What is revenue stamp, lah? Eits, jangan ngira cuma perangko biasa ya! Ini tuh kayak semacam pajak tersembunyi, dulu mah sering banget dipake di surat-surat penting, kayak akta tanah atau perjanjian bisnis. Bayangin aja, jaman dulu, negara dapet duitnya juga dari sini, asli cuan banget! Sekarang sih udah mulai jarang, tapi masih ada kok beberapa negara yang pake.

Yuk, kita bahas tuntas!

Revenue stamps are essentially small pieces of paper that act like a mini-tax. They were historically used to show proof of payment for certain documents and transactions. Think of it as an old-school way of making sure the government gets its cut. Different countries and regions have their own revenue stamp systems, with varying designs and applications. Some are still in use today, while others are relics of the past.

We’ll explore the history, current uses, and legal implications of revenue stamps, so you’ll be a pro in no time!

Definition and Purpose of Revenue Stamps

Revenue stamps, seemingly relics of a bygone era, hold a surprisingly vital place in the history of taxation and governance. These small, often colorful, adhesive labels, represent a tangible link to centuries of government revenue collection and document authentication. Their quiet presence on official documents speaks volumes about the intricate relationship between citizens and the state.Revenue stamps primarily serve as evidence of tax payment on specific transactions or documents.

Their use ensures that the government receives the appropriate revenue, contributing to the funding of public services and infrastructure. This function, seemingly simple, has played a critical role in the economic and administrative development of nations across the globe. The act of affixing a revenue stamp is more than just a bureaucratic procedure; it’s a symbolic acknowledgment of the social contract, a silent affirmation of the citizen’s duty to contribute to the common good.

Historical Context of Revenue Stamps

The origins of revenue stamps can be traced back to the 17th century, emerging as a practical method for collecting taxes on various goods and services. Early examples often lacked the sophisticated designs seen in later iterations, focusing primarily on functionality over aesthetics. The development of printing technology significantly impacted their production, enabling mass production and the incorporation of increasingly intricate designs and security features to prevent counterfeiting.

Over time, revenue stamps evolved from simple markings to complex works of art, reflecting the artistic sensibilities and technological advancements of their respective eras. Their history is a fascinating reflection of the evolution of tax systems and the ongoing struggle to ensure fiscal integrity.

Primary Function of Revenue Stamps

The core function of a revenue stamp is to act as irrefutable proof of payment of a specific tax levied on a document or transaction. This serves both to protect government revenue and to provide legal validity to the document itself. Without the appropriate revenue stamp, the document might be considered legally incomplete or invalid, leading to potential legal complications.

The use of revenue stamps ensures transparency and accountability in financial transactions, promoting trust and confidence in the system. In essence, they act as a verifiable record of a tax payment, providing a clear audit trail.

