level Calculation (based on household size and income)”. This then leads to “Eligibility Determination”. The right branch is labeled “Number of Foster Children: 3 or more”.

This branch leads to a box: “Higher Maximum Benefit Level Calculation (based on household size and income)”. This then leads to “Eligibility Determination”. Both “Eligibility Determination” boxes connect to an “End” box. The flowchart visually represents how the number of children significantly influences the calculation method and therefore, the eligibility for benefits.

State-Specific Variations in Food Assistance for Foster Parents

Navigating the landscape of food assistance for foster parents involves understanding that federal programs, while providing a foundational framework, are significantly shaped by individual state policies. These variations create a complex patchwork across the nation, impacting eligibility criteria, benefit levels, and the application process itself. This section will explore these state-specific nuances, offering examples and highlighting key differences.

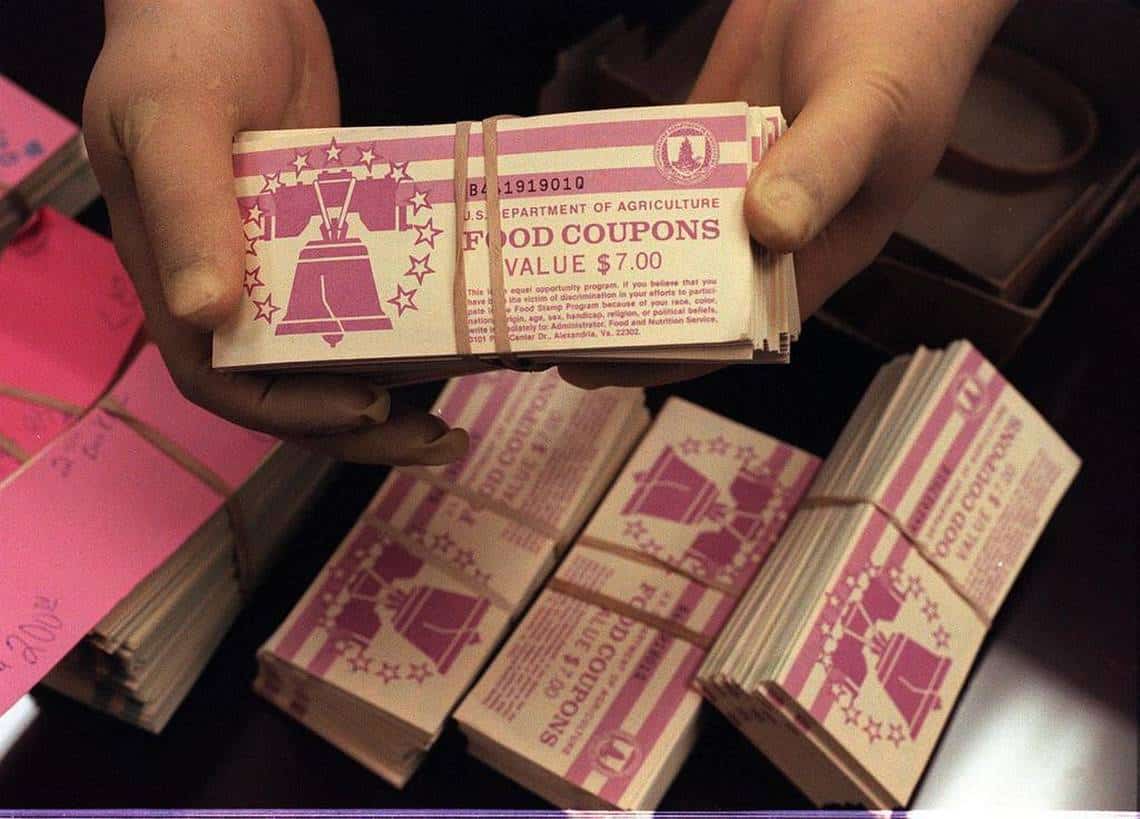

State Supplemental Nutrition Assistance Programs

Many states augment the federal Supplemental Nutrition Assistance Program (SNAP), formerly known as Food Stamps, with their own initiatives designed to better serve the needs of foster families. These supplementary programs often address gaps in federal coverage or provide additional benefits tailored to the unique challenges faced by foster parents. For example, some states offer increased benefit amounts for foster parents caring for a larger number of children or those with specific dietary needs.

Others might provide additional funding for purchasing specific food items, such as baby formula or specialized dietary supplements. These state-level additions can significantly impact the overall food security of foster families.

Variations in Eligibility Requirements Across States

Eligibility for food assistance programs varies considerably from state to state, even when considering the same federal program. While federal guidelines set a baseline, states can impose stricter requirements, potentially impacting the number of foster parents who qualify. For instance, some states may have stricter income or asset limits than the federal guidelines, resulting in a smaller pool of eligible foster parents.

