Navigating the complexities of government assistance programs can be a challenging experience, especially when trying to understand how different income sources are treated. One common question that arises is: Does VA compensation count as income for food stamps? This question is particularly relevant for veterans who rely on VA disability benefits to make ends meet and are seeking assistance with food expenses.

Understanding how VA compensation is factored into SNAP eligibility is crucial for veterans to make informed decisions about their financial well-being.

The Supplemental Nutrition Assistance Program (SNAP), commonly known as food stamps, provides financial assistance to low-income households to purchase food. To qualify for SNAP, individuals must meet certain income and asset requirements. The way VA compensation is treated in these calculations can significantly impact a veteran’s eligibility for SNAP benefits.

VA Compensation Overview: Does Va Compensation Count As Income For Food Stamps

VA disability compensation is a monthly payment from the U.S. Department of Veterans Affairs (VA) to veterans who have service-connected disabilities. This compensation is meant to help veterans cover the costs associated with their disabilities, such as medical expenses, lost wages, and other related expenses.

Eligibility Criteria for VA Compensation

To be eligible for VA disability compensation, veterans must meet specific criteria. These criteria ensure that only veterans with service-connected disabilities receive benefits.

- The veteran must have served in the U.S. Armed Forces.

- The veteran must have a disability that is service-connected, meaning the disability was caused or aggravated by their military service.

- The veteran must have a disability rating of at least 10%.

Types of VA Compensation Benefits

There are various types of VA compensation benefits available to eligible veterans. These benefits are designed to address different needs and situations.