Examples of Documents Requiring Revenue Stamps

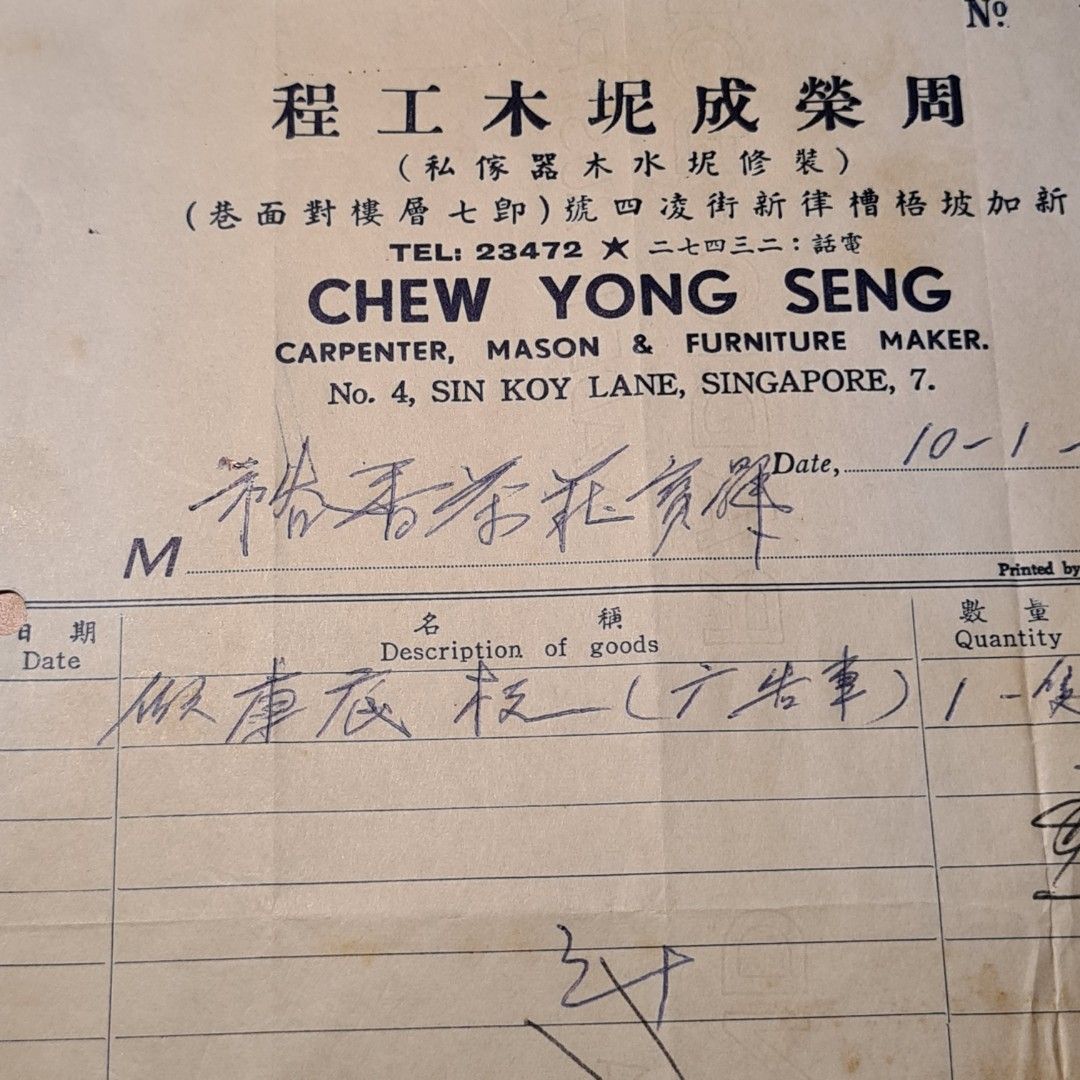

Historically, a wide variety of documents have required revenue stamps. These have included, but are not limited to, legal contracts, deeds of property transfer, marriage certificates, licenses, and commercial documents such as bills of lading and insurance policies. The specific documents requiring stamps vary greatly depending on the jurisdiction and the type of tax being levied. For instance, in some jurisdictions, revenue stamps might be required for court documents, while in others they might be associated with specific types of business transactions.

The requirements surrounding revenue stamps are often detailed in specific legal codes and regulations.

Comparison of Revenue Stamps Across Jurisdictions

The use of revenue stamps varies significantly across different jurisdictions. Some countries have completely phased them out, replacing them with electronic systems or other forms of tax collection. Others still rely heavily on revenue stamps, particularly for certain types of documents or transactions. Even within a single country, variations may exist at the state or provincial level.

The design, value, and legal implications of revenue stamps can differ dramatically based on geographical location and historical context. This disparity highlights the evolving nature of tax systems and the diverse approaches taken by governments worldwide.

