What are the income guidelines for food stamps in Illinois? That’s the bread and butter question, innit? Navigating the SNAP (Supplemental Nutrition Assistance Program) system in Illinois can feel like a maze, especially when you’re trying to figure out if you even qualify. This ain’t rocket science, but understanding the income limits – both gross and net – for different household sizes is key.

We’re breaking it down, straight up, no messing about, so you can see if you’re eligible for a bit of extra help with the food shop.

This guide covers everything from the nitty-gritty details of income thresholds and asset limits to the application process itself. We’ll look at what counts as income (wages, self-employment, benefits – the whole shebang), how deductions affect your eligibility, and where to find extra support if you need it. Think of us as your personal navigators through the SNAP system in Illinois – we’re here to make the process a bit less of a headache.

Eligibility Requirements for Illinois Food Stamps (Supplemental Nutrition Assistance Program – SNAP)

Understanding the eligibility requirements for Illinois’ Supplemental Nutrition Assistance Program (SNAP), often called food stamps, is crucial for those needing assistance. The program helps low-income families and individuals purchase groceries. Eligibility is determined by considering several factors, primarily income and household size.

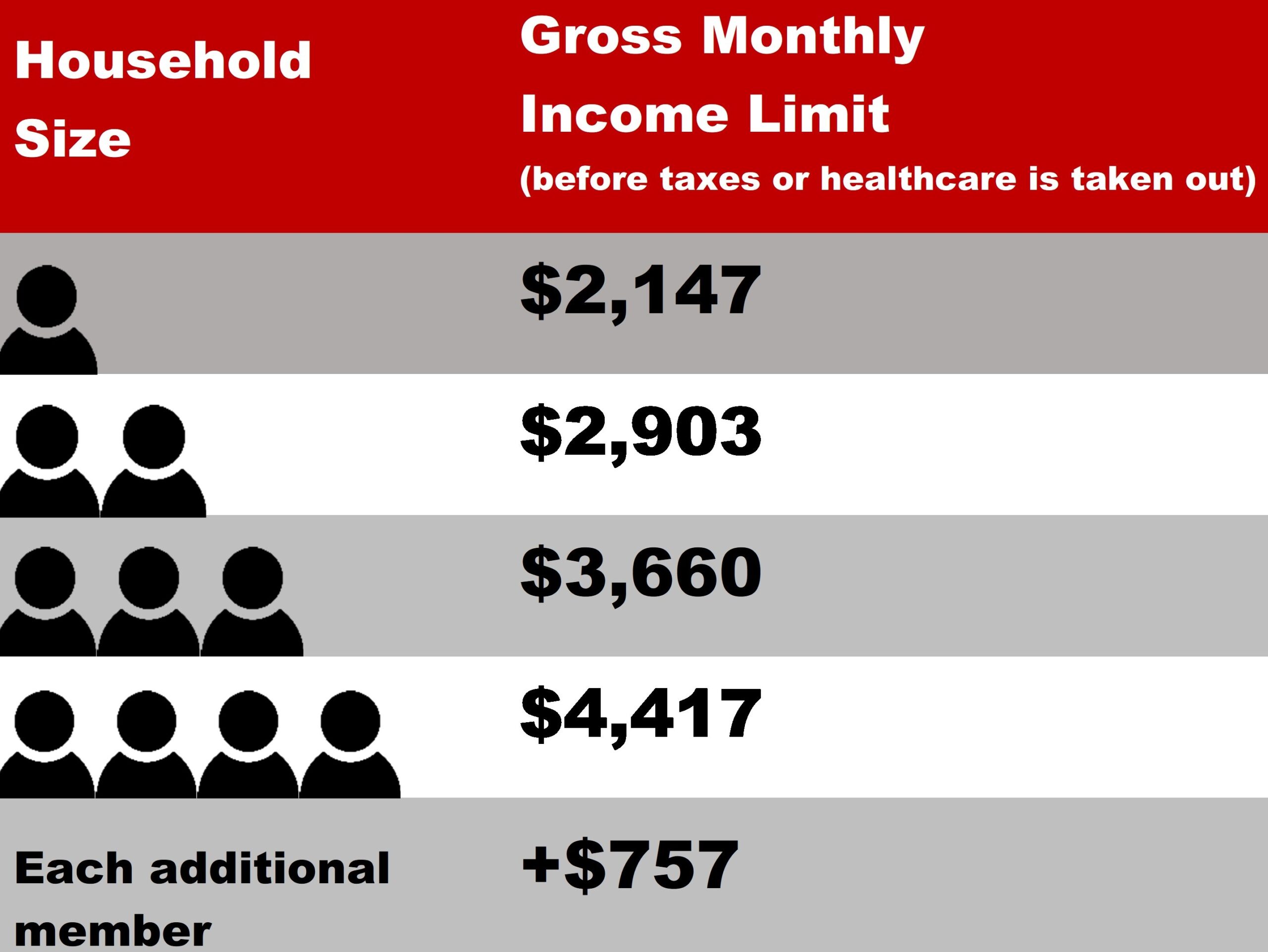

Gross Income Limits for a Single Person

The gross monthly income limit for a single person applying for SNAP benefits in Illinois varies and is adjusted periodically. It’s important to check the official Illinois Department of Human Services website for the most up-to-date figures. Generally, it is set below the federal poverty level. Exceeding this limit automatically disqualifies an applicant. This limit ensures that the program’s resources are directed to those most in need.

Net Income Limits for a Family of Four

Similarly, net income limits for a family of four are established and regularly reviewed. Net income, after allowable deductions, must fall below a specific threshold to qualify. These deductions can include childcare costs, medical expenses, and dependent care expenses. Families exceeding this limit may still be eligible if they have significant allowable deductions. The program aims to provide support while considering the financial realities faced by families.

Household Size and Income Eligibility