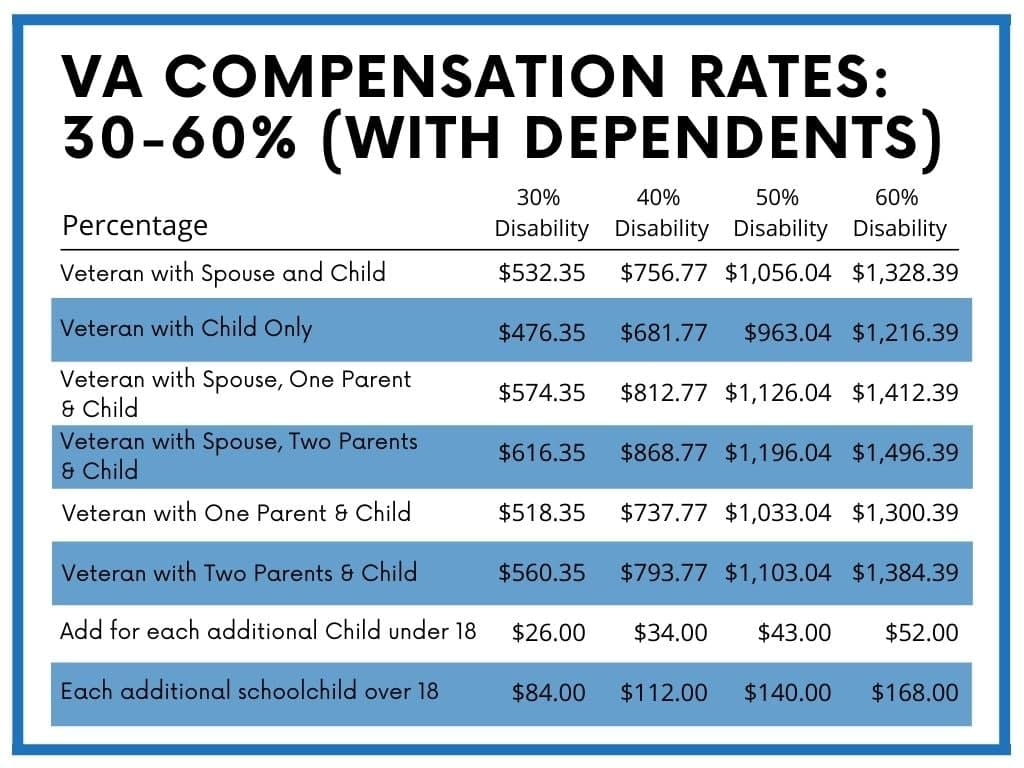

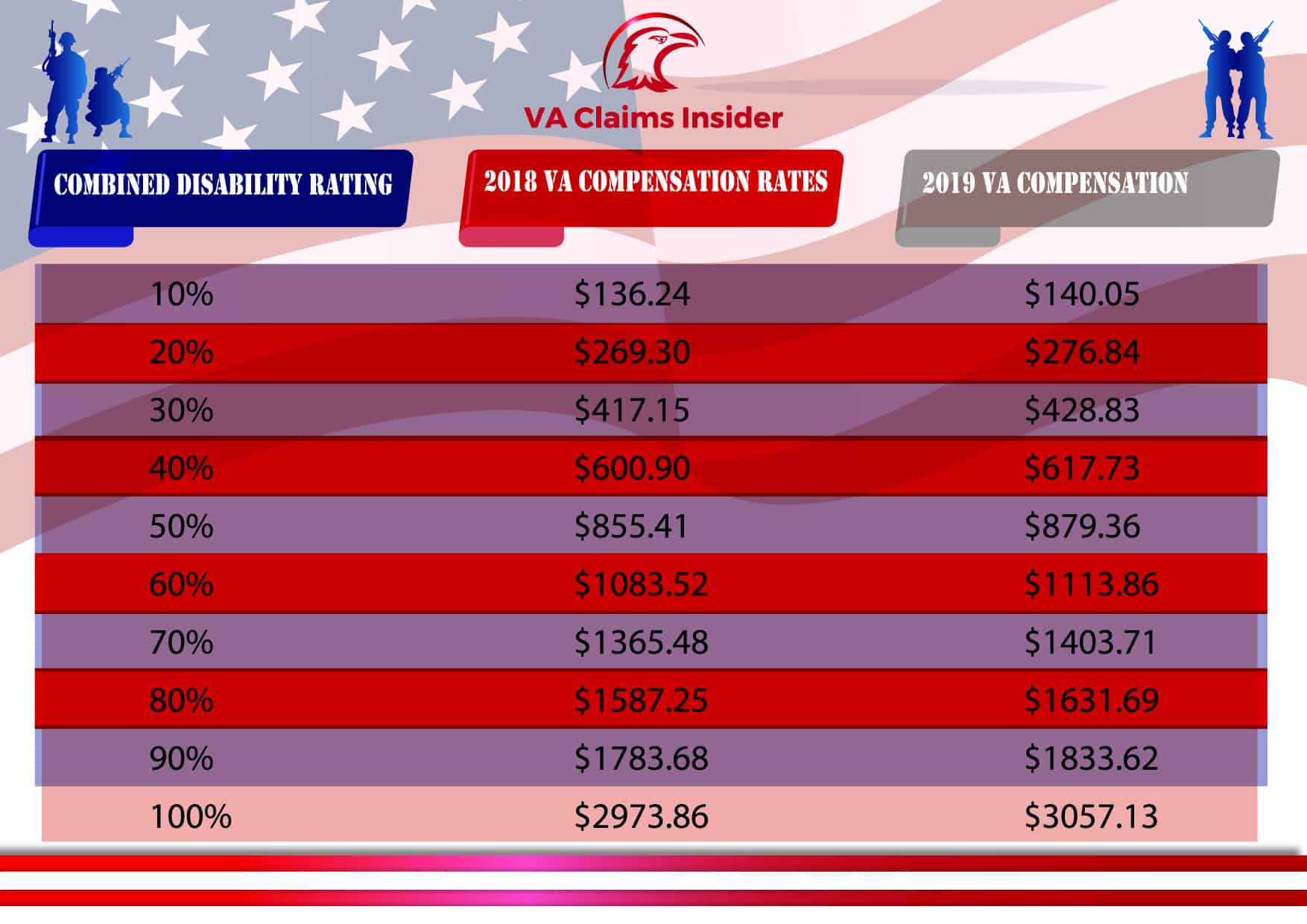

- Disability Compensation:This is the most common type of VA compensation benefit. It is paid monthly to veterans with service-connected disabilities. The amount of disability compensation received depends on the severity of the disability, as measured by a disability rating.

- Special Monthly Compensation (SMC):SMC is an additional monthly payment for veterans with certain disabilities, such as blindness, loss of use of both hands, or loss of use of both feet. SMC is intended to help veterans with these disabilities cover the additional expenses they may incur.

- Housebound Allowance:This allowance is paid to veterans who are permanently housebound due to their disability. It is intended to help cover the costs of home care and other related expenses.

- Aid and Attendance:This allowance is paid to veterans who need help with daily living activities, such as bathing, dressing, or eating. It is intended to help cover the costs of in-home care or assisted living.

Food Stamp Program Eligibility

The Supplemental Nutrition Assistance Program (SNAP), commonly known as food stamps, is a federal program that helps low-income individuals and families purchase food. SNAP provides benefits to eligible households in the form of an Electronic Benefits Transfer (EBT) card, which functions like a debit card that can be used to buy food at authorized retailers.