Legal Implications of Not Using Revenue Stamps

Failure to use revenue stamps where legally required can have significant legal consequences. These consequences may range from fines and penalties to the invalidation of the document itself. In some cases, the lack of a revenue stamp might lead to criminal charges, depending on the severity of the offense and the jurisdiction involved. The specific penalties associated with non-compliance are generally clearly Artikeld in the relevant legal framework.

The potential legal ramifications underscore the importance of adhering to the specific requirements concerning revenue stamps in any given jurisdiction.

Types of Revenue Stamps

Revenue stamps, those small, often overlooked pieces of paper, tell a fascinating story of taxation and governance across centuries and continents. Their seemingly simple function belies a rich tapestry of design, material, and purpose, reflecting the evolving needs and aesthetics of the issuing authorities. Exploring their diversity reveals a captivating glimpse into history and the mechanics of state revenue collection.

The types of revenue stamps are incredibly varied, reflecting the specific taxes and duties they represent. Their physical characteristics, too, changed significantly over time, influenced by printing technology and the artistic sensibilities of each era. From simple, almost crudely printed markings to intricate works of art, revenue stamps offer a visual record of their time.

Categorization of Revenue Stamps by Application

Revenue stamps were, and in some places still are, applied to a wide array of documents and transactions to denote the payment of a tax or duty. These applications can be broadly categorized, although the lines often blur, depending on the jurisdiction and historical period. For instance, a single stamp might cover multiple aspects of a transaction.

Common categories include stamps for legal documents (contracts, deeds, wills), commercial transactions (bills of exchange, promissory notes), licenses (trade, profession, alcohol), and excise duties (on goods like tobacco or alcohol). Some stamps were even used to verify the authenticity of specific goods or to ensure compliance with import/export regulations. The specific types issued varied dramatically depending on the needs and priorities of the government issuing them.