Household size significantly impacts income eligibility thresholds. Larger households generally have higher income limits than smaller households, reflecting the increased cost of living with more people. For example, a family of four will have a higher allowable income than a single individual. This reflects the program’s recognition of the varying expenses faced by households of different sizes.

Income Sources Considered for Eligibility

A wide range of income sources is considered when determining SNAP eligibility. This includes wages from employment, self-employment income (including profits from a business), unemployment benefits, Social Security benefits, pensions, child support, and alimony. Any regular income stream, regardless of source, is typically factored into the eligibility calculation. It’s vital to accurately report all income sources to ensure accurate assessment.

Income Eligibility Chart

| Household Size | Gross Income Limit | Net Income Limit | Notes |

|---|---|---|---|

| 1 | (Check IDHS website for current data) | (Check IDHS website for current data) | Deductions may apply for medical expenses, childcare, etc. |

| 2 | (Check IDHS website for current data) | (Check IDHS website for current data) | Deductions may apply for medical expenses, childcare, etc. |

| 3 | (Check IDHS website for current data) | (Check IDHS website for current data) | Deductions may apply for medical expenses, childcare, etc. |

| 4 | (Check IDHS website for current data) | (Check IDHS website for current data) | Deductions may apply for medical expenses, childcare, etc. |

Asset Limits and Resource Restrictions for Illinois SNAP

Applying for SNAP benefits in Illinois involves understanding not only your income but also your assets. The state, like others, sets limits on the amount of money and resources you can own while still qualifying for assistance. These limits help ensure that the program effectively serves those most in need.

Asset Limits for SNAP Applicants

Illinois, following federal guidelines, does have resource limits for SNAP applicants. These limits focus on the total value of your assets, excluding your home and vehicle (under certain conditions). This means that the overall value of your savings accounts, stocks, bonds, and other similar holdings is considered. Exceeding these limits can disqualify you from receiving benefits. It’s crucial to accurately report all assets during the application process to avoid delays or denial of benefits.

