Navigating the world of food stamps can feel overwhelming, especially when you’re unsure about the documentation needed. “How many pay stubs do I need for food stamps?” is a common question, and understanding the answer is crucial for a smooth application process.

This guide will break down the requirements, providing clarity on the pay stub information needed and alternative options for proving income.

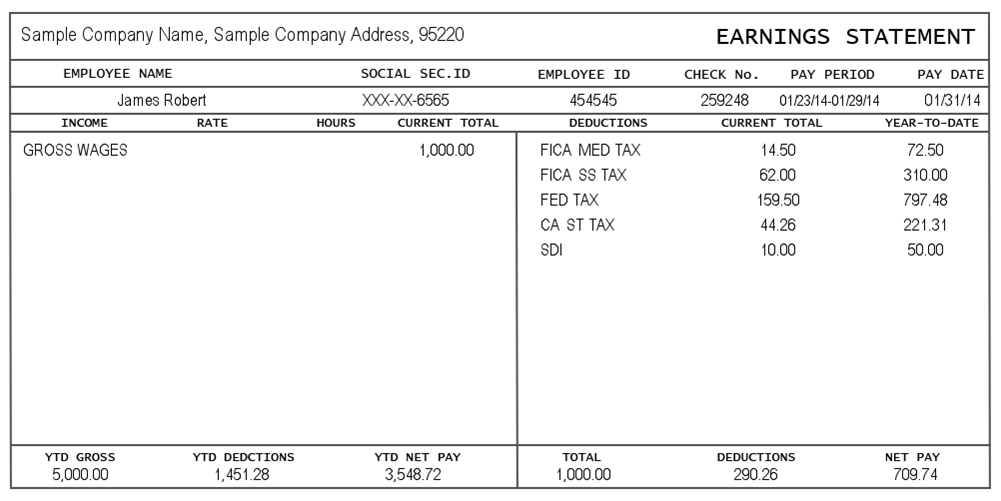

Your eligibility for food stamps depends on several factors, including your income, household size, and assets. The SNAP program, which administers food stamps, uses your pay stubs to verify your income and ensure you meet the program’s requirements. Understanding the documentation needed and the application process can help you navigate this system efficiently.

Eligibility for Food Stamps

The Supplemental Nutrition Assistance Program (SNAP), commonly known as food stamps, provides financial assistance to low-income households to purchase food. Eligibility for SNAP is determined by a number of factors, including income, household size, and assets.

Income Requirements

The income requirements for SNAP eligibility vary depending on the size of the household. To be eligible, a household’s gross monthly income must be below a certain limit. The income limit is based on the federal poverty guidelines, which are adjusted annually.

For example, in 2023, the gross monthly income limit for a household of one is $1,850.

Household Size

The number of people in a household is a significant factor in determining SNAP eligibility. The income limits are adjusted based on household size, with larger households having higher income limits.

Income Sources Considered for Eligibility

The following income sources are considered when determining SNAP eligibility:

- Earnings from employment

- Unemployment benefits

- Social Security benefits

- Child support payments

- Alimony payments

- Pensions

- Retirement income

- Interest and dividends

- Rental income

Asset Limits

In addition to income, SNAP eligibility is also affected by the value of a household’s assets. There are limits on the amount of assets a household can own and still be eligible for SNAP. These limits vary by state, but generally, the asset limit for a household of one is $2,000.

The asset limit does not include a household’s primary residence, one vehicle, or certain other assets, such as a burial plot or a life insurance policy with a death benefit of less than $1,500.

The Application Process

The process of applying for food stamps, also known as the Supplemental Nutrition Assistance Program (SNAP), is generally straightforward. You can apply online, in person, or by mail. The specific steps and required information may vary depending on your state.

Applying for Food Stamps

The first step is to gather all the necessary documentation, such as proof of income, identity, and residency. You can then submit your application through one of the following methods:

- Online:Many states offer online applications for SNAP benefits. You can typically find the application on the state’s human services website.

- In Person:You can visit your local SNAP office or a designated community center to apply in person.

- By Mail:You can download an application form from the state’s website or request one by mail. You can then mail the completed form and required documentation to the designated address.

Required Information on the Application Form

The SNAP application form will ask for detailed information about your household, income, and expenses. This includes:

- Household Information:The names, birthdates, and Social Security numbers of all household members.

- Income Information:Information about all sources of income for each household member, including wages, salaries, unemployment benefits, and child support.

- Expenses:Information about your monthly expenses, such as rent, utilities, and medical bills.

- Assets:Information about your assets, such as bank accounts, vehicles, and real estate.

- Citizenship Status:Proof of citizenship or legal residency.

- Verification of Identity:Valid photo ID, such as a driver’s license or passport.