Physical Characteristics of Revenue Stamps

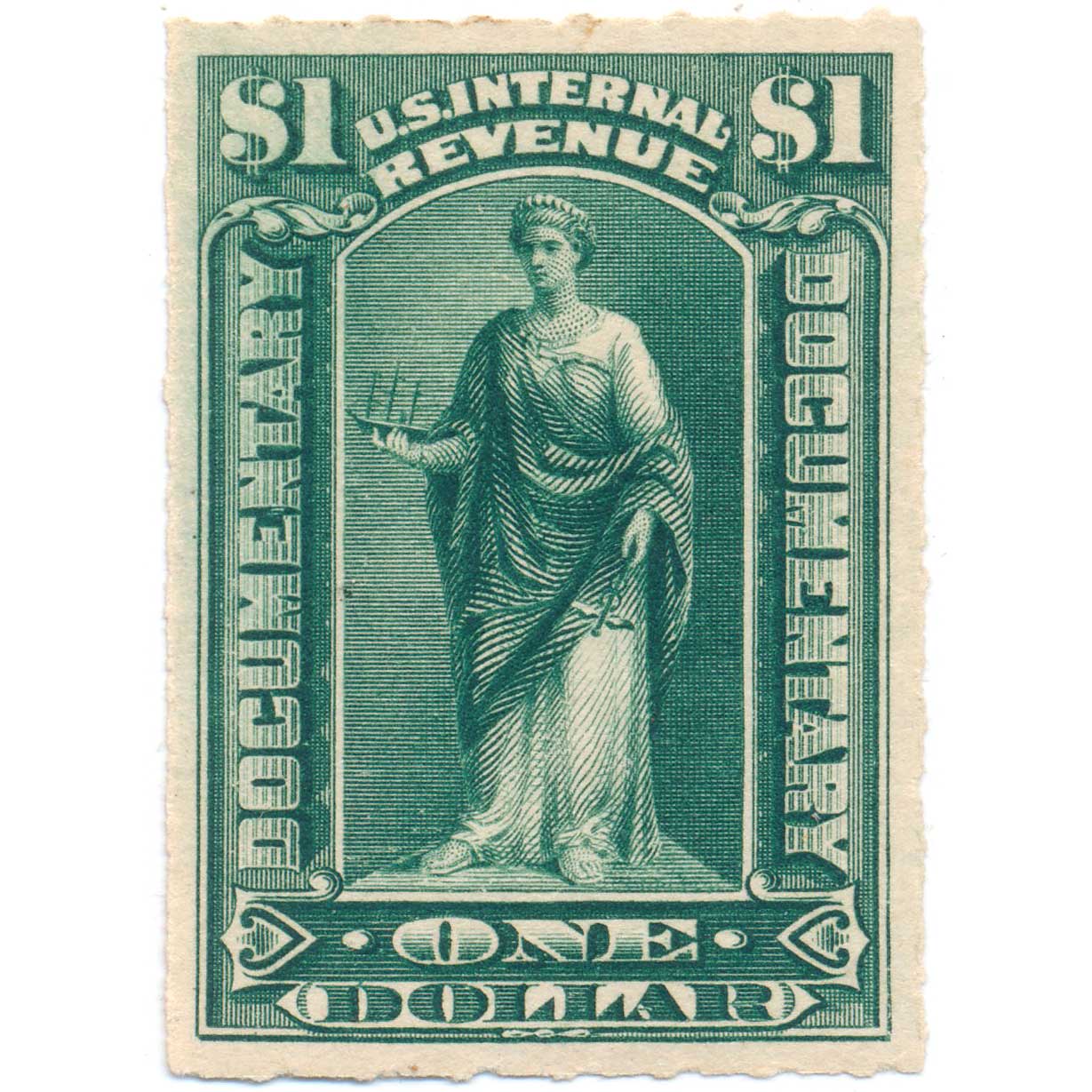

The physical characteristics of revenue stamps varied greatly depending on the era, the issuing authority, and the intended purpose. Early stamps were often simple, hand-printed markings on paper. Later, advancements in printing technology led to more intricate designs, utilizing techniques like lithography and engraving to produce highly detailed and visually appealing stamps.

Size, material, and design elements all played a role in differentiating stamps. Sizes ranged from tiny labels to relatively large sheets, while materials included paper, cardboard, and even metal. Design elements, such as colors, images (portraits of rulers, national symbols, allegorical figures), and intricate patterns, not only served to enhance the visual appeal but also helped to prevent counterfeiting.

The use of special inks, watermarks, and perforations further enhanced security features.

Examples of Revenue Stamps

| Type | Purpose | Jurisdiction |

|---|---|---|

| Contract Stamp | Tax on legal contracts | United States (19th century) |

| Liquor License Stamp | Tax on alcohol sales | British India (early 20th century) |

| Documentary Stamp | Tax on various documents | France (late 19th century) |

| Import Duty Stamp | Tax on imported goods | Canada (mid 20th century) |

Obsolete Revenue Stamps and Their Historical Significance

Many revenue stamps are now obsolete, having been replaced by modern tax systems. However, these obsolete stamps hold significant historical value. They provide tangible evidence of past tax laws, economic conditions, and artistic styles. Studying them can offer insights into the social and political climate of the time they were issued.

For example, examining the designs of stamps from periods of war or economic hardship can reveal the priorities and struggles of the governments that issued them. Changes in design might reflect shifts in national identity or artistic trends. The sheer diversity of obsolete stamps across different countries and periods offers a rich source of historical data for researchers in fields ranging from numismatics to economic history.

Visual Representation of Revenue Stamp Designs

Imagine a visual comparison: In the top row, a simple, almost crudely printed stamp from the 18th century, showing a plain text inscription indicating the tax amount and a small, indistinct image of a crown. Next to it, a more sophisticated 19th-century stamp, printed using lithography, showcasing a detailed portrait of a monarch surrounded by elaborate flourishes and a vibrant color scheme.