Types of Assets Considered

Several types of assets are included in the resource calculation. These typically include cash in checking and savings accounts, money market accounts, stocks, bonds, and other investments. The value of certain vehicles may also be included, although there are exceptions for vehicles used for employment or essential transportation needs. Retirement accounts, such as 401(k)s and IRAs, are generally excluded, providing a safety net for those saving for their future.

It is vital to consult the official Illinois SNAP guidelines for the most up-to-date and complete list of assets that are considered.

Exceptions and Waivers to Asset Limits

While the asset limits are generally strictly applied, there are exceptions and waivers available under certain circumstances. For example, the value of a vehicle used for employment or necessary transportation may be excluded from the asset calculation. Similarly, certain assets held in trust for a specific purpose might not be counted. Applicants should carefully review the eligibility criteria and seek assistance from caseworkers to understand if any exceptions apply to their situation.

Providing thorough documentation supporting any claim for an exception is highly recommended.

Resource Rules for Elderly or Disabled Applicants, What are the income guidelines for food stamps in illinois

Elderly and disabled applicants often face different resource limits than other applicants. Illinois recognizes the unique financial challenges faced by this population. They often have higher asset limits, acknowledging that they may have accumulated savings over their lifetime, which might otherwise disqualify them from receiving SNAP benefits. This provision ensures that those who have contributed to society but are facing financial hardship in their later years can still access essential food assistance.

Comparison of Asset Limits for Different Household Sizes

Understanding how household size impacts asset limits is crucial for accurate application. The following provides a simplified comparison; it’s vital to consult the official Illinois Department of Human Services website for the most current and precise figures. These limits are subject to change.

- Household Size 1: Example Asset Limit: $2,250

- Household Size 2: Example Asset Limit: $3,250

- Household Size 3: Example Asset Limit: $4,250

- Household Size 4: Example Asset Limit: $5,250

Note

These are example figures and should not be considered definitive. Always refer to the official Illinois SNAP guidelines for accurate and up-to-date information.*

The Application Process for Illinois Food Stamps

Applying for SNAP benefits in Illinois can seem daunting, but with clear steps and the right information, it’s a manageable process. This section Artikels the application procedure, offering guidance to help you navigate each stage successfully. Remember, seeking assistance from local agencies or community organizations can greatly simplify the process.

Steps to Apply for Illinois SNAP Benefits

The application process involves several key steps. Completing each step accurately and thoroughly will ensure a smoother application process and a quicker determination of eligibility.

- Gather Necessary Documents: Before starting the application, collect all required documentation. This includes proof of identity (such as a driver’s license or birth certificate), proof of income (pay stubs, tax returns, etc.), proof of residency (utility bill, lease agreement), and information on household members (birth certificates, Social Security numbers).

- Complete the Application: The application can be completed online through the ACCESS Illinois website, by phone, or in person at a local Illinois Department of Human Services (IDHS) office. The application will ask for detailed information about your household size, income, expenses, and assets.

- Submit the Application: Once completed, submit your application through your chosen method. Online submission is generally the fastest option. If submitting in person, ensure you have all the necessary documents. If submitting by phone, be prepared to answer questions and provide the necessary information.

- Attend an Interview (if required): You may be required to attend an interview with an IDHS caseworker to discuss your application further and verify the information provided. Be prepared to answer questions honestly and thoroughly.

- Await a Decision: After submitting your application and any necessary interviews, you will receive a notification regarding your eligibility for SNAP benefits. This process can take several weeks.

Tips for Completing the Application Form

Accuracy and completeness are crucial when filling out your SNAP application. Take your time, double-check your information, and don’t hesitate to seek assistance if needed.

Carefully review each question. If you are unsure about any information, contact the IDHS directly for clarification. Providing inaccurate information can delay your application or result in ineligibility.

Where to Submit the Application

Illinois residents can apply for SNAP benefits in several ways:

- Online: Through the ACCESS Illinois website, offering convenience and quick submission.