Income Eligibility Guidelines

SNAP eligibility is determined by several factors, including household income, assets, and household size. The program uses income eligibility guidelines to determine if a household qualifies for benefits and the amount of benefits they receive. These guidelines are based on the federal poverty level (FPL), which is adjusted annually to reflect changes in the cost of living.

- Income limits vary by state and household size. For example, in 2023, the maximum gross monthly income for a household of one in California is $2,055, while in Texas, it is $1,669. These income limits are generally set at 130% of the FPL.

- Income is calculated based on the household’s gross income, which includes all income from sources like wages, salaries, self-employment, unemployment benefits, and pensions.

- Certain income is excluded from the calculation, such as income from Social Security, child support, and certain disability payments.

Income Calculation for SNAP Eligibility

SNAP eligibility is determined based on a household’s net income, which is calculated by subtracting certain deductions from gross income.

The net income is calculated as: Gross Income

Deductions = Net Income

- Deductions:Deductions include a standard deduction for each household member, an earned income deduction, and a child care deduction.

- Standard Deduction:The standard deduction is a fixed amount for each household member, which is adjusted annually to reflect changes in the cost of living. In 2023, the standard deduction for a household of one is $170 per month.

- Earned Income Deduction:The earned income deduction is a percentage of earned income, which is designed to help low-income working families afford food. This deduction is generally capped at 20% of earned income, but the exact percentage varies by state.

- Child Care Deduction:The child care deduction is available to households with children under 13 years old who are in a work-related activity. This deduction covers the actual cost of child care, but it is limited to a certain amount based on the age of the child and the number of hours worked.

VA Compensation and Income Calculation

The Supplemental Nutrition Assistance Program (SNAP), commonly known as food stamps, is a federal program that helps low-income individuals and families buy food. To be eligible for SNAP, your household income must be below a certain limit, and your assets must also be below a certain limit.

One question that often arises is whether VA compensation counts as income for SNAP eligibility.The answer is: it depends. Whether VA compensation is counted as income for SNAP eligibility depends on the specific type of VA compensation you receive and your individual circumstances.

VA Compensation and SNAP Eligibility

The rules regarding VA compensation and SNAP eligibility are complex and can vary depending on the specific type of VA compensation you receive and your individual circumstances. Here are some general guidelines:

- Disability Compensation:Disability compensation is generally considered income for SNAP purposes. However, there are some exceptions. For example, if you are receiving disability compensation for a service-connected disability that is considered to be a “medical condition” under SNAP rules, then your disability compensation may be excluded from your income calculation.

This means that it will not count toward your household income for SNAP eligibility. A medical condition, as defined by SNAP, is a disability that limits your ability to work or perform other activities. If you are receiving disability compensation for a medical condition, you should contact your local SNAP office to determine whether your disability compensation will be excluded from your income calculation.

- Dependency and Indemnity Compensation (DIC):DIC is generally not considered income for SNAP purposes. This is because DIC is paid to surviving spouses and children of veterans who died as a result of their service-connected disability. The intent of DIC is to provide financial support to the family of the deceased veteran, and it is not considered to be income that the family can use to purchase food.

- Other VA Benefits:Other VA benefits, such as education benefits, housing benefits, and burial benefits, are generally not considered income for SNAP purposes.

Examples of How VA Compensation is Treated in Income Calculations

Here are some examples of how VA compensation is treated in income calculations:

- Example 1:A veteran is receiving $1,000 per month in disability compensation for a service-connected disability. The veteran has no other income. The veteran’s disability compensation will be counted as income for SNAP purposes. The veteran’s household income will be $1,000 per month, and the veteran will be eligible for SNAP benefits if the household income is below the SNAP income limit for their state.

- Example 2:A veteran is receiving $1,000 per month in disability compensation for a service-connected disability that is considered to be a “medical condition” under SNAP rules. The veteran has no other income. The veteran’s disability compensation will be excluded from their income calculation for SNAP purposes.

The veteran’s household income will be $0 per month, and the veteran will be eligible for SNAP benefits if the household income is below the SNAP income limit for their state.

- Example 3:A veteran is receiving $1,000 per month in DIC. The veteran has no other income. The veteran’s DIC will not be counted as income for SNAP purposes. The veteran’s household income will be $0 per month, and the veteran will be eligible for SNAP benefits if the household income is below the SNAP income limit for their state.

Important Considerations, Does va compensation count as income for food stamps

It is important to note that the rules regarding VA compensation and SNAP eligibility are complex and can vary depending on the specific type of VA compensation you receive and your individual circumstances. If you are unsure whether your VA compensation will be counted as income for SNAP purposes, you should contact your local SNAP office for guidance.