Finally, a 20th-century stamp, printed using advanced techniques, with a complex, multi-colored design incorporating national symbols and intricate security features, reflecting the technological advancements of the time. The progression visually highlights the evolution of printing technology and its impact on revenue stamp design.

The Process of Obtaining Revenue Stamps: What Is Revenue Stamp

Acquiring and properly using revenue stamps might seem daunting at first, but understanding the process can alleviate much of the anxiety. It’s a crucial step in ensuring your legal documents are compliant and accepted by the relevant authorities. This section will guide you through the entire procedure, from purchase to verification, highlighting the importance of using authentic stamps and the potential consequences of not doing so.Purchasing revenue stamps is usually a straightforward process, though the specifics vary depending on your location and the type of stamp required.

Generally, you can obtain them from designated government offices, authorized agents, or online portals. The process often involves filling out a form indicating the number of stamps needed and the type of document they will be affixed to. Payment is typically made through cash, check, or electronic transfer. Always retain your receipt as proof of purchase.

Methods for Purchasing Revenue Stamps

The methods for purchasing revenue stamps are diverse and tailored to the needs and preferences of users. Some jurisdictions offer a physical storefront approach, where individuals can visit designated government offices or authorized agents to make their purchases directly. This method provides a tangible and immediate experience, allowing for face-to-face interaction with representatives. Alternatively, many jurisdictions are embracing the digital age by offering online purchasing options.

This online approach offers convenience and accessibility, eliminating the need for physical travel. Users can simply browse available stamps, select their desired quantity, and complete the purchase through secure online payment gateways. Furthermore, some jurisdictions have established partnerships with private vendors, expanding the reach and accessibility of revenue stamp acquisition. This collaborative approach ensures wider distribution and availability for users who might not have easy access to government offices.

Methods for Affixing Revenue Stamps to Documents

Once you have your revenue stamps, proper affixation is vital. The stamp should be firmly attached to the document, ensuring it cannot be easily removed or tampered with. Generally, this involves carefully removing the stamp from its protective backing, positioning it in the designated area of the document (often indicated on the document itself or in relevant guidelines), and then pressing it down firmly to ensure complete adhesion.

Using a damp sponge or cloth can sometimes help the adhesive to better bond with the document. Avoid using excessive force, which could tear the document or damage the stamp. The goal is a secure and permanent bond.

Verifying the Authenticity of Revenue Stamps, What is revenue stamp

Counterfeit revenue stamps are a serious concern. Therefore, verifying authenticity is paramount. Most legitimate revenue stamps possess unique security features, such as watermarks, special inks, or holographic elements. Carefully examine the stamp for these features, comparing them to images or descriptions provided by the issuing authority. Check for inconsistencies in printing, color, or texture.

If you have any doubts, contact the issuing authority directly to verify the stamp’s authenticity. Don’t hesitate to seek expert assistance if necessary; it’s better to be safe than sorry.

Consequences of Using Counterfeit Revenue Stamps

Using counterfeit revenue stamps is a serious offense that can result in severe penalties. These penalties can include hefty fines, imprisonment, and the rejection of your documents. The legal ramifications can be far-reaching and significantly impact your personal or business affairs. Furthermore, your reputation could suffer irreparable damage, especially in professional or business contexts. The risk associated with using counterfeit stamps far outweighs any perceived benefit.

A Step-by-Step Guide to Applying a Revenue Stamp

1. Preparation

Ensure you have the correct revenue stamp for your document and that the document itself is clean and dry.

2. Positioning

Carefully peel the stamp from its backing, being mindful not to tear or damage it. Position the stamp in the designated area of your document.

3. Adhesion

Press the stamp firmly onto the document, ensuring complete adhesion. A damp cloth might aid in this process, but avoid excessive moisture.

4. Verification

After affixing the stamp, visually inspect it to confirm it is properly attached and that there is no damage to the stamp or the document.