- In Person: At a local IDHS office. This allows for in-person assistance and clarification of any questions.

- By Phone: Contacting the IDHS directly via phone to begin the application process. This method is suitable for those who prefer phone communication.

Required Documentation for Application

Providing accurate and complete documentation is vital for a timely application process. Missing documents can lead to delays.

Examples of required documents include proof of identity (driver’s license, state ID, birth certificate), proof of income (pay stubs, tax returns, self-employment records), proof of residency (utility bill, lease agreement), and documentation for all household members (birth certificates, Social Security cards).

Factors Affecting SNAP Benefits in Illinois: What Are The Income Guidelines For Food Stamps In Illinois

Receiving SNAP benefits in Illinois isn’t just about your income; several factors can significantly influence the final amount you receive. Understanding these factors can help you accurately estimate your potential benefits and plan your budget effectively. This section explains how deductions and the standard deduction affect your eligibility and benefit calculation.

Deductions and Their Impact on SNAP Benefits

Several deductions can reduce the amount of income considered when calculating your SNAP benefits. These deductions recognize that certain expenses are essential and shouldn’t be fully counted against your eligibility. Common deductions include childcare costs and medical expenses. The more you spend on these necessities, the lower your net income for SNAP purposes will be, potentially increasing your benefits or even making you eligible if you wouldn’t be otherwise.

The Standard Deduction’s Role in Net Income Calculation

Illinois applies a standard deduction to your gross income before considering other deductions. This standard deduction helps ensure that a portion of your income is always excluded from the calculation, providing a safety net for individuals and families. This amount is adjusted periodically to reflect changes in the cost of living. The standard deduction is subtracted from your gross income before any other deductions are applied, creating a lower net income that’s used to determine your SNAP benefit amount.

Examples of Deductions Reducing Income for Eligibility

Let’s consider some examples. Suppose a family has a gross monthly income of $2,500. If they have $500 in childcare expenses and $200 in medical expenses, these are deducted. Additionally, a standard deduction of $160 is applied. Their net income for SNAP purposes would be $2,500 – $500 – $200 – $160 = $1,640.

This significantly reduces the income considered for eligibility compared to the initial gross income. Another example could involve a single adult with $1800 gross income, $100 medical expenses, and the standard deduction. Their net income would be substantially lower, potentially increasing their eligibility for benefits.

Comparing the Impact of Different Deduction Types

The impact of different deduction types varies. Childcare expenses generally have a larger impact because childcare costs are often substantial. Medical expenses can also significantly reduce net income, especially for families facing high medical bills. The standard deduction provides a consistent baseline reduction for everyone, regardless of specific circumstances. The combined effect of all these deductions can dramatically alter the final SNAP benefit amount.

Scenarios Illustrating SNAP Benefit Amounts

The following table illustrates how varying incomes and deductions affect the final SNAP benefit amount. Note that these are simplified examples and the actual benefit amount will depend on many factors, including household size and other relevant circumstances. It is crucial to consult the official Illinois SNAP guidelines for accurate benefit calculations.

| Scenario | Gross Monthly Income | Childcare Expenses | Medical Expenses | Net Income (after deductions) | Estimated SNAP Benefit (Illustrative) |

|---|---|---|---|---|---|

| Family A | $2500 | $500 | $200 | $1640 | $300 |

| Family B | $1800 | $0 | $100 | $1440 | $450 |

| Single Adult C | $1200 | $0 | $0 | $1040 | $150 |

Resources and Assistance for SNAP Applicants in Illinois

Applying for SNAP benefits can sometimes feel overwhelming, but thankfully, Illinois offers numerous resources and support systems to help individuals and families navigate the process. Many organizations and government agencies are dedicated to assisting applicants, providing guidance and support throughout each step. This section details the available resources to ensure a smoother application experience.