Impact on SNAP Benefits

The amount of VA compensation you receive can significantly impact your eligibility for SNAP benefits and the amount you receive. SNAP, or the Supplemental Nutrition Assistance Program, is a federal program that provides food assistance to low-income households. To determine your SNAP eligibility and benefit amount, the program considers your total household income, including any VA compensation you receive.

SNAP Benefit Calculation

Your VA compensation is counted as income when calculating your SNAP benefits. However, there are some deductions and adjustments that may be applied to your VA compensation before it’s included in your total income.

For example, if you receive VA compensation for a disability, you may be eligible for a deduction for medical expenses related to your disability.

The amount of your SNAP benefits is determined by your household size and your net income. Your net income is your total income minus any deductions and adjustments, including any deductions for VA compensation.

Examples of How VA Compensation Can Affect SNAP Eligibility

- Scenario 1:A single veteran with a disability receives $1,000 in VA compensation each month. They have no other income. In this case, their VA compensation would be considered income for SNAP eligibility. They may be eligible for SNAP benefits, depending on the state’s SNAP eligibility guidelines.

- Scenario 2:A veteran with a disability receives $1,500 in VA compensation each month and lives with their spouse, who earns $1,000 per month. They have a child. The household income would be $2,500 per month. The family may be eligible for SNAP benefits, depending on the state’s SNAP eligibility guidelines and any deductions or adjustments that apply to the veteran’s VA compensation.

- Scenario 3:A veteran receives $2,000 in VA compensation each month and has no other income. They are single. Their VA compensation would be considered income for SNAP eligibility. They may not be eligible for SNAP benefits because their income exceeds the SNAP eligibility threshold for a single person in their state.

Resources and Information

Finding reliable information about VA compensation and SNAP benefits can be crucial for understanding your eligibility and maximizing your benefits. Luckily, there are several resources available to help you navigate this process.

Government Agencies and Organizations

Several government agencies and organizations can provide you with accurate and up-to-date information on VA compensation and SNAP benefits.

- U.S. Department of Veterans Affairs (VA):The VA is your primary source for information on VA compensation benefits. Their website, www.va.gov, offers detailed information on eligibility requirements, benefit amounts, and how to apply. You can also contact their toll-free number at 1-800-827-1000 for assistance.

- U.S. Department of Agriculture (USDA):The USDA administers the SNAP program. Their website, www.fns.usda.gov, provides comprehensive information on SNAP eligibility, benefit amounts, and how to apply. You can also find local SNAP offices and contact information on their website.

- State Social Services Agencies:Each state has its own social services agency that administers SNAP benefits within the state. You can find contact information for your state’s agency on the USDA website or by searching online.

Online Resources and Websites

Beyond government websites, several online resources can provide valuable information and guidance on VA compensation and SNAP benefits.

- Benefits.gov:This website, run by the U.S. government, provides information on a wide range of federal benefits programs, including VA compensation and SNAP. You can use their benefit finder tool to determine your eligibility for various programs.

- National Coalition for Homeless Veterans (NCHV):This organization provides resources and support for homeless veterans, including information on VA benefits and other assistance programs. Their website, www.nchv.org, offers a wealth of information and resources for veterans.

- Veterans Legal Services (VLS):VLS provides free legal assistance to veterans, including information on VA benefits and other legal matters. You can find their website and contact information through the VA website or by searching online.

Contact Information for Assistance

If you have questions about VA compensation or SNAP benefits, you can reach out to the following organizations for assistance:

- VA National Call Center:1-800-827-1000

- USDA National Call Center:1-800-221-5689

- Your State’s Social Services Agency:Contact information can be found on the USDA website or by searching online.

Ending Remarks

In conclusion, navigating the intersection of VA compensation and SNAP eligibility requires careful consideration of the specific regulations and policies in place. While VA compensation is generally not considered income for SNAP purposes, there are specific exceptions and nuances that can impact eligibility.

It’s essential for veterans to consult with relevant government agencies and organizations to obtain accurate information and guidance. By understanding the complexities of these programs, veterans can make informed decisions about their financial well-being and access the support they need.

FAQ Summary

How often are SNAP benefits issued?

SNAP benefits are typically issued on a monthly basis, with the specific date varying depending on the state and county.

What are the income limits for SNAP?

Income limits for SNAP vary based on household size and state. You can find specific income limits for your state on the USDA website.

Are there any deductions allowed when calculating SNAP eligibility?

Yes, certain deductions are allowed when calculating income for SNAP eligibility, such as medical expenses and child care costs.

What resources are available to help veterans apply for SNAP?

Veterans can reach out to the local SNAP office, veteran service organizations, or the USDA website for assistance with SNAP applications.