5. Documentation

Retain a copy of the document with the affixed stamp, along with your purchase receipt.

Revenue Stamps and Taxation

Revenue stamps, seemingly small pieces of paper, play a surprisingly significant role in the intricate world of taxation. Their unassuming nature belies their powerful contribution to government revenue and the smooth functioning of various economic sectors. Understanding their connection to taxation is key to appreciating their overall importance in a nation’s financial health.Revenue stamps represent a direct and efficient method of tax collection.

Their adhesive nature allows them to be affixed to documents or goods, providing immediate proof of tax payment. This straightforward approach minimizes administrative overhead and reduces the potential for evasion. The revenue generated from the sale of these stamps flows directly into government coffers, contributing significantly to funding essential public services.

Government Revenue Generation through Revenue Stamps

The revenue generated from revenue stamps directly fuels a wide array of government functions. Consider, for example, a country that uses revenue stamps for property transactions. The income derived from these stamps contributes directly to funding essential infrastructure projects, such as road construction, public transportation improvements, and the maintenance of public buildings. Similarly, revenue from stamps used in legal documents might help fund the judicial system, ensuring access to justice for all citizens.

The revenue is not just a passive income stream; it is actively channeled to support crucial public services that directly impact the lives of citizens.

Comparison with Other Tax Collection Methods

Revenue stamps offer a unique approach to tax collection compared to other methods. Unlike income tax, which relies on self-reporting and complex calculations, revenue stamps provide a simple, visible record of tax payment. This contrasts with value-added tax (VAT), which is often embedded within the price of goods and services, making it less immediately apparent to the consumer. The directness of revenue stamps makes them a transparent and easily verifiable tax collection tool, reducing ambiguity and enhancing accountability.

While income tax and VAT systems necessitate extensive bureaucratic infrastructure for processing and enforcement, revenue stamps often require less administrative overhead, making them particularly effective in simpler economic environments or for specific transactions.

Impact of Changes in Tax Laws on Revenue Stamp Usage

Changes in tax laws directly influence the usage and relevance of revenue stamps. For instance, if a government decides to increase the tax rate on property transactions, the value of the required revenue stamp will also increase. Conversely, if a government eliminates a particular tax, the associated revenue stamp becomes obsolete. Similarly, the introduction of new taxes on specific goods or services might necessitate the creation of new types of revenue stamps to facilitate the collection of these taxes.

The adaptability of revenue stamps to changing tax policies highlights their flexibility as a tool for government revenue generation. The potential impact of legislative changes should be carefully considered, as it directly influences the design, implementation, and overall effectiveness of a revenue stamp system.

Modern Applications and Relevance of Revenue Stamps

The seemingly archaic revenue stamp persists in the 21st century, albeit in a subtly transformed guise. While its traditional role in physically verifying tax payments on documents might seem anachronistic in our digitally driven world, revenue stamps continue to find applications, albeit often in a hybridized form, demonstrating a surprising resilience. Their enduring relevance stems from the fundamental need for secure, verifiable proof of payment and the inherent trust associated with a tangible, tamper-evident record.

This section explores the ongoing use of revenue stamps, the influence of technology on their management, and the challenges they face in an increasingly digital landscape.The continued use of revenue stamps reflects a deep-seated need for transparent and auditable financial transactions, especially in sectors where digital infrastructure is limited or where the risk of fraud is particularly high. In many developing nations, revenue stamps remain a vital component of tax collection, providing a tangible and easily understood method for verifying payment.

Even in developed nations, specialized applications continue to leverage the security and audit trail offered by these stamps.

Current Uses of Revenue Stamps Across Sectors

Revenue stamps, while evolving, maintain a presence in various sectors. They are still used extensively in jurisdictions with less-developed digital infrastructure for taxing documents like contracts, licenses, and permits. The physical nature of the stamp offers a level of security and verification that is difficult to replicate digitally, especially in regions with limited access to reliable internet or advanced technology.