Contact Information for Local SNAP Offices and State Agencies

Finding the appropriate contact information is crucial for initiating the application process and receiving assistance. The Illinois Department of Human Services (IDHS) is the primary agency responsible for administering the SNAP program. Their website, which will be detailed later, provides a search function to locate the nearest local office based on your address. You can also find contact information for regional offices and specialized assistance programs through the IDHS website.

Each local office will have its own phone number and address, and many offer in-person assistance as well as phone and online support. It’s advisable to check the IDHS website for the most up-to-date contact information, as these details may change.

Assistance Programs Supporting the SNAP Application Process

Several programs offer support beyond the direct assistance of the IDHS. Many local food banks and community organizations provide assistance with the application process itself. They can help with filling out forms, understanding eligibility requirements, and navigating any potential challenges. Some non-profit organizations also offer workshops and seminars educating individuals about SNAP benefits and the application process. These programs can be incredibly valuable for those unfamiliar with the system or who face language barriers or other obstacles.

Additionally, some legal aid organizations may provide free or low-cost assistance to those facing difficulties in their application.

Resources for Individuals Facing Application Challenges

Navigating the SNAP application process can be challenging for various reasons. Language barriers, disabilities, or lack of access to technology can create significant hurdles. Illinois recognizes these difficulties and offers various resources to address them. Many local offices provide multilingual assistance, ensuring applicants receive information in their preferred language. For those with disabilities, accommodations are available, including large-print applications and assistance with online applications.

Community organizations often serve as intermediaries, helping individuals overcome these barriers and successfully complete the application. They may provide translation services, transportation assistance, or simply a supportive environment to alleviate stress during the process.

Websites and Online Portals Providing SNAP Information

The primary source of information about SNAP benefits in Illinois is the Illinois Department of Human Services (IDHS) website. This website provides comprehensive details on eligibility requirements, application procedures, benefit amounts, and frequently asked questions. It also includes a searchable database to find local SNAP offices and contact information for additional support. The IDHS website is designed to be user-friendly and accessible, with information available in multiple languages.

While the IDHS website is the central hub for information, other websites maintained by community organizations and non-profit groups can provide supplementary information, guidance, and resources for SNAP applicants.

Organizations Offering Assistance to SNAP Applicants

Many organizations in Illinois dedicate their efforts to supporting SNAP applicants. These organizations offer a range of assistance, including application assistance, advocacy, and additional support services.

- Local Food Banks: These organizations often provide direct food assistance and can also offer guidance on the SNAP application process.

- Community Action Agencies: These agencies often have programs dedicated to assisting low-income families, including help with SNAP applications.

- Legal Aid Organizations: These organizations can provide legal assistance if you encounter difficulties with your application or face appeals.

- Senior Centers: Senior centers often have staff who are knowledgeable about SNAP benefits and can assist older adults with the application process.

- United Way: The United Way maintains a helpline and website that can connect individuals with resources in their local area, including SNAP application assistance.

So, there you have it – a clearer picture of the Illinois food stamp income guidelines. Remember, it’s not just about numbers on a page; it’s about putting food on the table for you and your family. Don’t be shy about reaching out for help if you need it. There are resources out there, and knowing your rights is half the battle.

Getting the support you’re entitled to shouldn’t be a struggle, so take a deep breath, gather the info you need, and get that application in. You’ve got this.

Popular Questions

What happens if my income fluctuates?

You should report any significant changes in your income to the relevant authorities immediately. They might adjust your benefits accordingly.

Can I get help filling out the application?

Yeah, mate. Lots of organisations offer assistance. Check online for local support groups or contact the Illinois Department of Human Services.

What if I don’t have all the required documents?

Contact the SNAP office; they can often guide you on what to do and might offer extensions or alternative ways to prove your eligibility.

Are there time limits on receiving SNAP benefits?

There are time limits for some recipients, but there are exceptions for certain groups like the elderly and disabled. It’s best to check the specific rules on the Illinois DHS website.