Other states might incorporate additional eligibility criteria, such as requiring specific documentation related to foster care status or the children’s needs. This variability necessitates careful examination of individual state regulations.

State Policies and Their Impact on Application Processes and Benefit Amounts

State-level policies profoundly affect both the application process and the ultimate benefit amount received by foster parents. Some states streamline the application process for foster parents, offering dedicated support staff or simplified forms to ease the burden of navigating complex paperwork. Conversely, other states may have more cumbersome application processes, potentially creating barriers to accessing needed assistance. Similarly, benefit amounts can vary widely.

While the federal government establishes minimum benefit levels, states can choose to supplement these amounts, leading to significant differences in the financial support available to foster families.

Resources for Foster Parents Seeking State-Level Food Assistance Information

Information on state-specific food assistance programs is typically available through several channels. State human services or welfare agencies often maintain dedicated websites providing comprehensive information on eligibility criteria, application procedures, and benefit levels. Local community organizations and non-profits supporting foster families can also serve as valuable resources, offering guidance and assistance with the application process. Contacting the state’s SNAP office directly is another effective method for obtaining accurate and up-to-date information.

Comparison of State Policies

| State | Eligibility Criteria | Benefit Levels | Application Process |

|---|---|---|---|

| California | Meets federal SNAP guidelines, with additional state-funded programs for specific foster care situations. | Generally follows federal guidelines, with potential for supplemental benefits depending on family size and specific needs. | Online application available, with potential for in-person assistance. |

| Texas | Stricter income and asset limits compared to federal guidelines. Specific documentation related to foster care status may be required. | Generally aligned with federal guidelines, with limited opportunities for supplemental state funding. | Primarily online application, with limited in-person support. |

| New York | Generally follows federal SNAP guidelines, with streamlined application process for foster parents. | May offer higher benefit levels than federal minimums, especially for families with multiple children. | Online and in-person application options available, with dedicated support for foster parents. |

Resources and Support for Foster Parents Seeking Food Assistance

Navigating the complexities of foster parenting often presents significant financial challenges. Securing adequate nutrition for the children in care is paramount, and understanding the available resources for food assistance is crucial for foster parents. This section details the various avenues of support available, including government programs, community organizations, and practical strategies for accessing these vital services.

Government Websites and Organizations Offering Support

Numerous federal and state agencies offer assistance to foster parents facing food insecurity. These resources are designed to supplement household income and ensure children receive proper nutrition. Understanding the eligibility criteria and application processes for each program is key to accessing the support available.

- The Supplemental Nutrition Assistance Program (SNAP): Administered at the state level, SNAP provides food benefits to eligible low-income individuals and families, including foster parents. State websites (often linked from the USDA’s Food and Nutrition Service website) provide specific application information and eligibility guidelines.

- The USDA Food and Nutrition Service (FNS): The FNS website serves as a central hub for information on SNAP and other federal nutrition assistance programs. It provides links to state-level resources and general information about eligibility criteria.

- State Child Welfare Agencies: Each state maintains its own child welfare agency, which often provides information and support services to foster parents, including referrals to food assistance programs. Contact information for these agencies can typically be found through a simple online search.

- Temporary Assistance for Needy Families (TANF): While not directly a food assistance program, TANF provides cash assistance to families in need, which can indirectly help alleviate food insecurity. Eligibility requirements vary by state.

Types of Assistance Beyond Food Stamps

Food assistance is only one piece of the puzzle. Many other programs can provide crucial support to foster families struggling financially. These services often work in conjunction with food assistance to create a more comprehensive safety net.

- Housing Assistance: Programs like Section 8 housing vouchers can significantly reduce housing costs, freeing up resources for food and other necessities. Contact your local public housing authority for more information.

- Medicaid: Medicaid provides healthcare coverage for low-income individuals and families, reducing the financial burden of medical expenses and allowing more resources to be allocated to food.

- Child Care Subsidies: Access to affordable childcare is vital for working foster parents. Subsidies can help offset the cost of childcare, ensuring parents can maintain employment and provide for their families.

- Utility Assistance: Programs like the Low Income Home Energy Assistance Program (LIHEAP) can help with heating and cooling costs, reducing financial strain on foster families.

Applying for and Receiving Food Assistance Benefits

The application process for food assistance programs varies by state, but generally involves completing an application form, providing documentation of income and household size, and undergoing an eligibility determination.

- Application Submission: Applications can often be submitted online, by mail, or in person at a local office. The specific method will depend on the state and the program.

- Eligibility Determination: Once the application is received, the state agency will review the information and determine eligibility based on income and resource limits.

- Benefit Issuance: If approved, benefits are typically issued via an electronic benefits transfer (EBT) card, similar to a debit card, that can be used at participating grocery stores.

- Renewal Process: Benefits are usually not permanent and require periodic renewal. Foster parents should be aware of the renewal deadlines and the necessary steps to maintain their eligibility.