In some cases, revenue stamps are integrated with digital systems, creating a hybrid approach that combines the security of a physical stamp with the efficiency of digital tracking. For example, a digitally generated unique code linked to a physical revenue stamp can allow for easier tracking and verification. This approach bridges the gap between traditional methods and modern technology.

The use of revenue stamps is also common in specialized industries where high levels of security and traceability are paramount, such as the control of narcotics and other regulated substances. The tamper-evident nature of the stamp makes it a valuable tool in preventing fraud and ensuring compliance.

Technology’s Role in Managing and Tracking Revenue Stamps

The integration of technology has significantly enhanced the efficiency and security of revenue stamp management. Barcodes and QR codes printed on revenue stamps allow for quick and easy verification of authenticity and payment. These codes can be scanned using mobile devices, linking the physical stamp to a central database that tracks its use and associated transactions. Sophisticated anti-counterfeiting techniques, such as microprinting, holograms, and special inks, are increasingly incorporated into the design of revenue stamps to deter fraud.

Digital platforms are also being used to manage the entire lifecycle of revenue stamps, from production and distribution to verification and retirement. This allows for better tracking of revenue, improved control over the stamp supply chain, and enhanced audit capabilities.

Challenges in Maintaining Relevance in a Digital Age

The digital transformation poses significant challenges to the continued relevance of revenue stamps. The inherent cost and logistical complexities associated with producing, distributing, and managing physical stamps are significant. Furthermore, the increasing reliance on digital transactions and electronic signatures creates a potential redundancy for physical stamps. The risk of counterfeiting, though mitigated by technological advancements, remains a concern.

The need for constant upgrades to anti-counterfeiting measures to stay ahead of sophisticated forgery techniques represents an ongoing investment. Finally, the environmental impact of producing and disposing of millions of physical stamps is a growing concern in a world increasingly focused on sustainability.

Examples of Jurisdictions Phasing Out Revenue Stamps

Several jurisdictions have either phased out or are in the process of phasing out revenue stamps, primarily in favor of more efficient and cost-effective digital systems. Many European countries have largely transitioned to digital tax systems, eliminating the need for physical revenue stamps. Similarly, many developed nations with robust digital infrastructure have moved towards electronic payment methods and digital tax records.

The shift reflects a broader trend toward digitalization in government services and tax administration.

Advantages and Disadvantages of Using Revenue Stamps

The decision to utilize revenue stamps involves weighing the advantages and disadvantages.Before listing the points, it is important to note that the balance between advantages and disadvantages heavily depends on the specific context, including the level of technological development, the prevalence of digital infrastructure, and the specific needs of the tax administration system.

- Advantages: Tangible proof of payment; Relatively simple to understand and use; Enhanced security features deter counterfeiting; Provides a verifiable audit trail; Suitable for areas with limited digital infrastructure.

- Disadvantages: High production and distribution costs; Logistical challenges in managing large volumes of stamps; Susceptible to physical damage or loss; Environmentally unfriendly; Becoming increasingly obsolete in a digital world.

So, there you have it! From historical context to modern applications, we’ve explored the world of revenue stamps. It’s fascinating how these little pieces of paper played (and still play) a significant role in government revenue and legal processes. While their usage might be declining in some areas, understanding their purpose and history gives us a deeper appreciation of taxation and record-keeping throughout history.

Asik kan?

Key Questions Answered

Are revenue stamps still used today?

Yes, but their usage is decreasing in many places due to digitalization. Some countries still use them for specific documents or transactions.

What happens if I don’t use a revenue stamp when it’s required?

You could face legal penalties, like fines or even legal challenges to the validity of your document. It’s best to always check the regulations.

Where can I buy revenue stamps?

This depends on your location and the type of stamp needed. Check with your local government offices or tax authorities.

Can I reuse a revenue stamp?

Absolutely not! That’s considered fraud and carries serious consequences.