Submitting the Application and Required Documentation

Once you have completed the application form, you will need to submit it along with supporting documentation, such as pay stubs, bank statements, and medical bills. You can submit your application and documentation in person, by mail, or online, depending on the method you choose.

Processing Timeline for Food Stamp Applications

The processing time for SNAP applications can vary depending on the state and the complexity of your application. However, it typically takes 30 to 60 days for your application to be processed. During this time, you may be contacted by the SNAP office for additional information or verification of your application.

Alternative Documentation

In some cases, pay stubs may not be required to prove income for food stamp eligibility. This can occur when someone is self-employed, receives income from sources other than a traditional job, or has experienced a recent change in employment status.

It is essential to understand the specific requirements for your state and be prepared to provide alternative documentation to verify your income.

Alternative Documentation for Income Verification, How many pay stubs do i need for food stamps

If you are unable to provide pay stubs, you can use other documentation to prove your income. The specific types of acceptable documentation may vary depending on your state, so it is essential to check with your local SNAP office for the most up-to-date requirements.

Here are some examples of common alternatives to pay stubs:

- Self-Employment Income:For self-employed individuals, you can provide documentation such as tax returns, bank statements, invoices, receipts, or contracts to verify your income.

- Income from Social Security or Disability:If you receive benefits from Social Security or disability, you can provide your benefit award letter or a statement from the Social Security Administration.

- Unemployment Benefits:If you are receiving unemployment benefits, you can provide your unemployment benefit statement or a letter from the unemployment office.

- Child Support Payments:If you receive child support payments, you can provide documentation such as court orders, payment receipts, or bank statements.

- Pension or Retirement Income:If you receive pension or retirement income, you can provide a statement from your pension provider or a letter from the retirement fund administrator.

- Alimony or Spousal Support:If you receive alimony or spousal support, you can provide a court order or a statement from the person paying the support.

- Other Income Sources:For other income sources, such as rental income, interest income, or dividends, you can provide bank statements or other documentation that shows the source and amount of the income.

Maintaining Accurate Financial Records

It is crucial to maintain accurate financial records, regardless of your income source. This helps ensure that you can quickly and easily provide the necessary documentation to verify your income for programs like SNAP. Accurate records can also help you track your income and expenses, making it easier to manage your budget and avoid potential financial problems.

Additional Information

This section provides further information and resources to assist you in your journey to obtaining food stamps. It covers state-specific resources, local office contact information, a summary of different food stamp programs, and a visual representation of the application process.

State-Specific Resources

This section lists resources for obtaining food stamps in different states.

- California:The California Department of Social Services provides information on food stamps, known as CalFresh, including eligibility requirements, application procedures, and contact information for local offices. [Insert website link for California Department of Social Services]

- Texas:The Texas Health and Human Services Commission offers resources on SNAP, including eligibility guidelines, application procedures, and information on how to contact local offices. [Insert website link for Texas Health and Human Services Commission]

- New York:The New York State Office of Temporary and Disability Assistance provides information on SNAP, including eligibility requirements, application procedures, and contact information for local offices. [Insert website link for New York State Office of Temporary and Disability Assistance]

Local Food Stamp Office Contact Information

Finding the contact information for your local food stamp office is essential for applying for benefits and resolving any questions or concerns. You can typically find this information on the website of your state’s social services agency. Alternatively, you can use online resources like the United States Department of Agriculture (USDA) website, which provides a directory of state and local food stamp offices.

Food Stamp Programs and Eligibility Requirements

This section summarizes different food stamp programs and their eligibility requirements.

| Program | Eligibility Requirements |

|---|---|

| SNAP (Supplemental Nutrition Assistance Program) | – U.S. citizenship or legal residency

|

| TANF (Temporary Assistance for Needy Families) | – U.S. citizenship or legal residency

|

| WIC (Women, Infants, and Children) | – Pregnant women

|

Food Stamp Application Process Flowchart

This flowchart visually illustrates the food stamp application process.[Insert flowchart illustration here]

Summary: How Many Pay Stubs Do I Need For Food Stamps

Securing food assistance is a crucial step for many families, and understanding the documentation requirements is key to a successful application. Remember, the SNAP program is designed to help individuals and families meet their basic needs, and by following the guidelines and providing the necessary documentation, you can access the support you need.

Popular Questions

What if I’m self-employed?

If you’re self-employed, you’ll need to provide documentation of your income, such as tax returns or bank statements. Contact your local SNAP office for specific guidance on acceptable documentation for self-employed individuals.

How long do I need to keep my pay stubs?

It’s recommended to keep your pay stubs for at least a year, as they may be needed for future SNAP applications or for other purposes.

What if I don’t have any pay stubs?

If you don’t have pay stubs, you may be able to provide alternative documentation, such as bank statements, tax returns, or other income verification documents. Contact your local SNAP office for specific guidance on acceptable alternatives.