Challenges Foster Parents Face in Accessing Resources

Foster parents may face unique challenges in accessing food assistance and other support services. These obstacles can hinder their ability to provide adequate care for the children in their charge.

- Complex Application Processes: The application process for various assistance programs can be confusing and time-consuming, particularly for those unfamiliar with the system.

- Documentation Requirements: Gathering the necessary documentation to prove eligibility can be difficult, especially for foster parents who may be dealing with unstable living situations or limited access to resources.

- Time Constraints: Foster parents often have demanding schedules and limited time to navigate the application process and attend appointments.

- Lack of Awareness: Many foster parents may be unaware of the available resources or unsure how to access them.

Locating Local Food Banks and Pantries

Food banks and pantries offer supplemental food assistance to those in need, providing a vital safety net for foster families. Locating these resources is relatively straightforward.

- Online Search: Begin by conducting an online search using terms such as “food bank near me,” “food pantry [your city/zip code],” or “emergency food assistance [your county].”

- Feeding America Website: Feeding America is a national network of food banks. Their website allows you to search for food banks and pantries in your area by entering your zip code or address.

- United Way 2-1-1: Dialing 2-1-1 (in the United States) connects you with your local United Way, which can provide referrals to food banks, pantries, and other community resources.

- Local Government Websites: Check the websites of your city, county, or state government for listings of local food assistance programs.

- Community Centers and Churches: Many community centers and churches operate food pantries or offer food assistance programs. Contact local organizations to inquire about available resources.

Illustrative Scenarios

Understanding the eligibility criteria for food assistance programs for foster parents requires examining specific cases. The following scenarios illustrate how different circumstances can impact eligibility, highlighting the complexities involved in determining need. These are simplified examples and actual eligibility is determined by state-specific regulations and individual circumstances.

Eligible Foster Parent Scenario

Sarah is a single foster parent caring for two children, ages 6 and 8. She works part-time as a home health aide, earning $1,200 per month before taxes. Her monthly rent is $800, utilities average $200, and transportation costs are $150. She receives a monthly foster care payment of $500 per child, totaling $1000. Her total monthly income is $2200.

Her total monthly expenses, excluding food, are $1150. Based on her income and expenses, and the number of people in her household (3), she likely falls below the income threshold for food assistance in her state. The food stamps program considers the number of people in the household when determining eligibility and benefit levels. Her relatively low income, coupled with the expenses associated with caring for two children, makes her a likely candidate for food assistance.

Ineligible Foster Parent Scenario

Michael and Jessica are a married couple fostering one teenager. Michael works as a software engineer, earning $6,000 per month. Jessica is a stay-at-home parent. They receive a monthly foster care payment of $750. Their total monthly income is $6750.

Their mortgage is $2,500, utilities are $300, and their other monthly expenses (excluding food) are approximately $1,500. Their total monthly expenses, excluding food, are $4300. Despite fostering a child, their combined income significantly exceeds the income limits for food assistance in their state, even considering the expenses related to fostering. The high income of the household outweighs the expenses of caring for the foster child, rendering them ineligible.

Comparison of Scenarios

The key difference between Sarah and Michael & Jessica lies in their income levels relative to their expenses and the number of individuals in their households. Sarah’s lower income and higher number of dependents place her within the eligibility range for food assistance. In contrast, Michael and Jessica’s high income, despite their expenses, surpasses the income limits set for food assistance programs.

The number of individuals in the household is a factor in both scenarios, but the income level ultimately determines eligibility. The state-specific income thresholds are critical to determining eligibility; a family considered ineligible in one state might be eligible in another with different guidelines. The foster care payments are considered income, and while they contribute to household income, they do not automatically disqualify a family from food assistance if the total income remains below the eligibility threshold.

Securing adequate nutrition for foster children is paramount, and understanding the complexities of food assistance programs is a critical step in achieving this goal. While the eligibility criteria can seem daunting, this guide has provided a framework for navigating the process. Remember, resources are available to assist foster parents in accessing these vital benefits. By understanding the eligibility requirements, income calculations, and state-specific variations, foster parents can advocate for themselves and the children in their care, ensuring they receive the support they need to thrive.

Commonly Asked Questions

What documents are typically required to apply for food stamps as a foster parent?

Generally, you’ll need proof of identity, residency, income, and household size. Specific requirements vary by state, so check with your local agency.

Can I receive food stamps if I’m already receiving other government assistance?

Yes, but the amount of food stamps you receive may be affected by other benefits. Your income and assets will be considered in determining eligibility for all programs.

What happens if my foster child’s income is considered in the calculation?

A child’s income is usually considered part of the household income, potentially impacting the overall benefit amount. The specifics depend on state and federal guidelines.

Where can I find a local food bank or pantry to supplement food stamps?

You can use online search engines or contact your local social services agency to find nearby food banks and pantries.